Connecticut Framework Contractor Agreement - Self-Employed

Description

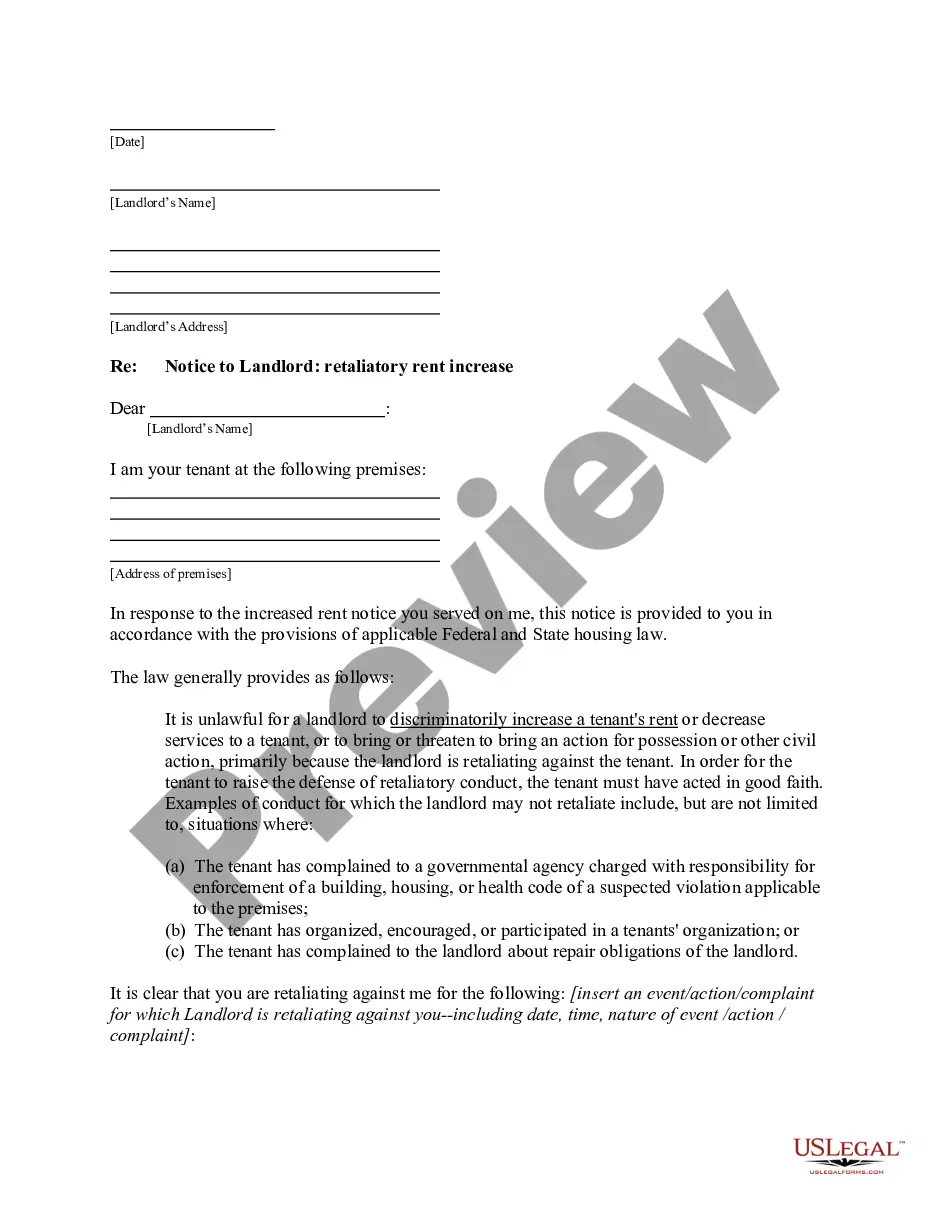

How to fill out Framework Contractor Agreement - Self-Employed?

If you wish to complete, acquire, or print legal document templates, utilize US Legal Forms, the largest assortment of legal forms available online. Leverage the site’s user-friendly search feature to locate the documents you need. Various templates for business and personal purposes are categorized by groups and states, or keywords. Use US Legal Forms to find the Connecticut Framework Contractor Agreement - Self-Employed in just a few clicks.

If you are already a US Legal Forms member, sign in to your account and click the Acquire button to obtain the Connecticut Framework Contractor Agreement - Self-Employed. You can also access forms you previously downloaded in the My documents tab of your account.

If you are using US Legal Forms for the first time, follow these steps: Step 1. Ensure you have selected the form for the correct city/state. Step 2. Use the Preview function to review the form’s details. Remember to read the summary. Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other variations of the legal form template. Step 4. Once you have found the form you want, click the Acquire now button. Choose the pricing plan you prefer and enter your information to register for the account. Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase. Step 6. Select the format of the legal form and download it to your device. Step 7. Fill out, modify, and print or sign the Connecticut Framework Contractor Agreement - Self-Employed.

- Every legal document template you purchase is yours permanently.

- You have access to each form you downloaded within your account.

- Click on the My documents section and select a form to print or download again.

- Complete and obtain, and print the Connecticut Framework Contractor Agreement - Self-Employed with US Legal Forms.

- There are numerous professional and state-specific forms available for your business or personal needs.

Form popularity

FAQ

Contract work does not usually fall under traditional employment definitions. Instead, it represents a business arrangement where individuals provide services under specific terms. When utilizing the Connecticut Framework Contractor Agreement - Self-Employed, it's essential to acknowledge that contract work is distinct from standard employment, allowing for greater flexibility and independence.

Yes, receiving a 1099 form typically indicates you are self-employed. This form is used to report income earned as a contractor rather than an employee. Therefore, if you're engaging in work covered by the Connecticut Framework Contractor Agreement - Self-Employed, receiving a 1099 reinforces your self-employed classification.

Both terms can be used interchangeably, but 'independent contractor' may provide more clarity in certain legal contexts. This distinction emphasizes the nature of the work arrangement. When drafting a Connecticut Framework Contractor Agreement - Self-Employed, using precise language will help delineate the working relationship effectively.

Yes, an operating agreement is not required but highly recommended for an LLC in Connecticut. This document outlines how the business will operate, including management and financial protocols. While creating a Connecticut Framework Contractor Agreement - Self-Employed, consider the importance of having an operating agreement to clarify the relationship between members and contractors.

Absolutely, a contractor is typically seen as self-employed. This classification allows them to manage their own business operations and client relations. When creating a Connecticut Framework Contractor Agreement - Self-Employed, it's critical to acknowledge this status to establish clear boundaries in the working relationship.

Yes, a self-employed individual can certainly have a contract. In fact, a clear contract is essential for outlining the terms of work, payment, and responsibilities. Utilizing the Connecticut Framework Contractor Agreement - Self-Employed provides a solid foundation for these contracts, ensuring all parties understand their obligations.

Yes, a contractor is often considered self-employed. This status typically means they operate their own business and are responsible for their own taxes. In the context of the Connecticut Framework Contractor Agreement - Self-Employed, this classification allows contractors the flexibility to work with multiple clients without being bound to a single employer.

Yes, independent contractors file as self-employed individuals when it comes to taxes. You report your income from contracting work on Schedule C of your tax return. It is important to track your expenses related to your work accurately. By leveraging a Connecticut Framework Contractor Agreement - Self-Employed, you can ensure proper documentation of your work relationship and income projection.

Filling out an independent contractor form involves entering your personal information and the details of the services you offer. Be specific about payment structures and timelines for deliverables. Ensure that you correctly classify your work according to the Connecticut Framework Contractor Agreement - Self-Employed guidelines to avoid any compliance issues.

To write an independent contractor agreement, start with a clear title and the date. Include details such as the parties' names, project description, payment terms, and deadlines. Make sure to address confidentiality, dispute resolution, and termination clauses. Using a Connecticut Framework Contractor Agreement - Self-Employed can provide you with a comprehensive template to guide your writing.