Letter from attorney to opposing counsel requesting documentation concerning homestead exemption for change of venue motion.

District of Columbia Sample Letter for Change of Venue and Request for Homestead Exemption

Description

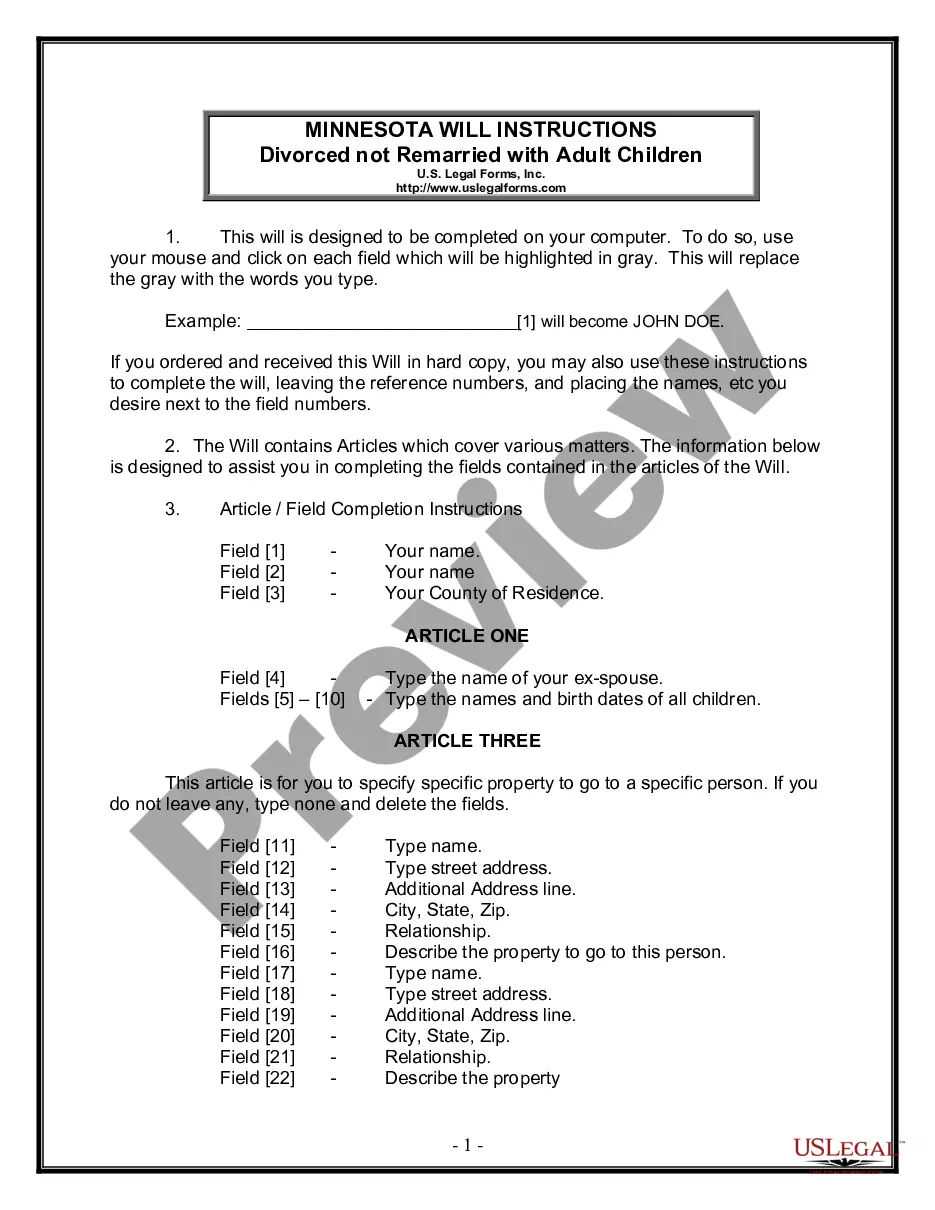

How to fill out Sample Letter For Change Of Venue And Request For Homestead Exemption?

You may spend several hours on the web looking for the lawful document format that meets the federal and state requirements you require. US Legal Forms provides a large number of lawful forms that are reviewed by experts. It is simple to acquire or printing the District of Columbia Sample Letter for Change of Venue and Request for Homestead Exemption from your services.

If you have a US Legal Forms profile, you are able to log in and click the Down load key. Afterward, you are able to full, change, printing, or sign the District of Columbia Sample Letter for Change of Venue and Request for Homestead Exemption. Every single lawful document format you acquire is your own property eternally. To have one more duplicate for any bought form, visit the My Forms tab and click the corresponding key.

If you use the US Legal Forms website for the first time, follow the simple directions listed below:

- Initially, make sure that you have chosen the best document format for that region/area of your liking. Browse the form description to ensure you have chosen the correct form. If readily available, use the Preview key to check from the document format also.

- If you wish to discover one more version of your form, use the Lookup discipline to find the format that meets your needs and requirements.

- Upon having discovered the format you need, click on Acquire now to move forward.

- Pick the pricing strategy you need, enter your qualifications, and register for a merchant account on US Legal Forms.

- Total the deal. You can use your bank card or PayPal profile to cover the lawful form.

- Pick the file format of your document and acquire it in your gadget.

- Make changes in your document if possible. You may full, change and sign and printing District of Columbia Sample Letter for Change of Venue and Request for Homestead Exemption.

Down load and printing a large number of document themes using the US Legal Forms web site, that provides the biggest collection of lawful forms. Use specialist and express-specific themes to handle your organization or person requires.

Form popularity

FAQ

To move your homestead exemption in Florida, you need to file a new application with the county where you are relocating. This process usually involves providing proof of residency at your new address. It’s essential to complete this before the property tax assessment date to ensure you maintain your exemption. For help with the necessary paperwork, you can use the District of Columbia Sample Letter for Change of Venue and Request for Homestead Exemption as a guide.

In Mississippi, once you file for a homestead exemption and it is approved, you typically do not need to refile every year unless there are changes to your property or ownership. However, it’s good practice to confirm your status annually. Staying informed helps ensure you continue to receive tax benefits. For assistance with documentation, refer to the District of Columbia Sample Letter for Change of Venue and Request for Homestead Exemption.

You may have been denied a homestead exemption for several reasons, such as failing to meet residency requirements or missing the application deadline. In some cases, incorrect information on your application can lead to denial. It's important to carefully review your application and reapply if necessary. For guidance on how to appeal a denial, explore the District of Columbia Sample Letter for Change of Venue and Request for Homestead Exemption.

In Kansas, the homestead exemption can provide significant property tax relief, with eligible homeowners receiving a reduction based on their property value. The amount varies, but many homeowners can save hundreds of dollars annually. Make sure to check state guidelines for specific amounts applicable to your situation. If you require assistance, the District of Columbia Sample Letter for Change of Venue and Request for Homestead Exemption offers a useful template.

To check if your homestead exemption was approved, you can contact your local tax assessor’s office or visit their website for updates. They typically provide online access to your application status. Keeping track of your exemption status ensures you receive the benefits you deserve. If you need help, consider referencing the District of Columbia Sample Letter for Change of Venue and Request for Homestead Exemption.

In Washington, D.C., property owners aged 65 and older may qualify for a property tax exemption or a tax freeze. However, eligibility depends on specific income limits and property value criteria. If you are a senior homeowner, it's wise to explore these exemptions to reduce your tax burden. For more information, looking into a District of Columbia Sample Letter for Change of Venue and Request for Homestead Exemption can be helpful.

Common mistakes when applying for a homestead exemption include failing to meet the residency requirement or missing the application deadline. Additionally, some homeowners forget to include all eligible properties or miscalculate their property value. It's crucial to double-check your application to avoid these pitfalls. For detailed guidance, you can utilize the District of Columbia Sample Letter for Change of Venue and Request for Homestead Exemption.

In Alabama, a homestead qualifies as a primary residence that you own and occupy. This property can include a house, mobile home, or farm, as long as it is your main home. The homestead exemption can reduce your property taxes, making it essential for homeowners. For assistance with related documents, consider using a District of Columbia Sample Letter for Change of Venue and Request for Homestead Exemption.