Connecticut Self-Employed Independent Contractor Consideration For Hire Form

Description

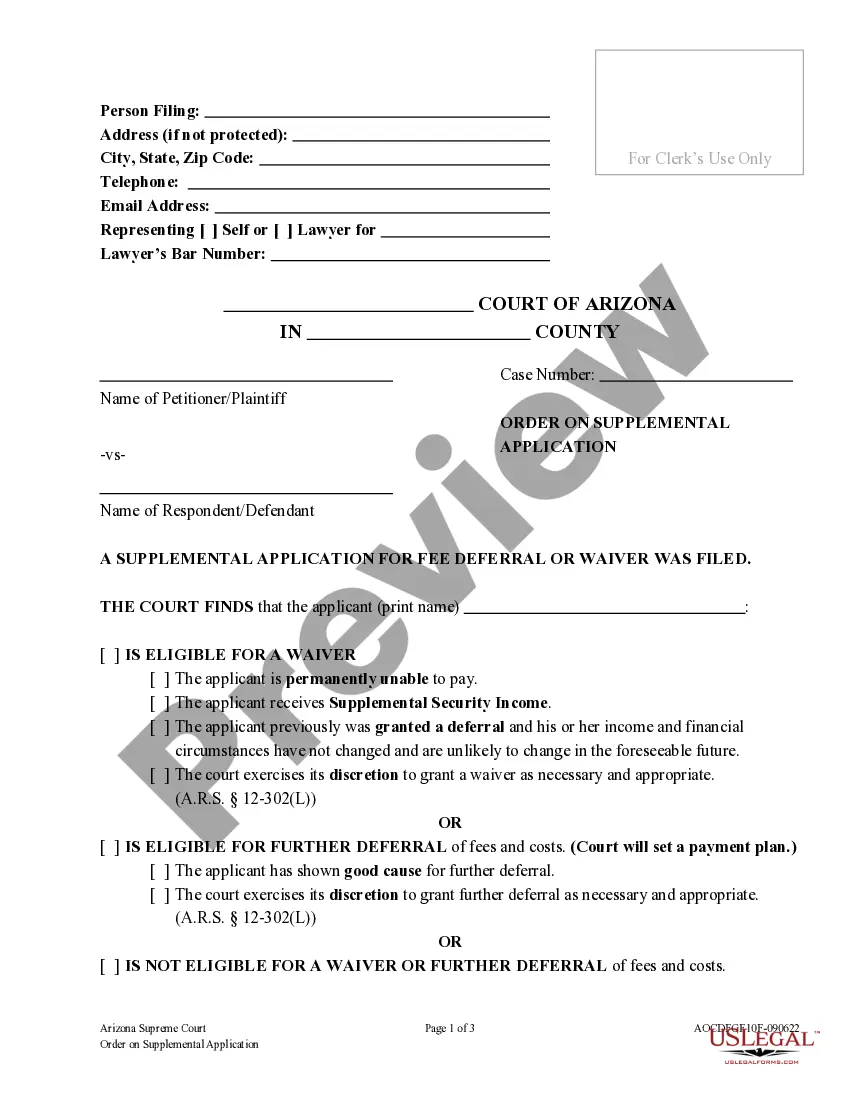

How to fill out Self-Employed Independent Contractor Consideration For Hire Form?

If you need to finalize, obtain, or generate legal document templates, utilize US Legal Forms, the largest assortment of legal forms available online. Take advantage of the site’s straightforward and convenient search to locate the documents you require. A variety of templates for business and personal purposes are organized by categories and titles, or keywords. Use US Legal Forms to find the Connecticut Self-Employed Independent Contractor Consideration For Hire Form in just a few clicks.

If you are already a US Legal Forms customer, Log In to your account and click on the Download button to obtain the Connecticut Self-Employed Independent Contractor Consideration For Hire Form. You can also access forms you have previously downloaded in the My documents section of the account.

If you are using US Legal Forms for the first time, follow the instructions below: Step 1. Ensure you have selected the correct form for the appropriate city/state. Step 2. Use the Preview option to review the form’s details. Remember to read the information carefully. Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template. Step 4. Once you have located the form you need, click the Purchase now button. Choose the payment plan you prefer and enter your information to register for an account. Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment. Step 6. Download the format of the legal form and save it to your device. Step 7. Complete, modify and print or sign the Connecticut Self-Employed Independent Contractor Consideration For Hire Form.

- Every legal document template you acquire is yours indefinitely.

- You have access to every form you downloaded with your account.

- Select the My documents section and choose a form to print or download again.

- Stay competitive and obtain, and print the Connecticut Self-Employed Independent Contractor Consideration For Hire Form with US Legal Forms.

- There are millions of professional and state-specific forms you can utilize for your business or personal needs.

Form popularity

FAQ

The choice between a 1099 and a W-9 doesn't exactly exist, as they serve different purposes. A W-9 form is used to collect the independent contractor's taxpayer information, while a 1099 forms are used to report payments made to them. Utilizing both forms, including the Connecticut Self-Employed Independent Contractor Consideration For Hire Form, can streamline your hiring process and ensure you meet compliance standards.

Legal requirements for independent contractors vary by state, but generally include proper classification and tax compliance. In Connecticut, using the Connecticut Self-Employed Independent Contractor Consideration For Hire Form helps ensure that you and the contractor understand these requirements. Always keep accurate records and consult with a legal professional if you are unsure of your obligations.

To protect yourself when hiring an independent contractor, it is crucial to have a written agreement outlining the scope of work, payment terms, and deadlines. Utilizing the Connecticut Self-Employed Independent Contractor Consideration For Hire Form can serve as a foundation for this agreement. Additionally, consider asking for proof of insurance to further minimize your liability.

Yes, an independent contractor is considered self-employed. They operate their own business and are responsible for managing their taxes, benefits, and business expenses. When you use the Connecticut Self-Employed Independent Contractor Consideration For Hire Form, it helps clarify this status for both you and the contractor.

An independent contractor typically needs to fill out a W-9 form to provide their taxpayer identification information. They may also need to complete a Connecticut Self-Employed Independent Contractor Consideration For Hire Form to formalize their status. It's essential that these forms are accurately filled out to ensure compliance during tax season.

To hire an independent contractor, you need to complete several key forms. Most importantly, you will need a Connecticut Self-Employed Independent Contractor Consideration For Hire Form to establish the contractor's status. Additionally, you may want to request a W-9 form from the contractor to collect tax information for reporting purposes.

An independent contractor typically needs to fill out a W-9 form, which provides necessary tax information. They may also need to complete a declaration of independent contractor status. Additionally, the Connecticut Self-Employed Independent Contractor Consideration For Hire Form must be filled out to formalize their status. This paperwork enables clarity for tax purposes and defines the working relationship.

Filling out an independent contractor form involves providing personal details, such as your full name, business name, and contact information. You will also describe the services you will offer and your payment preferences. Remember to include your tax identification number and consult the Connecticut Self-Employed Independent Contractor Consideration For Hire Form to ensure compliance with state regulations.

To fill out an independent contractor agreement, start with the names and contact information of both parties. Include the scope of work, payment terms, deadlines, and any confidentiality requirements. Ensure that you reference the Connecticut Self-Employed Independent Contractor Consideration For Hire Form to clarify the contractor's independent status. Completing this form thoroughly protects both parties and sets clear expectations.

When hiring an independent contractor, you should prepare a few key documents. First, you need an independent contractor agreement that outlines the terms of their service. You'll also need a W-9 form for tax purposes and the Connecticut Self-Employed Independent Contractor Consideration For Hire Form to confirm their independent status. Gathering these documents ensures a smooth hiring process.