Connecticut Notice Regarding Introduction of Restricted Share-Based Remuneration Plan

Description

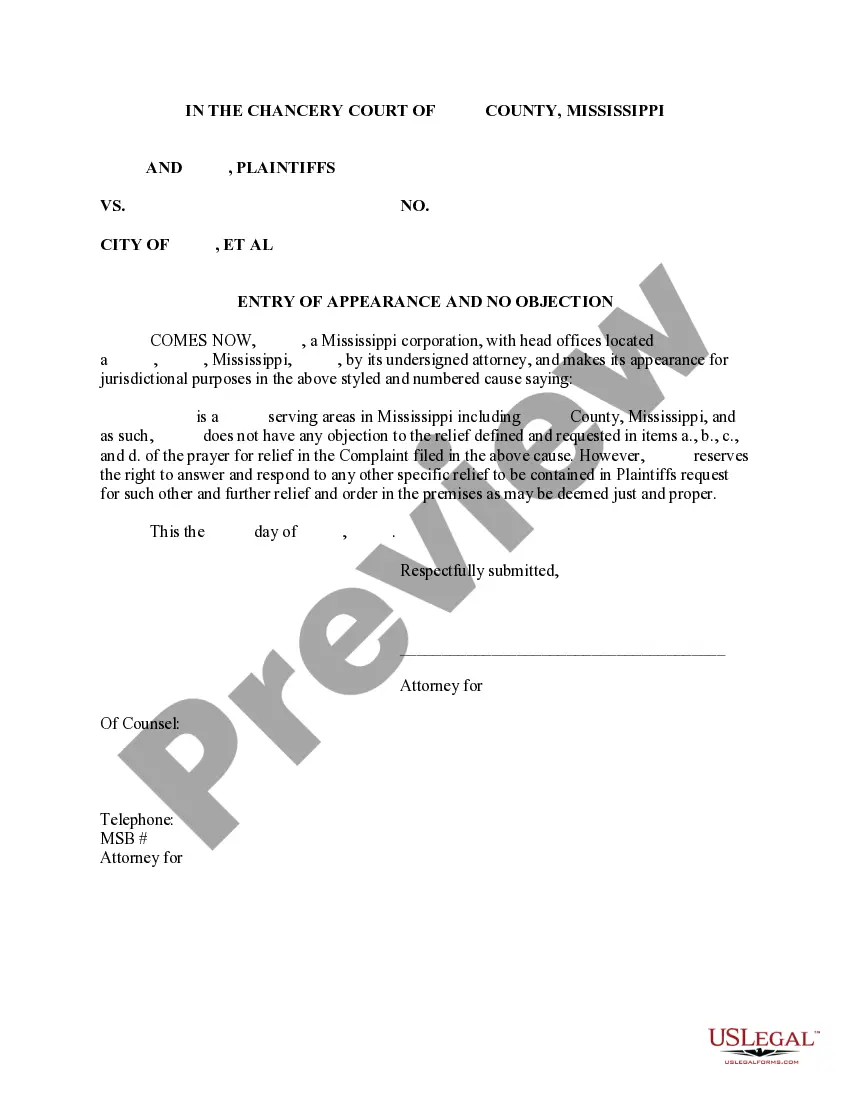

How to fill out Notice Regarding Introduction Of Restricted Share-Based Remuneration Plan?

Discovering the right lawful papers design might be a battle. Naturally, there are tons of templates accessible on the Internet, but how will you get the lawful form you will need? Take advantage of the US Legal Forms web site. The assistance provides 1000s of templates, for example the Connecticut Notice Regarding Introduction of Restricted Share-Based Remuneration Plan, which can be used for business and personal requirements. All of the kinds are inspected by pros and satisfy federal and state needs.

Should you be currently listed, log in to your profile and click on the Acquire option to have the Connecticut Notice Regarding Introduction of Restricted Share-Based Remuneration Plan. Make use of your profile to check throughout the lawful kinds you may have acquired formerly. Visit the My Forms tab of your own profile and acquire one more backup from the papers you will need.

Should you be a fresh customer of US Legal Forms, allow me to share simple guidelines for you to comply with:

- Initially, ensure you have chosen the proper form to your metropolis/area. You may check out the shape using the Preview option and browse the shape description to make certain it is the right one for you.

- In case the form is not going to satisfy your preferences, make use of the Seach area to discover the proper form.

- Once you are sure that the shape would work, go through the Buy now option to have the form.

- Pick the prices program you need and enter in the essential details. Design your profile and pay money for the order making use of your PayPal profile or bank card.

- Select the document structure and obtain the lawful papers design to your gadget.

- Full, edit and print out and indication the obtained Connecticut Notice Regarding Introduction of Restricted Share-Based Remuneration Plan.

US Legal Forms is the largest collection of lawful kinds where you can find a variety of papers templates. Take advantage of the company to obtain skillfully-made papers that comply with condition needs.

Form popularity

FAQ

General pension and annuity earnings are 100% exempt from income taxes for single filers and married people filing separately with an overall AGI of less than $75,000 a year. Couples filing jointly with an AGI of less than $100,000 a year are fully exempt as well.

You must file a Connecticut income tax return if your gross income for the 2022 taxable year exceeds: $12,000 and you are married filing separately; $15,000 and you are filing single; $19,000 and you are filing head of household; or.

You are a nonresident for the 2022 taxable year if you are neither a resident nor a part-year resident for the 2022 taxable year. If you are a nonresident and you meet the requirements for Who Must File Form CT?1040NR/PY for the 2022 taxable year, you must file Form CT?1040NR/PY.

A Connecticut Resident is an individual that is domiciled in Connecticut for the entire tax year. If you maintained a permanent place of abode in Connecticut and spent more than 183 days in the state, you are also considered to be a resident.

EFFECTIVE JULY 1, 2023: Cost of Living Adjustment (COLA): a. Salary Plan Adjustments: As a result of the Cost of Living Adjustment (COLA), the minimum and maximum rates of the EX, MP, MD, SE, HE, and DM range pay plans, and the rates in the CJ- EX pay plan shall be increased by 2.5% effective July 1, 2023.

Generally, you must file an income tax return if you're a resident , part-year resident, or nonresident and: Are required to file a federal return. Receive income from a source in California. Have income above a certain amount.

Income tax returns should be filed as per Section 139 (1) of the Income Tax Act. Individuals/entities who fall under the following criteria must file income tax returns. Gross income more than Rs. 2.5 lakhs - The gross annual income of an individual should exceed Rs.

To have economic nexus in Connecticut your business meets the following criteria: $100,000 or more in gross receipts from sales in the state AND. 200 or more separate retail transactions in a given year.