Connecticut Computer Repairman Services Contract - Self-Employed

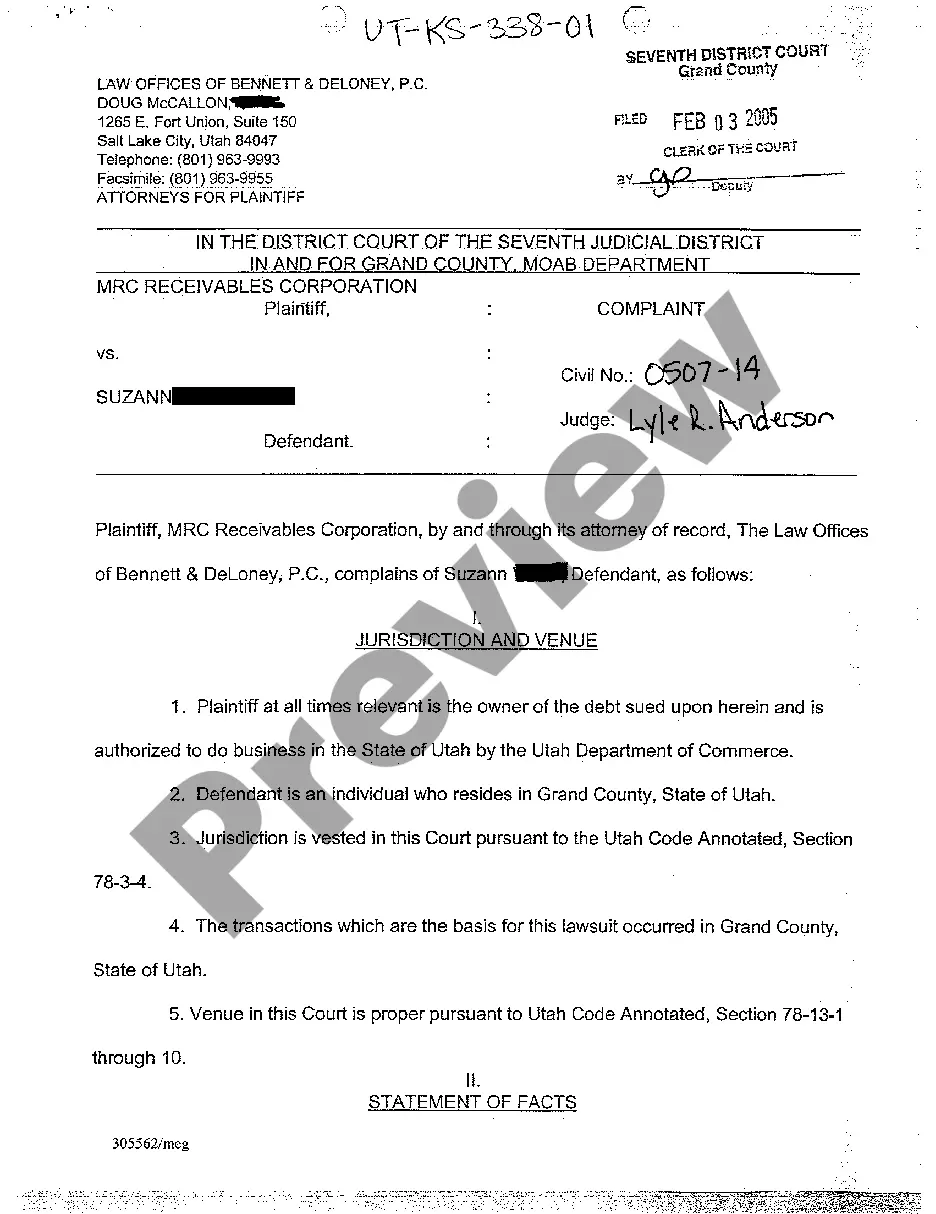

Description

How to fill out Computer Repairman Services Contract - Self-Employed?

US Legal Forms - one of the largest repositories of legal documents in the United States - offers a broad selection of legal document templates that can be downloaded or printed.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can find the most recent versions of documents such as the Connecticut Computer Repairman Services Contract - Self-Employed in just a few minutes.

Check the form summary to confirm that you have selected the appropriate form.

If the form does not suit your needs, use the Search field at the top of the screen to find one that does.

- If you already have an account, Log In and download the Connecticut Computer Repairman Services Contract - Self-Employed from the US Legal Forms library.

- The Download button will appear on each form you view.

- You can access all previously downloaded forms from the My documents section of your account.

- If you are using US Legal Forms for the first time, here are simple instructions to get started.

- Make sure you have chosen the correct form for your city/region.

- Click the Preview button to review the form's details.

Form popularity

FAQ

The right to repair in Connecticut empowers consumers to fix their purchased devices without interference from manufacturers. This legislation aims to ensure that individuals have access to the necessary tools and parts to repair their equipment. If you offer services under a Connecticut Computer Repairman Services Contract - Self-Employed, staying informed about these rights can enhance your service offerings and attract more clients.

Starting your own tech repair business involves several key steps. Firstly, draft a solid business plan, focusing on your services and target market. Additionally, securing a Connecticut Computer Repairman Services Contract - Self-Employed can formalize your operations and establish clear expectations with your clients, paving the way for success.

Certain services and items are not taxed in Connecticut, including some types of professional services, educational services, and medical services. However, when focusing on the Connecticut Computer Repairman Services Contract - Self-Employed, it is crucial to recognize that repair services usually fall under taxable categories. Understanding these distinctions can benefit your business plans.

Yes, in Connecticut, repair services are generally taxable. The state demands sales tax on most services performed in relation to tangible personal property. When you create your Connecticut Computer Repairman Services Contract - Self-Employed, it’s essential to include tax considerations to ensure compliance with state laws.

An employment contract should include the job title, responsibilities, salary, benefits, and termination conditions. Additionally, it should address any confidentiality and non-compete clauses. Although specific to employees, having a strong Connecticut Computer Repairman Services Contract - Self-Employed can help guide your approach to business agreements.

To write a contract agreement for services, begin by clearly defining the services to be provided, including deadlines and payment rates. Use clear language to detail the terms and conditions, and ensure both parties sign the document. A structured Connecticut Computer Repairman Services Contract - Self-Employed simplifies this process and protects both parties’ interests.

Independent contractors must adhere to state and federal laws, including tax obligations and any licensing requirements. They should also have a written agreement that outlines the terms of service. A well-drafted Connecticut Computer Repairman Services Contract - Self-Employed can help ensure compliance and minimize legal risks.

employed contract should include the scope of work, payment details, deadlines, and liability clauses. Additionally, it should address confidentiality and ownership of workrelated materials. By using a comprehensive Connecticut Computer Repairman Services Contract SelfEmployed, you can safeguard your rights and responsibilities while maintaining a professional relationship.

A 1099 contract should include the names and addresses of both parties, a description of the services, payment terms, and the total amount. It is essential to specify whether expenses are reimbursable. Incorporating a solid Connecticut Computer Repairman Services Contract - Self-Employed can ensure clarity and compliance with tax regulations.

employed individual typically operates under a freelancer contract or an independent contractor agreement. This type of contract clearly outlines the services provided, payment terms, and the project timeline. It is crucial to have a wellstructured Connecticut Computer Repairman Services Contract SelfEmployed to clarify expectations for both parties.