Connecticut Promissory Note and Pledge Agreement regarding loan and grant of security interest in shares of the company's common stock

Description

How to fill out Promissory Note And Pledge Agreement Regarding Loan And Grant Of Security Interest In Shares Of The Company's Common Stock?

It is possible to invest several hours on the Internet trying to find the legitimate papers format that meets the state and federal needs you will need. US Legal Forms supplies a large number of legitimate forms that happen to be examined by specialists. It is possible to obtain or produce the Connecticut Promissory Note and Pledge Agreement regarding loan and grant of security interest in shares of the company's common stock from the support.

If you already have a US Legal Forms accounts, you may log in and click the Download button. Afterward, you may full, change, produce, or indicator the Connecticut Promissory Note and Pledge Agreement regarding loan and grant of security interest in shares of the company's common stock. Each and every legitimate papers format you acquire is yours for a long time. To get another copy for any bought form, visit the My Forms tab and click the related button.

Should you use the US Legal Forms site for the first time, adhere to the basic guidelines beneath:

- Initial, make certain you have selected the best papers format for that area/city of your liking. See the form explanation to make sure you have selected the proper form. If readily available, utilize the Preview button to search through the papers format too.

- In order to find another version in the form, utilize the Look for industry to find the format that fits your needs and needs.

- Upon having located the format you would like, just click Get now to continue.

- Pick the costs plan you would like, type your credentials, and sign up for a free account on US Legal Forms.

- Total the transaction. You can utilize your Visa or Mastercard or PayPal accounts to pay for the legitimate form.

- Pick the file format in the papers and obtain it to the device.

- Make modifications to the papers if needed. It is possible to full, change and indicator and produce Connecticut Promissory Note and Pledge Agreement regarding loan and grant of security interest in shares of the company's common stock.

Download and produce a large number of papers layouts making use of the US Legal Forms website, which provides the largest collection of legitimate forms. Use skilled and condition-particular layouts to deal with your business or personal requires.

Form popularity

FAQ

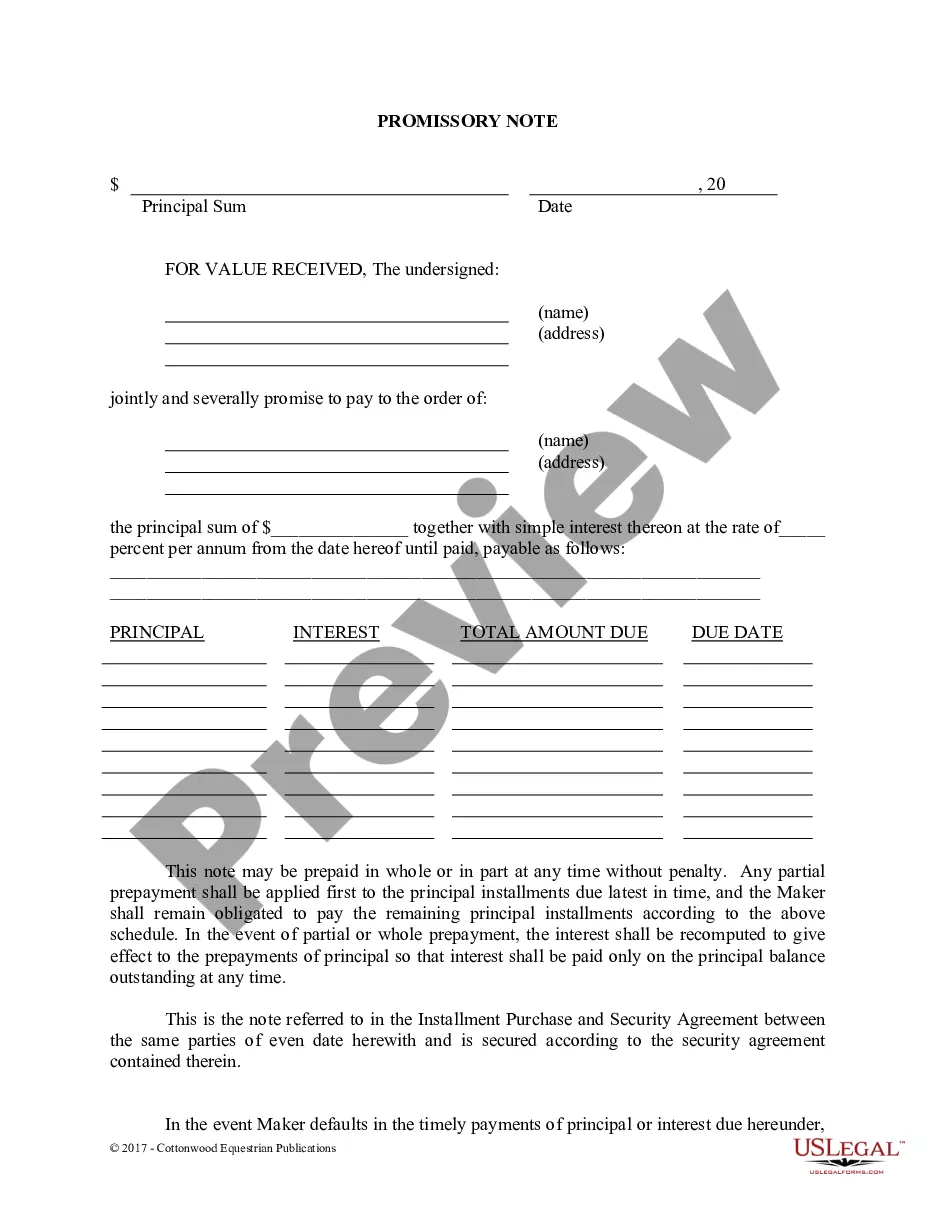

Although it is legally enforceable, a promissory note is less formal than a loan agreement and is suitable where smaller sums of money are involved. However, its terms - which can include a specific date of repayment, interest rate and repayment schedule - are more certain than those of an IOU.

What should be included in a Secured Promissory Note? The amount of the loan and how that money may be transferred. All parties involved and their contact information. ... Repayment schedule. ... Any interest on the loan. ... The details of the collateral.

A promissory note is a written agreement between one party (you, the borrower) to pay back the loan issued by another party (often a bank or other financial institution). Anyone lending money (like home sellers, credit unions, mortgage lenders and banks, for instance) can issue a promissory note.

An agreement typically used to create a security interest in equity interests (including capital stock, LLC interests, and partnership interests) and promissory notes.

For a personal loan agreement to be enforceable, it must be documented in writing, as well as signed and dated by all parties involved. It's also a good idea to have the document notarized or signed by a witness.

At its most basic, a promissory note should include the following things: Date. Name of the lender and borrower. Loan amount. Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral? ... Payment amount and frequency. Payment due date. Whether the loan has a cosigner, and if so, who.

A loan note can offer greater flexibility than a simple loan agreement, while still being legally actionable should it need to be upheld in court. They are also much easier to enforce than an informal IOU because the legal terms of the agreement are much more clearly defined.

A loan agreement serves a similar purpose as a promissory note. Like a promissory note it is a contractual agreement between a lender who agrees to loan money to a borrower. However, a loan agreement is much more detailed than a promissory note. There are two types of loan agreements.