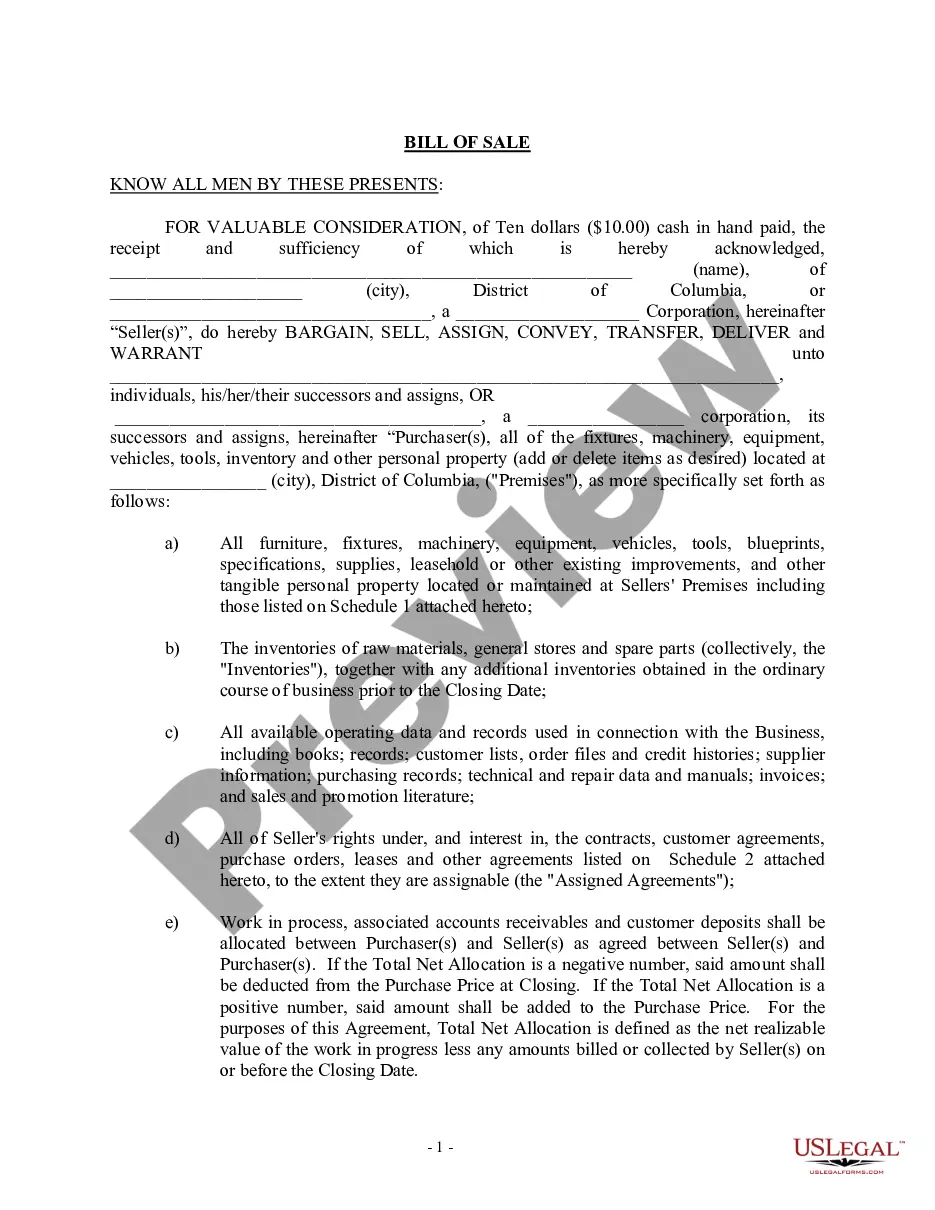

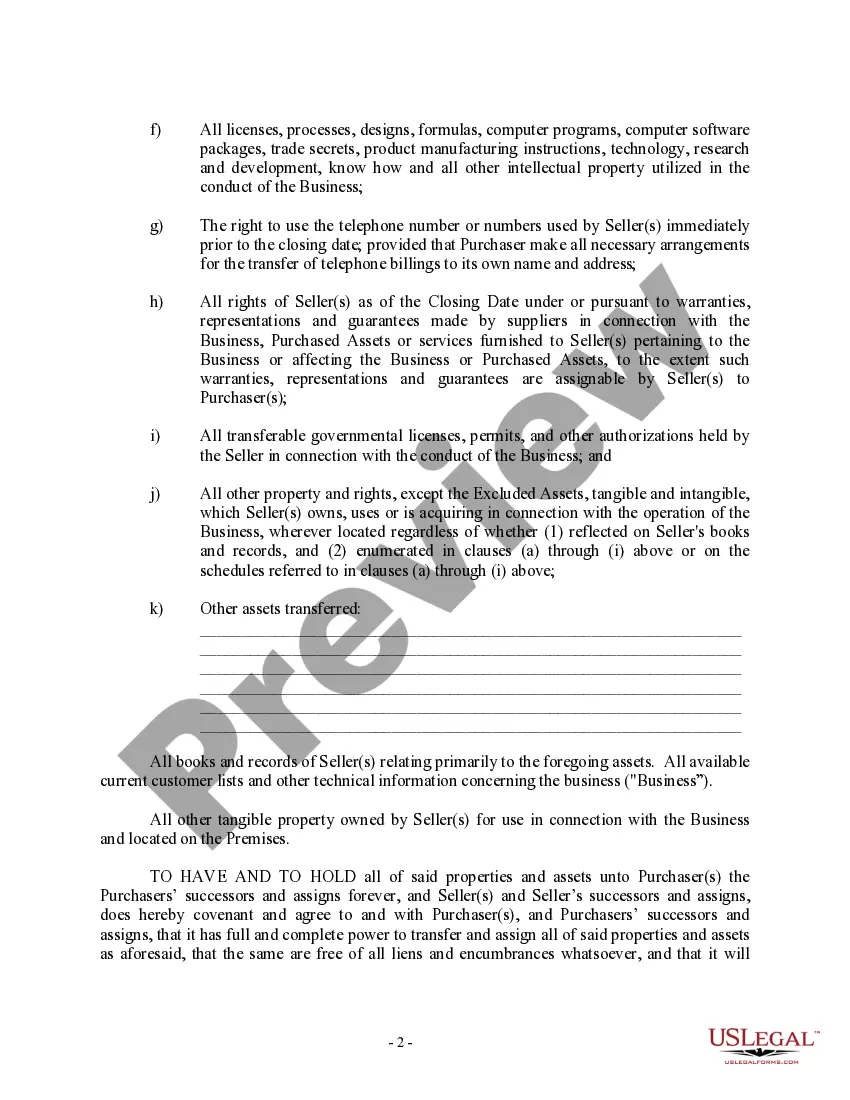

Bill of Sale in Connection with Sale of Business - Individual or Corporate Seller or Buyer. This bill of sale may include anything that is intangible but considered part of the business. These may be all licenses, processes, designs, formulas, computer programs, computer software packages, trade secrets, product manufacturing instructions etc.

District of Columbia Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller

Description

How to fill out District Of Columbia Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller?

The larger quantity of documents you are required to generate - the more anxious you become.

You can find a vast selection of District of Columbia Bill of Sale related to the Sale of Business by Individual or Corporate Seller templates online, yet you are unsure which ones to rely on.

Eliminate the inconvenience of finding samples with US Legal Forms.

Simply click Buy Now to initiate the sign-up process and pick a pricing plan that suits your needs. Provide the necessary details to set up your profile and pay for your order using PayPal or credit card. Select a convenient file format and obtain your template. Access every document you receive in the My documents section. Simply visit there to complete a new copy of the District of Columbia Bill of Sale related to the Sale of Business by Individual or Corporate Seller. Even when working with expertly drafted templates, it remains important to consider consulting your local attorney to verify that your document is accurately completed. Achieve more for less with US Legal Forms!

- Obtain professionally crafted forms tailored to fulfill state regulations.

- If you already have a US Legal Forms membership, Log In to your account, and you will find the Download option on the District of Columbia Bill of Sale related to the Sale of Business by Individual or Corporate Seller’s page.

- If you are new to our platform, follow these steps to complete the sign-up process.

- Verify that the District of Columbia Bill of Sale related to the Sale of Business by Individual or Corporate Seller is valid in your state.

- Double-check your choice by reviewing the description or by using the Preview mode if available for the selected document.

Form popularity

FAQ

Yes, if your LLC makes sales of tangible goods or taxable services in the District of Columbia, you will need to collect sales tax. This requirement applies regardless of whether your LLC is an individual or corporate seller. Ensuring that you follow the rules concerning the District of Columbia Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller will help you remain compliant and avoid penalties.

To register your business in DC, you will need to file the necessary paperwork with the Department of Consumer and Regulatory Affairs (DCRA). This process includes selecting a business structure and obtaining the required licenses or permits. Using a well-structured District of Columbia Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller will also help streamline operations once your business is established.

If your business operates in the District of Columbia, you are generally required to collect sales and use tax. This tax applies to the majority of sales transactions unless otherwise exempted. It is important to incorporate this into your sales process, especially when executing the District of Columbia Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller, to adhere to local regulations.

Indeed, a properly executed District of Columbia Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller transfers title to the business equipment involved in the sale. This document serves as legal proof of the transaction, providing the new owner with clear ownership rights. To ensure a smooth transfer, ensure that all equipment is listed in detail in the bill of sale.

Yes, if your business sells to DC residents, you may need to withhold DC income tax. This requirement ensures compliance with local tax laws when conducting business in the District of Columbia. Therefore, it is crucial to be aware of your responsibilities concerning the District of Columbia Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller to avoid unexpected tax liabilities.

In most cases, the District of Columbia does not exempt sales tax. However, certain transactions may qualify for exemptions, including specific sales in connection with the District of Columbia Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller. It's essential to consult a tax professional or the DC Office of Tax and Revenue to understand your specific situation and any available exemptions.

Filling out the consideration section of a District of Columbia Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller involves stating the amount exchanged for the business. Clearly indicate the total consideration amount and any additional terms, like deposits or payment installments. This section is crucial as it legally defines the agreed value and ensures transparency in the transaction.

To register for remote seller sales tax in the District of Columbia, you must first determine if your business meets the state's economic nexus threshold. Once confirmed, you can create an account on the District of Columbia's Office of Tax and Revenue website. Complete the registration form for a sales and use tax permit. This process helps ensure you comply with local tax laws when making sales.

People seek a bill of sale, such as the District of Columbia Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller, to protect their interests during a transaction. It provides clear evidence of ownership transfer, outlines the details of the sale, and helps prevent future disputes. By using platforms like uslegalforms, individuals can create an effective bill of sale tailored to their specific needs.

In Oklahoma, notarization is not generally required for a bill of sale, including the District of Columbia Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller. However, having a bill notarized can add an extra layer of authenticity and may be beneficial in certain situations. Always check local requirements to ensure you’re meeting all legal standards.