Connecticut Founders Collaboration Agreement

Description

How to fill out Founders Collaboration Agreement?

Are you currently in a place where you will need paperwork for sometimes company or personal purposes virtually every day? There are a lot of legal file web templates available on the net, but locating ones you can trust is not easy. US Legal Forms gives a large number of develop web templates, like the Connecticut Founders Collaboration Agreement, which can be written to meet state and federal requirements.

When you are currently familiar with US Legal Forms web site and possess a free account, merely log in. Next, you can obtain the Connecticut Founders Collaboration Agreement format.

Should you not come with an account and wish to begin using US Legal Forms, follow these steps:

- Obtain the develop you need and make sure it is to the correct area/county.

- Take advantage of the Preview option to analyze the shape.

- Look at the information to actually have chosen the correct develop.

- If the develop is not what you are looking for, utilize the Search industry to obtain the develop that meets your requirements and requirements.

- If you get the correct develop, click on Get now.

- Select the rates strategy you need, fill in the necessary details to produce your bank account, and pay for an order with your PayPal or Visa or Mastercard.

- Select a hassle-free data file format and obtain your backup.

Discover all of the file web templates you have bought in the My Forms food selection. You can get a more backup of Connecticut Founders Collaboration Agreement at any time, if necessary. Just click on the necessary develop to obtain or printing the file format.

Use US Legal Forms, by far the most extensive collection of legal kinds, to conserve time and stay away from errors. The services gives expertly manufactured legal file web templates that you can use for a selection of purposes. Make a free account on US Legal Forms and start generating your way of life a little easier.

Form popularity

FAQ

Up to this point, generally speaking, with teams of less than 12 people, the average granted equity for startup employees is 1%. This number can be as high as 2% for the first hires, and in some circumstances, the first hire(s) can be considered founders and their equity share could be even greater.

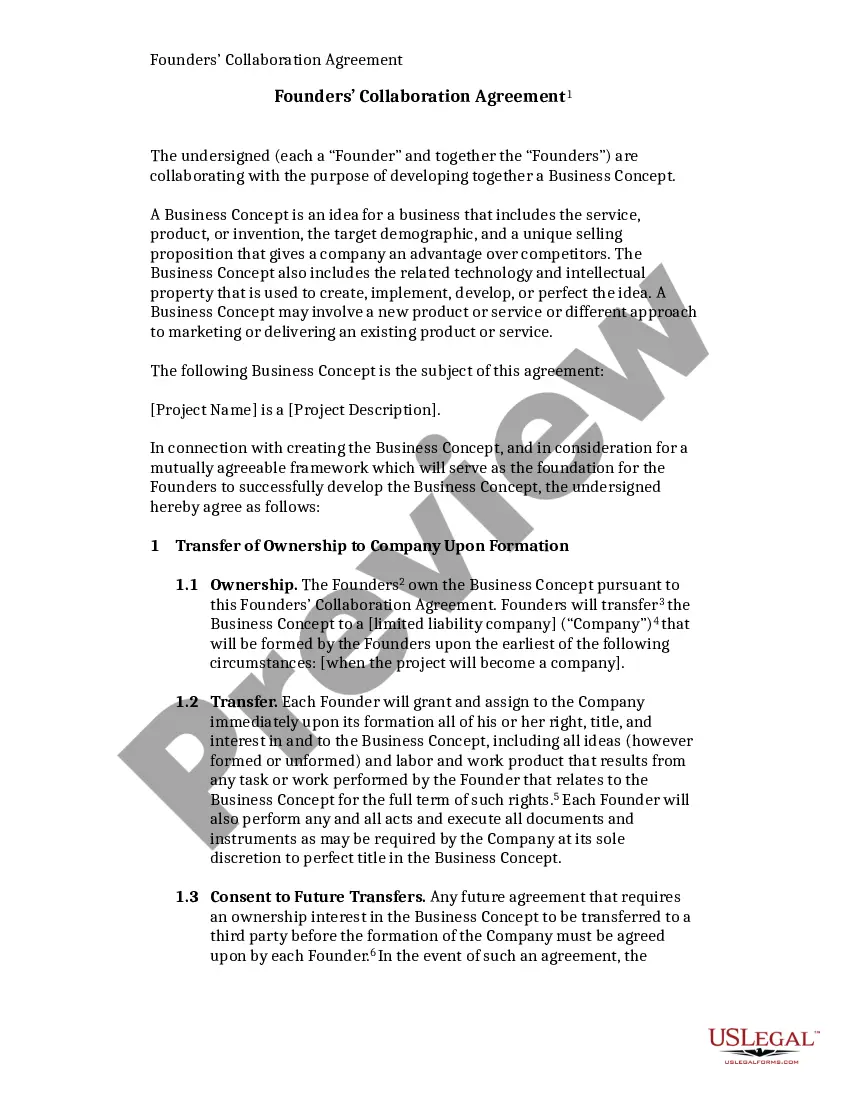

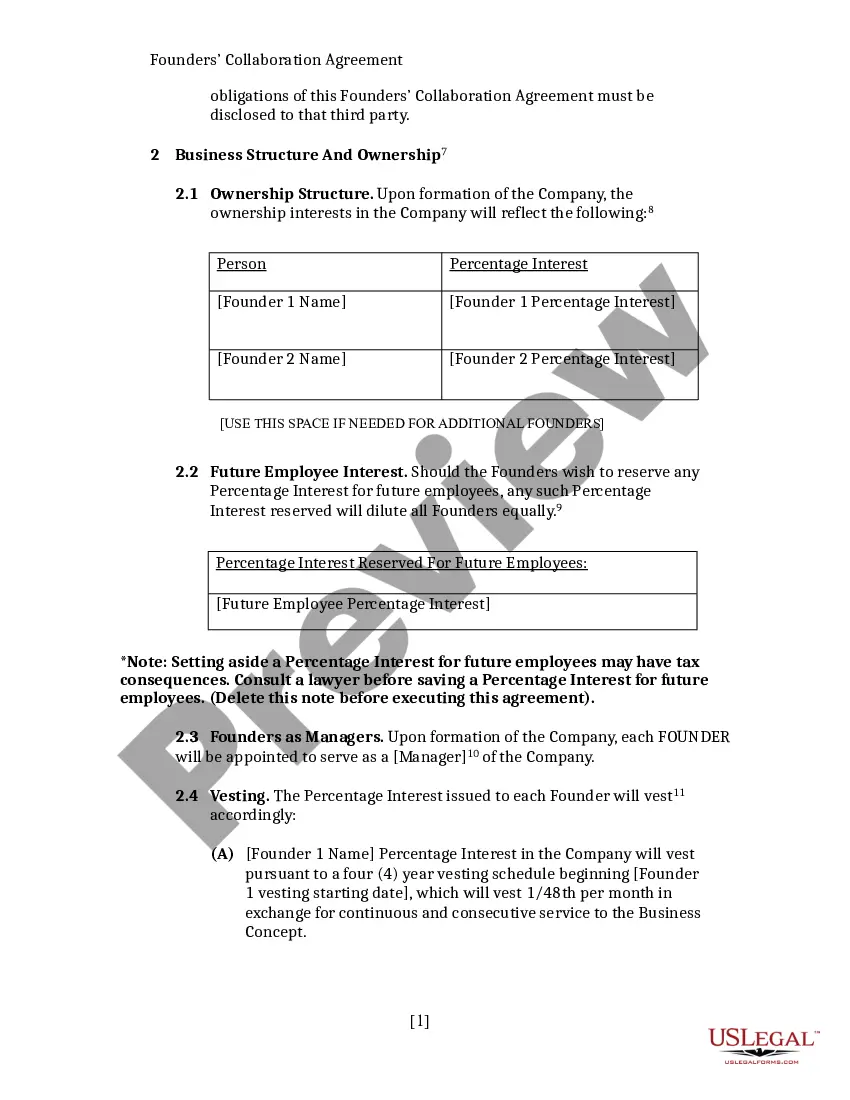

Contents of a Co-Founder Agreement Company Formation. Details on the formation of the company, including the company's name, location, and purpose. Ownership and Equity. ... Roles and Responsibilities. ... Capital Contributions. ... Intellectual Property. ... Confidentiality and Non-compete. ... Dispute Resolution. ... Termination.

While there's no formal structure for a founders agreement, here are some things you should strongly consider including in yours. Names of Founders and Company. ... Ownership Structure. ... The Project. ... Initial Capital and Additional Contributions. ... Expenses and Budget. ... Taxes. ... Roles and Responsibilities.

Although no ?perfect? balance exists, conventional wisdom says that at incorporation, when a company has no investors, 80%-90% of the stock is typically allocated to the founders, with the remaining 10%-20% of the outstanding shares reserved for grant under an equity incentive plan.

The Elements of the Perfect Founder Letter Personal Anecdote. A personal letter from the founder should be, well, personal. ... Gratitude. Whether you're sharing good news or bad, a little gratitude goes a long way. ... The News (duh) ... Humility. ... Vulnerability. ... Belief / Vision / Mission. ... What's Next.

The most common splits are 2-for-1 or 3-for-1, which means a stockholder gets two or three shares, respectively, for every share held. In a reverse stock split, a company divides the number of shares that stockholders own, raising the market price ingly.

If you started as a solo-founder and have made progress on the business (especially if you've already raised), you should consider a something along the line of an 80/20 split of founder shares. In fact, the range I'm seeing is anywhere from 5-20% for the 2nd co-founder.

Splitting equity amongst co-founders fairly Rule 1: Aim to split as equally and fairly as possible; Rule 2: Don't take on more than 2 co-founders; Rule 3: Your co-founders should complement your competencies, not copy them; Rule 4: Use vesting. ... Rule 5: Keep 10% of the company for the most important employees;