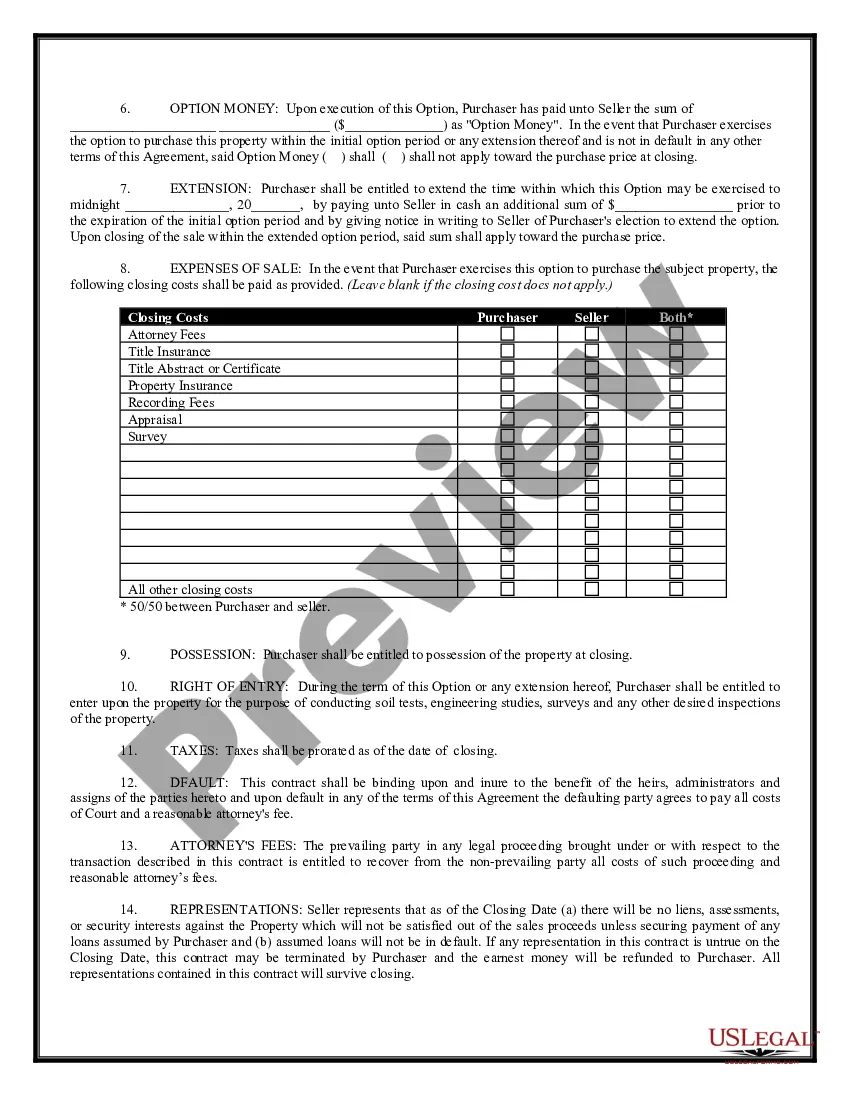

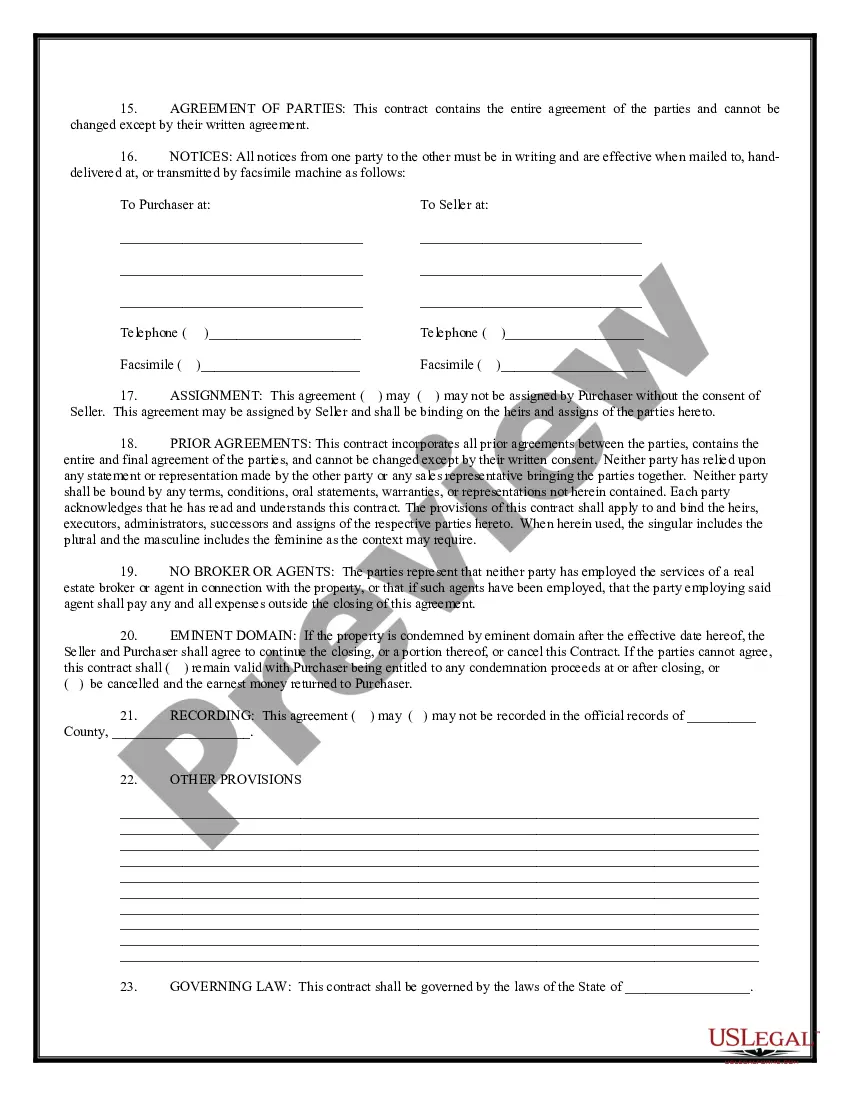

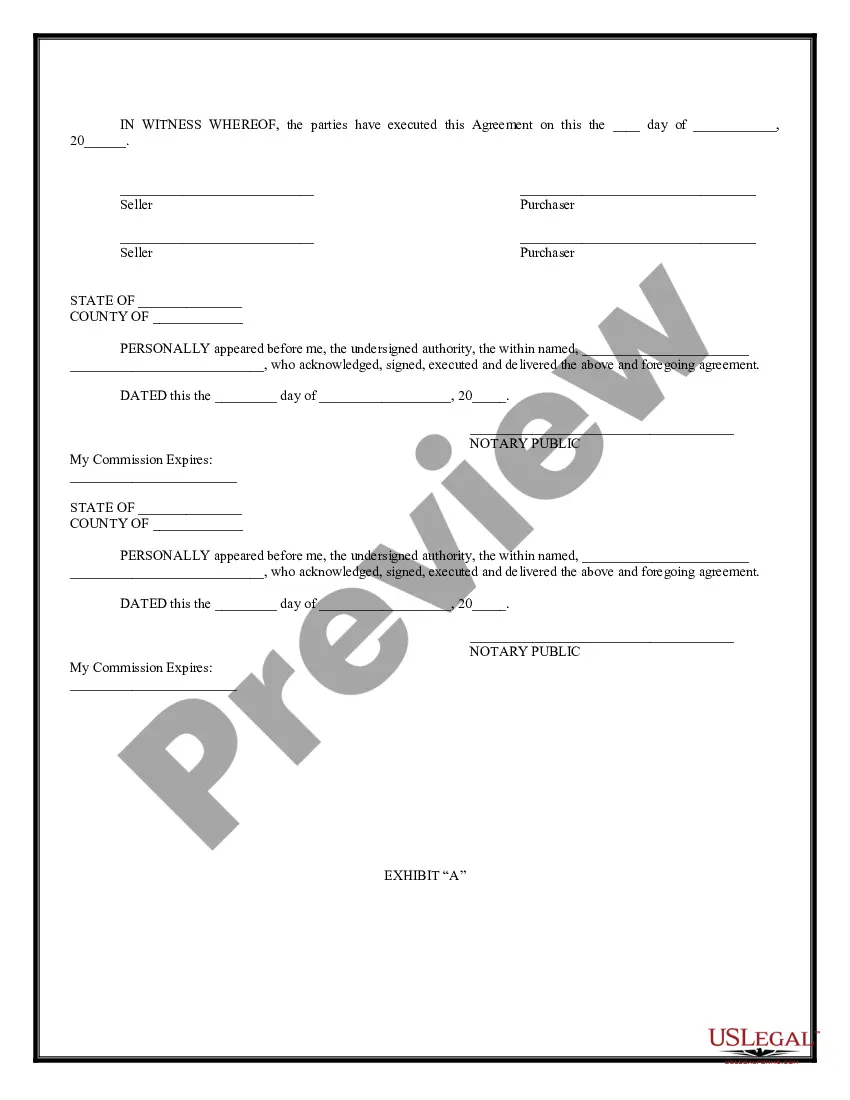

District of Columbia Option For the Sale and Purchase of Real Estate - General Form

Description

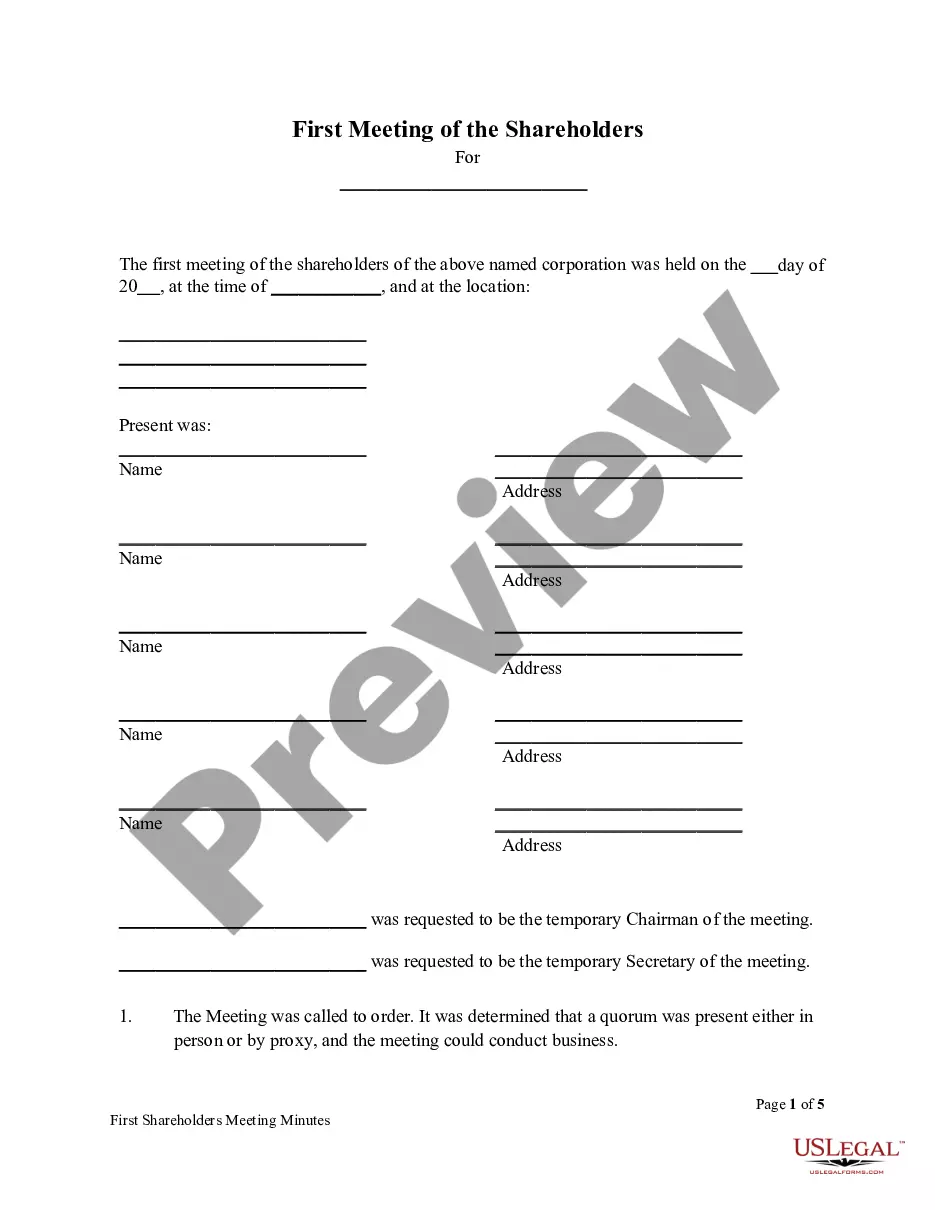

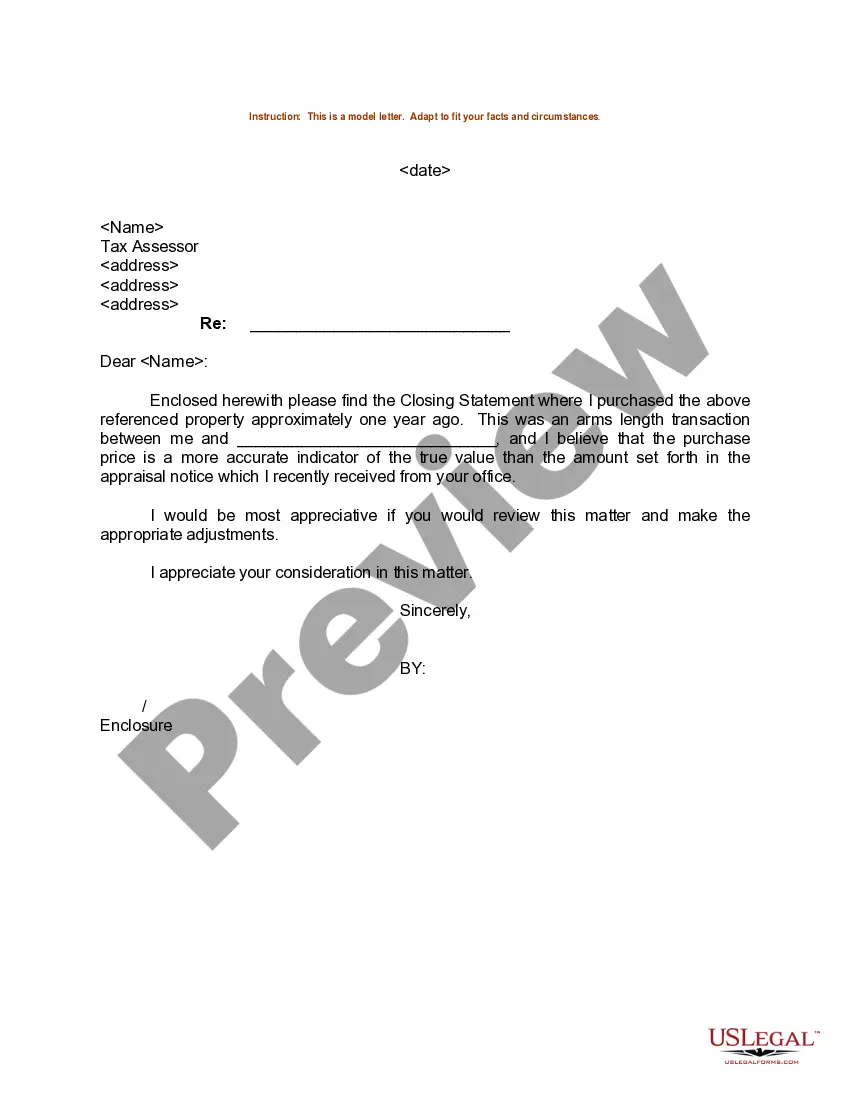

How to fill out Option For The Sale And Purchase Of Real Estate - General Form?

It is feasible to invest hours online trying to locate the valid document template that satisfies the state and federal criteria you require.

US Legal Forms offers a vast array of valid forms that are verified by experts.

You can effortlessly download or print the District of Columbia Option For the Sale and Purchase of Real Estate - General Form from the service.

If available, utilize the Preview button to review the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click on the Obtain button.

- Subsequently, you can complete, modify, print, or sign the District of Columbia Option For the Sale and Purchase of Real Estate - General Form.

- Every single valid document template you acquire is yours indefinitely.

- To obtain an additional copy of the purchased form, visit the My documents tab and click the corresponding button.

- If you use the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the region/city of your choice.

- Review the form description to confirm you have chosen the appropriate form.

Form popularity

FAQ

Generally, an unincorporated business, with gross income (Line 10) more than $12,000 from District sources, must file a D-30 (whether or not it has net income). This includes any business carrying on and/or engaging in any trade, business, or commercial activity in DC with income from DC sources.

In addition, some Forms 1040, 1040-A, 1040-EZ, and 1041 cannot be e-filed if they have attached forms, schedules, or documents that IRS does not accept electronically.

Additional information. Form D-30 can be e-filed. Refer to this article for information on the date you can begin e-filing this form. Generally, an unincorporated business with gross income over $12,000 from D.C. sources must file a D-30, regardless of whether it has net income.

If you meet the single status tax filing requirements and you're under 65, you must file if your federal gross income was $12,550 or more. If you're 65 or older, you must file if your federal gross income was $14,250 or more.

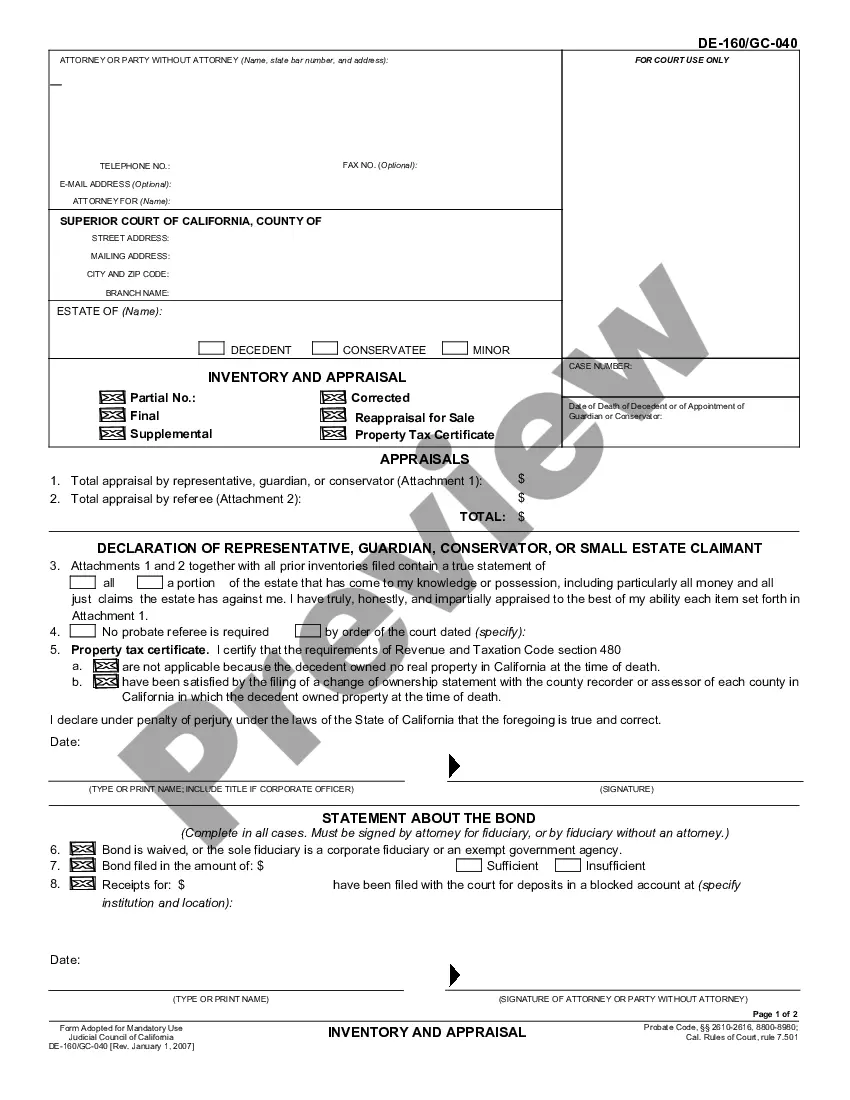

In addition to the DC Deed Tax, DC also imposes a Real Property Transfer Tax (DC Transfer Tax) at the time a deed or certain leases are submitted for recordation. The rate is 1.45% of the consideration for, or fair market value of, the property. Thus, the current total combined rate is 2.9%.

For the purposes of this chapter (not alone of this subchapter) and unless otherwise required by the context, the term unincorporated business means any trade or business, conducted or engaged in by any individual, whether resident or nonresident, statutory or common-law trust, estate, partnership, or limited or

The unincorporated business franchise tax (Form D-30) must be filed by any D.C. business that is unincorporated, which includes partnerships, sole proprietorships, and joint ventures, so long as such a business derives rental income or any other income from D.C. sources in excess of $12,000 per year.

A DC Resident is an individual that maintains a place of abode within DC for 183 days or more. If the individual is domiciled in the state at anytime, you are considered to be a DC resident. A DC Nonresident is an individual that did not spend any time domiciled in the state.

Through a commercial online filing service. This allows taxpayers to transmit their DC and federal returns from their PC for a fee. Note: An Unincorporated business must have an FEIN to file through MeF.

You must file a DC tax return if: You were a resident of the District of Columbia and you were required to file a federal tax return. (A resident is an individual domiciled in DC at any time during the taxable year);