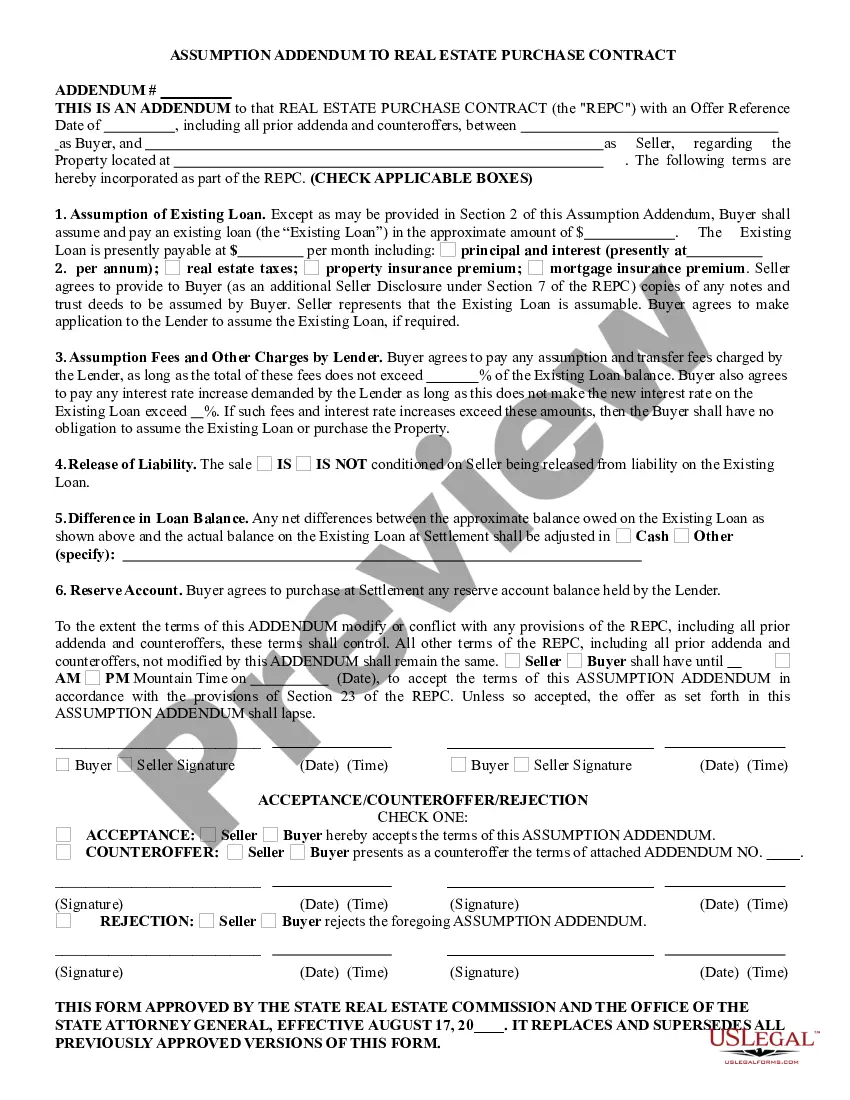

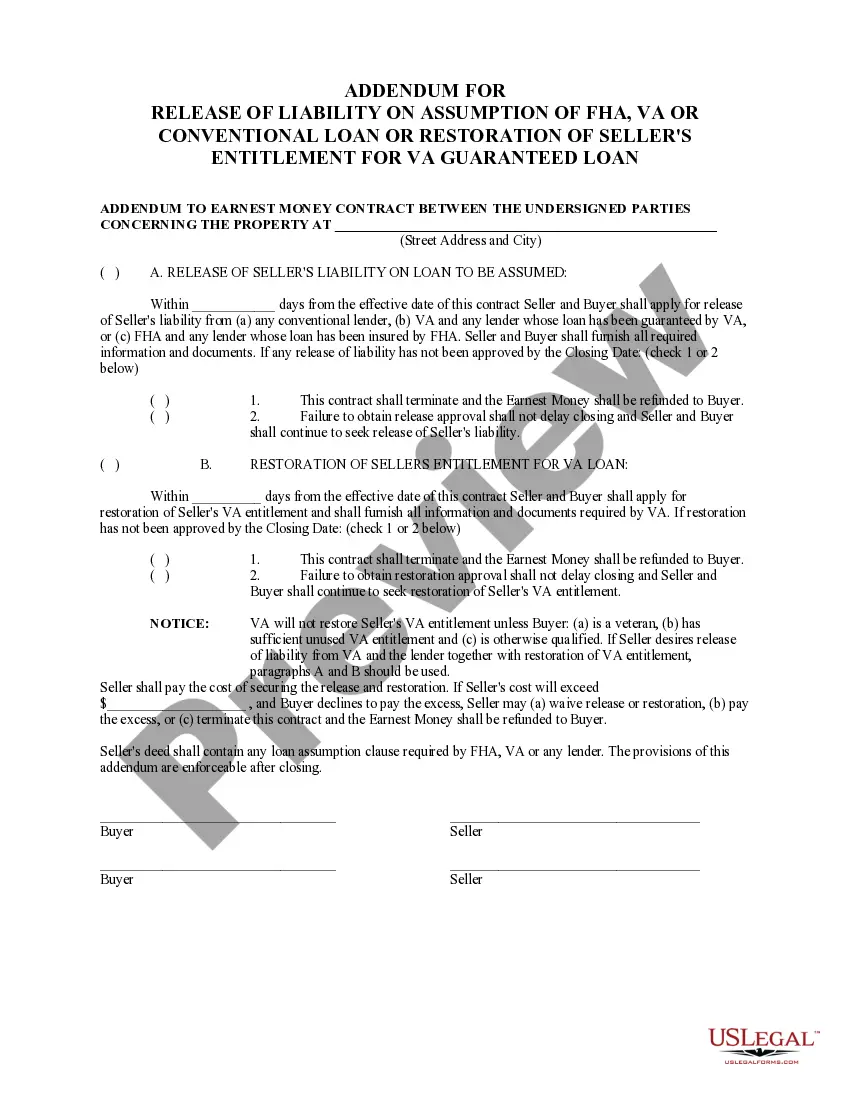

District of Columbia Addendum for Release of Liability on Assumption of FHA, VA or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan

Description

How to fill out Addendum For Release Of Liability On Assumption Of FHA, VA Or Conventional Loan, Restoration Of Seller's Entitlement For VA Guaranteed Loan?

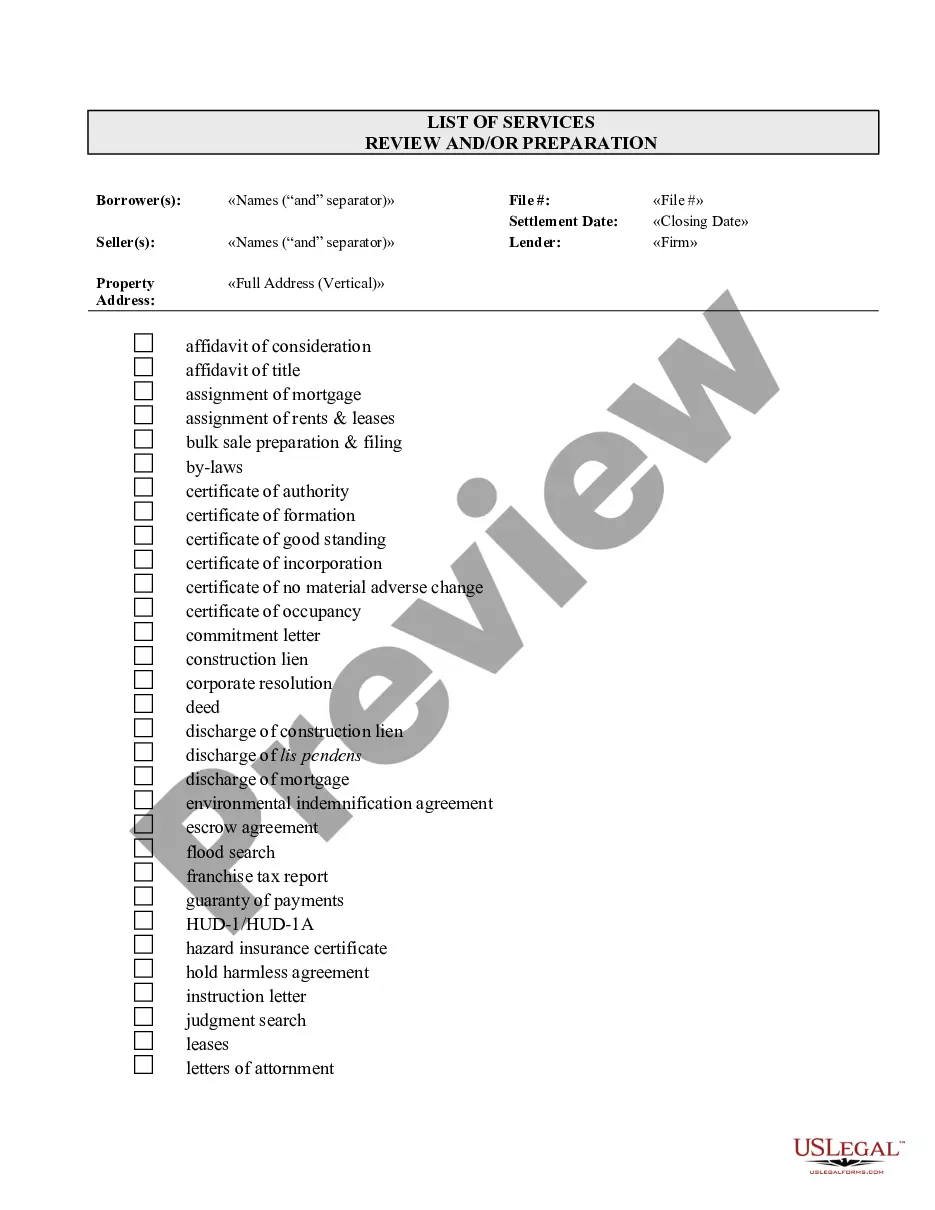

You can dedicate time online searching for the valid document template that meets the federal and state requirements you have. US Legal Forms provides thousands of valid forms that can be reviewed by professionals.

You can acquire or generate the District of Columbia Addendum for Release of Liability on Assumption of FHA, VA or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan with my help.

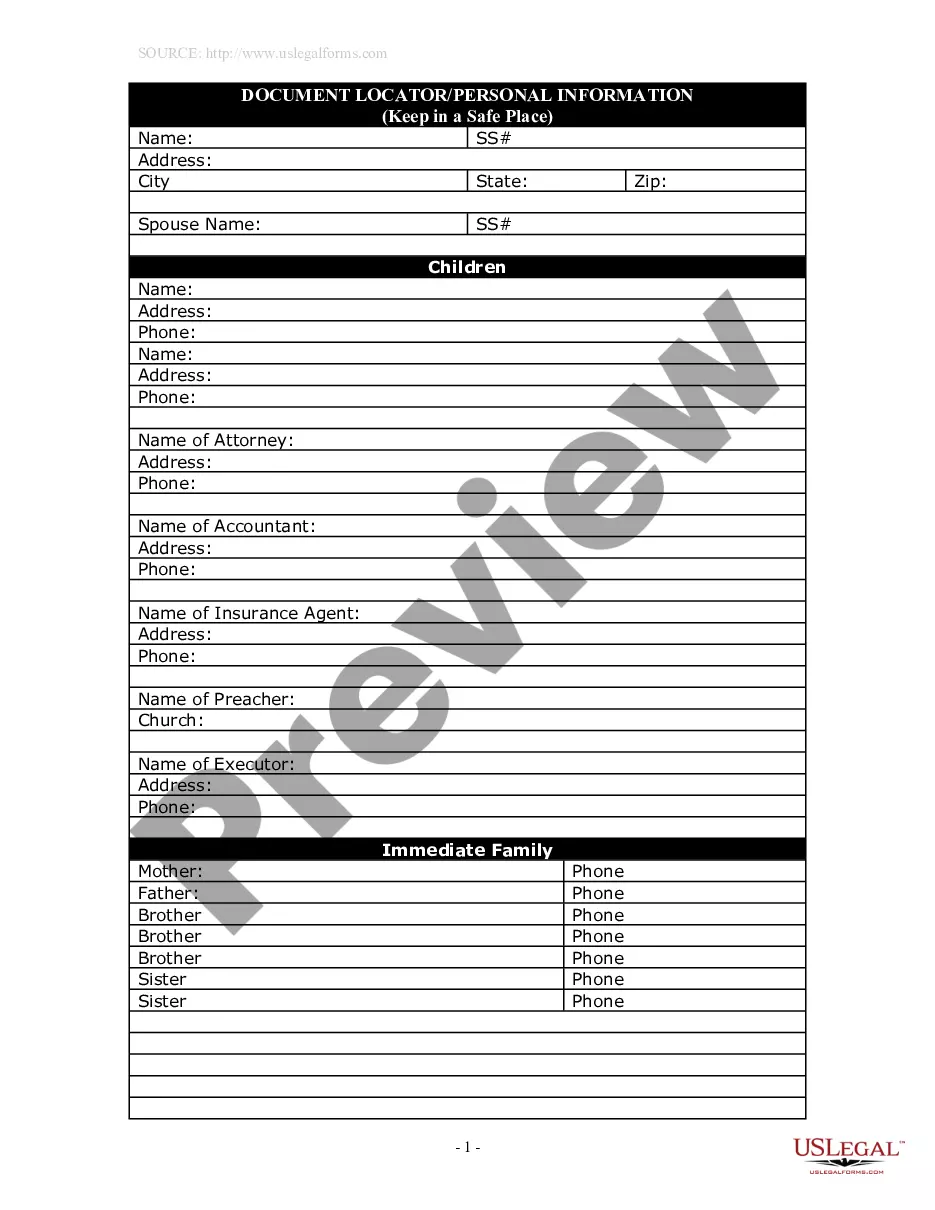

If you possess a US Legal Forms account, you can Log In and click the Download button. After that, you can complete, modify, print, or sign the District of Columbia Addendum for Release of Liability on Assumption of FHA, VA or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan. Every legal document template you purchase belongs to you permanently. To obtain another copy of the acquired form, go to the My documents tab and click the corresponding button.

Make changes to your document if necessary. You can complete, modify, sign, and print the District of Columbia Addendum for Release of Liability on Assumption of FHA, VA or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan. Download and print thousands of document templates using the US Legal Forms site, which offers the largest selection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, make sure you have chosen the correct document template for your region/area of choice. Review the form description to ensure you have selected the right form. If available, use the Review button to check the document template at the same time.

- If you wish to find another version of your form, use the Search box to locate the template that fits your requirements and preferences.

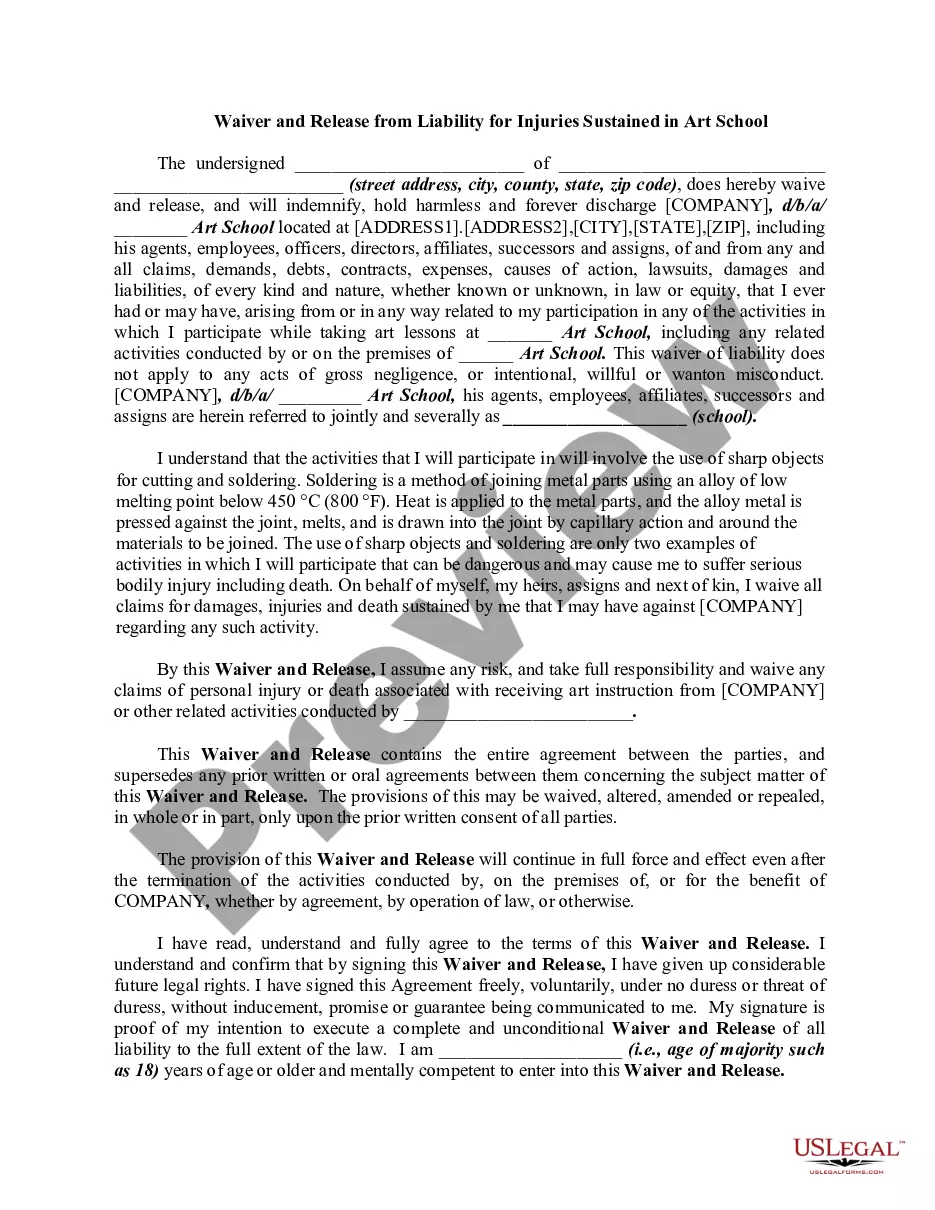

- Once you have found the template you need, click on Purchase now to continue.

- Select the pricing plan you want, enter your details, and register for your account on US Legal Forms.

- Complete the purchase. You can use your credit card or PayPal account to pay for the legal document.

- Choose the format of your document and download it to your system.

Form popularity

FAQ

Find a home seller who will allow you to assume their VA loan. Verify that you meet the VA's minimum credit score and income requirements. Agree to assume all obligations of the existing loan. Pay the funding fee, down payment (if required) and closing costs.

Funding fee: A VA loan assumption will come with a funding fee equal to 0.5% of the loan balance.

The Bottom Line The FHA amendatory clause protects borrowers because if the appraisal comes back low, the buyer can cancel the transaction and get their earnest money back. Signing on the dotted line for a home that appraises for below the sales price could result in a bad investment for both lenders and buyers.

The essential purpose of the FHA and VA amendatory/escape clauses is to give the buyer the right to terminate the sales contract if the sales price exceeds the appraised value of the Property. Form 2A4-T includes the prescribed wording of the FHA and VA amendatory/escape clauses.

A seller financing addendum outlines the terms under which the seller of a property agrees to loan money to the buyer in order to purchase their property.

VA loans include certain contingencies that protect earnest money deposits and allow them to be refunded to the buyer under specific circumstances. Some of the most common VA contract contingencies include a home inspection contingency, financing contingency, home sale contingency and appraisal contingency.

An FHA/VA financing addendum is attached to a purchase contract to state that a buyer with FHA/VA financing can back out of the sale if the appraised property value is less than the asking price.

If the purchaser(s) is creditworthy and assumes the liability to the lender and VA to the same extent that you did when you obtained the loan, you will be released from liability on the loan. To obtain a release from liability, you should check with the company to whom you make your payments before you sell your home.

However, borrowers who allow another buyer to assume their mortgage ?remain liable to the VA for any loss that may occur as a result of a future default and subsequent claim payment,? ing to VA Pamphlet 26-7, ?Unless the property is sold to a creditworthy purchaser who agrees to assume the payment obligation.?

To receive VA home loan benefits and services, the Veteran's character of discharge or service must be under other than dishonorable conditions (e.g., honorable, under honorable conditions, general). Generally, there is no character of discharge bar to benefits to Veterans' Group Life Insurance.