Connecticut Executor's Deed of Distribution

Description

How to fill out Executor's Deed Of Distribution?

If you wish to total, obtain, or produce legal papers templates, use US Legal Forms, the largest variety of legal kinds, which can be found on the web. Use the site`s basic and hassle-free search to discover the paperwork you want. Different templates for organization and personal reasons are sorted by types and says, or search phrases. Use US Legal Forms to discover the Connecticut Executor's Deed of Distribution in a couple of clicks.

When you are currently a US Legal Forms consumer, log in to the account and click on the Obtain option to get the Connecticut Executor's Deed of Distribution. You can also entry kinds you previously downloaded in the My Forms tab of your account.

If you use US Legal Forms initially, follow the instructions listed below:

- Step 1. Be sure you have selected the form for your appropriate town/land.

- Step 2. Use the Preview choice to look through the form`s content. Do not overlook to read the explanation.

- Step 3. When you are unsatisfied with the develop, utilize the Lookup field near the top of the display screen to find other versions of your legal develop format.

- Step 4. After you have found the form you want, click on the Buy now option. Choose the pricing plan you favor and add your references to sign up to have an account.

- Step 5. Process the purchase. You can use your charge card or PayPal account to complete the purchase.

- Step 6. Select the format of your legal develop and obtain it in your gadget.

- Step 7. Total, edit and produce or sign the Connecticut Executor's Deed of Distribution.

Each and every legal papers format you buy is yours for a long time. You have acces to each develop you downloaded inside your acccount. Go through the My Forms segment and select a develop to produce or obtain again.

Contend and obtain, and produce the Connecticut Executor's Deed of Distribution with US Legal Forms. There are many expert and status-certain kinds you can use for your personal organization or personal demands.

Form popularity

FAQ

Here's a walk-through of the Connecticut probate process: Application for administration or probate of Will. ... Certificate for Land Records. ... Inventory of solely-owned assets. ... Pay expenses and claims. ... File estate tax returns. Final accounting and proposed distribution.

How much does an estate have to be worth to go to probate in Connecticut? In the state of Connecticut, the minimum value of the deceased's assets is $40,000.

The Estate Settlement Timeline: Although Connecticut law does not specify a particular deadline for this, it is generally advisable to do so within a month to avoid unnecessary delays in the probate process.

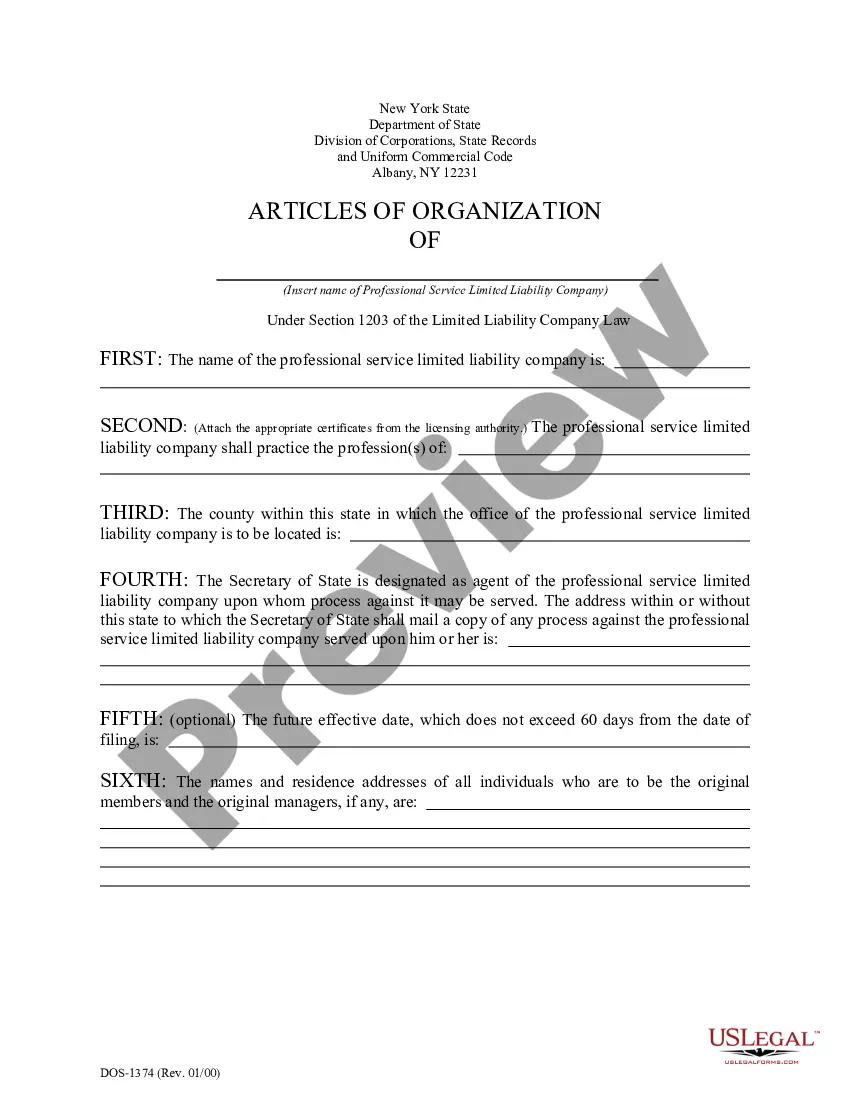

Executor Deed for Real Estate Located in Connecticut An executor is a personal representative designated by a decedent's will to settle the decedent's estate. Use an executor's deed to convey fee simple title to a grantee, who is either a beneficiary, heir, or buyer.

If you own the car with someone else and the word ?or? appears between the two names then it will automatically be solely owned by the other owner when you pass away, thereby avoiding probate. Or you could fill out the beneficiary designation section on the back of your registration.

Full "probate" is ONLY required by law if the person who dies, with or without a will, (1) owned real estate (not just a life use) that does not pass by the deed to the "surviving" joint owner, OR (2) owned $40,000 or more of other assets that also don't pass by beneficiary or joint ownership to another person.

Avoiding Probate In Connecticut If assets are jointly owned, they are not subject to probate. If assets pass by beneficiary designation, they are not subject to probate. Finally, if assets are in a Revocable Trust, they are not subject to probate.

List of Probate Assets Real property which is titled only in the name of the person who passed away (the person who passed away is called the decedent). Personal property owned by the decedent. ... Bank accounts if those accounts are solely in the name of the decedent. ... Interests in certain types of businesses.