Connecticut Disclaimer and Quitclaim of Interest in Mineral / Royalty Interest

Description

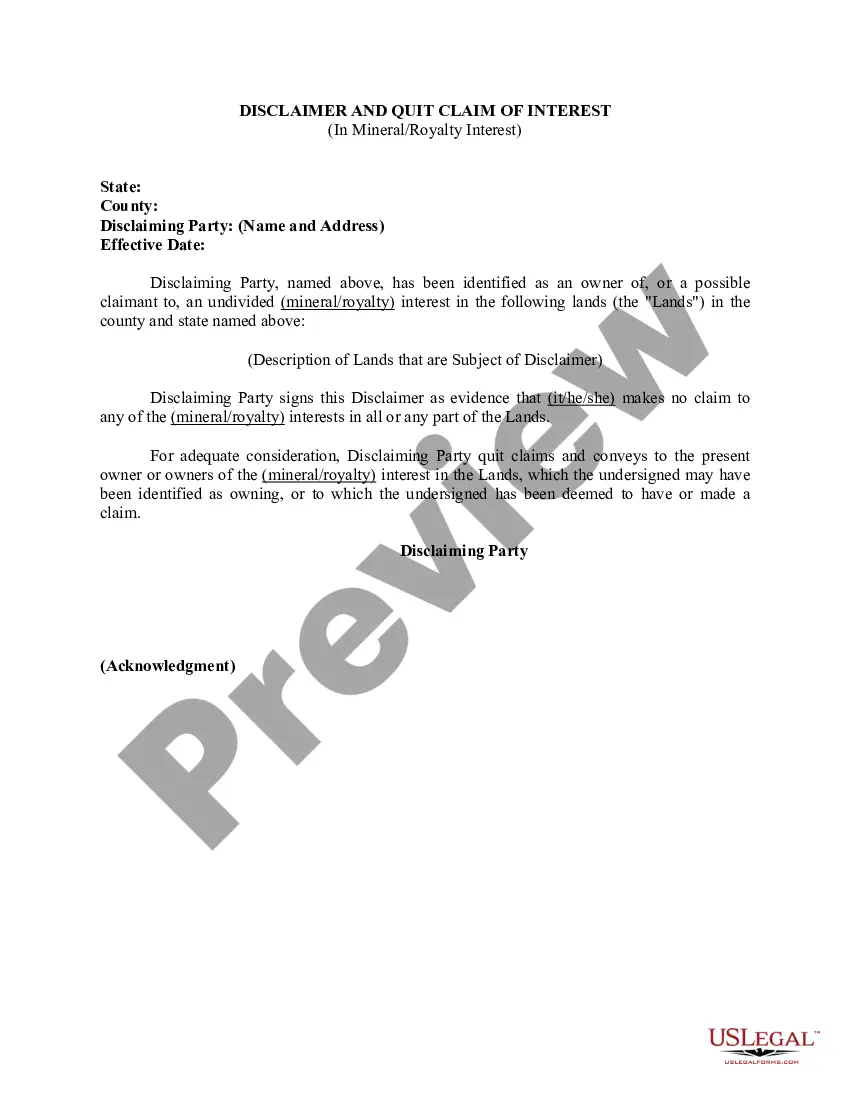

How to fill out Disclaimer And Quitclaim Of Interest In Mineral / Royalty Interest?

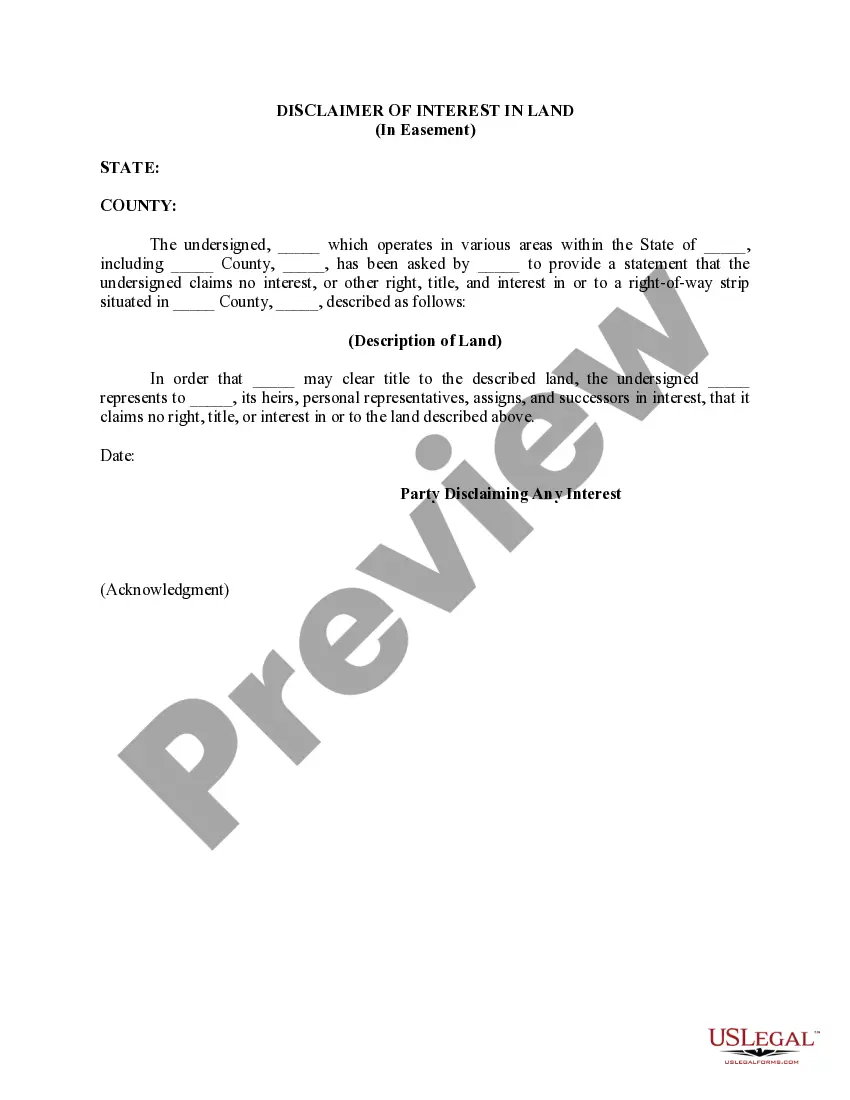

Choosing the best legal document design could be a have difficulties. Obviously, there are a variety of web templates available on the Internet, but how can you discover the legal develop you require? Utilize the US Legal Forms website. The services offers thousands of web templates, for example the Connecticut Disclaimer and Quitclaim of Interest in Mineral / Royalty Interest, which you can use for company and personal needs. Each of the varieties are checked out by experts and fulfill federal and state requirements.

If you are already signed up, log in to the profile and then click the Obtain switch to have the Connecticut Disclaimer and Quitclaim of Interest in Mineral / Royalty Interest. Make use of your profile to check with the legal varieties you might have acquired in the past. Check out the My Forms tab of the profile and obtain yet another backup of your document you require.

If you are a whole new consumer of US Legal Forms, allow me to share basic directions that you should follow:

- Initially, be sure you have selected the appropriate develop for your area/county. You can look over the shape using the Preview switch and study the shape outline to guarantee this is the best for you.

- In case the develop fails to fulfill your expectations, make use of the Seach discipline to get the right develop.

- When you are sure that the shape is suitable, select the Acquire now switch to have the develop.

- Opt for the costs plan you need and enter in the necessary information. Build your profile and pay money for your order utilizing your PayPal profile or Visa or Mastercard.

- Select the document format and acquire the legal document design to the product.

- Complete, change and produce and indicator the obtained Connecticut Disclaimer and Quitclaim of Interest in Mineral / Royalty Interest.

US Legal Forms is definitely the biggest catalogue of legal varieties in which you can find a variety of document web templates. Utilize the company to acquire appropriately-created papers that follow express requirements.

Form popularity

FAQ

A disclaimer of interest is, essentially, a written statement to the probate court where someone who stands to inherit property or assets states that they do not wish to exercise that inheritance. They ?disclaim? any right to receive the interest that they otherwise would.

Disclaiming means that you give up your right to receive the inheritance. If you choose to do so, whatever assets you were meant to receive would be passed along to the next beneficiary in line. It's not typical for people to disclaim inheritance assets.

A disclaimer of interest is, essentially, a written statement to the probate court where someone who stands to inherit property or assets states that they do not wish to exercise that inheritance.

For example, in her will a decedent leaves $500,000 to her nephew if he survives her, but if he does not survive her, this amount passes to her nephew's children who survive the decedent. If the nephew disclaims the property, it passes to his children who survive the decedent.

Disclaiming means that you give up your right to receive the inheritance. If you choose to do so, whatever assets you were meant to receive would be passed along to the next beneficiary in line. It's not typical for people to disclaim inheritance assets.

(a) All conveyances of land shall be: (1) In writing; (2) if the grantor is a natural person, subscribed, with or without a seal, by the grantor with his own hand or with his mark with his name annexed to it or by his agent authorized for that purpose by a power executed, acknowledged and witnessed in the manner ...

In addition to reducing federal estate and income taxes, there are a few more reasons why a beneficiary may want to disclaim inherited assets: To avoid receiving undesirable real property, such as an eroding beachfront property or property with high real estate taxes that may take a long time to sell.

The Connecticut Quiet Title Process Under Connecticut General Statute § 52-325, the Notice of Lis Pendens provides notice to the public of the pending title claim and forces future owners of the property to take the property subject to the outcome of the court action.