This is a rider to the software/services master agreement order form. It provides that a related entity of the customer may use the software purchased from the vendor.

Connecticut Related Entity

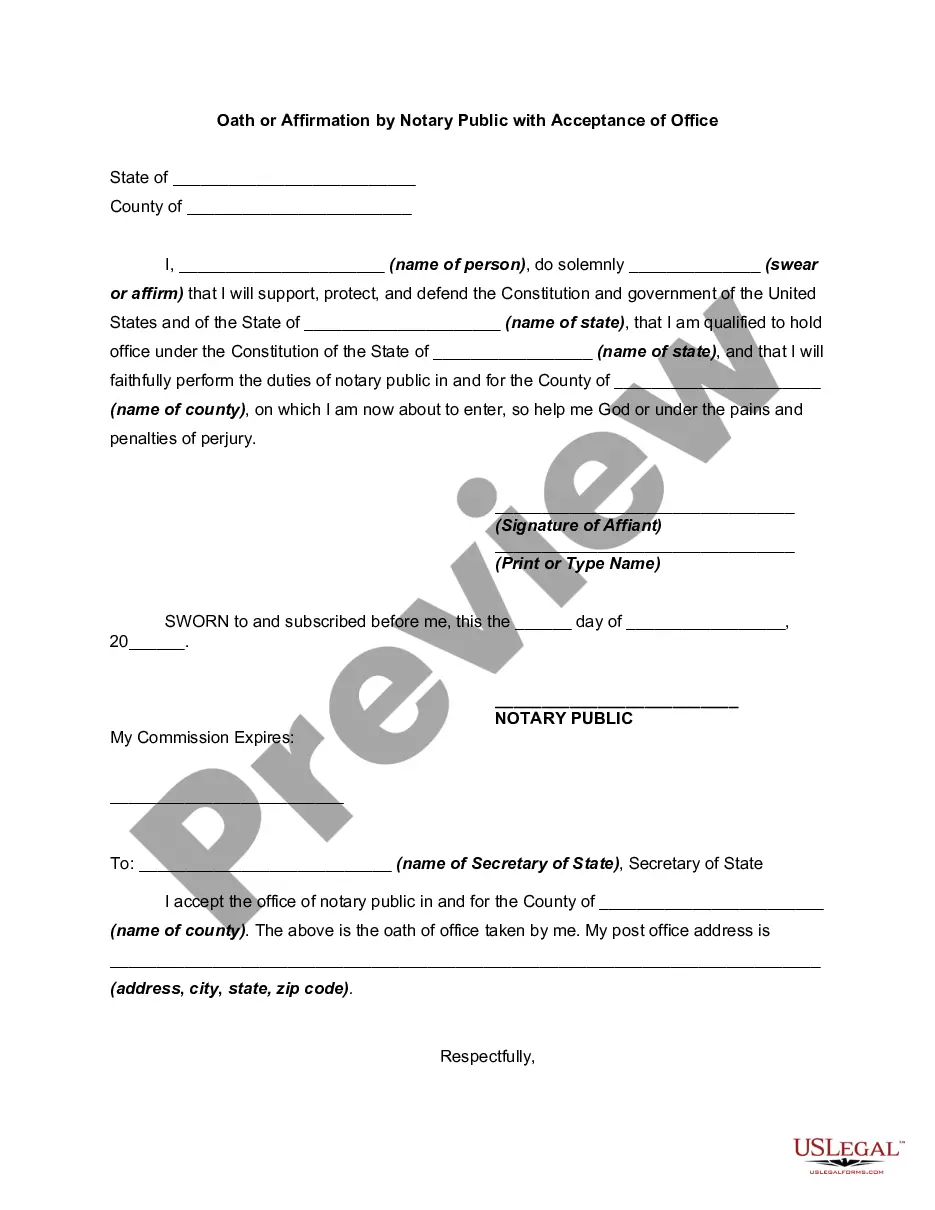

Description

How to fill out Related Entity?

If you want to comprehensive, acquire, or print out legitimate record web templates, use US Legal Forms, the most important collection of legitimate kinds, which can be found on the web. Utilize the site`s basic and convenient lookup to obtain the files you need. A variety of web templates for organization and person purposes are categorized by categories and states, or search phrases. Use US Legal Forms to obtain the Connecticut Related Entity in just a few mouse clicks.

In case you are presently a US Legal Forms consumer, log in for your bank account and then click the Down load option to have the Connecticut Related Entity. You can even access kinds you in the past delivered electronically in the My Forms tab of your own bank account.

If you work with US Legal Forms the very first time, refer to the instructions beneath:

- Step 1. Be sure you have selected the form for your correct town/country.

- Step 2. Use the Review option to check out the form`s content material. Never forget about to see the outline.

- Step 3. In case you are not happy with all the kind, use the Look for industry at the top of the screen to find other models from the legitimate kind design.

- Step 4. Upon having identified the form you need, click the Get now option. Choose the pricing prepare you prefer and put your accreditations to register for the bank account.

- Step 5. Procedure the transaction. You can use your credit card or PayPal bank account to finish the transaction.

- Step 6. Find the file format from the legitimate kind and acquire it on the system.

- Step 7. Full, edit and print out or indication the Connecticut Related Entity.

Every single legitimate record design you buy is your own property forever. You may have acces to every kind you delivered electronically inside your acccount. Click the My Forms area and pick a kind to print out or acquire once again.

Be competitive and acquire, and print out the Connecticut Related Entity with US Legal Forms. There are thousands of expert and status-particular kinds you may use for the organization or person requirements.

Form popularity

FAQ

Pass-Through Business Deduction (Sec. The Tax Cuts and Jobs Act created a deduction for households with income from sole proprietorships, partnerships, and S corporations, which allows taxpayers to exclude up to 20 percent of their pass-through business income from federal income tax.

through entity refers to a business that does not pay income tax of its own. Its income, losses, credits, and deductions ?passthrough? to each business owner's personal tax return, where its profits are taxed ing to each owner's individual income tax rate.

The law imposes a 6.99 percent tax on partnerships, LLCs, and S corporations. The tax is imposed on either the entity's entire Connecticut-sourced taxable income or an alternative tax base, which reduces taxable income by the percentage of nonresident ownership.

If you earn income in one state while living in another, you should expect to file a tax return for the state where you are living (your ?resident? state). You may also be required to file a state tax return where your employer is located or any state where you have a source of income.

LLCs taxed as C-Corp When filing as a C-Corp, your LLC will need to pay the 21% federal corporate income tax rate along with the 7.5% Connecticut corporate tax rate.

Connecticut?sourced income of a part?year resident is the sum of: Connecticut adjusted gross income for the part of the year you were a resident; Income derived from or connected with Connecticut sources for the part of the year you were a nonresident; and. Special accruals.

Connecticut State Department of Revenue Services Holiday Closure: The Department of Revenue Services will be closed on Friday, November 10th, a state holiday. Note: The Business Entity Tax (BET) no longer exists.

You must file a Connecticut income tax return if your gross income for the 2022 taxable year exceeds: $12,000 and you are married filing separately; $15,000 and you are filing single; $19,000 and you are filing head of household; or. $24,000 and you are married filing jointly or qualifying surviving spouse.