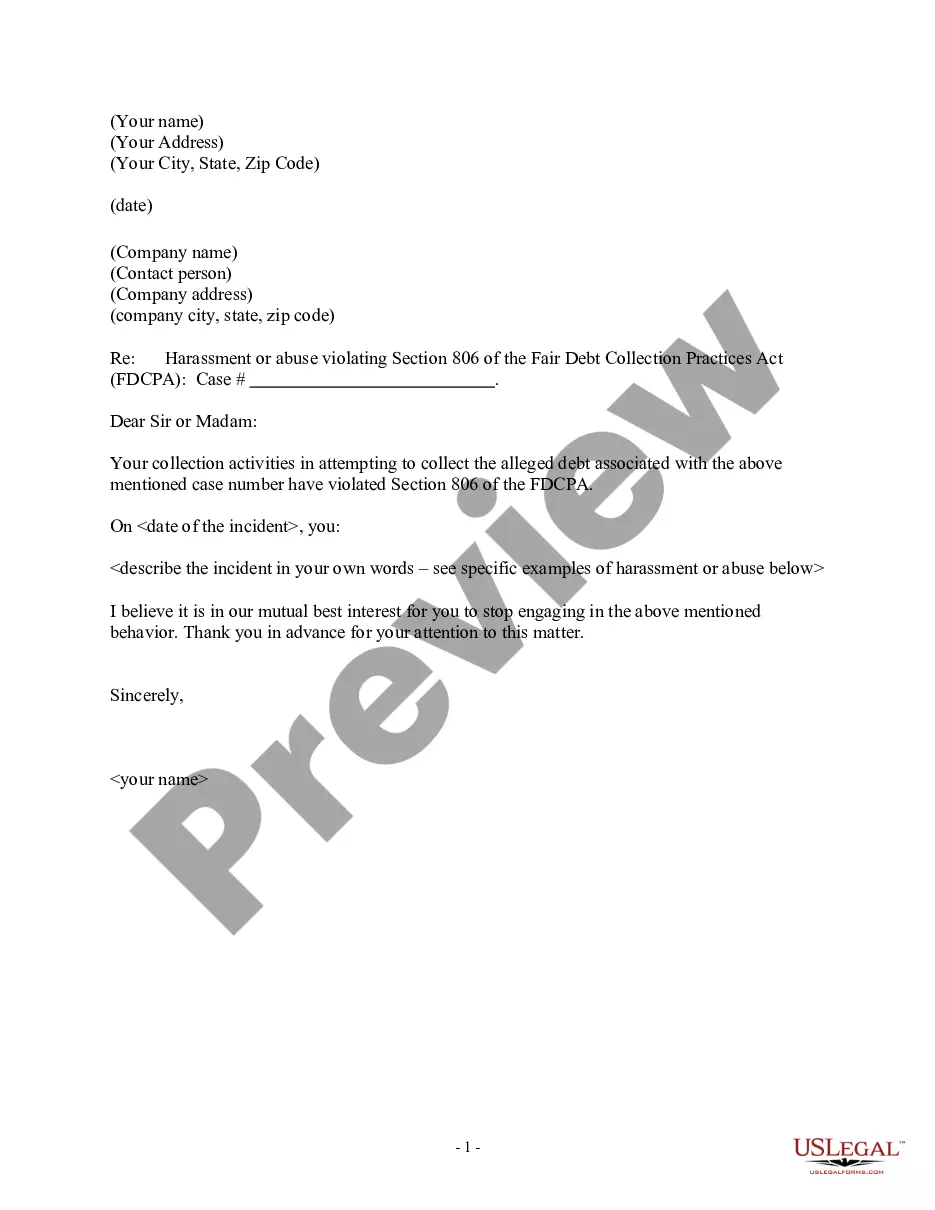

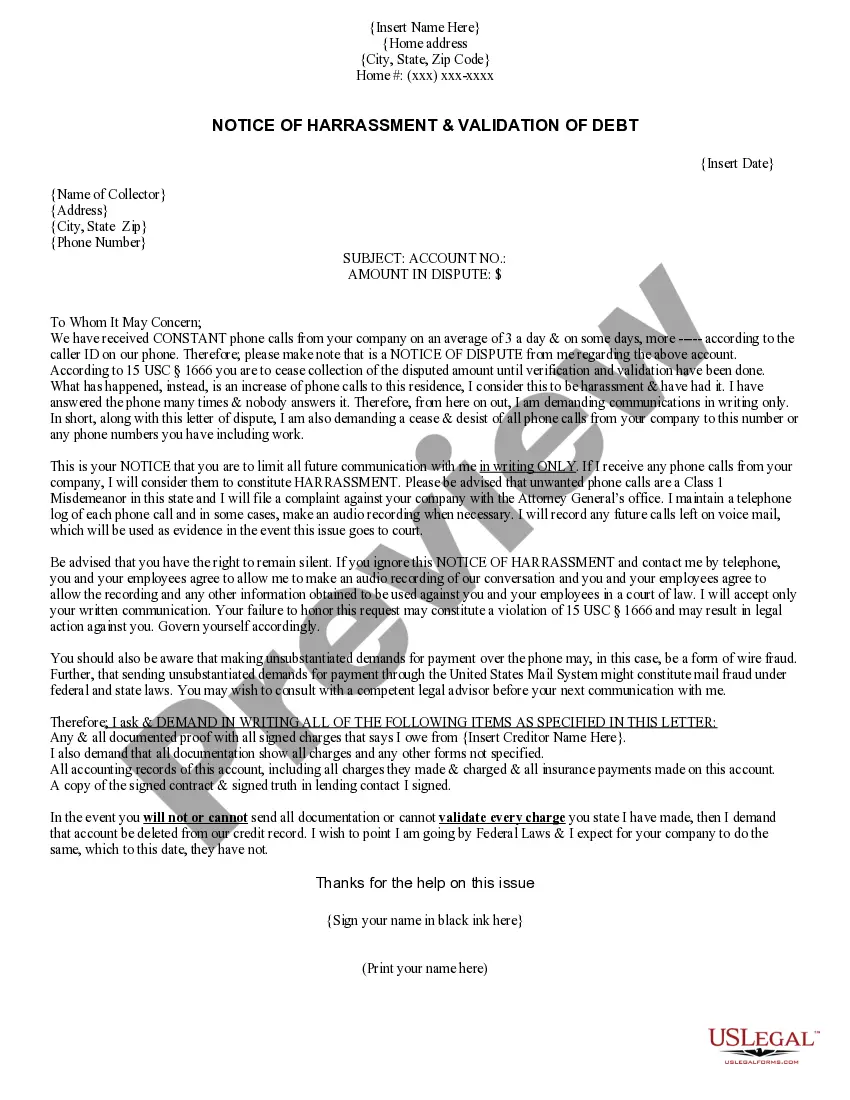

This NOTICE OF HARRASSMENT & VALIDATION OF DEBT is to be used when creditors call you repeatedly and mail you letters too. This form includes a cease and desist and a validation of debt, 2 letters in one.

Connecticut Notice of Harassment and Validation of Debt

Description

How to fill out Notice Of Harassment And Validation Of Debt?

If you wish to full, obtain, or print out legal record layouts, use US Legal Forms, the most important assortment of legal kinds, that can be found online. Utilize the site`s simple and easy convenient lookup to get the papers you require. Different layouts for company and personal purposes are categorized by types and states, or search phrases. Use US Legal Forms to get the Connecticut Notice of Harassment and Validation of Debt with a couple of mouse clicks.

If you are presently a US Legal Forms consumer, log in in your account and then click the Download button to obtain the Connecticut Notice of Harassment and Validation of Debt. You can also gain access to kinds you formerly delivered electronically in the My Forms tab of your respective account.

If you are using US Legal Forms for the first time, refer to the instructions below:

- Step 1. Ensure you have chosen the form for that correct area/country.

- Step 2. Use the Preview method to check out the form`s content material. Never overlook to see the outline.

- Step 3. If you are unsatisfied together with the develop, take advantage of the Research industry towards the top of the display screen to get other versions in the legal develop design.

- Step 4. Upon having discovered the form you require, click the Purchase now button. Opt for the prices program you favor and include your accreditations to sign up for an account.

- Step 5. Approach the transaction. You should use your bank card or PayPal account to complete the transaction.

- Step 6. Find the formatting in the legal develop and obtain it in your gadget.

- Step 7. Full, change and print out or indicator the Connecticut Notice of Harassment and Validation of Debt.

Every legal record design you purchase is the one you have forever. You possess acces to each and every develop you delivered electronically in your acccount. Click the My Forms section and select a develop to print out or obtain once again.

Remain competitive and obtain, and print out the Connecticut Notice of Harassment and Validation of Debt with US Legal Forms. There are many skilled and state-specific kinds you may use for the company or personal needs.

Form popularity

FAQ

Also, debt collectors can't call you numerous times a day. Doing so is considered a form of harassment by the Federal Trade Commission (FTC) and is explicitly not allowed.

The definition of debt collection harassment is to intimidate, abuse, coerce, bully or browbeat consumers into paying off debt. This happens most often over the phone, but harassment could come in the form of emails, texts, direct mail or talking to friends or neighbors about your debt.

Fortunately, there are legal actions you can take to stop this harassment:Write a Letter Requesting To Cease Communications.Document All Contact and Harassment.File a Complaint With the FTC.File a Complaint With Your State's Agency.Consider Suing the Debt Collection Agency for Harassment.

It is Legal for a Debt Collector to Contact Your Family Typically, debt collectors are allowed to contact each family member, but only once. The only case where they may do so again is if they believe the information given to them was false.

No harassment The Fair Debt Collection Practices Act (FDCPA) says debt collectors can't harass, oppress, or abuse you or anyone else they contact. Some examples of harassment are: Repetitious phone calls that are intended to annoy, abuse, or harass you or any person answering the phone. Obscene or profane language.

The definition of debt collection harassment is to intimidate, abuse, coerce, bully or browbeat consumers into paying off debt. This happens most often over the phone, but harassment could come in the form of emails, texts, direct mail or talking to friends or neighbors about your debt.

No harassment The Fair Debt Collection Practices Act (FDCPA) says debt collectors can't harass, oppress, or abuse you or anyone else they contact. Some examples of harassment are: Repetitious phone calls that are intended to annoy, abuse, or harass you or any person answering the phone. Obscene or profane language.

Federal law doesn't give a specific limit on the number of calls a debt collector can place to you. A debt collector may not call you repeatedly or continuously intending to annoy, abuse, or harass you or others who share the number.

Connecticut has a six-year statute of limitations for debt collection actions resulting from simple and implied contracts (CGS § 52-576; attachment 1). Medical bills generally are simple or implied contracts and thus the SOL is six years.

Debt Collectors Can't Call You Repeatedly to Harass You This means that while the FDCPA doesn't place a specific limit on the number of calls debt collectors can make, it prohibits them from calling you multiple times just to harass you. (15 U.S. Code §? 1692d).