District of Columbia Balloon Unsecured Promissory Note

Description

How to fill out Balloon Unsecured Promissory Note?

Are you currently in a situation where you require documents for both business or personal purposes nearly every day? There are numerous authentic document templates available online, but finding those you can rely on is not easy.

US Legal Forms offers a vast array of document templates, including the District of Columbia Balloon Unsecured Promissory Note, designed to comply with state and federal standards.

If you are already acquainted with the US Legal Forms website and possess your account, simply Log In. Then, you can download the District of Columbia Balloon Unsecured Promissory Note template.

- Locate the template you need and ensure it is for your correct city/region.

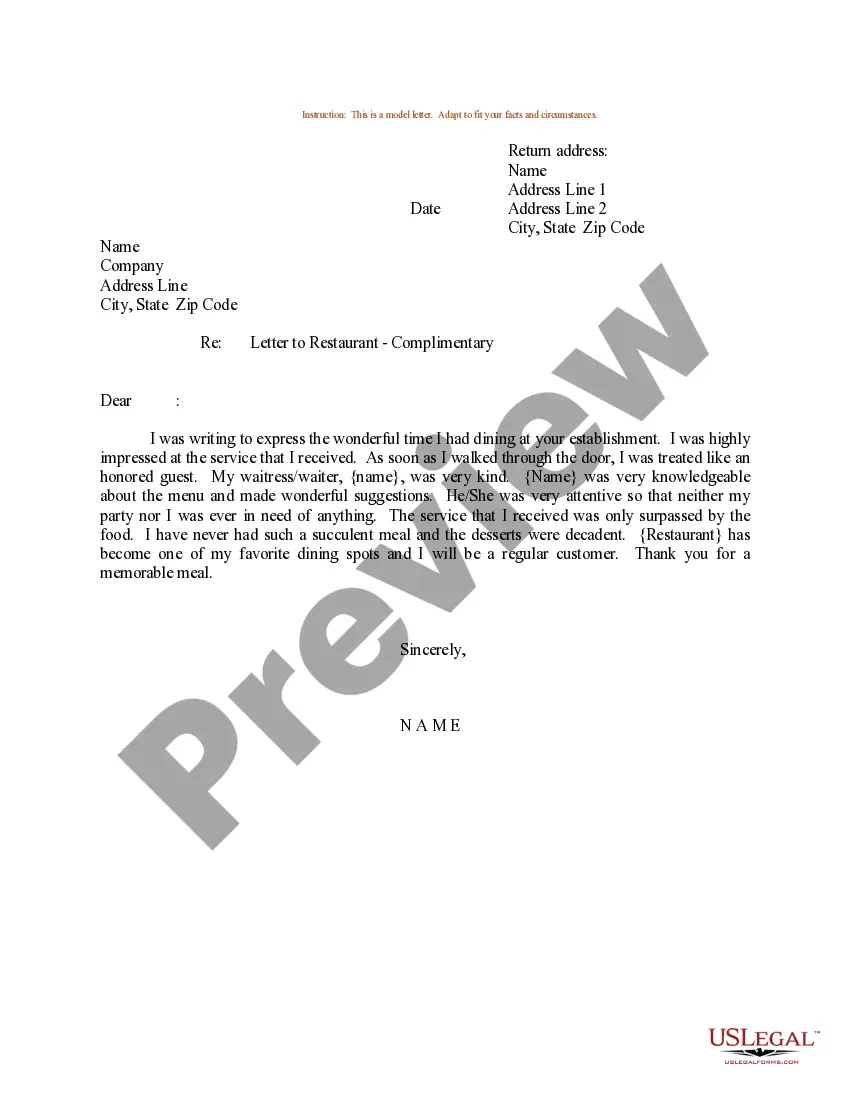

- Utilize the Review feature to inspect the document.

- Read the description to confirm you have selected the appropriate template.

- If the template is not what you are looking for, use the Search bar to find the document that suits your requirements and criteria.

- Once you find the correct document, click Buy now.

- Select the pricing plan you require, fill in the necessary information to process your payment, and complete the transaction using your PayPal or credit card.

- Choose a convenient file format and download your copy.

Form popularity

FAQ

If you lose your promissory note, don't panic. You can often obtain a replacement from your lender or financial institution that issued the District of Columbia Balloon Unsecured Promissory Note. Additionally, keeping detailed records of your transaction can help resolve disputes and prove the terms of your agreement.

Collecting on an unsecured promissory note involves reaching out to the borrower to discuss the repayment terms outlined in the District of Columbia Balloon Unsecured Promissory Note. Open communication is key, as this establishes a clear understanding of the expectations. If necessary, consider legal action or mediation to recover the owed amount if the borrower defaults.

To retrieve your promissory note, first check your personal records for any copies you may have saved. If you cannot find it, reach out to the lender or financial institution that issued the District of Columbia Balloon Unsecured Promissory Note and request a copy. They will generally provide this information after verifying your identity.

To locate your master promissory note, you should first check your email for any digital copies sent by your lender. If you received a District of Columbia Balloon Unsecured Promissory Note physically, it might be in your important documents folder. Additionally, you can contact your lender directly to request another copy.

An on-demand promissory note allows the lender to request repayment at any time. Generally, these notes specify the total amount and include any applicable interest charges. If you are looking into a District of Columbia Balloon Unsecured Promissory Note, this format can provide flexibility for lenders and borrowers alike.

Filling a demand promissory note involves entering the names of the parties involved, the amount borrowed, and the statement that repayment can be demanded at any time. State any applicable interest rates and conditions for repayment. When creating a District of Columbia Balloon Unsecured Promissory Note, it's vital to make these terms clear for both parties.

Yes, a properly executed promissory note generally holds up in court as a binding contract. Courts will enforce the terms outlined in the note, provided they meet legal requirements. If you're using a District of Columbia Balloon Unsecured Promissory Note, ensure all details are accurately represented to strengthen your case if disputes arise.

Companies often issue unsecured notes to raise funds without tying up assets as collateral. This flexibility can be beneficial for maintaining operational liquidity. By issuing a District of Columbia Balloon Unsecured Promissory Note, businesses can attract investors while managing their financial obligations efficiently.

An unsecured promissory note is not considered a security under most circumstances. Legal definitions and regulations may influence this classification, but generally, these notes lack the characteristics that define securities. It’s beneficial to consult with a professional to clarify the legal standing of a District of Columbia Balloon Unsecured Promissory Note.

An unsecured promissory note generally does not meet the criteria to be classified as a security. However, specifics can vary based on state rules and the nature of the note. When dealing with a District of Columbia Balloon Unsecured Promissory Note, understanding its classification helps guide its use and potential implications.