Connecticut Door Contractor Agreement - Self-Employed

Description

How to fill out Door Contractor Agreement - Self-Employed?

If you want to finalize, retrieve, or print valid document templates, utilize US Legal Forms, the largest repository of valid forms available online.

Take advantage of the website's straightforward and efficient search to find the documents you require.

Different templates for corporate and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Purchase now button. Choose the pricing plan you prefer and provide your details to register for an account.

Step 5. Complete the transaction. You can use your Visa, MasterCard, or PayPal account to finalize the transaction.

- Utilize US Legal Forms to locate the Connecticut Door Contractor Agreement - Self-Employed in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to acquire the Connecticut Door Contractor Agreement - Self-Employed.

- You can also access forms you previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

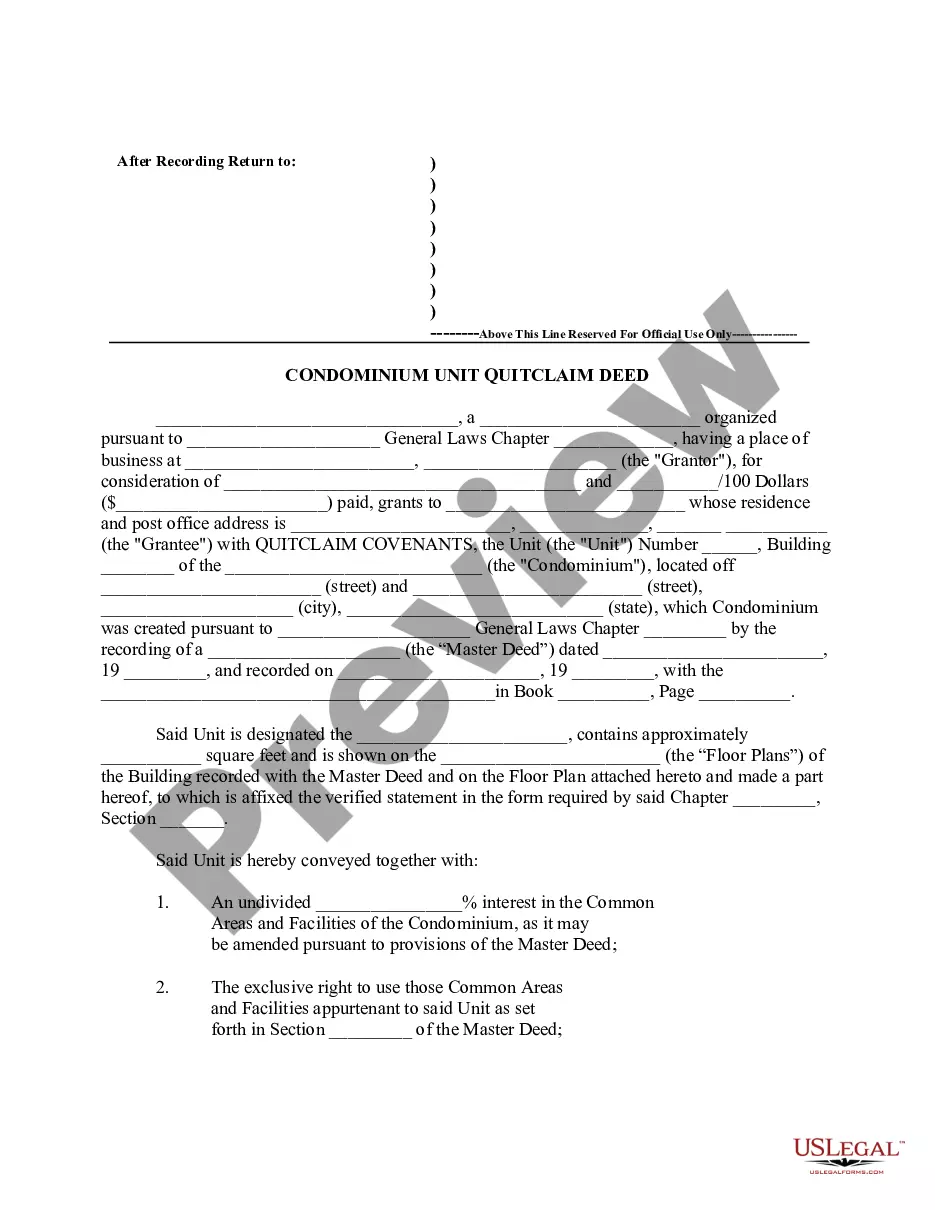

- Step 2. Use the Preview option to review the form's content. Remember to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search feature at the top of the screen to find alternative versions of the valid form template.

Form popularity

FAQ

Filling out an independent contractor form can be straightforward if you follow the prompts carefully. Provide accurate information such as your name, contact information, and tax identification number. Be sure to include the nature of the work you will perform and the payment terms. Utilizing a Connecticut Door Contractor Agreement - Self-Employed can streamline this process by providing a structured format.

To write an independent contractor agreement, begin with the names and addresses of both parties, followed by a detailed description of the work to be done. Include payment terms, deadlines, and any confidentiality clauses if necessary. A Connecticut Door Contractor Agreement - Self-Employed template can guide you in creating a comprehensive agreement that protects both yourself and your client.

Writing a self-employed contract requires clear terms that define the scope of work, payment structure, and duration of the agreement. Start by identifying the parties involved and outlining the specific services to be provided. Ensure to include details about payment schedules and conditions for termination. Using a well-structured Connecticut Door Contractor Agreement - Self-Employed from uslegalforms can simplify this process.

Yes, being a contractor typically means you are self-employed. As a contractor, you operate independently and manage your own business affairs. This status gives you the freedom to choose your clients and projects. A Connecticut Door Contractor Agreement - Self-Employed will help formalize your self-employed status with clients.

New rules for self-employed individuals focus on tax considerations, benefits, and operational requirements. These regulations aim to provide better protections and tax structures for self-employed workers. Stay updated on policies that might affect your work. A well-crafted Connecticut Door Contractor Agreement - Self-Employed can help you navigate these changes effectively.

The terms self-employed and independent contractor can often be used interchangeably. However, 'independent contractor' specifically refers to someone who works for themselves under a contract. When discussing your work, consider your audience to choose the best term. Utilize a Connecticut Door Contractor Agreement - Self-Employed to formalize your status.

Yes, Connecticut requires certain contractors to obtain a license. Depending on your line of work, you may need specific qualifications to operate legally. Familiarize yourself with local regulations to ensure you comply. Having a Connecticut Door Contractor Agreement - Self-Employed is vital, especially if you're working without a license.

Yes, having a contract while being self-employed is common practice. A Connecticut Door Contractor Agreement - Self-Employed clarifies the working relationship and protects your rights. This legal document sets clear expectations, which helps prevent misunderstandings later. Make sure to detail every important aspect of your arrangement.

Creating an independent contractor agreement is straightforward. Start by defining the scope of work, payment terms, and duration of the contract. You can use resources like USLegalForms to easily generate a Connecticut Door Contractor Agreement - Self-Employed tailored to your needs. This helps ensure all critical details are included and legally sound.

Yes, you can be self-employed and have a contract. A Connecticut Door Contractor Agreement - Self-Employed outlines the terms of your work with clients. This agreement specifies the responsibilities and expectations for both parties. This clarity helps ensure a smooth working relationship.