Connecticut Nonqualified Defined Benefit Deferred Compensation Agreement

Description

How to fill out Nonqualified Defined Benefit Deferred Compensation Agreement?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a range of legal document templates you can download or print.

By using the platform, you can access thousands of forms for business and personal needs, organized by categories, states, or keywords.

You can find the latest versions of forms such as the Connecticut Nonqualified Defined Benefit Deferred Compensation Agreement in seconds.

Review the form summary to ensure you have chosen the right template.

If the form does not meet your requirements, utilize the Search field at the top of the screen to find one that does.

- If you have an account, Log In and download the Connecticut Nonqualified Defined Benefit Deferred Compensation Agreement from your US Legal Forms repository.

- The Download button will appear on every template you view.

- You can access all previously saved forms in the My documents section of your profile.

- If you are using US Legal Forms for the first time, here are simple steps to help you get started.

- Make sure you have selected the appropriate template for your locality/state.

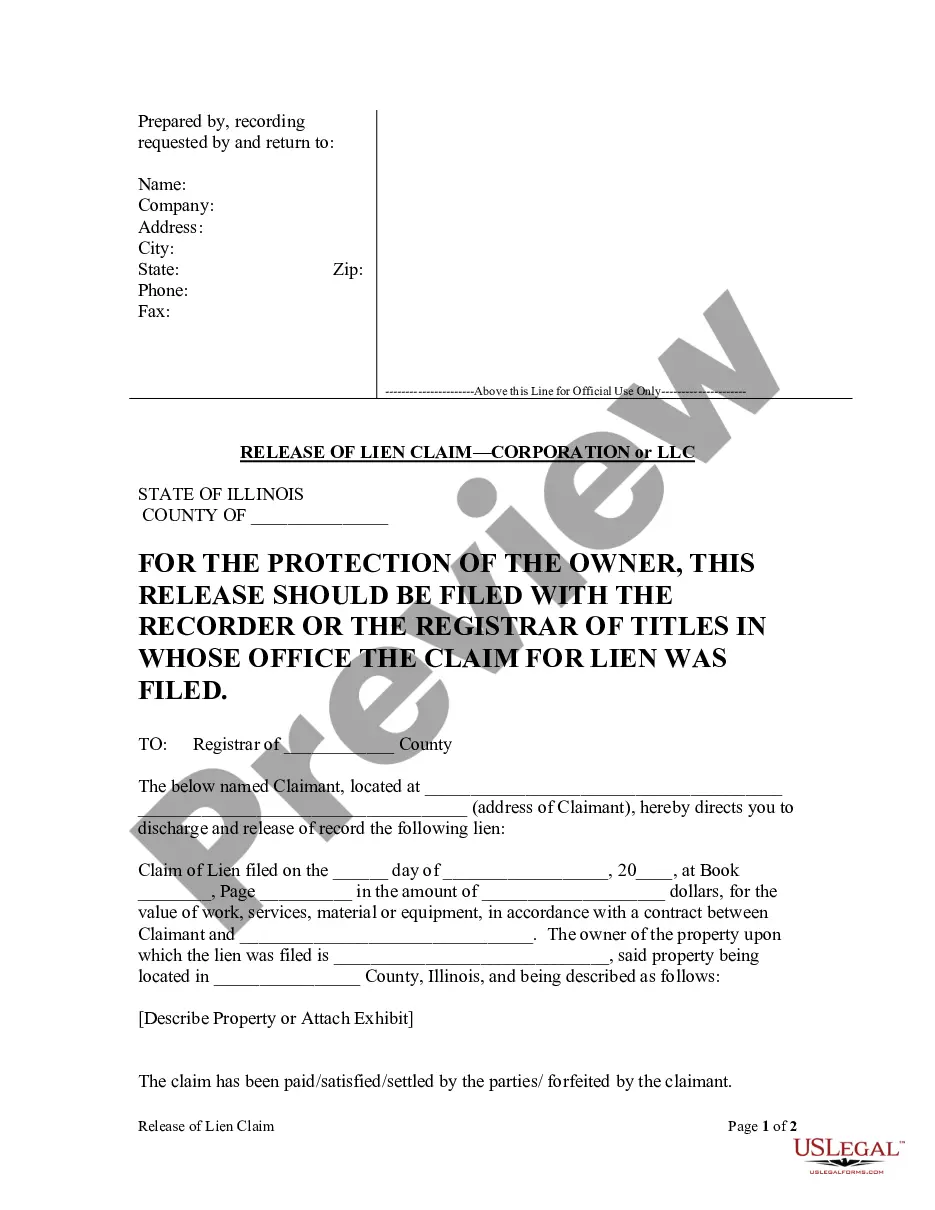

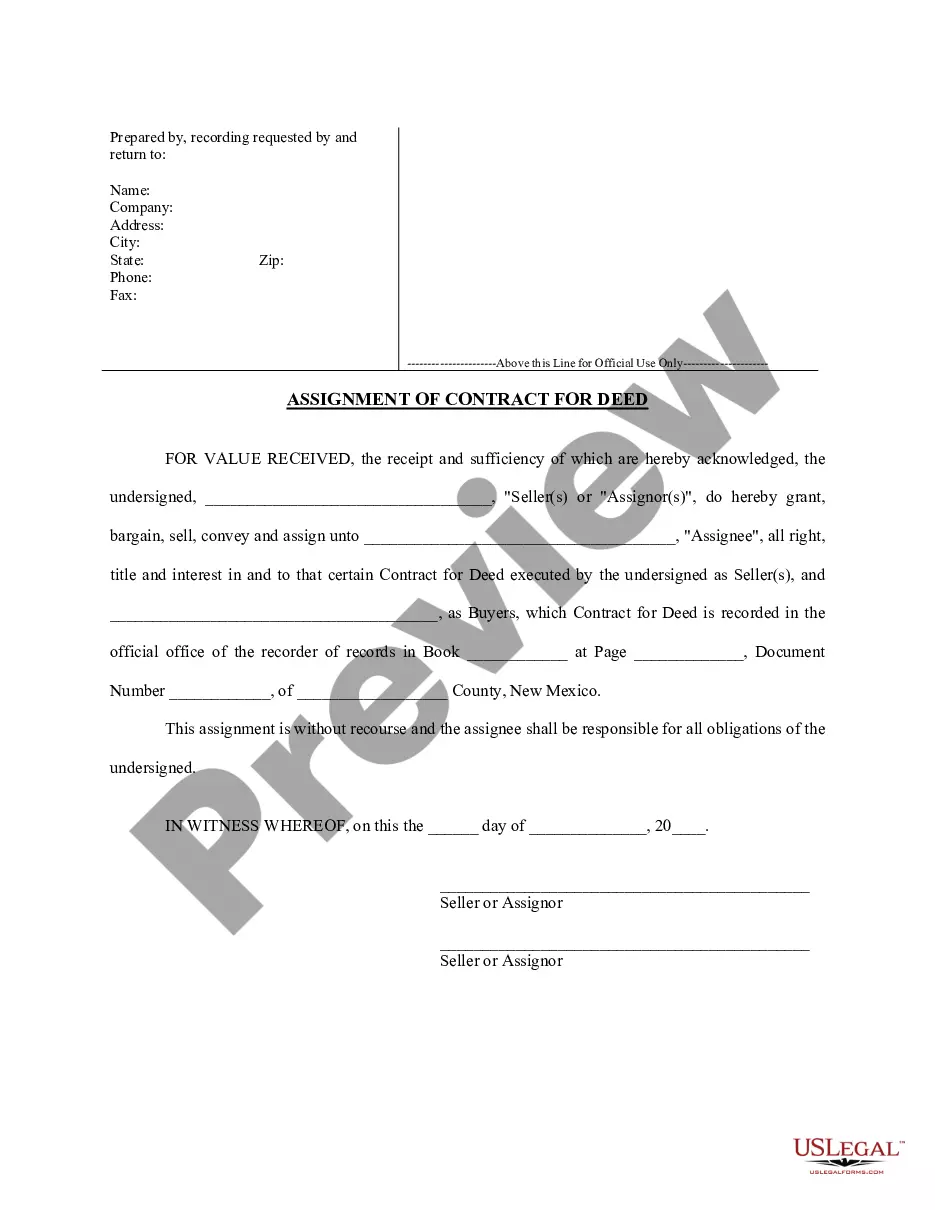

- Click the Preview button to review the content of the form.

Form popularity

FAQ

Typically, non-qualified deferred compensation plans are taxed when the funds are distributed to you. Unlike qualified plans, these agreements do not receive the same tax benefits until you receive payments. Understanding the tax implications is essential to maximize your retirement savings. Utilizing resources like US Legal Forms can guide you through the specifics of a Connecticut Nonqualified Defined Benefit Deferred Compensation Agreement and its tax treatment.

Currently, Connecticut's approach to taxing pensions is undergoing evaluation. Some discussions suggest that certain pension income may be exempt from state taxes. However, this can depend on numerous factors such as your income level and the specific pension plan. Staying informed about the latest updates will help you effectively plan your finances, especially in relation to your Connecticut Nonqualified Defined Benefit Deferred Compensation Agreement.

The Connecticut deferred compensation plan allows eligible employees to set aside part of their salaries for retirement. This plan is designed to help you save more effectively for your future. A key feature of this plan is that it provides tax advantages, allowing you to grow your savings without immediate tax implications. When considering a Connecticut Nonqualified Defined Benefit Deferred Compensation Agreement, it is crucial to understand how it fits into your overall retirement strategy.

To avoid paying taxes on your deferred compensation plan, consider a Connecticut Nonqualified Defined Benefit Deferred Compensation Agreement that aligns with tax deferral strategies. You may defer income until retirement, helping to lower your taxable income in your peak earning years. Additionally, utilize tax planning resources to maximize the benefits of your plan while ensuring compliance with IRS regulations. Consulting with a tax professional can also provide personalized advice tailored to your financial situation.

The 10 year rule for deferred compensation refers to the period during which the IRS requires participants to receive distributions from their deferred compensation plans. This rule applies to Connecticut Nonqualified Defined Benefit Deferred Compensation Agreements, ensuring that distributions happen within a specified timeframe. Therefore, plan participants must be aware of their choices to avoid penalties and manage their tax liabilities effectively. Understanding this rule can help you optimize your financial strategy.

The CT W4P withholding certificate for pension or annuity payments is a specific form that ensures the correct amount of Connecticut state tax is withheld from your retirement benefits. If you are receiving income from a Connecticut Nonqualified Defined Benefit Deferred Compensation Agreement, filling out this certificate is essential for accurate tax compliance. This process simplifies managing your state tax obligations.

A W4P withholding certificate is a tax form that lets you decide how much state tax is withheld from your pension payments. This can apply to distributions from your Connecticut Nonqualified Defined Benefit Deferred Compensation Agreement. Using the W4P helps you avoid surprises during tax season by controlling your tax withholdings more effectively.

The de 4P withholding certificate is a document used in Connecticut for withholding state taxes on pension or annuity payments. This certificate allows pensioners to specify the amount of state tax to be withheld, offering a more tailored approach to managing tax withholdings from a Connecticut Nonqualified Defined Benefit Deferred Compensation Agreement. Completing this form helps in financial planning.

If you do not fill out a W4P, your pension or annuity payments may be taxed at the maximum withholding rate. This could lead to higher tax payments than necessary on your income from a Connecticut Nonqualified Defined Benefit Deferred Compensation Agreement. It's wise to fill out the W4P to better manage your tax liabilities.

The CT W4P form is a withholding certificate specifically for pensions and annuities in Connecticut. This form allows you to request the amount of state tax withheld from your pension payments, which includes those from a Connecticut Nonqualified Defined Benefit Deferred Compensation Agreement. Completing this form helps ensure that you meet your tax obligations while receiving your pension benefits.