For use in all states except AK,FL,ME,NY,PR,VT,VA,WV,WI

District of Columbia Multistate Promissory Note - Unsecured - Signature Loan

Description

How to fill out Multistate Promissory Note - Unsecured - Signature Loan?

If you intend to finish, download, or print legitimate document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Utilize the site's straightforward and user-friendly search to find the documents you need.

Various templates for business and personal use are categorized by types and states, or keywords. Use US Legal Forms to access the District of Columbia Multistate Promissory Note - Unsecured - Signature Loan in just a few clicks.

Every legal document template you buy is yours permanently. You will have access to each form you acquired in your account. Click on the My documents section and choose a form to print or download again.

Complete, download, and print the District of Columbia Multistate Promissory Note - Unsecured - Signature Loan with US Legal Forms. There are millions of professional and state-specific forms you can use for your business or personal requirements.

- If you are already a US Legal Forms member, Log In to your account and click the Download button to obtain the District of Columbia Multistate Promissory Note - Unsecured - Signature Loan.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the guidelines below.

- Step 1. Ensure you have selected the form for the correct city/state.

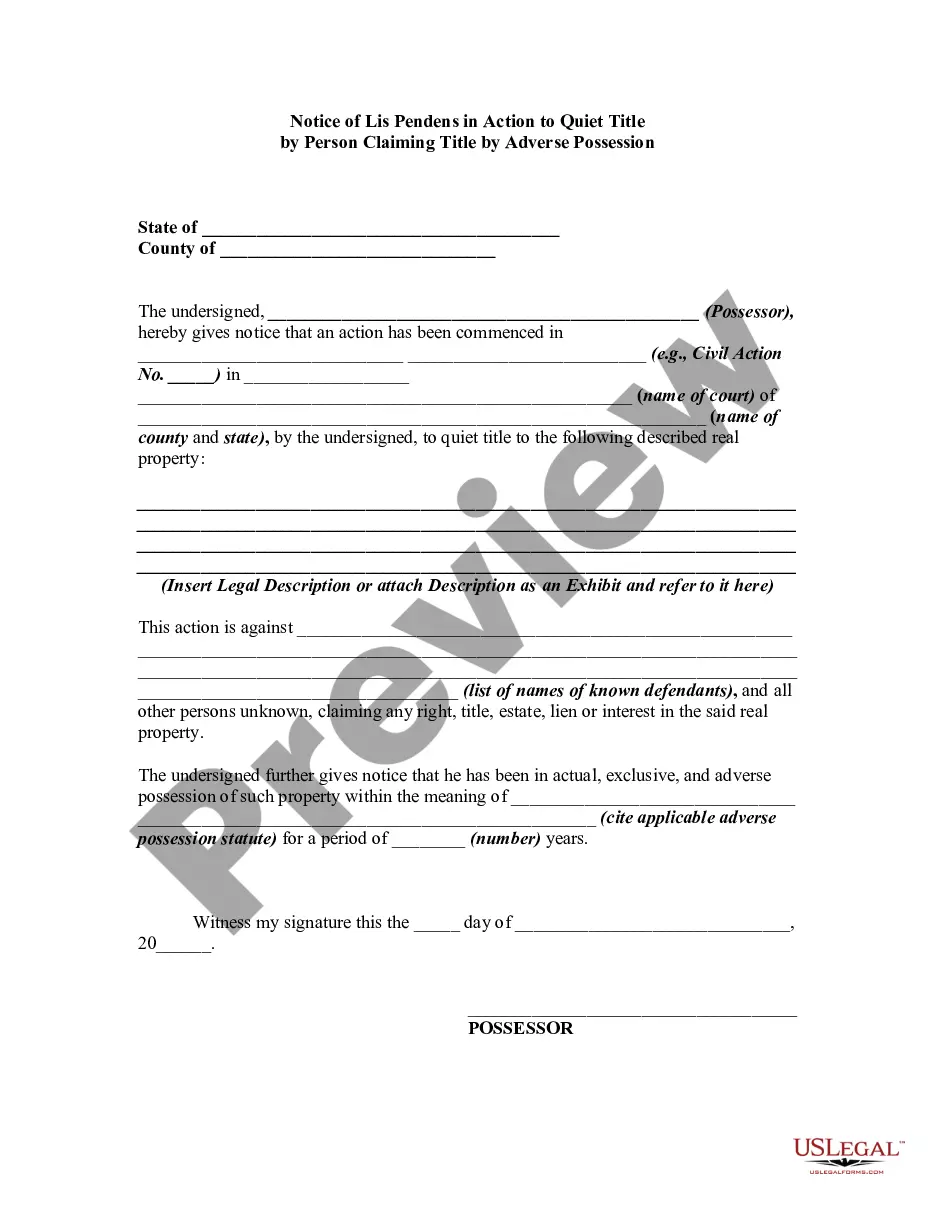

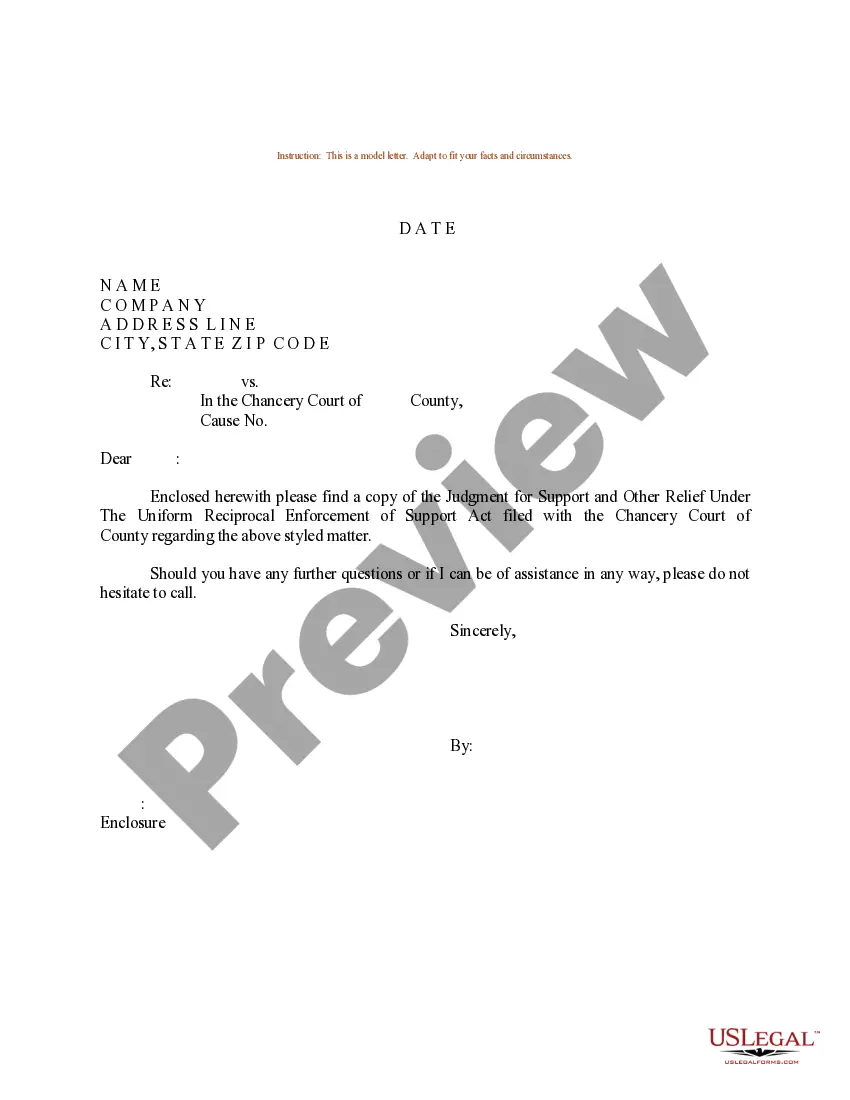

- Step 2. Use the Review option to examine the contents of the form. Be sure to read the description.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find alternative versions of the legal document template.

- Step 4. Once you have found the form you need, click the Get now button. Choose the pricing plan you prefer and enter your details to register for an account.

- Step 5. Complete the purchase. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Select the format of the legal document and download it to your device.

- Step 7. Complete, modify, print, or sign the District of Columbia Multistate Promissory Note - Unsecured - Signature Loan.

Form popularity

FAQ

Getting out of a promissory note is possible, but it often requires negotiation with the lender. You might request to modify the payment terms or seek forgiveness of the debt if financial hardship is present. In some cases, lenders may agree to settle for a lesser amount to close the obligation. Legal guidance, such as that from US Legal Forms, can provide useful resources for drafting any necessary agreements.

Collecting on an unsecured promissory note involves several steps. Initially, the lender should send reminders and payment requests, which can be formalized through a demand letter. If payment is still not received, the lender can take legal action, seeking a judgment in court. Utilizing a platform like US Legal Forms can help create and manage necessary legal documents for this process efficiently.

In order for a promissory note to be valid and legally binding, it needs to include specific information. "A promissory note should include details including the amount loaned, the repayment schedule and whether it is secured or unsecured," says Wheeler.

Unsecured Promissory NotesAn unsecured promissory note is an obligation for payment without any property securing the payment. If the payor fails to pay, the payee must file a lawsuit and hope that the payor has sufficient assets that can be seized to satisfy the loan.

In common speech, other terms, such as "loan", "loan agreement", and "loan contract" may be used interchangeably with "promissory note".

An unsecured promissory note is a legally binding contract between two parties where one party agrees to pay the other a certain amount of money at a specific time in the future. The reason it is called 'unsecured' is because the borrower does not want to pledge any assets as collateral for the loan.

In order for the promissory note to be valid, the borrower needs to sign it. The lender may require the borrower to sign this document in front of a notary to guarantee the signature.

Types of Promissory NotesSimple Promissory Note.Student Loan Promissory Note.Real Estate Promissory Note.Personal Loan Promissory Notes.Car Promissory Note.Commercial Promissory note.Investment Promissory Note.

Signatures. Generally, promissory notes do not need to be notarized. Typically, legally enforceable promissory notes must be signed by individuals and contain unconditional promises to pay specific amounts of money. Generally, they also state due dates for payment and an agreed-upon interest rate.

An unsecured promissory note is an obligation for payment without any property securing the payment. If the payor fails to pay, the payee must file a lawsuit and hope that the payor has sufficient assets that can be seized to satisfy the loan.