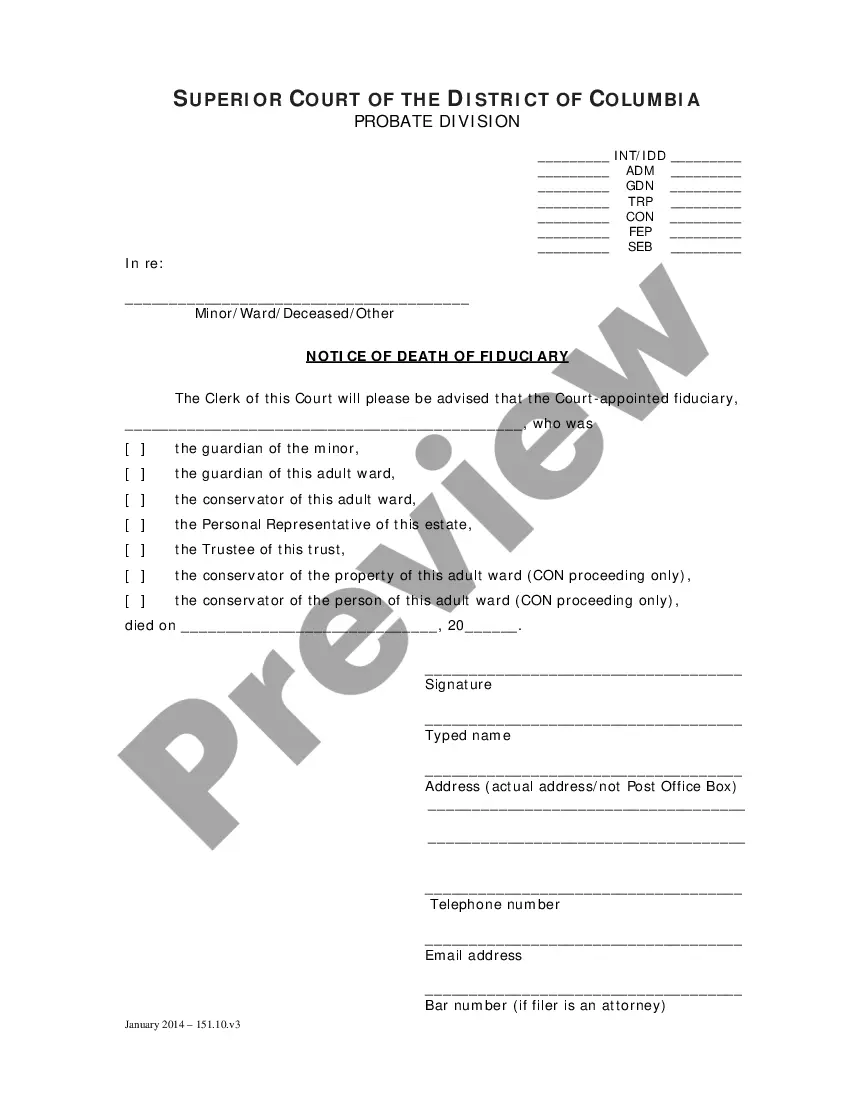

This is an official form from the District of Columbia Court System, which complies with all applicable laws and statutes. USLF amends and updates forms as is required by District of Columbia statutes and law.

District of Columbia Notice of Death of Trust Beneficiary

Description

How to fill out District Of Columbia Notice Of Death Of Trust Beneficiary?

The larger amount of documentation you must prepare - the more anxious you become.

You can find a vast quantity of District of Columbia Notice of Death of Trust Beneficiary forms online; however, you are unsure which ones to trust.

Eliminate the stress and simplify obtaining templates with US Legal Forms. Obtain professionally created documents that are tailored to meet state requirements.

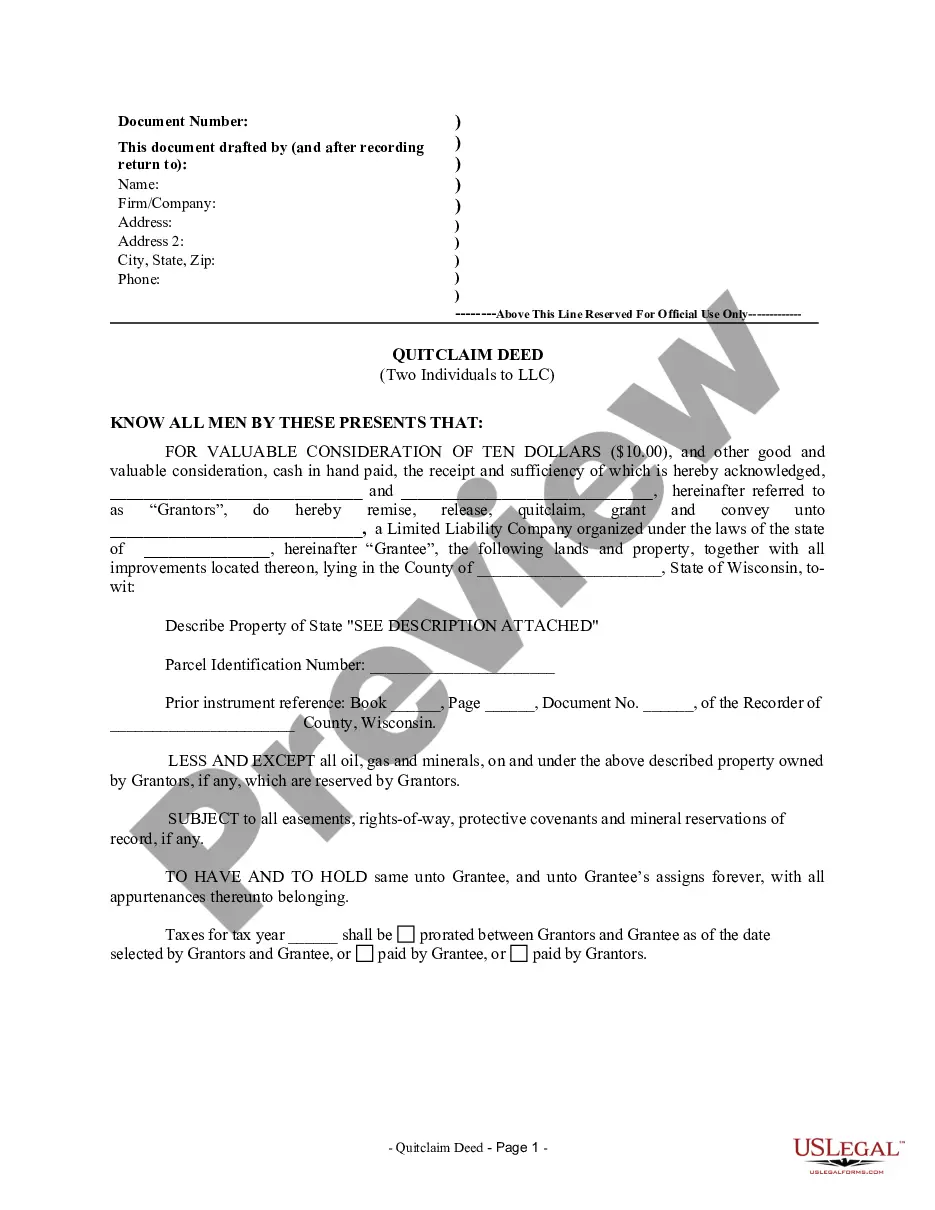

Input the requested information to create your profile and settle your order using PayPal or a credit card. Choose a preferred file format and obtain your template. Locate each document you receive in the My documents section. Simply navigate there to complete a new version of your District of Columbia Notice of Death of Trust Beneficiary. Even when utilizing correctly drafted forms, it remains crucial that you consider consulting a local attorney to verify the completed document to ensure that your record is correctly filled out. Do more for less with US Legal Forms!

- If you currently hold a US Legal Forms subscription, Log In to your account, and you will see the Download option on the District of Columbia Notice of Death of Trust Beneficiary page.

- If you haven’t utilized our platform previously, complete the registration process with these steps.

- Ensure the District of Columbia Notice of Death of Trust Beneficiary is applicable in your state.

- Verify your choice by reviewing the description or utilizing the Preview feature if available for the chosen document.

- Click on Buy Now to initiate the registration process and select a pricing plan that meets your requirements.

Form popularity

FAQ

Distributing a trust upon death involves several steps. First, the trustee must confirm the death and obtain a District of Columbia Notice of Death of Trust Beneficiary, which acknowledges the beneficiary's passing. Next, the trustee should review the trust document to determine the specific distribution instructions. Finally, the trustee will carry out the instructions, distributing the assets to the remaining beneficiaries as outlined in the trust.

The probate process in Washington, D.C., can take anywhere from several months to over a year, depending on various factors. The complexity of the estate, the presence of disputes, and the number of beneficiaries can all extend the timeline. If relevant, the District of Columbia Notice of Death of Trust Beneficiary could help clarify heirship issues. For a smoother process, using services like US Legal Forms may provide necessary assistance and documentation.

The time it takes to receive letters of administration in D.C. can vary based on specific cases, but it generally takes a few weeks to a couple of months. Factors such as the complexity of the estate and any potential disputes among heirs can influence this timeline. Additionally, if the District of Columbia Notice of Death of Trust Beneficiary applies, processing may be more efficient with proper documentation. Always stay in touch with the probate court for updates on your application.

A letter of administration in Washington, D.C., is a legal document issued by the probate court. This document authorizes an individual to manage and distribute the estate of a deceased person who did not leave a will. If a trust exists, the District of Columbia Notice of Death of Trust Beneficiary is essential for identifying beneficiaries. Thus, understanding the scope of a letter of administration can help you navigate estate matters smoothly.

Avoiding probate in D.C. can often be accomplished through estate planning strategies, such as establishing trusts or designating beneficiaries on accounts. When you create a trust, the District of Columbia Notice of Death of Trust Beneficiary becomes crucial, as it indicates any party involved after death. Additionally, consider joint ownership of property as another method to bypass probate. Consulting with an attorney can also provide tailored strategies for your specific situation.

To obtain a letter of administrator in Washington, D.C., you must file an application with the probate court. This process typically requires the death certificate and details regarding the estate. The District of Columbia Notice of Death of Trust Beneficiary may also play a role if the deceased held any trust benefits. Utilizing the resources on US Legal Forms can streamline this application process significantly.

To determine if you are a beneficiary of a trust, you can start by checking with the trustee or the attorney who created the trust. They can provide you with the District of Columbia Notice of Death of Trust Beneficiary if applicable. Additionally, reviewing the trust documents, if you have access, will clarify your status. Always consider contacting legal professionals for assistance with your inquiries.

When a beneficiary of a trust dies, the trustee must follow the terms outlined in the trust agreement. This may involve redistributing the deceased beneficiary’s share according to the trust's directives or state law. Filing a District of Columbia Notice of Death of Trust Beneficiary ensures that the event is officially recorded and relevant parties are notified promptly.

When a beneficiary of a trust is deceased, the trust document typically provides instructions on how to handle this situation. Often, their share may be redistributed among remaining beneficiaries or designated alternate beneficiaries. In such cases, issuing a District of Columbia Notice of Death of Trust Beneficiary is crucial to keep all parties informed and up to date.

After death, a trust is distributed according to its terms, which outline the beneficiaries and their respective shares. The trustee oversees the distribution process, ensuring all obligations are met and debts are cleared. If a District of Columbia Notice of Death of Trust Beneficiary needs to be filed, it is an important step in notifying relevant parties about changes due to the death.