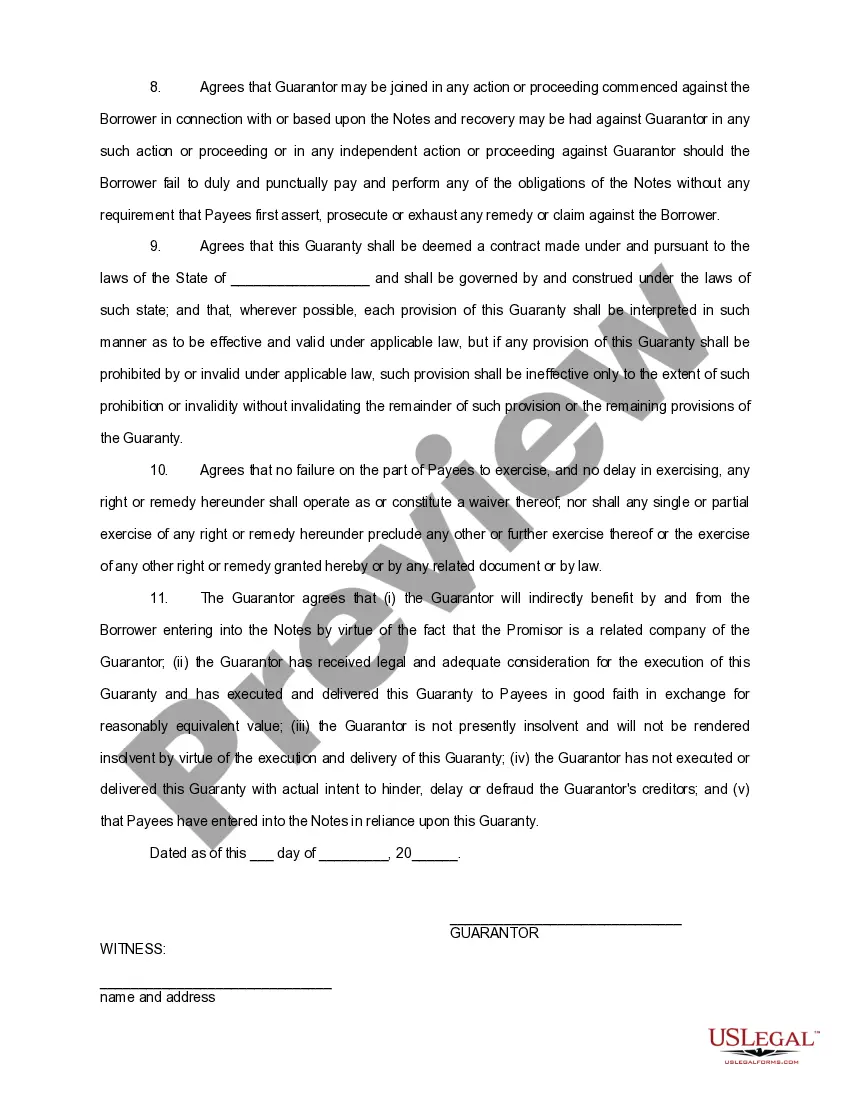

District of Columbia Guaranty of Promissory Note by Individual - Corporate Borrower

Description

How to fill out Guaranty Of Promissory Note By Individual - Corporate Borrower?

Are you presently in a circumstance where you require documents for either professional or personal uses nearly every day.

There are numerous legal document templates available online, but locating reliable ones can be challenging.

US Legal Forms offers a vast selection of template forms, such as the District of Columbia Guaranty of Promissory Note by Individual - Corporate Borrower, which can be drafted to meet state and federal requirements.

Choose the pricing plan you prefer, fill in the required information to create your account, and complete the purchase using your PayPal or credit card.

Select a convenient file format and download your copy.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the District of Columbia Guaranty of Promissory Note by Individual - Corporate Borrower template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Find the form you need and confirm that it is for your correct city/region.

- Use the Review button to examine the form.

- Check the summary to ensure that you have selected the right form.

- If the form isn’t what you’re looking for, use the Search field to locate the form that fits your needs and requirements.

- Once you find the correct form, click on Buy now.

Form popularity

FAQ

The Benefits of a Personal GuaranteeThe asset (promissory note) is protected by the collateral (the guarantor's promise to pay, and the ability to sue the guarantor personally for noncompliance with the terms of the promissory note). As with any collateral, a personal guarantee gives the asset more security.

Guaranteed promissory note means a written contract obligating a recipient to repay the funds received if the recipient does not fulfill the service obligation, which was a condition of the recipient's scholarship, or grant award.

A promissory note is a legal and a financial instrument that is written between three financing parties: the maker, the lender, and the payee/the borrower.

Guaranty Agreement a two-party contract in which the first party agrees to perform in the event that a second party fails to perform. Unlike a surety, a guarantor is only required to perform after the obligee has made every reasonable and legal effort to force the principal's performance.

Parties to Promissory Notes 1) The maker: This is basically the person who makes or executes a promissory note and pays the amount therein. 2) The payee: The person to whom a note is payable is the payee.

The Bottom Line. A promissory note is a legal promise to repay money borrowed. People can borrow money from each other, or from banks and other lending institutions. When someone borrows money, a promissory note is written to legally protect both the payor and the payee.

Guarantee Obligation as to any Person (the guaranteeing person), any obligation, including a reimbursement, counterindemnity or similar obligation, of the guaranteeing Person that guarantees or in effect guarantees, or which is given to induce the creation of a separate obligation by another Person (including any

As per section 32 of negotiable instrument act, in the absence of a contract to the contrary, the maker of a promissory note and the acceptor before the maturity of a bill of exchange are under the liability to pay the amount thereof at maturity.

A promissory note is a legal document signed by a debtor who promises to pay a debt in a form and manner as described in the document. A personal guaranty, as defined at businessdictionary.com, is an agreement that makes one liable for one's own or a third party's debts or obligations.

A Promissory note is essentially an unconditional written promise to repay a loan or other debts, at a fixed or determinable future date. Although it is legally enforceable, a promissory note is less formal than a loan agreement and is suitable where smaller sums of money are involved.