District of Columbia General Form for Bill of Sale of Personal Property

Description

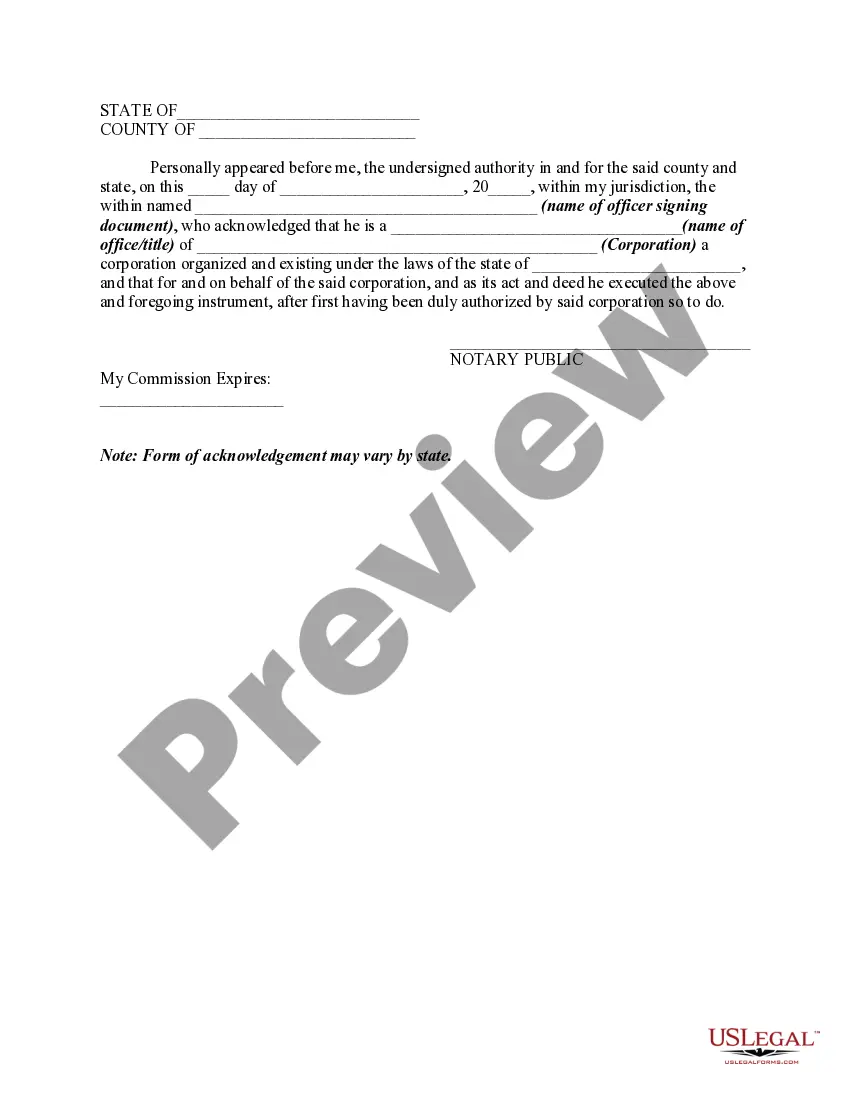

How to fill out General Form For Bill Of Sale Of Personal Property?

Locating the appropriate legal document template can be a challenge.

Of course, there are numerous templates available on the internet, but how do you acquire the legal document you need.

Utilize the US Legal Forms website. This service offers thousands of templates, such as the District of Columbia General Form for Bill of Sale of Personal Property, which can be utilized for both business and personal purposes.

If the form does not meet your requirements, utilize the Search field to locate the appropriate form. Once you are confident the form is adequate, click on the Buy now button to obtain the document. Select the pricing plan you desire and enter the necessary information. Create your account and complete the payment using your PayPal account or credit card. Choose the file format and download the legal document template to your device. Fill out, edit, print, and sign the acquired District of Columbia General Form for Bill of Sale of Personal Property. US Legal Forms is the largest library of legal templates from which you can access various document templates. Leverage this service to obtain well-crafted documents that conform to state regulations.

- Each of the templates is reviewed by experts and complies with federal and state regulations.

- If you are already registered, Log In to your account and then select the Download option to access the District of Columbia General Form for Bill of Sale of Personal Property.

- Use your account to look up the legal forms you have previously ordered.

- Navigate to the My documents section of your account to obtain another copy of the document you require.

- If you are a new user of US Legal Forms, here are some straightforward steps to follow.

- First, ensure you have selected the correct form for your city/state. You can review the form using the Preview option and read the form description to confirm it is suitable for you.

Form popularity

FAQ

Yes, MyTax.dc is a legitimate platform used by the D.C. government for tax filing and payment services. It provides a secure way to file your tax returns, including options for filing non-resident returns. By using MyTax.dc, you can efficiently manage your tax obligations, such as payments related to the District of Columbia General Form for Bill of Sale of Personal Property. Always ensure you are on the official site to protect your personal information.

To file a non-resident tax return in Washington, D.C., you must complete the necessary forms, including the District of Columbia General Form for Bill of Sale of Personal Property if applicable. Be sure to gather all required documents, such as your income records and receipts. You can submit your return either electronically through MyTax.dc or by mailing a paper return. Utilizing resources like US Legal Forms can help ensure you have the correct forms completed.

To file a DC tax exemption, you will need to complete the appropriate exemption form based on your specific circumstances. For personal property, you may refer to the District of Columbia General Form for Bill of Sale of Personal Property as part of your submission. It is crucial to clearly outline your eligibility for exemption to expedite the review process. You can submit your application online through the D.C. Office of Tax and Revenue website.

The 183 day rule refers to the tax residency statute in Washington, D.C., which states that if you maintain a physical presence in D.C. for 183 days or more within a calendar year, you are considered a D.C. resident for tax purposes. This status can affect your personal property tax obligations. Being aware of this rule can help you make informed decisions regarding the registration and documentation of your personal property, including utilizing the District of Columbia General Form for Bill of Sale of Personal Property where necessary.

The FP-31 is a form used to report the assessment of personal property for business purposes in Washington, D.C. To effectively utilize this form, ensure that you include details about your personal property as outlined in the District of Columbia General Form for Bill of Sale of Personal Property. This will help streamline the assessment process and ensure you correctly report your assets. Proper completion of the FP-31 can help in determining your tax liability accurately.

To file personal property taxes in Washington, D.C., first, gather all necessary documentation related to your personal property. You will need to complete the District of Columbia General Form for Bill of Sale of Personal Property to accurately report your assets. Make sure to submit your forms by the designated deadlines to avoid any penalties. You can file online through the D.C. government’s tax portal for convenience.

The personal property tax form in D.C. helps taxpayers report all personal property owned as of a specific date and calculate applicable taxes. This form is critical for monitoring your tax responsibilities regarding personal assets. If you have sold or transferred personal property, ensuring you have a copy of the District of Columbia General Form for Bill of Sale of Personal Property can provide valuable documentation.

The DC non-resident tax refund form is used by individuals who have overpaid taxes while working in the District but reside elsewhere. It is an essential document for ensuring you recover any excess taxes. When selling personal property in D.C., the District of Columbia General Form for Bill of Sale of Personal Property can create a solid foundation for any related tax inquiries.

The DC personal property tax form allows property owners to report their personal property and assess the tax due on it. This form is crucial for individuals and businesses to comply with local tax regulations. If you are selling personal property, utilizing the District of Columbia General Form for Bill of Sale of Personal Property can help clarify your ownership and support your tax filings.

DC form D-30 must be filed by partnerships and limited liability companies operating in the District of Columbia. This form gathers important information about business income and deductions. When engaging in transactions involving personal property, pairs well with the District of Columbia General Form for Bill of Sale of Personal Property to document the sale properly.