Connecticut Breeder Agreement - Self-Employed Independent Contractor

Description

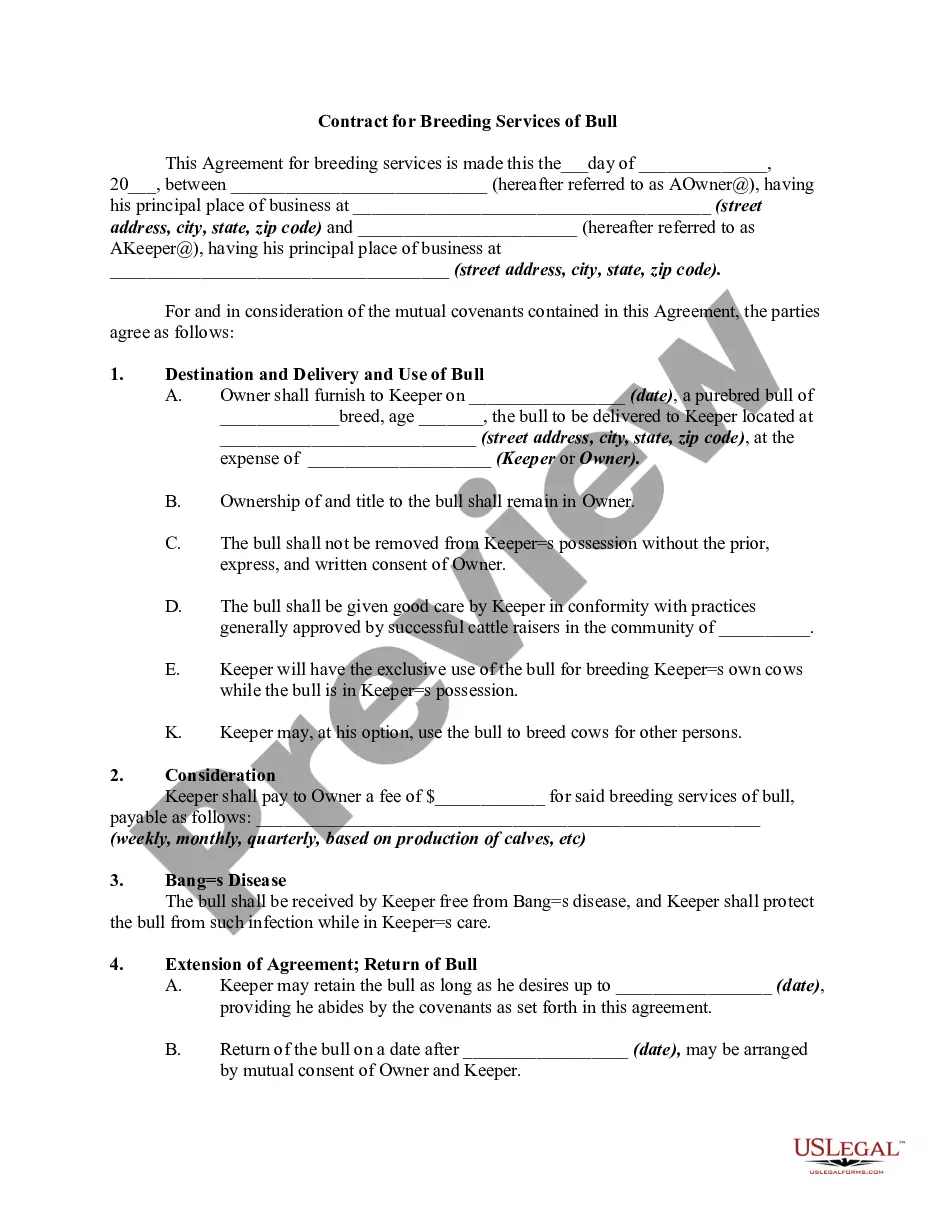

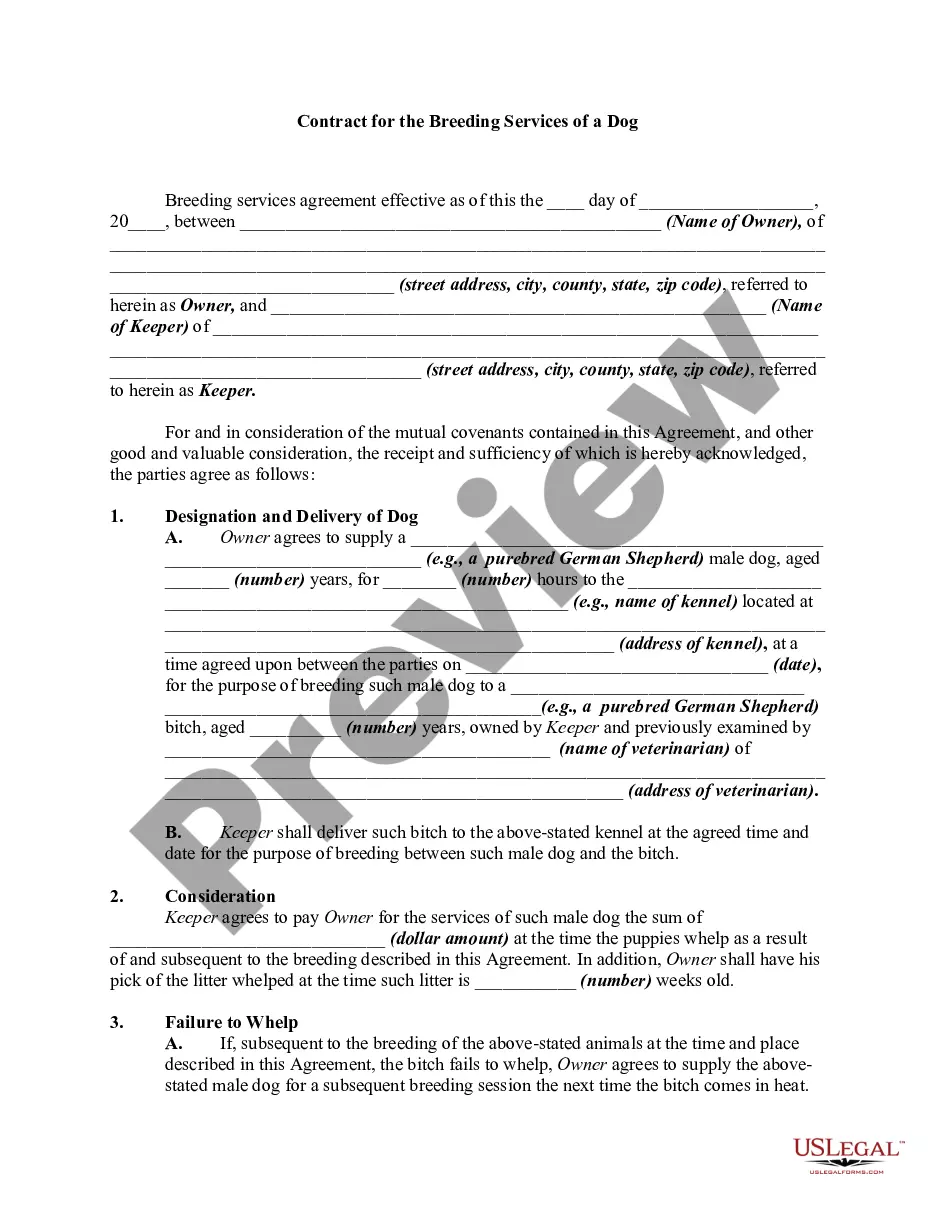

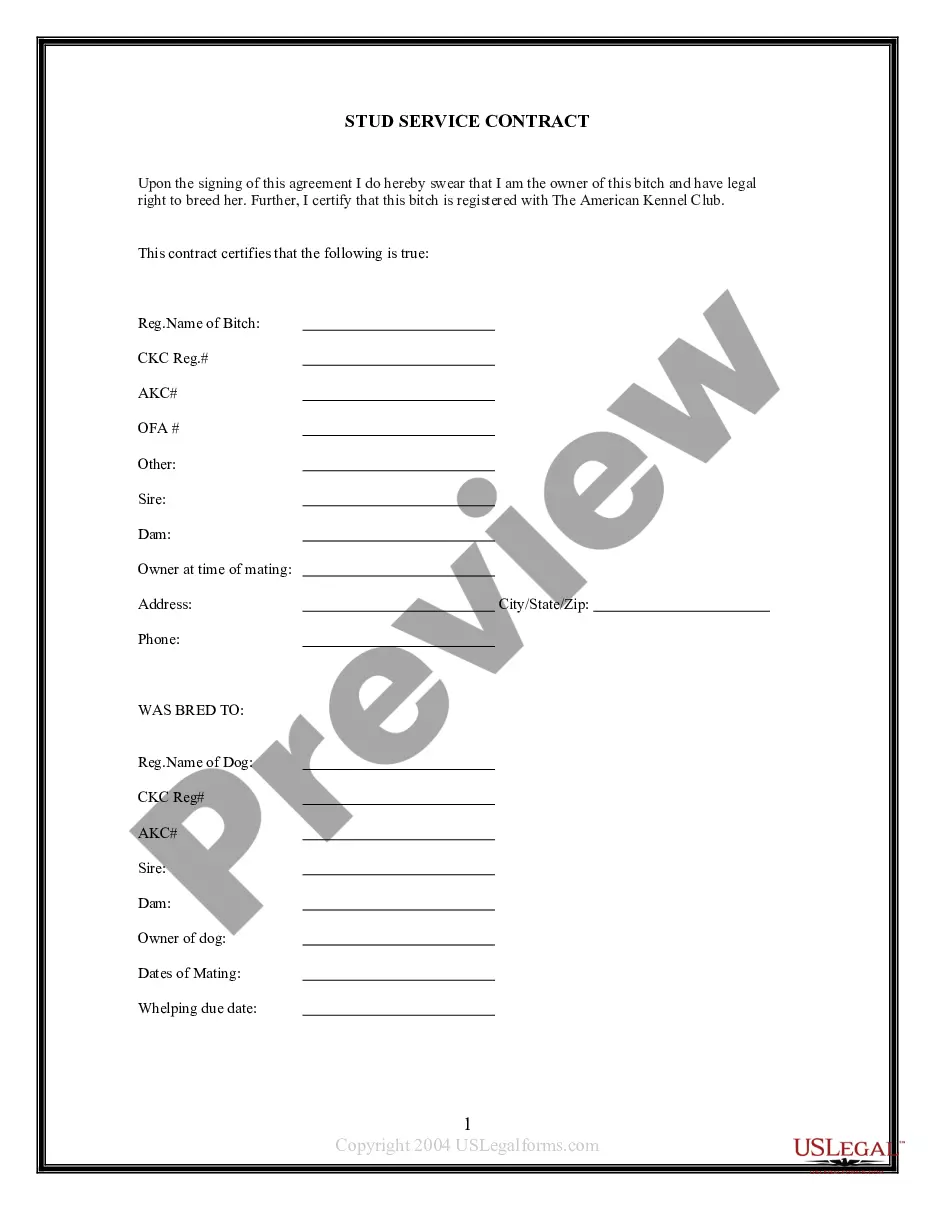

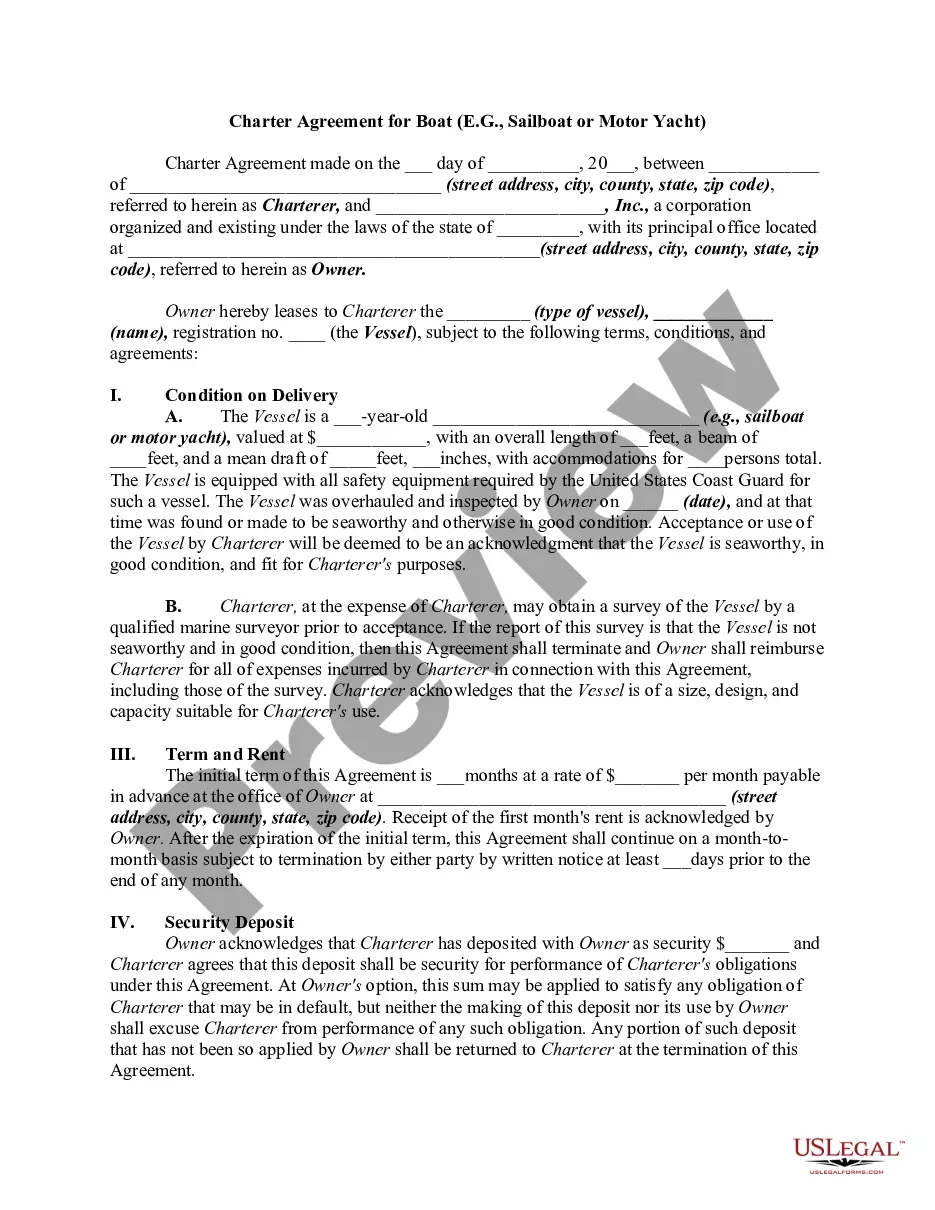

How to fill out Breeder Agreement - Self-Employed Independent Contractor?

If you require to thorough, obtain, or create valid document templates, utilize US Legal Forms, the largest collection of legal forms, that is available online.

Employ the site’s straightforward and user-friendly search to find the documents you need.

An assortment of templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click on the Order now button. Choose the pricing plan you prefer and enter your details to register for an account.

Step 5. Complete the payment. You can use your credit card or PayPal account to finalize the transaction.

- Use US Legal Forms to locate the Connecticut Breeder Agreement - Self-Employed Independent Contractor in just a few clicks.

- If you are currently a US Legal Forms user, sign in to your account and click on the Download button to obtain the Connecticut Breeder Agreement - Self-Employed Independent Contractor.

- You can also access forms you have previously purchased in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct area/region.

- Step 2. Use the Review option to examine the form’s details. Remember to read the information.

- Step 3. If you are unsatisfied with the form, utilize the Search area at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

Yes, independent contractors do file as self-employed when they complete a Connecticut Breeder Agreement - Self-Employed Independent Contractor. This designation means they report their income directly to the IRS using a Schedule C form. By filing as self-employed, independent contractors can take advantage of various tax deductions related to their business expenses. It's essential to maintain good records of your income and expenses to ensure accurate reporting.

Writing an independent contractor agreement begins with outlining the essential elements such as the scope of work, payment terms, and duration of the contract. Be clear about the responsibilities and rights of each party to avoid conflicts later on. For a comprehensive Connecticut Breeder Agreement - Self-Employed Independent Contractor, you can refer to customizable templates available on US Legal Forms, making the process straightforward and legally sound.

To become an independent contractor in Connecticut, you need to register your business and obtain the necessary licenses or permits for your specific field. Familiarize yourself with tax obligations and consider establishing a separate business bank account. Utilizing a Connecticut Breeder Agreement - Self-Employed Independent Contractor template can help formalize your business arrangement and protect your interests. US Legal Forms offers resources to help with compliance.

Filling out an independent contractor form involves inputting accurate information including your name, address, and payment details. Additionally, specify the type of services you offer and the duration of the contract. For a Connecticut Breeder Agreement - Self-Employed Independent Contractor, ensure you clearly understand the terms and conditions, and consider using US Legal Forms for guidance.

Independent contractors typically need to fill out forms like the W-9 for tax purposes, as well as any specific agreements related to the contractual work. If you are working under a Connecticut Breeder Agreement - Self-Employed Independent Contractor, this will also outline your obligations and payment terms. Accessing forms on US Legal Forms can provide you with the necessary templates to streamline this process.

To fill out an independent contractor agreement, start by entering relevant details such as the names of both parties and the project's scope. Clearly define the payment terms and timeline, ensuring both parties understand their responsibilities. By using a Connecticut Breeder Agreement - Self-Employed Independent Contractor template from US Legal Forms, you can simplify this process and ensure compliance with local laws.

The independent contractor carries out business on his or her own account, unlike in a contract of service where the employee does business for the employer. Independent contractors are not covered by the Employment Act, and statutory benefits such as working hours and leave benefits do not apply to them.

Traditionally, an Interconnection Agreement (ICA) is a regulated contract between telecommunications carriers for the purpose of interconnecting their networks and passing traffic on the PSTN.

An ICA file is an Independent Computing Architecture (ICA) file used by Citrix application servers. It contains configuration information for connecting to different servers and may link to a published application or to a server desktop environment.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.