Connecticut Software License and Support Agreement

Description

How to fill out Software License And Support Agreement?

Are you situated in a position where you frequently need to obtain documentation for various organizational or specific needs on a daily basis.

There are numerous legal document templates available online, but finding ones you can trust is challenging.

US Legal Forms offers a vast array of form templates, including the Connecticut Software License and Support Agreement, designed to comply with federal and state regulations.

Access all the document templates you have purchased from the My documents section.

You can obtain an additional copy of the Connecticut Software License and Support Agreement at any time, if needed. Just click the desired form to download or print the document template. Use US Legal Forms, the most extensive collection of legal documents, to save time and avoid errors. The service offers precisely crafted legal document templates that you can use for various purposes. Create your account on US Legal Forms and begin simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Connecticut Software License and Support Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

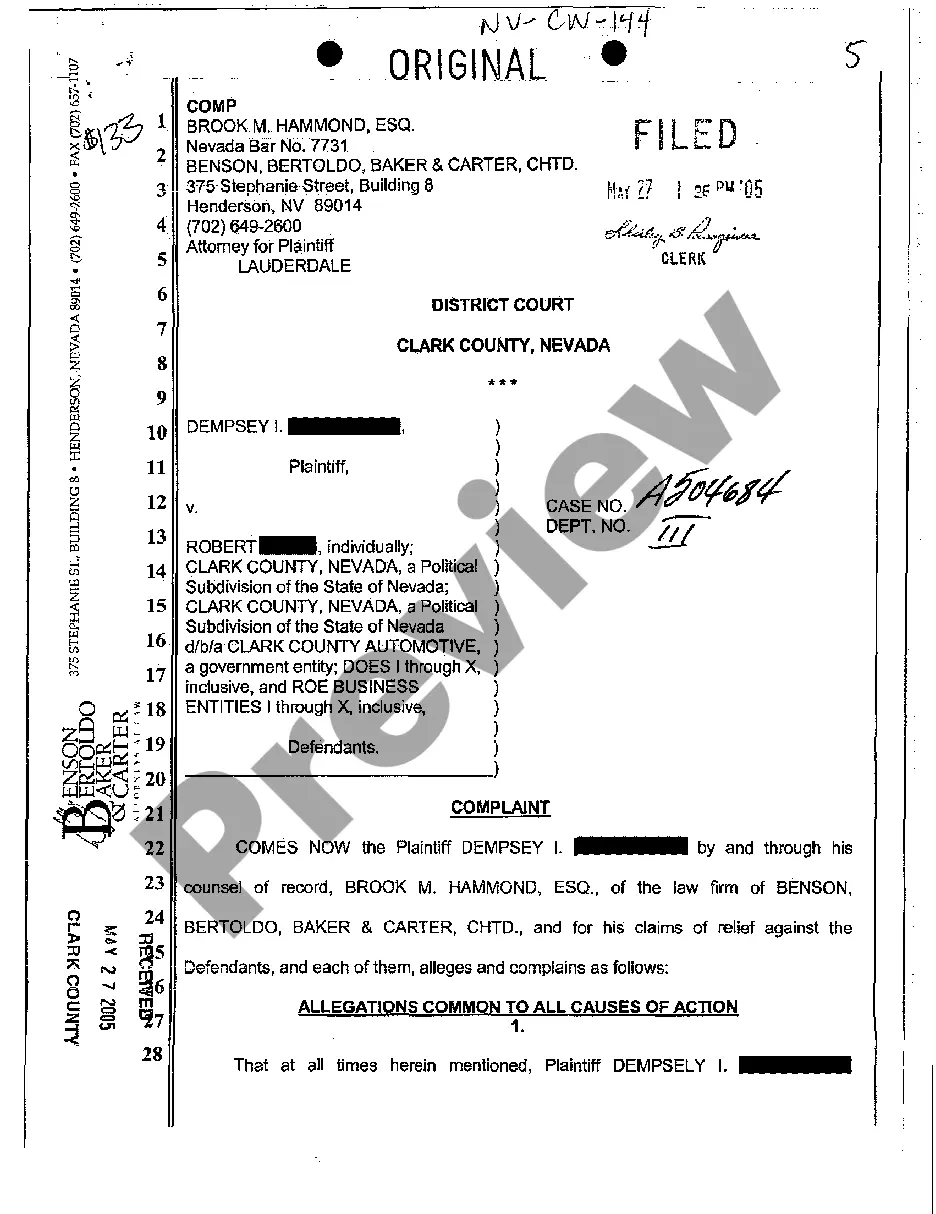

- Select the form you need and make sure it is for the correct city/state.

- Utilize the Preview option to review the document.

- Check the description to confirm that you have chosen the right form.

- If the form is not what you’re looking for, use the Lookup field to find the form that meets your requirements.

- Once you obtain the correct form, click on Purchase now.

- Choose the payment plan you prefer, fill in the required information to create your account, and pay for the order using your PayPal or credit card.

- Select a convenient file format and download your copy.

Form popularity

FAQ

Filing CT sales and use tax involves completing the appropriate forms and submitting them to the Connecticut Department of Revenue Services. You can file these forms electronically for convenience. Be sure to accurately report sales that may arise from your Connecticut Software License and Support Agreement to comply with state laws.

Yes, sales and use tax differ from income tax. Sales tax applies to transactions, while income tax is applied to earnings. Understanding these distinctions is crucial, especially when drafting or reviewing a Connecticut Software License and Support Agreement that may have financial implications.

In Connecticut, Software as a Service (SaaS) is generally considered taxable. This means that subscription fees for SaaS products are subject to sales tax. If your Connecticut Software License and Support Agreement involves any SaaS components, you should account for these taxes during your financial planning.

To record sales and use tax in Connecticut, you must maintain accurate financial records of all taxable sales. This includes tracking software licensing fees outlined in your Connecticut Software License and Support Agreement. Proper documentation helps you calculate the correct tax amount when filing.

Yes, you can file Connecticut state taxes online. The Connecticut Department of Revenue Services provides an easy-to-navigate platform for electronic filing. By filing online, you can save time and ensure accurate submission of your taxes, including relevant details regarding your Connecticut Software License and Support Agreement.

Yes, a Software as a Service (SaaS) agreement can be considered a type of license agreement. It defines the terms of use for subscribing to cloud-based software services, often including support details and data access rights. With a Connecticut Software License and Support Agreement, you can safely navigate the world of SaaS, ensuring clarity in your service usage.

A license agreement for software allows users to access and use a particular software product under defined conditions. This agreement usually includes usage rights, support options, and any limitations. When utilizing a Connecticut Software License and Support Agreement, both parties understand what to expect from each other, ensuring smoother operations.

A software license agreement is a legal contract between the software creator and the user that specifies how the software can be used. This agreement often includes information on installation, usage rights, and restrictions. A properly constructed Connecticut Software License and Support Agreement can help you enjoy the benefits of the software while protecting your interests.

Accepting the Microsoft license agreement usually offers benefits, including access to their vast range of software and support services. With a Connecticut Software License and Support Agreement, you gain clarity on your rights and obligations while using Microsoft products. It's wise to read the terms carefully to ensure they align with your usage needs.

An End User License Agreement (EULA) is a specific type of software license agreement designed for users. While both documents serve to govern the use of software, a Connecticut Software License and Support Agreement may apply to broader business contexts, outlining support services and additional terms beyond simple usage. Understanding both terms helps you make informed decisions about software usage.