Connecticut Golf Pro Services Contract - Self-Employed

Description

How to fill out Golf Pro Services Contract - Self-Employed?

Have you ever been in a situation where you need documents for either organizational or personal purposes almost every day.

There are plenty of valid document templates accessible online, but finding reliable ones is not straightforward.

US Legal Forms offers a vast array of form templates, such as the Connecticut Golf Pro Services Contract - Self-Employed, that are designed to comply with federal and state regulations.

Once you find the correct form, click Purchase now.

Choose the pricing plan you prefer, complete the required information to create your account, and pay for the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Connecticut Golf Pro Services Contract - Self-Employed template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for your correct city/state.

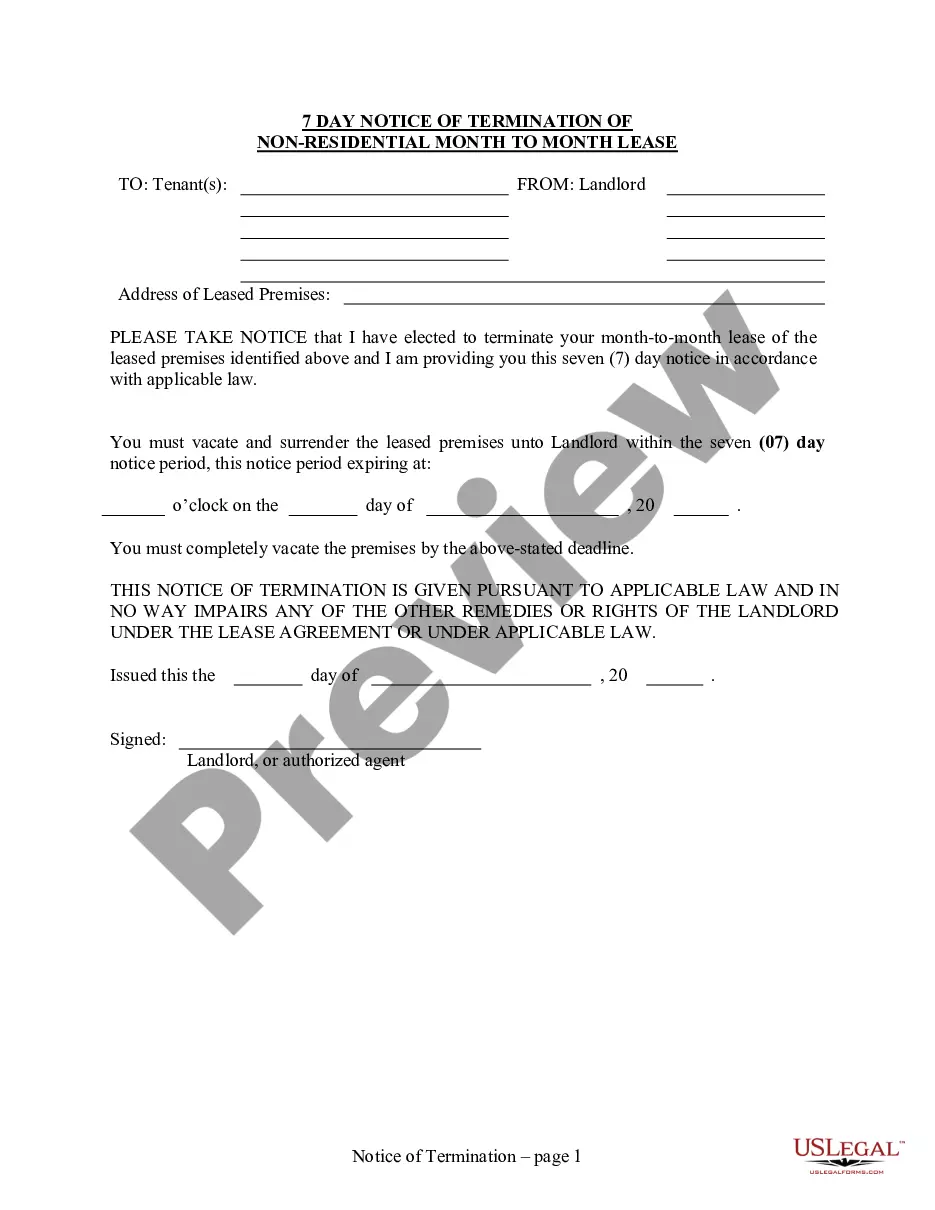

- Utilize the Preview button to review the form.

- Read the description to confirm that you have selected the right form.

- If the form is not what you're looking for, use the Search section to locate the form that meets your requirements.

Form popularity

FAQ

In Connecticut, you do need a license to operate as a contractor, including in the golf industry. This requirement ensures that you meet specific standards of practice and professionalism. If you are working under a Connecticut Golf Pro Services Contract - Self-Employed, it's imperative to confirm that you have the necessary licenses to avoid penalties and provide a trustworthy service.

PGA players typically receive compensation as independent contractors, meaning they often get a 1099 form instead of a W-2. This classification allows them flexibility and can affect how they manage their taxes. Having a solid understanding of your financial obligations, particularly under a Connecticut Golf Pro Services Contract - Self-Employed, is crucial for any aspiring professional golfer, as it ensures proper compliance with tax regulations.

The 7 minute rule in Connecticut refers to a regulation concerning pacing during golf tournaments, where players are allowed a specific amount of time to complete their shots. Understanding this rule can significantly benefit golfers, especially those under a Connecticut Golf Pro Services Contract - Self-Employed, by ensuring they maintain the pace of play. Adhering to this rule can also contribute to a positive golfing experience for all participants.

To declare yourself a professional golfer, you generally need to demonstrate consistent performance and skill in the sport, often achieved by participating in recognized golf tournaments and events. Additionally, securing a Connecticut Golf Pro Services Contract - Self-Employed can provide a formal acknowledgment of your status. It's beneficial to keep detailed records of your playing history and any winnings, as these can support your claim.

Yes, professional athletes, including golfers, are often categorized as independent contractors. This classification allows them to negotiate their contracts, manage their income, and control various aspects of their professional careers. Understanding the terms of a Connecticut Golf Pro Services Contract - Self-Employed can provide clarity and align expectations between athletes and their clients or employers.

To be an independent contractor in Connecticut, you need to establish your business presence, set your rates, and market your services. You should also familiarize yourself with local laws and tax implications to remain compliant. Utilizing a Connecticut Golf Pro Services Contract - Self-Employed helps in formalizing your relationships with clients and clarifying your role as an independent contractor.

Becoming an independent contractor in Connecticut involves several steps, including registering your business, obtaining the necessary licenses, and developing a solid contract. It's important to understand tax obligations as an independent contractor, particularly if you work in specialized fields like golf. A well-crafted Connecticut Golf Pro Services Contract - Self-Employed can ensure you cover essential elements that protect your interests and outline your services.

Yes, professional golfers are typically considered self-employed. They often work under contracts that outline their responsibilities and payment structures, such as a Connecticut Golf Pro Services Contract - Self-Employed. This classification allows them to manage their own business expenses and taxes, providing them with flexibility and financial independence.

The 4 hour rule in Connecticut refers to regulations determining how independent contractors are classified, particularly in regards to part-time work. If you consistently work under four hours for a specific employer in a week, you may be classified as an independent contractor, impacting your benefits and legal obligations. Understanding this rule is essential for anyone engaging in a Connecticut Golf Pro Services Contract - Self-Employed.

To qualify as an independent contractor in Connecticut, you must meet certain criteria defined by the IRS and state guidelines. Generally, you need to have control over how you complete your work, provide your own tools, and operate independently without direct supervision. A Connecticut Golf Pro Services Contract - Self-Employed can help clarify your responsibilities and rights as a contractor.