Connecticut Qualified Written RESPA Request to Dispute or Validate Debt

Description

How to fill out Qualified Written RESPA Request To Dispute Or Validate Debt?

Are you in a situation where you need documents for various business or personal purposes nearly every day.

There are numerous legitimate document templates accessible online, but finding ones you can rely on is challenging.

US Legal Forms offers a wide array of form templates, including the Connecticut Qualified Written RESPA Request to Dispute or Validate Debt, which can be completed to adhere to state and federal regulations.

Once you locate the correct form, click on Buy now.

Select the payment plan you prefer, complete the necessary information to create your account, and pay for your order using PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Connecticut Qualified Written RESPA Request to Dispute or Validate Debt template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Find the form you require and ensure it is for the appropriate area/state.

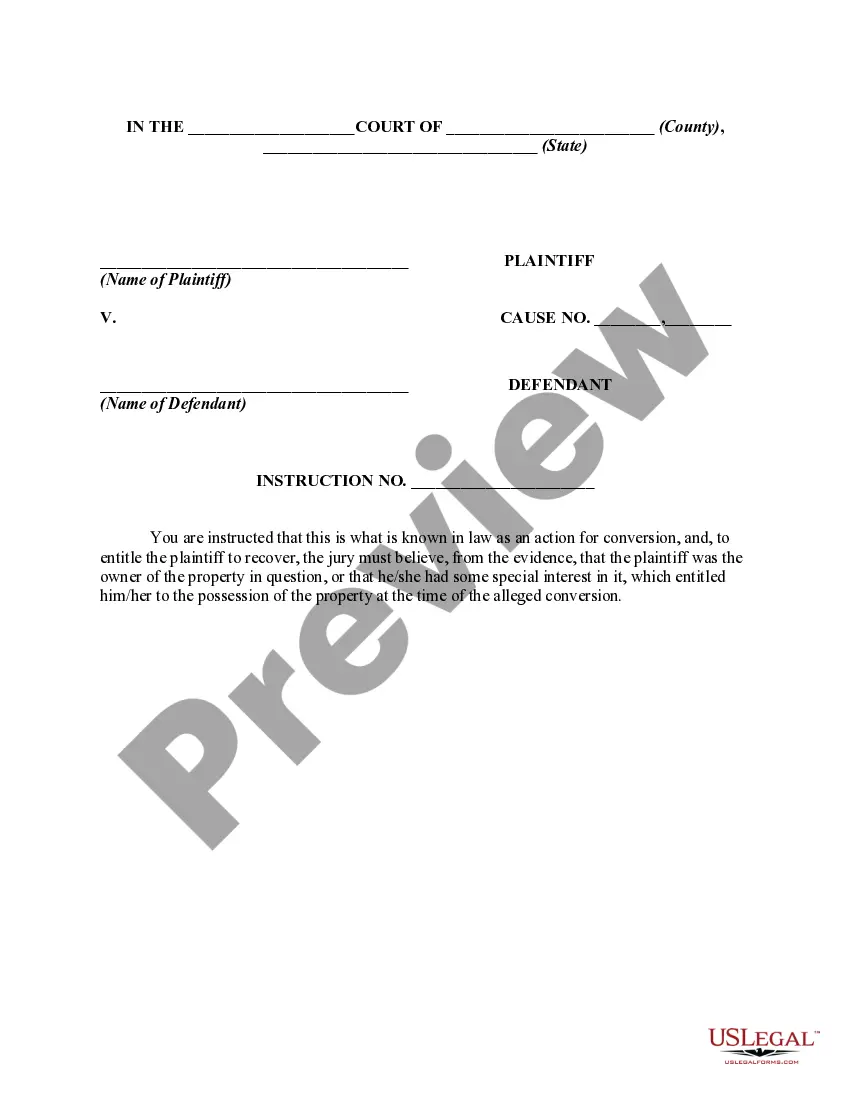

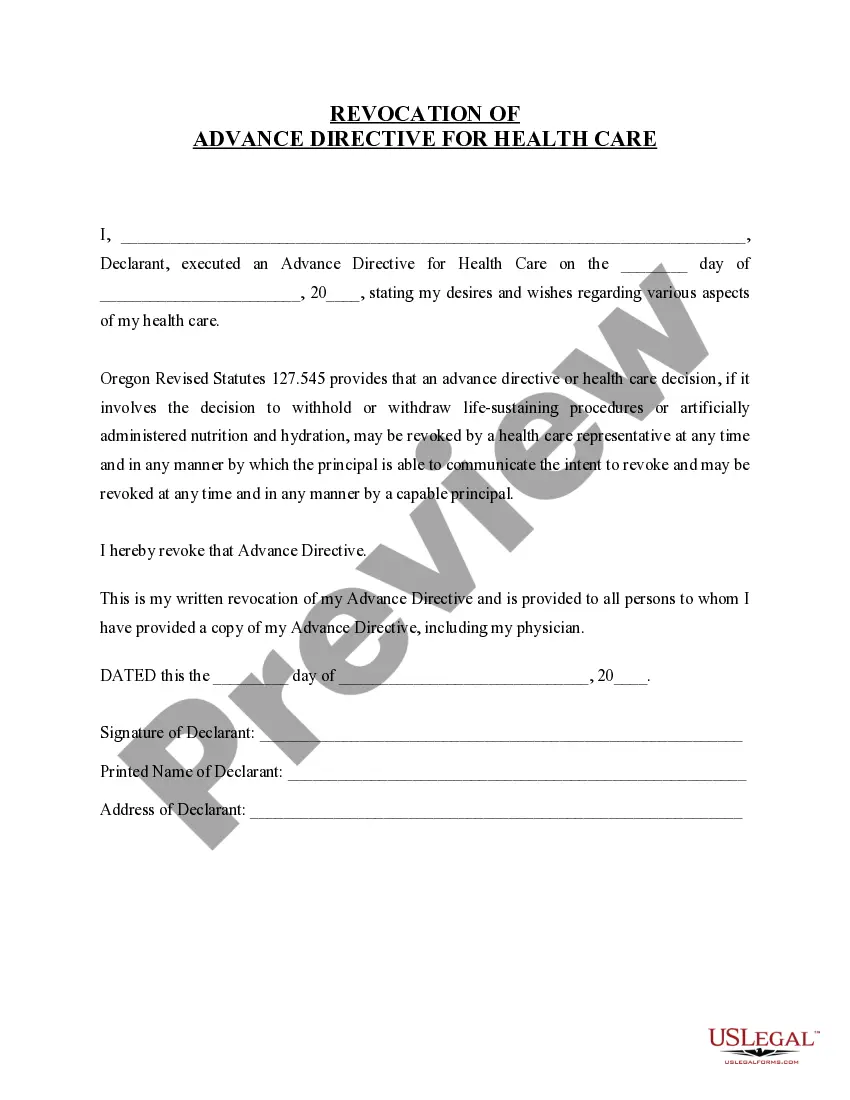

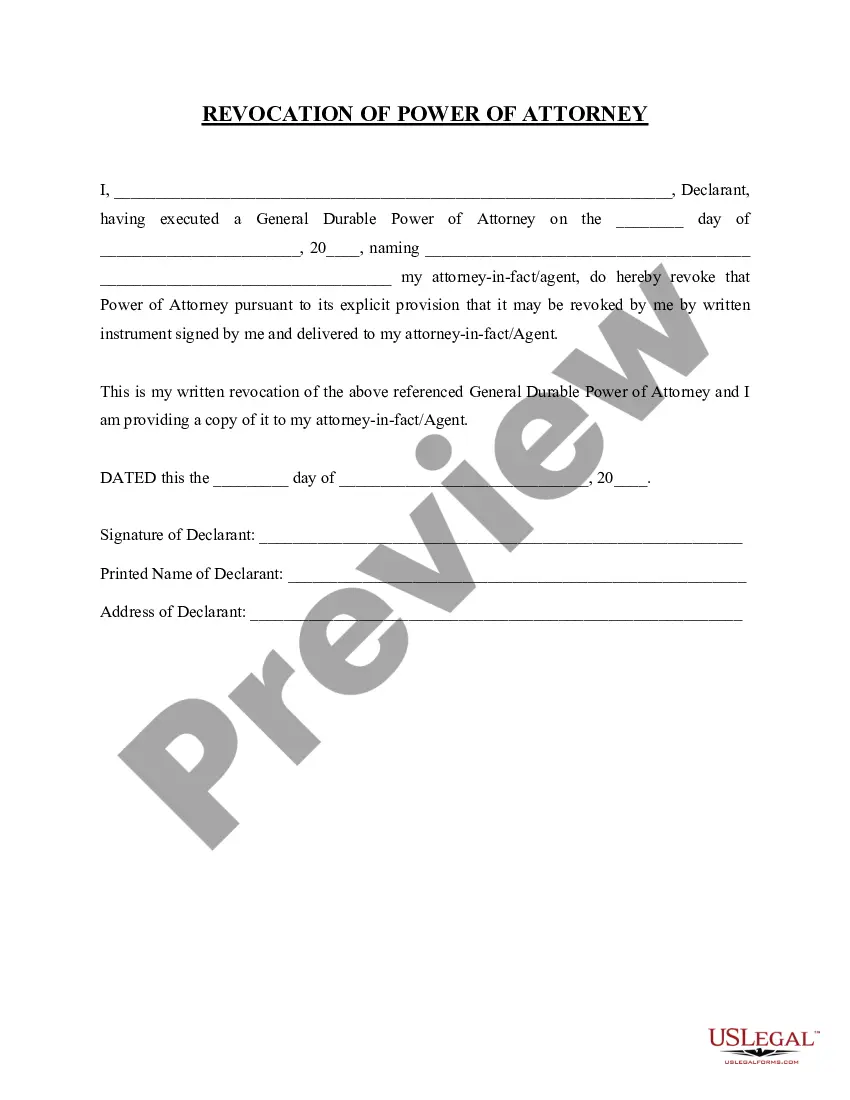

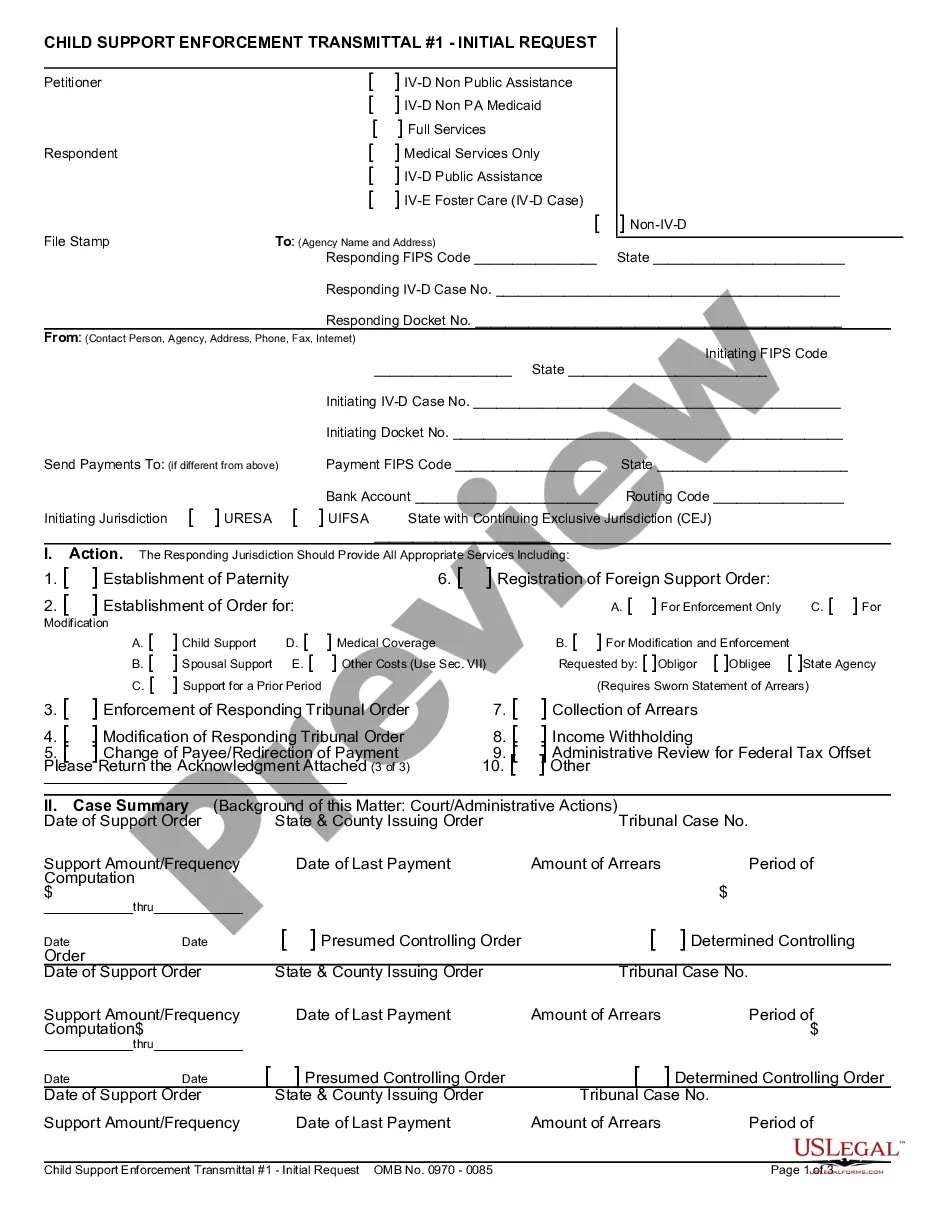

- Utilize the Preview feature to inspect the form.

- Examine the description to confirm that you have chosen the correct form.

- If the form isn't what you are looking for, use the Lookup field to find the form that meets your needs and requirements.

Form popularity

FAQ

To write a qualified written request, start by clearly stating your name, address, and account number at the top of the letter. Be specific about the information you are requesting or the issues you wish to address regarding your mortgage account. It is wise to format your letter formally, maintaining a professional tone, and ensure that it references the Connecticut Qualified Written RESPA Request to Dispute or Validate Debt to reinforce its validity. For added assistance, consider using the US Legal Forms platform to access templates and guidance.

A deed in lieu of foreclosure is a legal option that allows homeowners in Connecticut to transfer ownership of their property to the lender to avoid foreclosure proceedings. This process can be beneficial for both parties, as it helps the homeowner avoid the damaging effects of foreclosure while allowing the lender to reclaim the property without lengthy legal battles. When facing financial difficulties, consider exploring the Connecticut Qualified Written RESPA Request to Dispute or Validate Debt to better understand your options.

When dealing with debt collectors, asking for specific details helps clarify your situation. You can request a copy of the original contract, the account statement, and the collector's authorization to collect on the debt. Utilizing a Connecticut Qualified Written RESPA Request to Dispute or Validate Debt will provide you with a formal way to gather all necessary information and confirm the legitimacy of the debt.

In Connecticut, creditors typically have six months from the date of the estate’s notice to file a claim against the estate. If you are managing an estate, it's essential to stay informed about this timeline. By initiating a Connecticut Qualified Written RESPA Request to Dispute or Validate Debt, you can ensure that any claims are appropriately addressed and verified.

The best sample for a debt validation letter includes clear, specific language referencing your Connecticut Qualified Written RESPA Request to Dispute or Validate Debt. Your letter should include your contact information, the account details, and a request for proof of the debt. You can find templates through platforms like uslegalforms, which provide guidance to ensure your letter meets legal requirements. Using a well-structured letter can facilitate effective communication with debt collectors.

The 777 rule refers to the concept that you should follow up with a debt collector if you have not received a response to your validation request within seven days. You then give them another seven days to respond fully before considering further actions. This approach emphasizes consistent communication regarding your Connecticut Qualified Written RESPA Request to Dispute or Validate Debt. Staying proactive can enhance your ability to dispute inaccurate claims.

To ask a debt collector to validate a debt, you should send them a Connecticut Qualified Written RESPA Request to Dispute or Validate Debt. In your request, clearly state that you are seeking verification of the debt and specify the details you require. This can include the original creditor’s name and the amount owed. A well-crafted request can help you obtain necessary information to make informed decisions.

Yes, debt collectors must validate debt when requested. According to federal law, if you send a Connecticut Qualified Written RESPA Request to Dispute or Validate Debt, they are obligated to provide proof that you owe the amount they claim. This validation includes documentation that shows the original creditor and the amount owed. Understanding your rights can help you navigate the process confidently.

When communicating with a debt collector, avoid making statements that may compromise your position. Do not acknowledge the debt unless you are certain it is valid. Additionally, refrain from providing personal information or making payment promises without careful consideration. It’s wise to maintain control of the conversation and use a Connecticut Qualified Written RESPA Request to Dispute or Validate Debt for formal communication.

To request proof of debt from a debt collector, you can send them a Connecticut Qualified Written RESPA Request to Dispute or Validate Debt. This formal request should clearly state that you demand evidence supporting their claim that you owe the debt. Be sure to include your account information to ensure they accurately identify your account. By doing this, you assert your rights and establish a clear communication channel.