Connecticut Accredited Investor Status Certificate

Description

To become an accredited investor the (SEC) requires certain wealth, income or knowledge requirements. The investor must fall into one of three categories. Firms selling unregistered securities must put investors through their own screening process to determine if investors can be considered an accredited investor.

The Verifying Individual or Entity should take reasonable steps to verify and determined that an Investor is an "accredited investor" as such term is defined in Rule 501 of the Securities Act, and hereby provides written confirmation. This letter serves to help the Entity determine status.

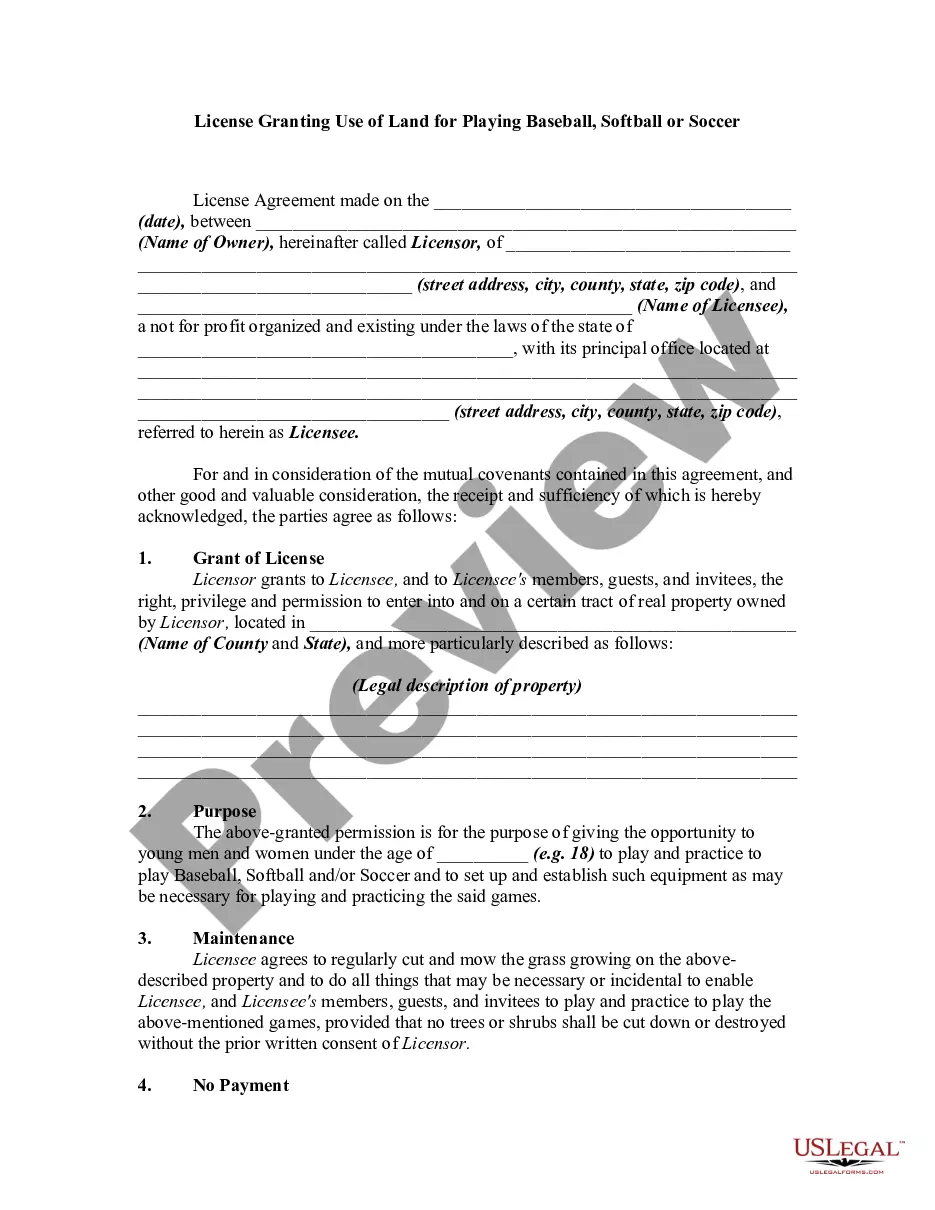

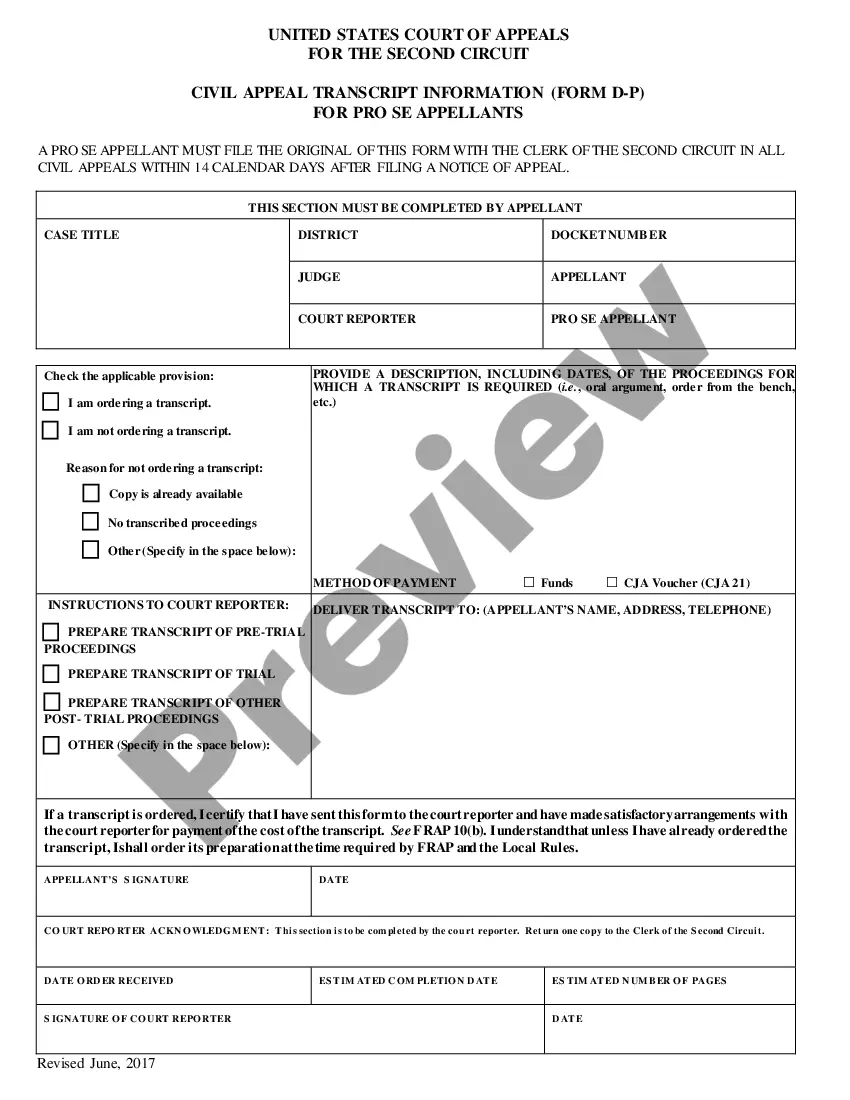

How to fill out Accredited Investor Status Certificate?

US Legal Forms - one of several biggest libraries of authorized types in the United States - gives a variety of authorized file templates you may obtain or printing. Using the website, you may get thousands of types for business and personal uses, sorted by classes, states, or search phrases.You can find the most recent versions of types much like the Connecticut Accredited Investor Status Certificate within minutes.

If you already possess a subscription, log in and obtain Connecticut Accredited Investor Status Certificate through the US Legal Forms collection. The Download switch can look on every single type you see. You have accessibility to all formerly delivered electronically types within the My Forms tab of the bank account.

If you want to use US Legal Forms the first time, listed below are basic directions to help you started out:

- Ensure you have selected the proper type for your personal metropolis/state. Go through the Preview switch to review the form`s content material. Browse the type explanation to actually have selected the right type.

- When the type doesn`t match your needs, use the Search area near the top of the display screen to discover the one which does.

- In case you are happy with the form, verify your option by visiting the Buy now switch. Then, pick the pricing prepare you favor and give your credentials to sign up to have an bank account.

- Process the financial transaction. Use your charge card or PayPal bank account to perform the financial transaction.

- Select the format and obtain the form on your own product.

- Make modifications. Fill out, modify and printing and indicator the delivered electronically Connecticut Accredited Investor Status Certificate.

Each web template you included in your account lacks an expiry particular date and it is the one you have forever. So, if you would like obtain or printing yet another version, just visit the My Forms segment and then click around the type you need.

Obtain access to the Connecticut Accredited Investor Status Certificate with US Legal Forms, probably the most extensive collection of authorized file templates. Use thousands of professional and status-specific templates that meet up with your organization or personal demands and needs.

Form popularity

FAQ

The SEC considered comments on the rule proposal advocating accreditation of holders of a variety of other professional designations, such as certified public accountant (CPA), chartered financial analyst (CFA), and certified financial planner (CFP), as well as certain educational degrees, such as legal or business ...

Professional certifications, designations or credentials administered by the Financial Industry Regulatory Authority (FINRA). Regarding that last bullet point, an investor holding FINRA's Series 7, Series 65 or Series 82 designations qualifies as an accredited investor.

Generally, any person who, for compensation, engages in the business of advising others, either directly or through publications or writings, as to the value of securities or the advisability of investing in, purchasing or selling securities must register as an "investment adviser" with the Connecticut Department of ...

How to become a financial adviser Pursue an education. ... Join a networking organization. ... Create a resume. ... Get an entry-level position. ... Register as a financial adviser. ... Pursue professional certification. ... Cultivate key skills. ... Stay up-to-date with your continuing education.

At a minimum, it takes about six years to become a certified financial planner. Along with earning a bachelor's degree, CFPs must have about two years of professional experience and pass an exam.

Certified Financial Planner (CFP) ? Hold a bachelor's degree, plus 3 years experience. Personal Financial Specialist (PFS) ? Have 75 hours personal financial planning education; also, hold a CPA, which requires a degree, plus 2 years experience.

Among other categories, the SEC now defines accredited investors to include the following: Individuals who have certain professional certifications, designations, or credentials. Individuals who are ?knowledgeable employees? of a private fund. SEC- and state-registered investment advisers5.

Among other categories, the SEC now defines accredited investors to include the following: Individuals who have certain professional certifications, designations, or credentials. Individuals who are ?knowledgeable employees? of a private fund. SEC- and state-registered investment advisers5.

Net worth over $1 million, excluding primary residence (individually or with spouse or partner) Income over $200,000 (individually) or $300,000 (with spouse or partner) in each of the prior two years, and reasonably expects the same for the current year.

Among other categories, the SEC now defines accredited investors to include the following: individuals who have certain professional certifications, designations, or credentials; individuals who are ?knowledgeable employees? of a private fund; and SEC- and state-registered investment advisors.