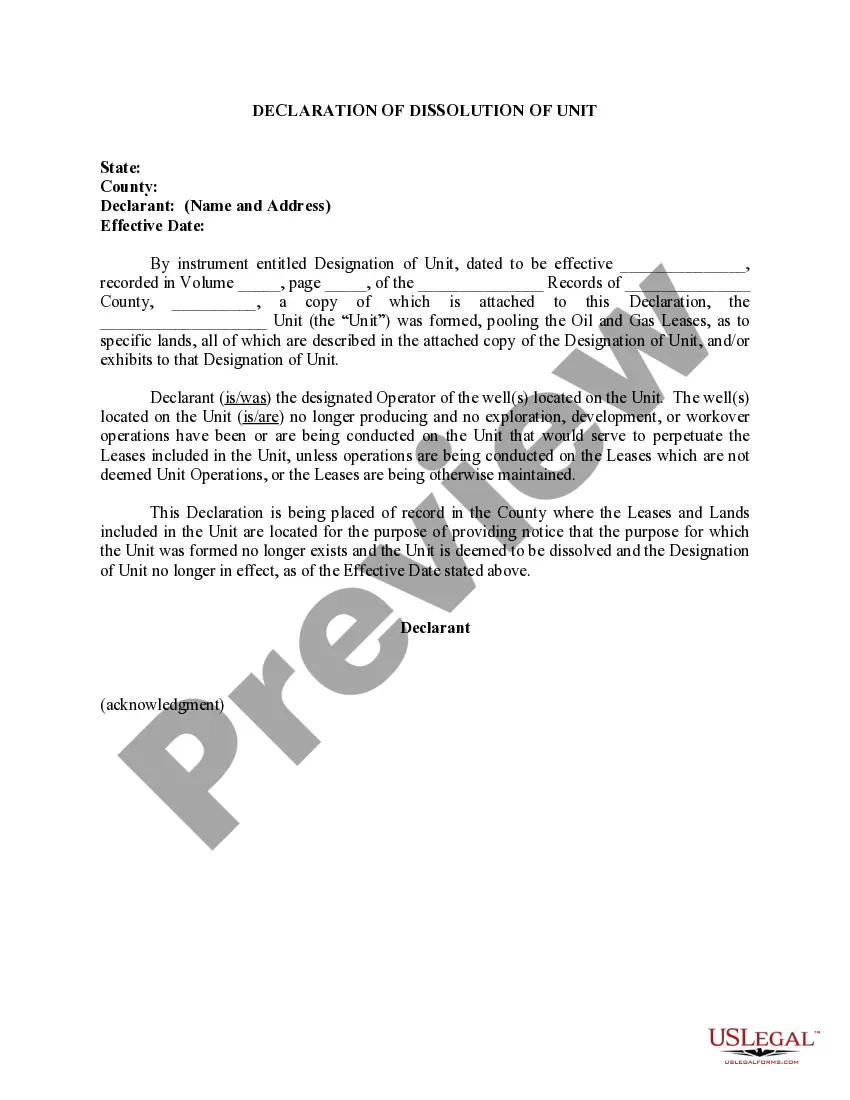

Connecticut Declaration of Dissolution of Unit

Description

How to fill out Declaration Of Dissolution Of Unit?

Choosing the right lawful document template can be quite a battle. Obviously, there are a variety of layouts available on the Internet, but how would you find the lawful form you need? Take advantage of the US Legal Forms site. The services gives 1000s of layouts, such as the Connecticut Declaration of Dissolution of Unit, which can be used for organization and private requires. All of the varieties are examined by specialists and satisfy federal and state requirements.

If you are already registered, log in in your profile and then click the Obtain key to get the Connecticut Declaration of Dissolution of Unit. Make use of your profile to appear through the lawful varieties you possess purchased earlier. Visit the My Forms tab of the profile and obtain one more copy of the document you need.

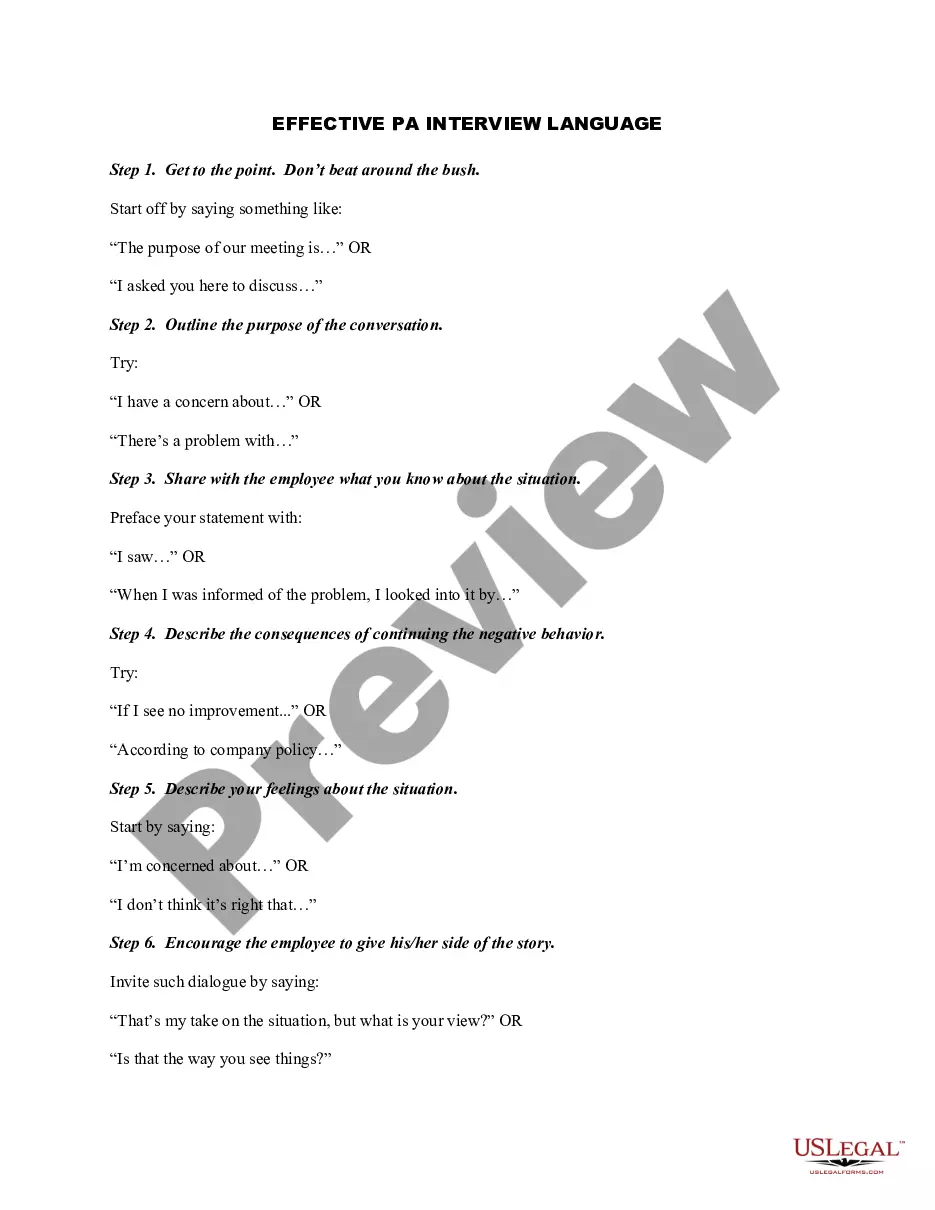

If you are a fresh user of US Legal Forms, listed below are easy recommendations that you can stick to:

- Very first, be sure you have selected the proper form for your metropolis/region. You can examine the shape utilizing the Review key and study the shape outline to make certain it is the best for you.

- If the form does not satisfy your expectations, make use of the Seach industry to get the proper form.

- Once you are sure that the shape is proper, go through the Buy now key to get the form.

- Select the rates strategy you would like and enter in the needed details. Build your profile and pay money for the order with your PayPal profile or bank card.

- Opt for the submit file format and obtain the lawful document template in your device.

- Total, revise and print and sign the attained Connecticut Declaration of Dissolution of Unit.

US Legal Forms is definitely the most significant local library of lawful varieties where you can see a variety of document layouts. Take advantage of the service to obtain appropriately-made files that stick to express requirements.

Form popularity

FAQ

To dissolve a Connecticut corporation, you just need to file a Certificate of Dissolution with the Connecticut Secretary of the State, Commercial Recording Division (SOTS). Connecticut has forms available for use but you can draft your own articles of dissolution as long as they contain the required information.

File Certificate of Dissolution To ensure your Connecticut LLC is properly closed, you must file a Certificate of Dissolution with the Secretary of State. You may file for dissolution online, or you can mail the completed Certificate of Dissolution form to the Office of the Secretary of State in Hartford, Connecticut.

A certificate of dissolution form (Form CDRS-1) is available for download from the SOTS website. There is a $50 fee to file the certificate. You can file by mail, fax, or in person.

Locate the Taxpayer Updates group and click the Close Accounts hyperlink. Enter the date of closure for each account you wish to close. Important: All returns must be filed up to the closing date.

As required by law, a nonprofit organization that is ceasing existence is required to transfer all remaining assets to another tax-exempt organization or to the government. It is unlawful to give any property away to individuals - including board members, volunteers, staff, or beneficiaries.

The board must vote on and adopt a plan to dissolve. The organization's bylaws and articles of incorporation govern the voting process and adoption of the plan. membership for a vote. A vote of two-thirds in favor of dissolution is needed to continue the process.

The ?dissolution? clause in a nonprofit organization's Articles of Incorporation is one of the key provisions required to qualify for 501(c)(3) status. This language must require that the organization's assets remain dedicated to 501(c)(3) exempt purposes in the event it dissolves.

Here are the main areas to properly address. Debt payments. Be sure to handle all your debts to lenders and creditors. ... Notify the IRS. Handle your tax liabilities for the current year. ... Cancel your business licenses. Be sure to cancel all your business licenses and registrations with DCP in Connecticut. ... Collect amounts owed.