District of Columbia Oil, Gas and Mineral Deed - Individual to Two Individuals

Description

How to fill out Oil, Gas And Mineral Deed - Individual To Two Individuals?

Are you presently in a scenario where you need documents for both corporate or personal purposes almost every time.

There are numerous legal document templates accessible online, but finding ones you can trust is not straightforward.

US Legal Forms provides a multitude of form templates, such as the District of Columbia Oil, Gas and Mineral Deed - Individual to Two Individuals, designed to comply with state and federal regulations.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the District of Columbia Oil, Gas and Mineral Deed - Individual to Two Individuals template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you require and ensure it is for the correct city/state.

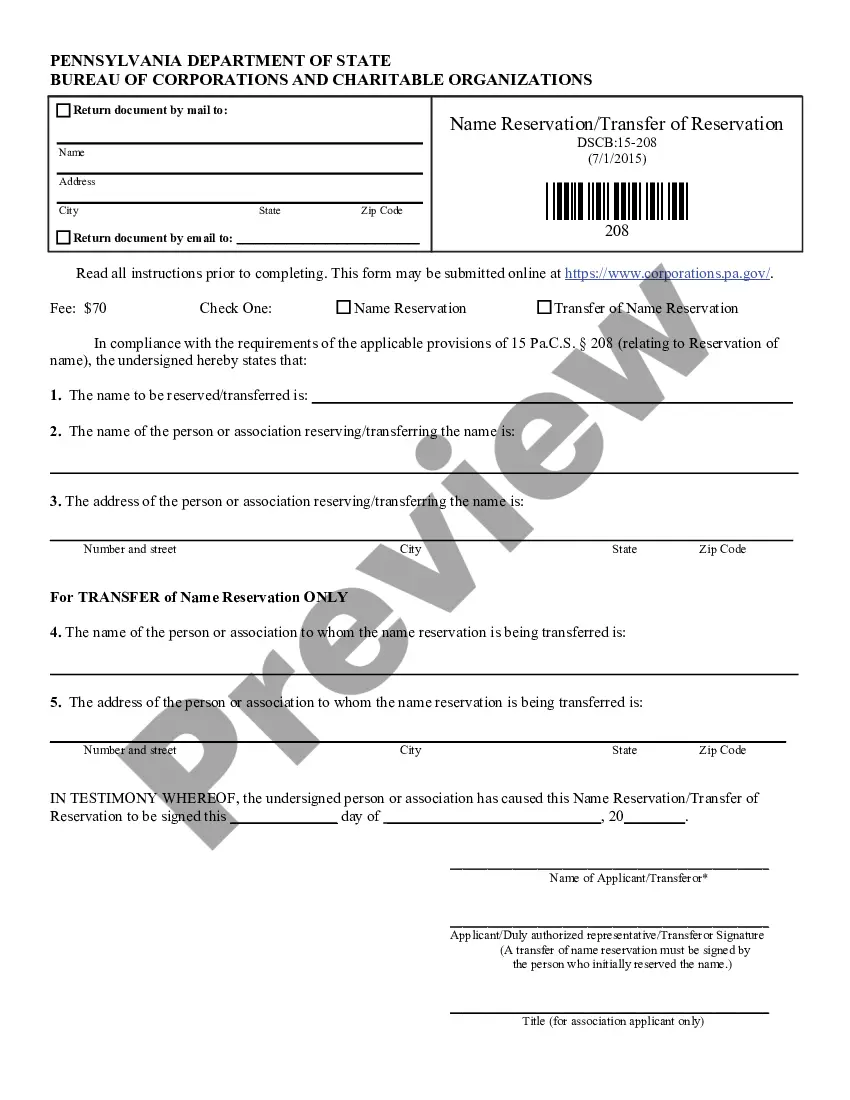

- Use the Preview feature to review the document.

- Check the description to confirm you have selected the right form.

- If the form is not what you are looking for, utilize the Search field to find the document that meets your needs.

- When you find the appropriate form, click Acquire now.

- Choose the payment plan you prefer, enter the required information to create your account, and complete the purchase using your PayPal or Visa or Mastercard.

- Select a suitable file format and download your copy.

- Access all the document templates you have purchased in the My documents section. You can obtain an additional copy of District of Columbia Oil, Gas and Mineral Deed - Individual to Two Individuals at any time, if desired. Click on the desired form to download or print the document template.

- Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid errors. The service offers professionally crafted legal document templates that can be used for a variety of purposes. Create an account on US Legal Forms and start making your life a bit easier.

Form popularity

FAQ

(2) ?Deed of trust? means a mortgage or a deed of trust encumbering real property located in the District of Columbia as the same may be modified, amended, supplemented, or restated. (3) ?Land records? means the land records in the Office of the Recorder of Deeds of the District of Columbia.

2. FP-31 Tax Return. The FP-31 tax return is essential for individuals who use property for business purposes in D.C. This includes rental property owners, freelancers, contractors, and 1099-NEC employees.

A Washington, DC, deed must identify by name the current owner (the grantor) transferring the property and the new owner (the grantee) receiving it. Party addresses. A deed should include the new owner's address. DC law does not strictly require the current owner's address, but it is often included.

A Washington, DC, deed must identify by name the current owner (the grantor) transferring the property and the new owner (the grantee) receiving it. Party addresses. A deed should include the new owner's address. DC law does not strictly require the current owner's address, but it is often included.

The DC recorder of deeds requires two forms when recording deeds: Real Property Recordation and Tax Form FP-7/C. Form FP-7/C is a return form listing details about the transfer?including the amount of consideration. The current owner and new owner must both sign the form.

Learn How to Complete the FR-500 Business Registration Application. Taxpayers who wish to register a new business in the District of Columbia can conveniently complete the ?Register a New Business: Form FR-500? application online via the Office of Tax and Revenue's (OTR) tax portal, MyTax.DC.gov.

You may research this information at: Office of the Recorder of Deeds or Real Property Tax Database Search. The cost to purchase a copy is $2.25 per page plus ($2.25) per document for certification of a copied document. Your copies will be mailed promptly to you.

The DC recorder of deeds requires two forms when recording deeds: Real Property Recordation and Tax Form FP-7/C. Form FP-7/C is a return form listing details about the transfer?including the amount of consideration. The current owner and new owner must both sign the form.