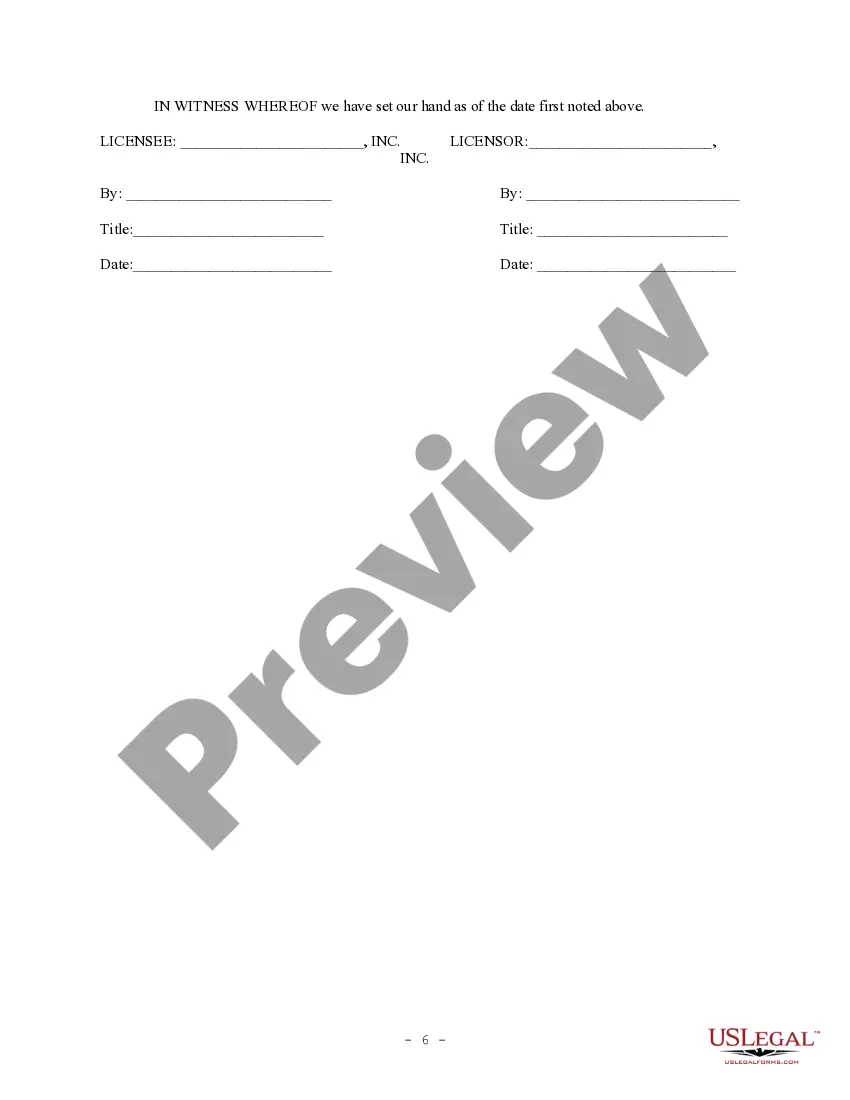

Connecticut Software License Subscription Agreement

Description

How to fill out Software License Subscription Agreement?

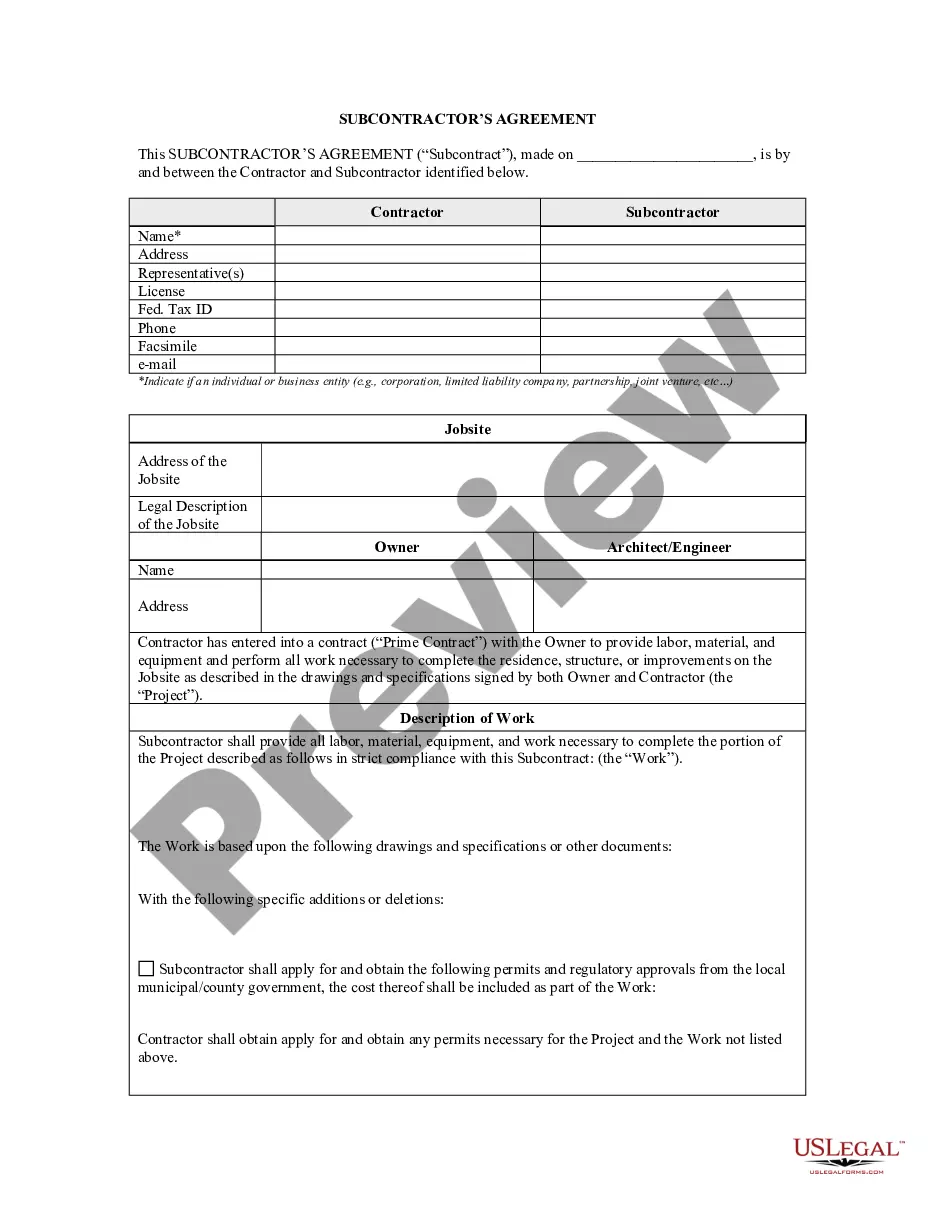

US Legal Forms - one of the largest collections of legal documents in the United States - provides a range of legal document templates that you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, categorized by types, states, or keywords. You can obtain the latest versions of forms like the Connecticut Software License Subscription Agreement in just moments.

If you already possess a membership, Log In and download the Connecticut Software License Subscription Agreement from the US Legal Forms library. The Acquire button will appear on every form you view. You can access all previously obtained forms in the My documents tab of your profile.

Complete the transaction. Use your credit card or PayPal account to finalize the transaction.

Choose the format and download the form to your device. Edit. Fill out, modify, print, and sign the downloaded Connecticut Software License Subscription Agreement. Every document you added to your account does not have an expiration date and is yours permanently. Therefore, if you want to download or print another copy, simply go to the My documents section and click on the form you need. Access the Connecticut Software License Subscription Agreement with US Legal Forms, one of the most extensive collections of legal document templates. Utilize a vast number of professional and state-specific templates that cater to your business or personal needs and requirements.

- If you wish to use US Legal Forms for the first time, here are simple instructions to help you get started.

- Ensure you have selected the correct form for your city/region. Click the Review button to inspect the form's content.

- Read the form description to confirm that you have chosen the right form.

- If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your choice by clicking the Purchase now button.

- Then, select the pricing plan you prefer and provide your details to register for an account.

Form popularity

FAQ

Yes, many license agreements include confidentiality clauses to protect sensitive information shared between the parties. This is especially important in a Connecticut Software License Subscription Agreement, where proprietary software and trade secrets may be involved. Always review the agreement carefully to understand the confidentiality terms that apply.

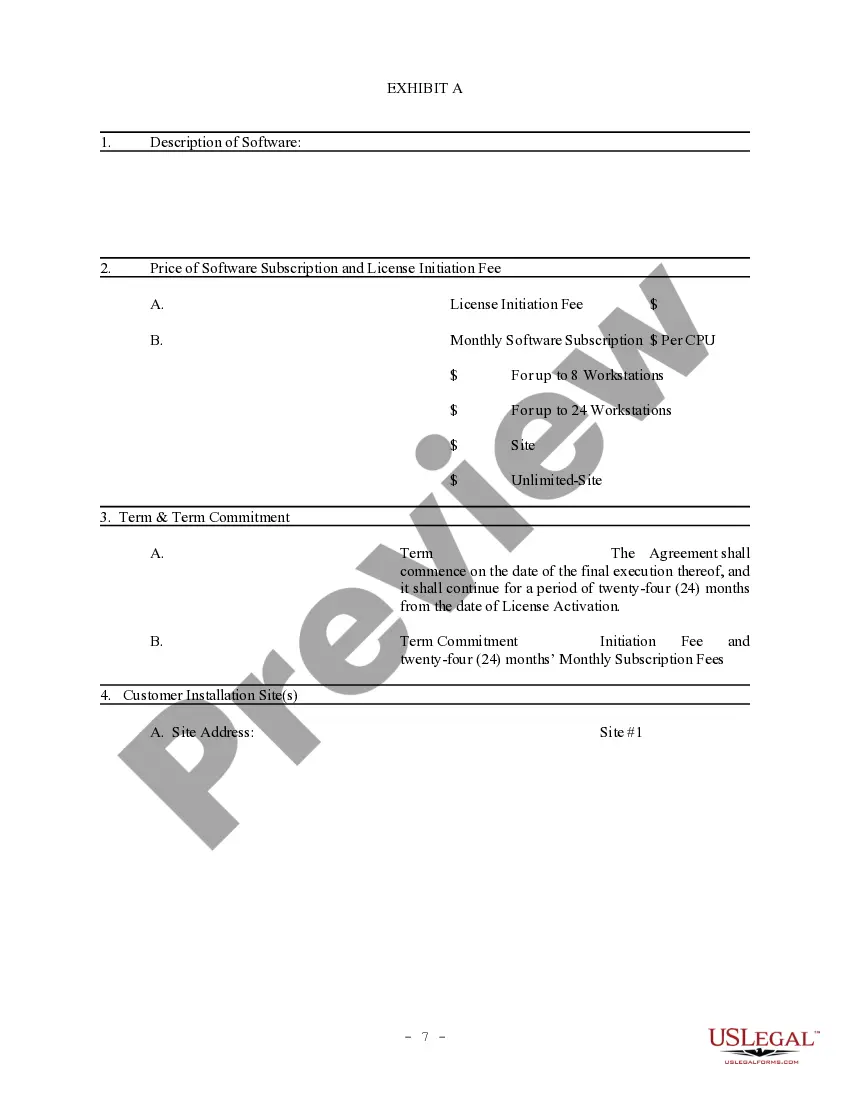

Licensing agreements typically include important details such as the scope of use, duration of the license, payment terms, and conditions for termination. They may also specify intellectual property rights and any restrictions on usage. A well-structured Connecticut Software License Subscription Agreement will clearly outline these components, ensuring both parties understand their obligations and rights.

Setting up a licensing agreement involves defining the terms and conditions under which one party can use another's software or intellectual property. Start by drafting a document that outlines the rights, responsibilities, and limitations for both parties. Using the Connecticut Software License Subscription Agreement template from USLegalForms can simplify this process and ensure you cover all necessary aspects.

You can find license agreements, including the Connecticut Software License Subscription Agreement, on various legal and software websites. Many companies provide templates for license agreements that you can customize to fit your needs. Additionally, platforms like USLegalForms offer a wide range of legal documents, making it easier for you to locate the right agreement.

The sales tax on software as a service (SaaS) in Connecticut is generally applied at the state rate of 6.35%. When entering into a Connecticut Software License Subscription Agreement, it's essential to factor this tax into your budgeting. This sales tax can vary based on specific conditions, so staying informed about the latest tax rates is beneficial. Consulting with a tax expert can provide clarity on how this tax applies to your agreements.

In Connecticut, the grace period for license renewal can vary depending on the type of license. Generally, you may have a specific timeframe to renew your Connecticut Software License Subscription Agreement without facing penalties. It is best to check with the relevant authorities for precise details regarding your license type. Ensuring timely renewal can help you avoid interruptions in service and maintain compliance.

Software licenses are generally taxable in Connecticut, which also includes subscriptions to software services. When you engage in a Connecticut Software License Subscription Agreement, you may incur sales tax on the license fees. Understanding this tax liability is crucial for effective budgeting and financial planning. It is advisable to stay updated on any changes in tax regulations that may impact your software agreements.

Yes, Connecticut does tax software. This includes both traditional software and software as a service. When you sign a Connecticut Software License Subscription Agreement, you should be aware of the tax implications that may affect your overall costs. To ensure compliance with state tax laws, consider seeking advice from professionals who understand the nuances of Connecticut's tax system.

Yes, software as a service (SaaS) is generally taxable in Connecticut. This means that when you enter into a Connecticut Software License Subscription Agreement, you may be subject to sales tax on the fees associated with the subscription. It is important to understand your obligations regarding tax compliance. For more detailed guidance, you may consider consulting with a tax professional.

Most states, including Connecticut, do not require LLCs to have operating agreements. However, some states may have specific requirements or strongly recommend having one. It's beneficial for LLC owners to understand their state's regulations and best practices. To navigate these requirements effectively, consider using resources like UsLegalForms to create a comprehensive operating agreement.