Connecticut Leased Personal Property Workform

Description

How to fill out Leased Personal Property Workform?

US Legal Forms - one of the most substantial libraries of legal documents in the USA - offers a variety of legal record templates that you can download or print.

Using the site, you can discover thousands of documents for business and personal use, categorized by type, state, or keywords.

You can find the latest versions of documents such as the Connecticut Leased Personal Property Workform within moments.

Review the form outline to confirm you have chosen the correct document.

If the form does not meet your requirements, use the Search field at the top of the screen to find one that does.

- If you already have a monthly subscription, Log In and download the Connecticut Leased Personal Property Workform from your US Legal Forms library.

- The Download button will appear on each form you view.

- You have access to all previously downloaded documents in the My documents section of your account.

- To use US Legal Forms for the first time, here are simple instructions to get started.

- Ensure you have selected the right form for your city/state.

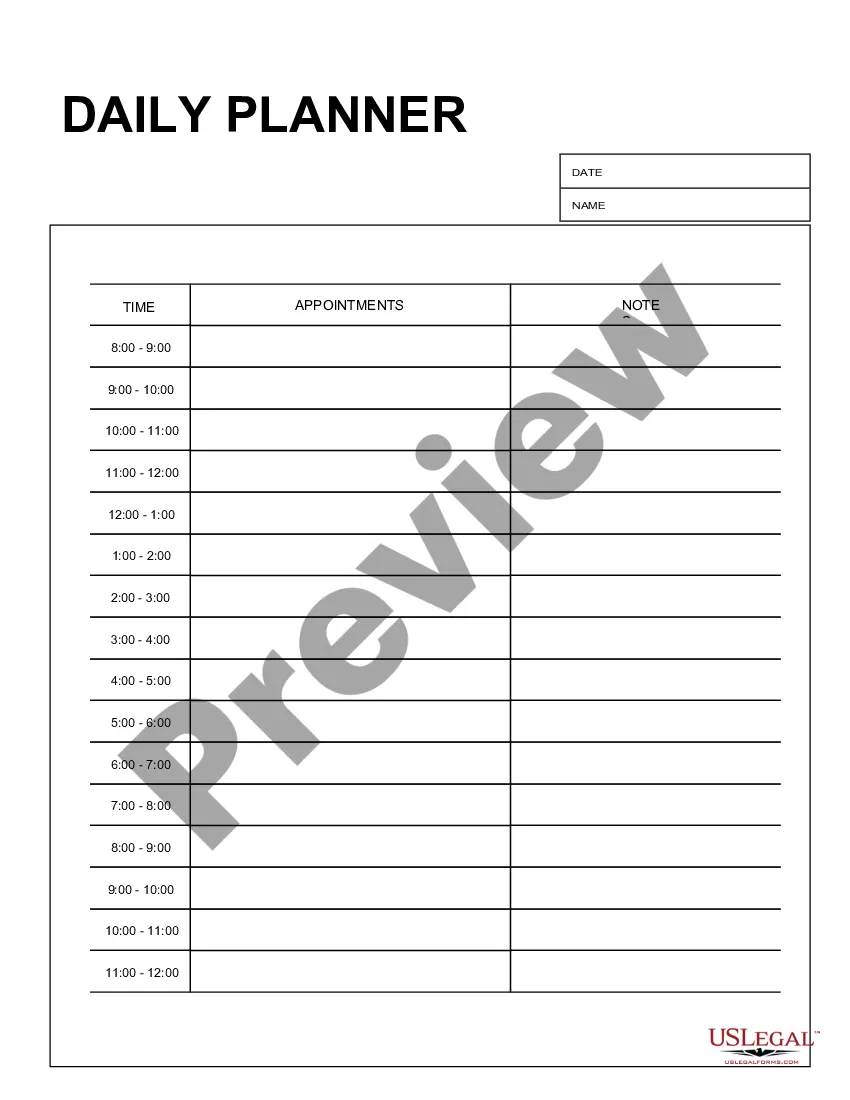

- Click the Preview button to review the form's contents.

Form popularity

FAQ

Yes, Connecticut does impose a personal property tax on certain items. This tax applies to businesses and individuals who own or lease personal property. To accurately report your personal property, you should complete the Connecticut Leased Personal Property Workform. Utilizing platforms like US Legal Forms can simplify the process and ensure you meet all requirements.

Personal property typically includes assets that are not real estate. Common examples are vehicles, furniture, equipment, and machinery. In the context of taxes, the Connecticut Leased Personal Property Workform applies specifically to items that you lease, such as office equipment or retail inventory. Understanding what qualifies as personal property is essential for accurate tax reporting.

You can find Connecticut tax forms, including the Connecticut Leased Personal Property Workform, on the official Connecticut Department of Revenue Services website. Additionally, website platforms like US Legal Forms provide easy access to a variety of tax forms. Simply search for the required form, and you can download it conveniently. Using reliable sources ensures you have the most current and accurate information.

Yes, Connecticut does impose personal property tax on various categories of personal property. This includes items such as machinery, equipment, and leased property including vehicles and furniture. When dealing with leased personal property, it is crucial to complete the Connecticut Leased Personal Property Workform accurately to ensure compliance with tax regulations. Utilizing the right forms can simplify the process and help you avoid potential pitfalls related to personal property tax.

A personal property declaration refers to the process by which individuals or businesses report their taxable personal assets to the tax assessor. In Connecticut, this declaration helps determine tax liabilities on items like leased vehicles or equipment. The Connecticut Leased Personal Property Workform is an essential tool in this process. It ensures transparency and compliance with state tax laws.

A personal property declaration in Connecticut is a formal statement provided to local tax authorities listing taxable personal property. This includes assets like machinery, office furniture, and leased items, as covered in the Connecticut Leased Personal Property Workform. Filing this declaration is crucial for accurate tax assessments. Failure to submit can lead to significant fines.

In Connecticut, personal property tax applies to items such as equipment, machinery, and leased property. Businesses must file a Connecticut Leased Personal Property Workform to report these items accurately. The local tax assessor determines the tax based on the property's assessed value. It's essential for businesses to stay compliant to avoid penalties.

To calculate the vehicle property tax in Connecticut, start by determining the fair market value of your vehicle. You then apply your local tax rate to this value to arrive at your total tax obligation. Utilizing the Connecticut Leased Personal Property Workform can simplify this process, ensuring you accurately report and calculate your property tax obligations.

Failing to declare personal property in Connecticut can lead to significant penalties, including fines and increased assessments. If you neglect to submit the Connecticut Leased Personal Property Workform, municipalities may estimate your property value, often resulting in higher taxes. To avoid complications and ensure compliance, it is advisable to report all personal property accurately and timely.

Yes, Connecticut does impose a personal property tax on vehicles, including cars, trucks, and other motor vehicles. When you register your vehicle, the tax is assessed based on its value, following the guidelines of the Connecticut Leased Personal Property Workform. To avoid penalties, it's crucial to include your vehicle in your property declaration.