This lease rider form may be used when you are involved in a lease transaction, and have made the decision to utilize the form of Oil and Gas Lease presented to you by the Lessee, and you want to include additional provisions to that Lease form to address specific concerns you may have, or place limitations on the rights granted the Lessee in the “standard” lease form.

Connecticut Offset Well Protection and Payment of Compensatory Royalty

Description

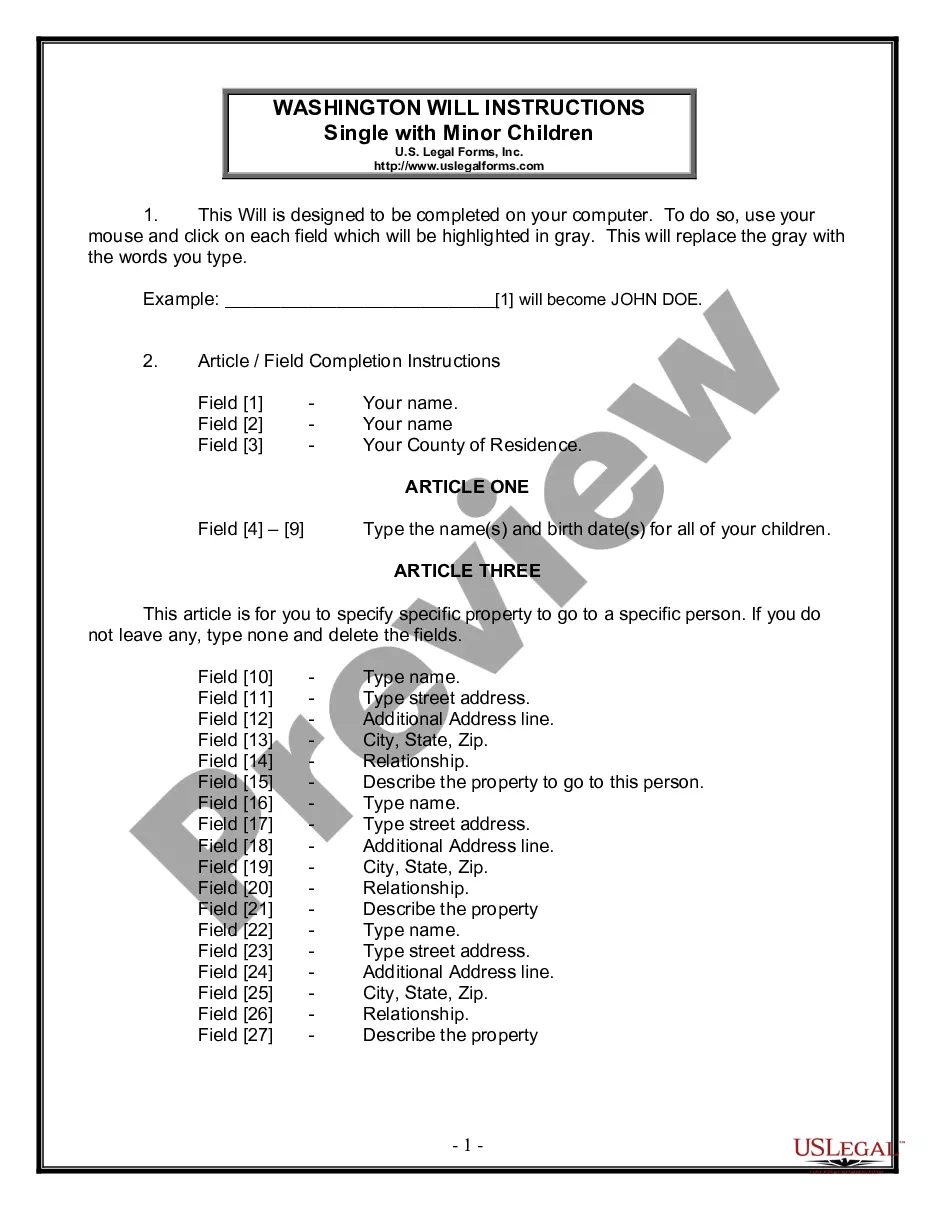

How to fill out Offset Well Protection And Payment Of Compensatory Royalty?

US Legal Forms - one of several biggest libraries of legitimate forms in America - provides a variety of legitimate document templates you are able to download or print out. Making use of the website, you can get thousands of forms for organization and personal uses, categorized by categories, claims, or key phrases.You can get the most recent versions of forms much like the Connecticut Offset Well Protection and Payment of Compensatory Royalty in seconds.

If you already possess a membership, log in and download Connecticut Offset Well Protection and Payment of Compensatory Royalty in the US Legal Forms local library. The Download button can look on each kind you see. You gain access to all earlier saved forms in the My Forms tab of your respective profile.

In order to use US Legal Forms for the first time, here are basic directions to help you get began:

- Be sure to have chosen the correct kind for the metropolis/area. Click the Review button to check the form`s content. Read the kind description to ensure that you have selected the proper kind.

- When the kind does not match your demands, take advantage of the Look for discipline at the top of the screen to get the one that does.

- If you are happy with the form, verify your selection by clicking the Purchase now button. Then, choose the prices program you like and offer your credentials to register on an profile.

- Process the purchase. Utilize your Visa or Mastercard or PayPal profile to finish the purchase.

- Find the structure and download the form on your own system.

- Make adjustments. Load, revise and print out and signal the saved Connecticut Offset Well Protection and Payment of Compensatory Royalty.

Every single format you included in your bank account does not have an expiry particular date and is yours permanently. So, if you wish to download or print out an additional version, just go to the My Forms section and click on the kind you need.

Gain access to the Connecticut Offset Well Protection and Payment of Compensatory Royalty with US Legal Forms, by far the most comprehensive local library of legitimate document templates. Use thousands of professional and condition-certain templates that fulfill your organization or personal needs and demands.

Form popularity

FAQ

How many royalties do you get from an oil well? The customary royalty percentage is 12.5 percent or 1/8 of the value of the oil or gas at the wellhead. Some states have laws that require the owner be paid a minimum royalty (often 12.5 percent). What is an oil well royalty owner's share of production called ... - Quora quora.com ? What-is-an-oil-well-royalty-ow... quora.com ? What-is-an-oil-well-royalty-ow...

The compensatory royalty is to be paid monthly one-half (1/2) to the Commissioner, and one-half (1/2) to owner of the soil, beginning on or before the last day of the month following the month in which the Oil or Gas is produced from the well causing the drainage or that is completed in the same producing reservoir and ...

Compensatory royalty A royalty paid in lieu of drilling a well that would otherwise be required under the covenants of a lease, express or implied. compensatory royalty agreement An agreement developed for unleased Federal or Indian land being drained by a well located on adjacent land. Glossary - Office of Natural Resources Revenue Office of Natural Resources Revenue (.gov) ? document ? Glossary Office of Natural Resources Revenue (.gov) ? document ? Glossary PDF

Royalty Payment Clauses A royalty is agreed upon as a percentage of the lease, minus what was reasonably used in the lessee's production costs. This is stipulated in a Royalty Clause. The royalty is paid by the lessee to the owner of the mineral rights, the lessor in the lease.

Compensatory royalties are often assessed based on the production from the. well deemed to be draining the lease. Some leases base the compensatory royalty on a. percentage of the adjacent wells' production, while others are silent.