Connecticut Material Storage Lease (For Pipe and Equipment)

Description

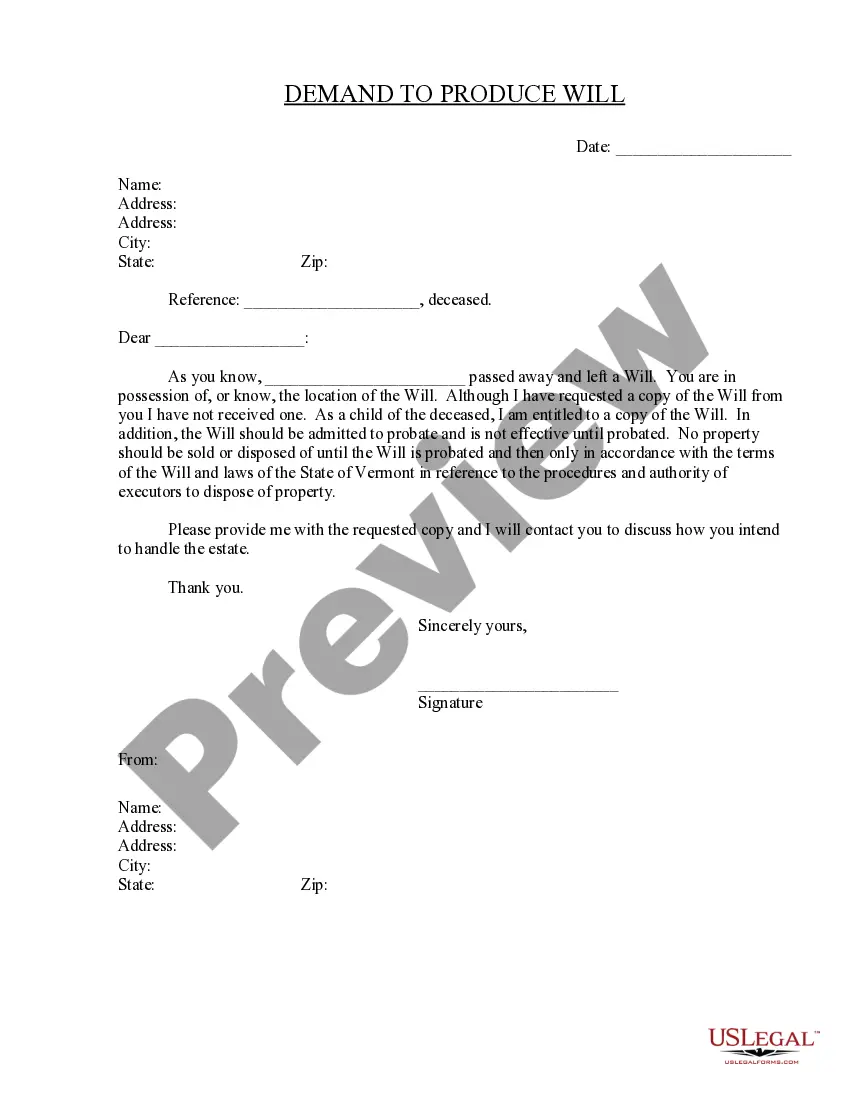

How to fill out Material Storage Lease (For Pipe And Equipment)?

Discovering the right authorized document web template can be quite a battle. Naturally, there are tons of web templates available online, but how do you find the authorized form you want? Take advantage of the US Legal Forms website. The services provides a large number of web templates, for example the Connecticut Material Storage Lease (For Pipe and Equipment), which you can use for business and private needs. All the kinds are inspected by experts and meet federal and state demands.

In case you are already signed up, log in in your accounts and then click the Acquire key to obtain the Connecticut Material Storage Lease (For Pipe and Equipment). Make use of your accounts to search throughout the authorized kinds you may have purchased formerly. Check out the My Forms tab of the accounts and have one more duplicate from the document you want.

In case you are a fresh end user of US Legal Forms, listed here are straightforward directions that you should follow:

- Initially, make certain you have selected the proper form for your town/county. You are able to look over the form while using Preview key and browse the form description to make sure this is basically the best for you.

- If the form does not meet your needs, make use of the Seach field to obtain the right form.

- Once you are sure that the form is acceptable, click the Purchase now key to obtain the form.

- Pick the pricing plan you desire and enter in the essential details. Make your accounts and pay money for the transaction with your PayPal accounts or charge card.

- Choose the file format and obtain the authorized document web template in your gadget.

- Comprehensive, revise and print and sign the attained Connecticut Material Storage Lease (For Pipe and Equipment).

US Legal Forms is the most significant collection of authorized kinds that you can see a variety of document web templates. Take advantage of the service to obtain expertly-produced documents that follow state demands.

Form popularity

FAQ

The rental surcharge rate for the rental of machinery is 2.75%. Form OP?383, Rental Surcharge Annual Report, must be filed and paid electronically using myconneCT. When filing Form OP?383, follow the instructions on myconneCT for filing Schedule A.

Tax-exempt goods Some goods are exempt from sales tax under Connecticut law. Examples include bicycle helmets, most non-prepared food items, medicines, and some medical devices and supplies.

Manufacturers and fabricators are afforded a full exemption on purchases of materials, tools and fuel that become an ingredient or component part of tangible personal property to be sold or are used directly in an industrial plant in a manufacturing or fabrication process of finished products to be sold.

Rental income is taxed very similarly to regular income, and tax rates will vary based on the specific property.

New York imposes sales tax on receipts from: every retail sale (including sales, rentals, and leases) of tangible personal property (unless an exemption applies); certain enumerated services; and. certain other enumerated items, including hotel occupancy, admission charges, and dues.

The resale certificate must: Be signed by the issuer; Have the name and address of the issuer; Describe the general character of the property or service sold by the issuer in the regular course of business; Describe the property or service being purchased by the issuer from the seller; and.

Transitional Rules: All charges for space for storage for periods on and after October 1, 2002, are subject to 6% sales and use taxes, and charges for periods before October 1, 2002, are not taxable.

The rental or leasing of tangible personal property for a consideration in this state is a sale and is subject to the tax. The lessor is a retailer who must register with the Commissioner of Revenue Services for a permit and collect the tax.