Connecticut Water Softening And Purification Services Contract - Self-Employed

Description

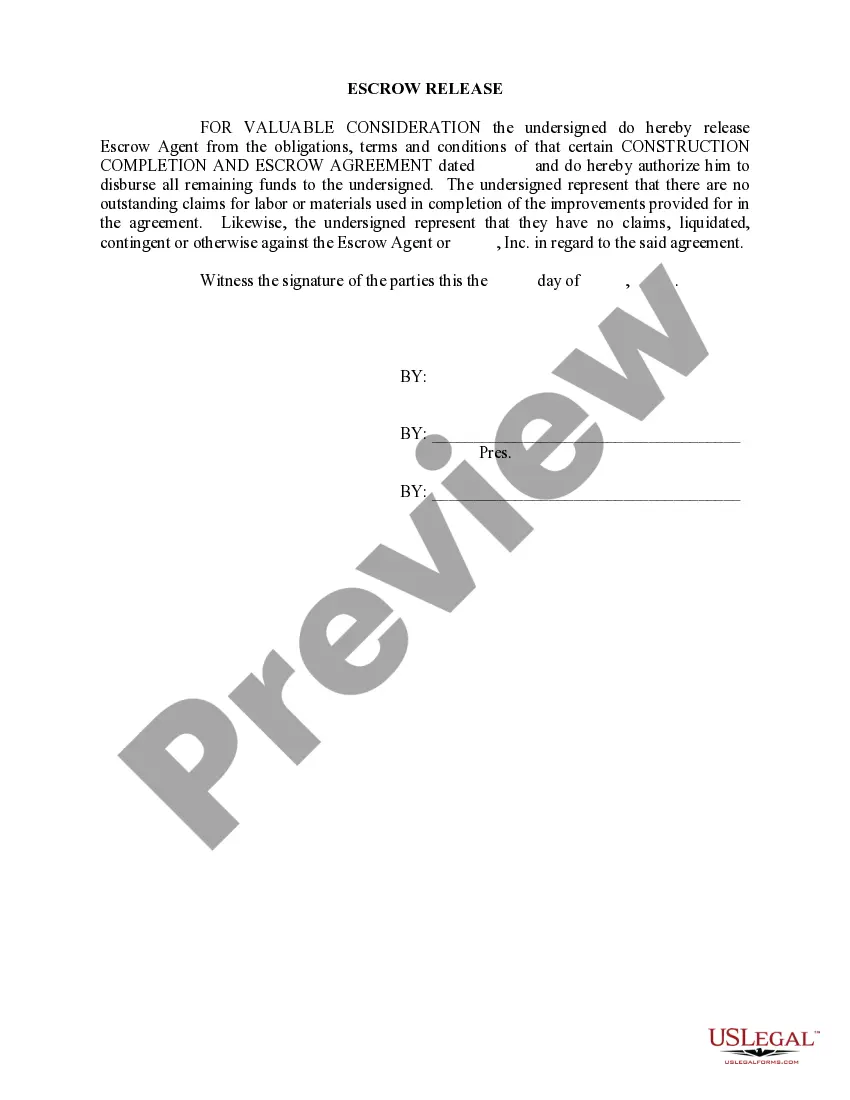

How to fill out Water Softening And Purification Services Contract - Self-Employed?

US Legal Forms - one of the most important collections of legal documents in the United States - offers a variety of legal document templates that you can download or print. By using the website, you can access thousands of documents for business and personal use, categorized by types, states, or keywords. You can find the latest versions of forms such as the Connecticut Water Softening And Purification Services Contract - Self-Employed in just minutes.

If you have a monthly membership, Log In and download the Connecticut Water Softening And Purification Services Contract - Self-Employed from the US Legal Forms library. The Download option will appear on each document you view. You can access all previously obtained forms in the My documents section of your account.

If you are using US Legal Forms for the first time, here are simple instructions to help you get started: Ensure you have selected the correct form for your city/region. Click the Review button to check the form’s details. Read the form description to confirm that you have selected the appropriate form. If the form does not meet your needs, use the Search field at the top of the page to find one that does. If you are satisfied with the form, confirm your choice by clicking on the Buy now button. Then, choose the payment plan you prefer and provide your details to register for an account. Process the payment. Use your credit card or PayPal account to complete the transaction. Select the format and download the form to your device. Make modifications. Complete, edit, print, and sign the acquired Connecticut Water Softening And Purification Services Contract - Self-Employed. Every template you add to your account has no expiration date and is yours indefinitely. So, if you wish to download or print another copy, simply go to the My documents section and click on the form you need.

- Access the Connecticut Water Softening And Purification Services Contract - Self-Employed with US Legal Forms, one of the largest collections of legal document templates.

- Utilize thousands of professional and state-specific templates that fulfill your business or personal needs and requirements.

Form popularity

FAQ

In Connecticut, many services are subject to sales tax, including home improvement services. However, there are exemptions based on the nature of the service. If you provide water softening and purification services under a Connecticut Water Softening And Purification Services Contract - Self-Employed, it is important to consult local regulations to ensure compliance and accurate tax calculations.

Currently, California is known for having one of the highest self-employment tax rates in the United States. This can impact your bottom line significantly if you are a self-employed contractor in that state. Conversely, if you operate under a Connecticut Water Softening And Purification Services Contract - Self-Employed, you will find Connecticut's rates more manageable.

Yes, Connecticut has a self-employment tax. This tax applies to individuals who earn income through self-employment activities in the state. When you manage your finances as a self-employed professional under a Connecticut Water Softening And Purification Services Contract, understanding this tax helps you maintain compliance and avoid penalties.

The self-employment tax rate is currently 15.3%. This includes 12.4% for Social Security and 2.9% for Medicare. If you're running a business under a Connecticut Water Softening And Purification Services Contract - Self-Employed, it is crucial to budget for these taxes to avoid surprises during tax season.

When creating a home improvement contract in Connecticut, you need to include the scope of work, payment details, and timelines. It's also important to include any warranty information and the necessary licenses. If you’re self-employed and working in the water softening and purification industry, a solid contract protects both you and your clients under a Connecticut Water Softening And Purification Services Contract - Self-Employed.

To become an independent contractor in Connecticut, you must first register your business with the state. You should also obtain any necessary licenses related to your services, such as those for water softening and purification. Establishing a Connecticut Water Softening And Purification Services Contract - Self-Employed allows you to outline your services clearly and manage client relationships effectively.

Yes, Connecticut imposes a self-employment tax on income earned by self-employed individuals. This tax helps fund Social Security and Medicare. If you are operating under a Connecticut Water Softening And Purification Services Contract - Self-Employed, understanding these taxes is essential for your financial planning.