This forms is an agreement between a company and a former employee. Included in this agreement are terms, services and compensation information.

Connecticut Consulting Agreement with Former Employee

Description

How to fill out Consulting Agreement With Former Employee?

You have the capability to dedicate numerous hours online trying to locate the authentic document format that satisfies the federal and state requirements you require.

US Legal Forms provides countless authentic templates that have been reviewed by professionals.

You can effortlessly access or print the Connecticut Consulting Agreement with Former Employee from my support.

If available, use the Review button to look at the document format as well. If you wish to find another version of the document, use the Search field to locate the format that suits your needs and requirements. Once you have found the format you want, click Acquire now to continue. Choose the pricing plan you prefer, enter your credentials, and register for an account on US Legal Forms. Complete the transaction. You can use your credit card or PayPal account to pay for the authentic document. Select the format from the file and download it to your device. Make changes to your document if necessary. You can fill out, edit, sign, and print the Connecticut Consulting Agreement with Former Employee. Download and print thousands of document templates using the US Legal Forms website, which offers the largest selection of authentic templates. Utilize professional and state-specific templates to manage your business or personal needs.

- If you already possess a US Legal Forms account, you may sign in and click on the Download button.

- After that, you can fill out, modify, print, or sign the Connecticut Consulting Agreement with Former Employee.

- Every authentic document format you acquire is yours indefinitely.

- To obtain another copy of any purchased document, navigate to the My documents section and click on the relevant button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document format for your county/city of choice.

- Review the document description to confirm you have chosen the right form.

Form popularity

FAQ

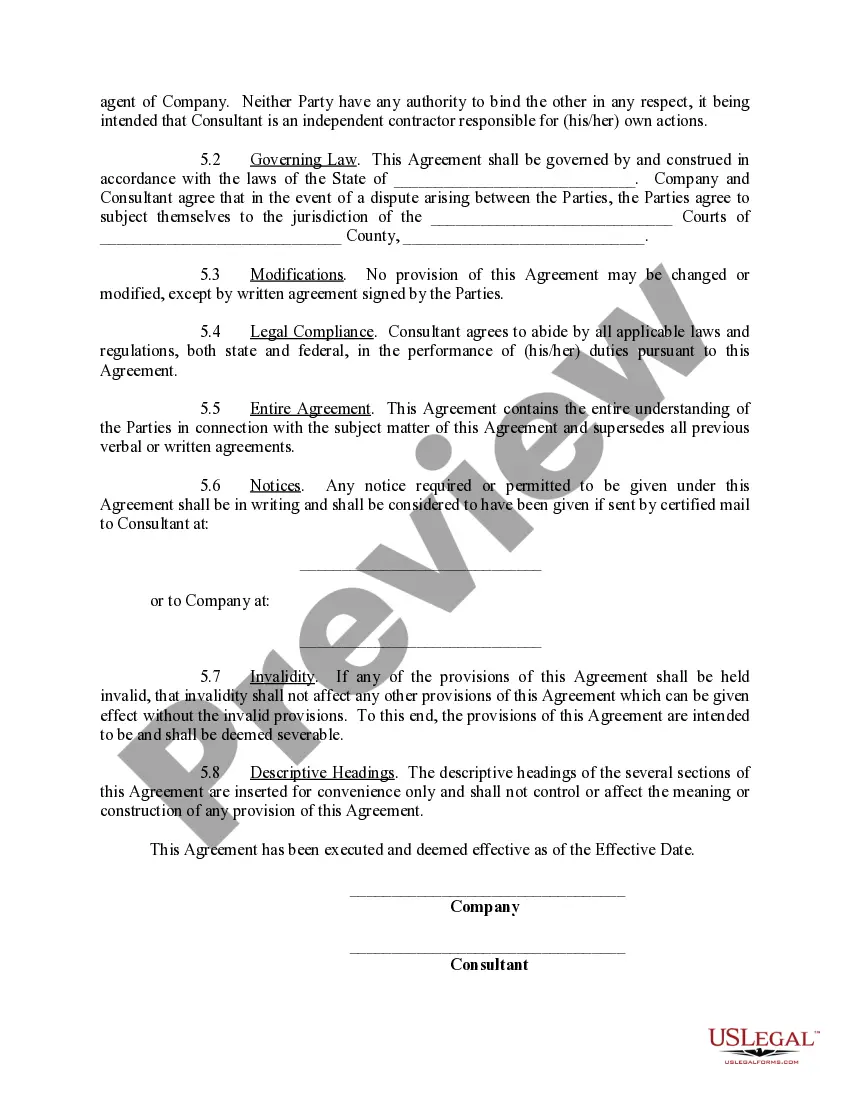

A comprehensive consultancy agreement, particularly a Connecticut Consulting Agreement with Former Employee, should include essential elements such as the names of the parties involved, the purpose of the agreement, and the consulting fees. Additionally, specify the payment schedule, deliverables, and the process for terminating the agreement. Including clauses on intellectual property rights and confidentiality can also protect both parties. Utilizing uslegalforms can simplify this process, providing you with templates that cover all necessary components.

To write a Connecticut Consulting Agreement with Former Employee, start by clearly defining the scope of work and the specific services the consultant will provide. Next, include the duration of the agreement, payment terms, and any confidentiality clauses. It’s also important to outline the rights and obligations of both parties. For added assurance, consider using a reliable platform like uslegalforms to draft your agreement, ensuring it meets all legal requirements.

Typical payment terms for consultants often include hourly rates, fixed fees, or retainer arrangements. It's crucial to specify the payment schedule, such as monthly or upon project milestones, in your Connecticut Consulting Agreement with Former Employee. This clarity protects both parties and helps prevent misunderstandings. For comprehensive templates and guidance, the US Legal Forms platform can offer valuable resources.

To set up a consulting agreement, start by clearly defining the scope of work you expect from the consultant. Include important details such as the duration of the agreement, confidentiality clauses, and any specific deliverables. Utilizing a template, like the Connecticut Consulting Agreement with Former Employee available on the US Legal Forms platform, can streamline this process. This ensures that you cover all essential elements while remaining compliant with state laws.

A consulting agreement is not classified as an employment contract. It defines a professional relationship based on service delivery without the employer-employee dynamic. For clarity and legal protection, ensure your Connecticut Consulting Agreement with Former Employee reflects this distinction.

Yes, consulting services are generally subject to sales tax in Connecticut. Businesses providing consulting services must collect and remit the appropriate tax based on the services offered. It's vital to understand these tax implications when entering into a Connecticut Consulting Agreement with Former Employee.

A consulting agreement is indeed a type of contract, specifically tailored for consulting services. It outlines the expectations, deliverables, and payment terms between the consultant and the client. When creating a Connecticut Consulting Agreement with Former Employee, ensure all key elements are clearly defined to avoid misunderstandings.

Consulting does not usually count as employment in the traditional sense. Consultants operate as independent contractors, providing services without the benefits or tax obligations associated with employment. Understanding this difference is crucial when drafting a Connecticut Consulting Agreement with Former Employee.

A consultancy agreement typically outlines the terms of service between a consultant and a client, focusing on project-based work without an employer-employee relationship. In contrast, an employment agreement establishes a formal employment relationship with benefits, obligations, and a regular paycheck. Knowing the distinctions can help you structure your Connecticut Consulting Agreement with Former Employee effectively.

In Connecticut, the time frame to cancel a contract often depends on the type of agreement. For most contracts, you may have a three-day window to cancel after signing, especially if it involves certain consumer transactions. However, always refer to your specific Connecticut Consulting Agreement with Former Employee for any unique cancellation terms.