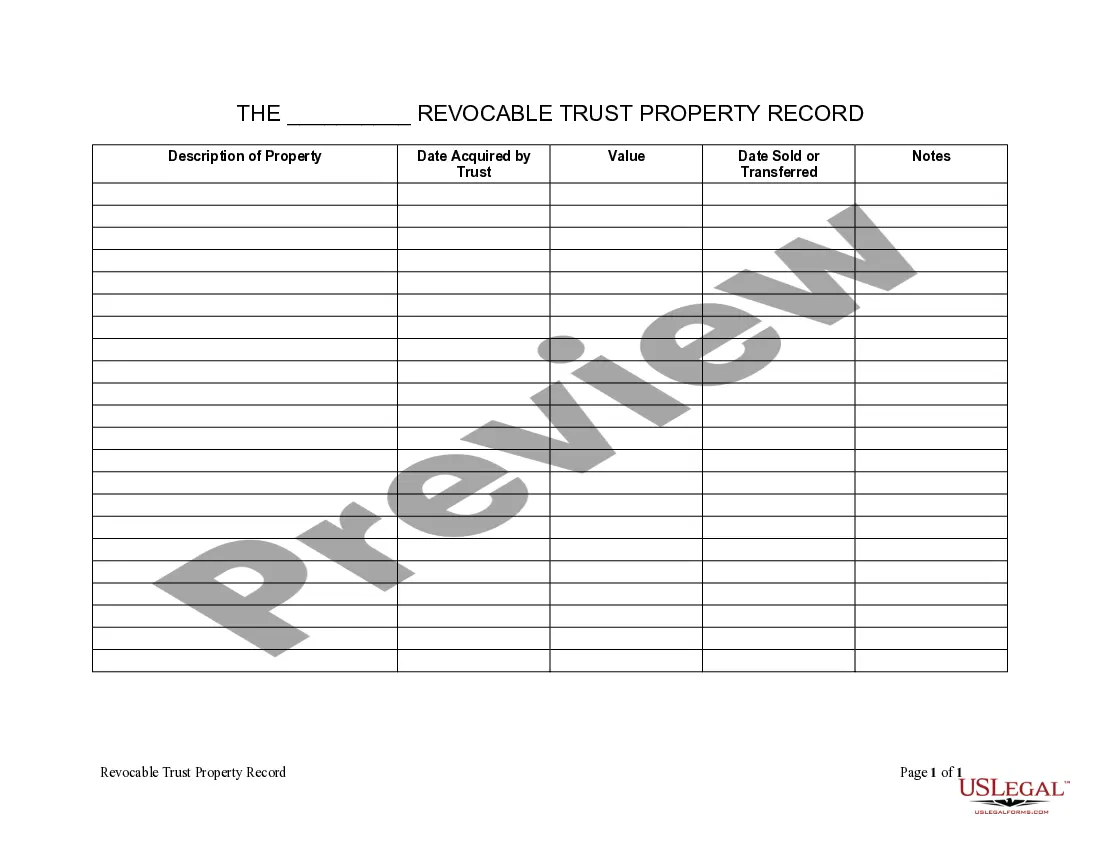

This is a Living Trust Property Inventory form. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form allows the Trustee to record a Description of Property, Date Acquired by Trust, Value, Date Sold or Transferred so that all property held by the trust can be accounted for including the real, personal or intellectual property.

District of Columbia Living Trust Property Record

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out District Of Columbia Living Trust Property Record?

The larger quantity of documents you should produce - the more anxious you become.

You can find a vast array of District of Columbia Living Trust Property Record samples online, but you are uncertain which to trust.

Eliminate the frustration and make finding examples easier by utilizing US Legal Forms. Obtain expertly crafted forms that conform to state requirements.

- Confirm that the District of Columbia Living Trust Property Record is applicable in your state.

- Verify your choice by examining the description or using the Preview feature if available for the selected document.

- Click Purchase Now to initiate the registration process and select a pricing option that suits your needs.

- Provide the necessary information to create your account and pay for the order using your PayPal or credit card.

- Select a suitable file format and receive your template.

Form popularity

FAQ

To obtain a recorded deed, you can request it from the Recorder of Deeds office in the District of Columbia. Typically, you will need to provide the property address and possibly the book and page number associated with the District of Columbia Living Trust Property Record. Additionally, utilizing online platforms like US Legal Forms can simplify the process by providing access to forms and guidance, ensuring you have everything you need to obtain your recorded deed.

Recording a deed in the District of Columbia typically takes a few days to a couple of weeks. The exact duration can depend on the current workload of the Recorder of Deeds and any specific requirements for the District of Columbia Living Trust Property Record. It is beneficial to ensure that all required documents are accurate and complete to avoid delays. To expedite the process, consider using services that specialize in filing, such as US Legal Forms.

To determine property ownership in Washington, DC, access the online property database provided by the DC government. You can search using relevant details like the property's address or the name of the owner. If the property is held within a trust, it may appear under a District of Columbia Living Trust Property Record. For assistance and streamlined navigation, consider using the resources available through US Legal Forms.

Finding a property owner in Washington, DC, is straightforward with online resources. You can visit the DC Office of Tax and Revenue's website, where you can search by property address or owner name. Many properties are documented under the District of Columbia Living Trust Property Record, which may provide additional insights into ownership structures. For a more comprehensive search experience, check out US Legal Forms to simplify the process.

To find out who owns the property near you, utilize public property records available through the District of Columbia government website. You can search by address or parcel number to access ownership details. Many properties may also be listed under a District of Columbia Living Trust Property Record, reflecting ownership via a trust. If you need help navigating these records, consider using US Legal Forms for easy access and guidance.

The income limit for the DC tax abatement varies based on the specific abatement type, focusing primarily on lower-income residents. Each program has its guidelines, aimed at providing financial relief. Reviewing your circumstances against the District of Columbia Living Trust Property Record may help determine what options are available to you for sustainable property management.

Individuals who own and occupy their primary residence in DC may qualify for the homestead property tax credit. This credit reduces the assessed value of the property for tax purposes, easing the financial load on homeowners. Referencing the District of Columbia Living Trust Property Record can assist in confirming your eligibility for this beneficial program.

To place a lien on a property in DC, you must file specific legal documents through the proper channels. This includes submitting the lien with the District of Columbia's Recorder of Deeds. Knowing how to access the District of Columbia Living Trust Property Record can streamline this process, offering necessary insights into property ownership.

Eligibility for the DC property tax credit primarily includes homeowners who meet specified income levels and property ownership criteria. Additionally, persons with disabilities and senior citizens often qualify for enhanced benefits. Always refer to the District of Columbia Living Trust Property Record for the most accurate and personalized information.

In Washington, residents who meet certain income criteria and own property may qualify for tax credits. This can be quite beneficial for those looking to ease their financial responsibilities. It is advisable to check the District of Columbia Living Trust Property Record to ensure you meet all requirements for optimal benefits.