Connecticut Notice of Violation of Fair Debt Act - Creditor Misrepresented Himself

Description

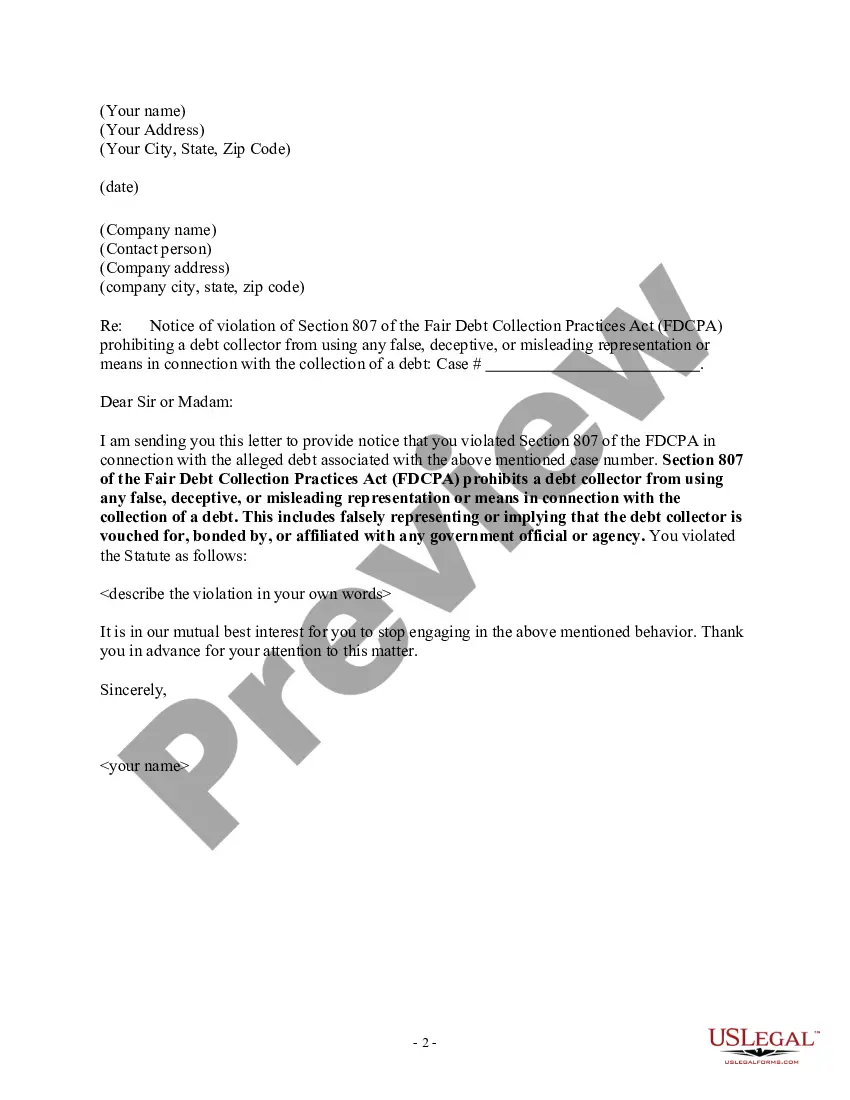

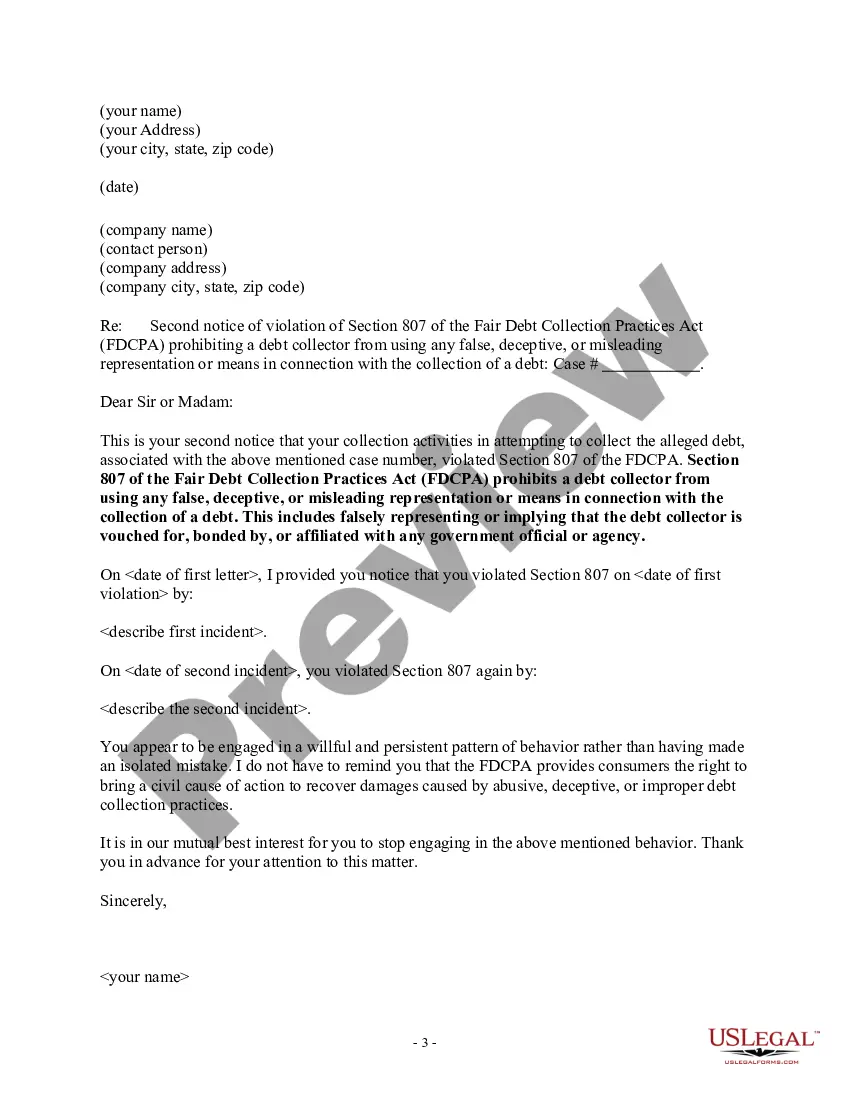

How to fill out Notice Of Violation Of Fair Debt Act - Creditor Misrepresented Himself?

You can spend time online attempting to locate the legal document template that meets federal and state requirements you will require.

US Legal Forms provides a wide array of legal forms that have been evaluated by experts.

You can download or print the Connecticut Notice of Violation of Fair Debt Act - Creditor Misrepresented Himself from the service.

First, make sure you have selected the correct document template for the state/city of your choice. Review the form description to ensure you have chosen the right template.

- If you already possess a US Legal Forms account, you may Log In and click on the Acquire button.

- After that, you can complete, modify, print, or sign the Connecticut Notice of Violation of Fair Debt Act - Creditor Misrepresented Himself.

- Every legal document template you receive is yours permanently.

- To get another copy of any downloaded form, go to the My documents tab and click on the corresponding button.

- If you are utilizing the US Legal Forms site for the initial time, follow the simple instructions below.

Form popularity

FAQ

If the debtor does not show up at the hearing, the court may issue a bench warrant for the debtor's arrest. If the debtor shows up, you will have the chance to ask him or her questions about where he or she works and what bank accounts, property, belongings, stocks, or any other assets the debtor may have.

The Fair Debt Collection Practices Act (FDCPA) The FDCPA prohibits debt collection companies from using abusive, unfair or deceptive practices to collect debts from you.

Debts that may not be covered are those that are not incurred voluntarily, such as income taxes, parking and speeding tickets, and domestic support obligations like child support and alimony, or spousal support.

The FDCPA broadly prohibits a debt collector from using 'any false, deceptive, or misleading representation or means in connection with the collection of any debt. ' 15 U.S.C. § 1692e. The statute enumerates several examples of such practices, 15 U.S.C.

Connecticut has a six-year statute of limitations for debt collection actions resulting from simple and implied contracts (CGS § 52-576; attachment 1). Medical bills generally are simple or implied contracts and thus the SOL is six years.

If the debtor still refuses to pay the unsecured debt, the creditor can file a lawsuit against the debtor. Once a court grants judgment in favor of the creditor, it can usually take money from the debtor's bank account or garnish the debtor's wages.

Creditor's rights can refer to many different aspects of creditor-debtor and creditor-creditor relations including a creditor's rights to place a lien on a debtor's property, garnish a debtor's wages, set aside a fraudulent conveyance, and contact the debtor and relatives.

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

Debt collectors must be truthful The Fair Debt Collection Practices Act states that debt collectors cannot use any false, deceptive or misleading representation to collect the debt. Along with other restrictions, debt collectors cannot misrepresent: The amount of the debt. Whether it's past the statute of limitations.

Debt collectors are required to give the full mini Miranda in their initial communication with you, no matter what form. 1fefffeff The first time a third-party debt collector speaks with you on the phone or sends you a letter, the mini Miranda statement must be included.