Connecticut Public Relations Agreement - Self-Employed Independent Contractor

Description

How to fill out Public Relations Agreement - Self-Employed Independent Contractor?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a broad selection of official paper templates that you can download or print.

By using the website, you can discover thousands of forms for both commercial and personal needs, organized by categories, states, or keywords.

You can access the latest versions of documents such as the Connecticut Public Relations Agreement - Self-Employed Independent Contractor in just moments.

If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

Once you are satisfied with the form, confirm your choice by clicking the Buy Now button. Then, choose your preferred payment method and provide your details to register for an account.

- If you already have an account, Log In to download the Connecticut Public Relations Agreement - Self-Employed Independent Contractor from the US Legal Forms library.

- The Download button will appear on every form you view.

- You can find all previously downloaded forms in the My documents section of your account.

- If this is your first time using US Legal Forms, here are simple steps to get you started.

- Ensure you have selected the correct form for your city/state.

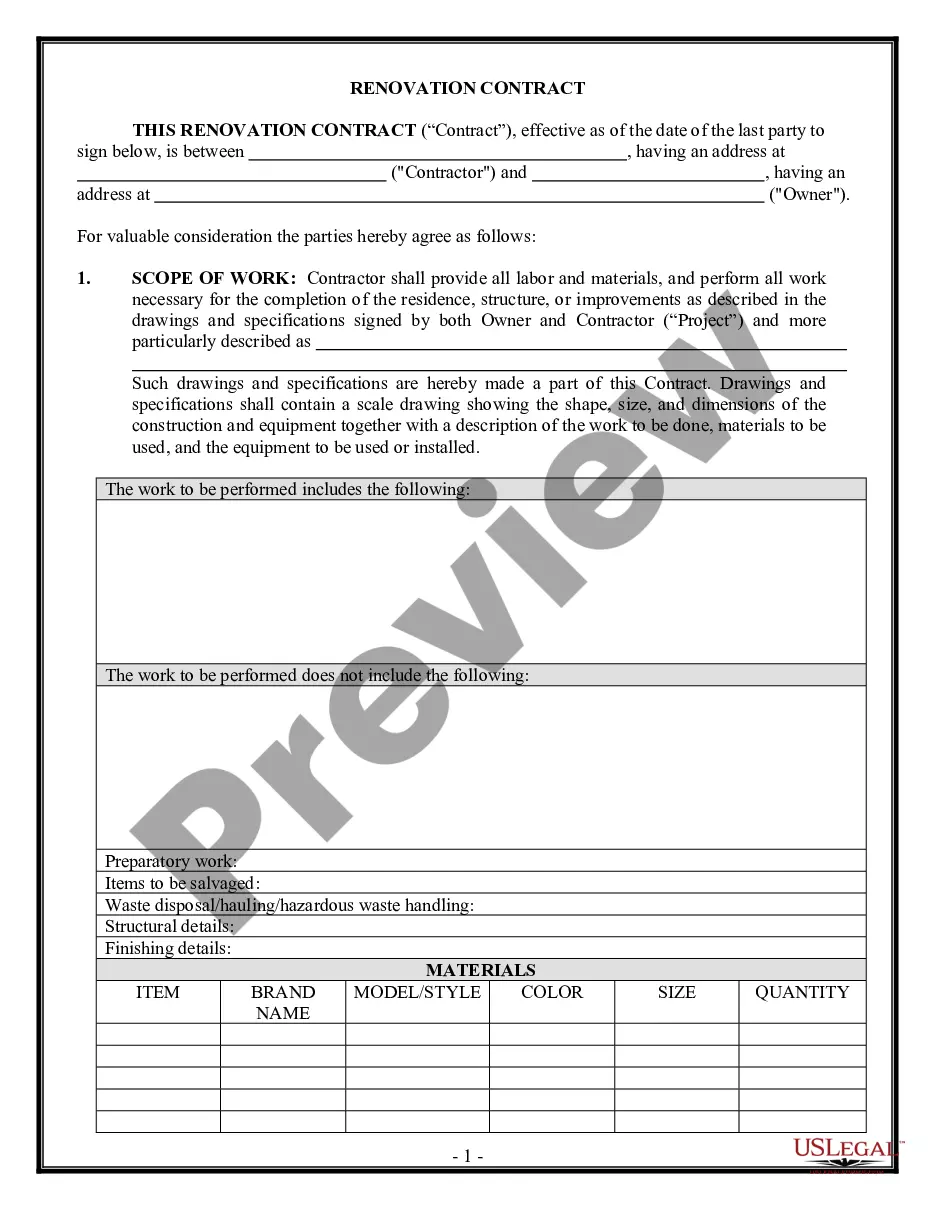

- Click the Preview button to review the form's content.

Form popularity

FAQ

To write an independent contractor agreement, begin by outlining key details such as project specifications, payment terms, and deadlines. Incorporate essential elements like confidentiality clauses and terms for terminating the agreement. Ensure the document is clear and understandable to protect both parties. Utilizing services from US Legal Forms can provide you with customizable templates to make this task more straightforward.

Yes, independent contractors do file taxes as self-employed individuals. They report their income through Schedule C on their tax return. This process allows them to deduct qualifying business expenses, making it beneficial for managing finances. Using a Connecticut Public Relations Agreement - Self-Employed Independent Contractor helps clarify their status and rights, promoting better tax practices.

When hiring an independent contractor, you need to gather specific documentation to ensure legal compliance. Typically, a Connecticut Public Relations Agreement - Self-Employed Independent Contractor is essential, along with a W-9 form to collect tax information. You might also need proof of insurance and relevant certifications related to the work. Using US Legal Forms can simplify obtaining and managing these documents.

To fill out a Connecticut Public Relations Agreement - Self-Employed Independent Contractor, start by gathering essential details about both parties. Clearly define the scope of work, payment terms, and deadlines. Ensure you include relevant clauses like confidentiality and termination procedures. For a streamlined process, you can use the templates available on the US Legal Forms platform.

Typically, the hiring party drafts the Connecticut Public Relations Agreement - Self-Employed Independent Contractor. However, both parties should review and agree on the terms to ensure clarity and fairness. Engaging a legal professional can be beneficial, but many individuals successfully use resources like uslegalforms to create comprehensive agreements on their own.

Creating a Connecticut Public Relations Agreement - Self-Employed Independent Contractor is a straightforward process. First, outline the services you will provide and clarify the terms of the arrangement. Next, include provisions for payment, deadlines, and any necessary legal disclaimers. Utilizing platforms like uslegalforms can simplify this process by providing templates tailored to your needs.

To fill out a declaration of independent contractor status form, start by gathering the necessary personal information, such as your name, address, and business details. Next, provide a description of the services you offer under the Connecticut Public Relations Agreement - Self-Employed Independent Contractor. Ensure you accurately declare your independent contractor status by complying with relevant guidelines. If you need assistance, platforms like US Legal Forms offer templates to simplify this process.

Yes, Non-Disclosure Agreements (NDAs) can indeed apply to independent contractors. When you enter a contract, like a Connecticut Public Relations Agreement - Self-Employed Independent Contractor, including an NDA helps protect sensitive information shared during your collaboration. It's essential to clearly outline which information remains confidential to safeguard your business interests. Utilizing a reliable platform like US Legal Forms can help you create or access NDAs that suit your specific needs.