Connecticut Masonry Services Contract - Self-Employed

Description

How to fill out Masonry Services Contract - Self-Employed?

Are you presently in a location where you frequently require documents for both business or personal purposes almost every working day.

There are numerous authentic document templates accessible online, but locating ones you can trust is quite challenging.

US Legal Forms offers a vast array of templates, including the Connecticut Masonry Services Agreement - Self-Employed, designed to satisfy state and federal regulations.

If you find the correct form, just click Buy now.

Choose the payment plan you need, enter the necessary information to create your account, and finalize your purchase using PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Connecticut Masonry Services Agreement - Self-Employed template.

- If you do not have an account and wish to use US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is specific to your correct region/area.

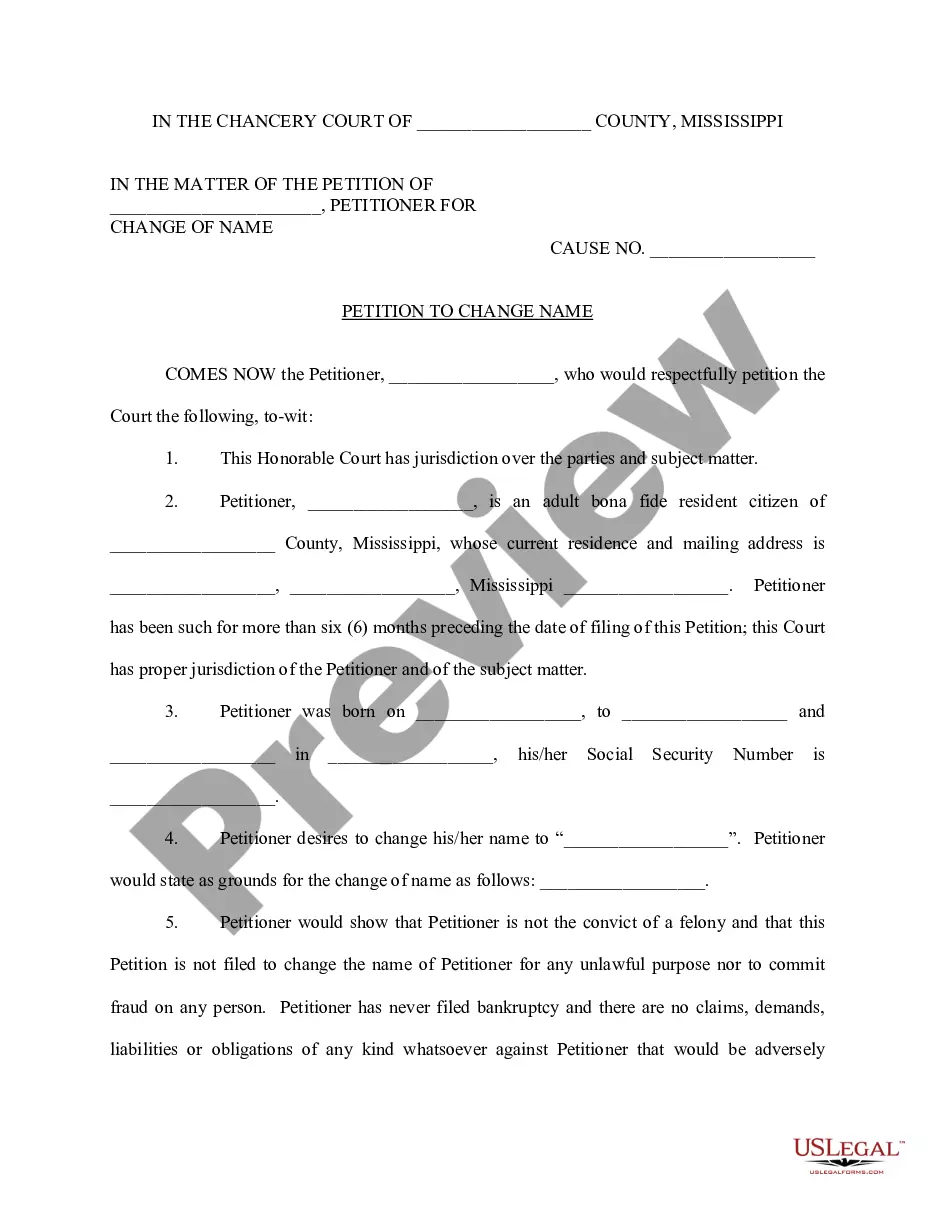

- Utilize the Preview button to review the form.

- Read the description to confirm that you have selected the correct form.

- If the form is not what you are looking for, use the Search field to find the form that meets your needs and requirements.

Form popularity

FAQ

Connecticut has a defined list of taxable services, which includes many construction and repair services. If your work involves modifying or constructing buildings, it is likely taxable. Understanding what services fall under this taxable umbrella is essential when executing a Connecticut Masonry Services Contract. You can explore guidance from professionals or tools like uslegalforms to clarify any doubts.

In Connecticut, construction labor is generally taxable unless it involves specific work that qualifies for exemptions. Most services related to constructing or improving property are subject to tax. When engaged in a Connecticut Masonry Services Contract, it's essential to know these tax responsibilities. Consider consulting resources like uslegalforms for accurate guidance on navigating these complexities.

Masonry services performed in Connecticut are typically considered taxable unless certain exceptions apply. If you are using materials that significantly alter real property, such work might not be subject to sales tax. Understanding the tax obligations tied to a Connecticut Masonry Services Contract is crucial for compliant operations. Therefore, consulting a tax professional can provide necessary insights.

To set up as a self-employed contractor in Connecticut, start by choosing a business structure, such as a sole proprietorship or LLC. Next, secure any necessary licenses and permits for your specific trade. Finally, consider drafting a Connecticut Masonry Services Contract to clearly outline your services and protect your interests. Resources on uslegalforms can provide templates and guidance to help with this process.

Yes, landscaping services are generally taxable in Connecticut unless they fall under certain exemptions. For instance, if you offer a service that directly enhances the value of real property, it may not be taxed. When signing a Connecticut Masonry Services Contract, consider whether your landscaping activities could be subject to tax. It's wise to consult with a skilled accountant or tax advisor to understand your specific situation.

In Connecticut, independent contractors must comply with specific legal requirements to operate legally. You should register your business, obtain any necessary licenses, and ensure you have the appropriate insurance coverage. Additionally, understand the tax implications of being a self-employed worker under a Connecticut Masonry Services Contract. Consulting a legal expert can further clarify your obligations.

Yes, contractors working in Connecticut typically need to hold a valid license. This requirement ensures that you hire qualified professionals who meet state regulations. When you engage in a Connecticut Masonry Services Contract - Self-Employed, verify that your contractor possesses the necessary credentials to guarantee quality and compliance with local laws.

Yes, you can write your own legally binding contract as long as it meets specific legal requirements. Ensure that you include essential elements such as offer, acceptance, consideration, and mutual consent. However, to avoid potential pitfalls, it's wise to consult resources. Exploring US Legal Forms can help you draft a solid Connecticut Masonry Services Contract - Self-Employed that meets all requirements.

Writing a contract as an independent contractor involves detailing the work, payment structure, and deadlines. You should also clarify the expectations and responsibilities of each party. This contract needs to be thorough to safeguard your interests. Consider using templates from US Legal Forms for a structured Connecticut Masonry Services Contract - Self-Employed that meets legal standards.

To write a self-employment contract, begin by clearly defining your services and the scope of work. It's crucial to include payment details, the frequency of payments, and any required deadlines. Make sure both parties agree on the terms to prevent disputes. US Legal Forms offers templates that guide you through creating a comprehensive Connecticut Masonry Services Contract - Self-Employed.