If you wish to total, obtain, or produce legal document themes, use US Legal Forms, the biggest collection of legal types, which can be found on the Internet. Take advantage of the site`s simple and easy hassle-free lookup to get the files you want. Different themes for company and specific functions are categorized by categories and claims, or key phrases. Use US Legal Forms to get the Connecticut Letter Informing Debt Collector of Unfair Practices in Collection Activities - Collecting an Amount not Authorized by the Agreement Creating the Debt or by Law with a handful of mouse clicks.

If you are previously a US Legal Forms buyer, log in to the account and then click the Acquire option to find the Connecticut Letter Informing Debt Collector of Unfair Practices in Collection Activities - Collecting an Amount not Authorized by the Agreement Creating the Debt or by Law. You may also access types you in the past saved from the My Forms tab of the account.

If you work with US Legal Forms the first time, follow the instructions below:

- Step 1. Be sure you have chosen the form for the correct area/land.

- Step 2. Utilize the Review option to check out the form`s information. Never overlook to see the explanation.

- Step 3. If you are not happy with all the form, use the Look for discipline at the top of the display screen to locate other types from the legal form format.

- Step 4. Once you have found the form you want, select the Acquire now option. Opt for the prices strategy you choose and add your references to register on an account.

- Step 5. Approach the deal. You can use your Мisa or Ьastercard or PayPal account to perform the deal.

- Step 6. Select the structure from the legal form and obtain it in your gadget.

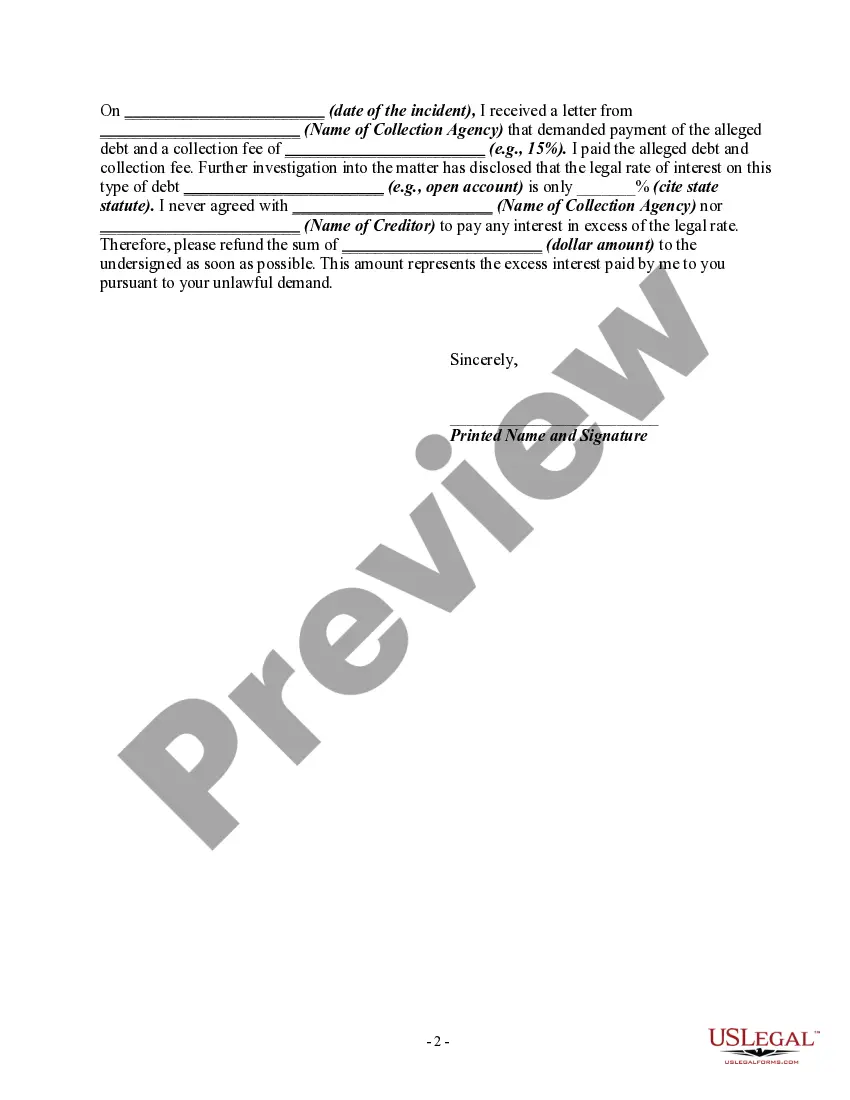

- Step 7. Complete, edit and produce or indicator the Connecticut Letter Informing Debt Collector of Unfair Practices in Collection Activities - Collecting an Amount not Authorized by the Agreement Creating the Debt or by Law.

Every single legal document format you purchase is your own property permanently. You possess acces to each form you saved with your acccount. Click on the My Forms portion and pick a form to produce or obtain yet again.

Remain competitive and obtain, and produce the Connecticut Letter Informing Debt Collector of Unfair Practices in Collection Activities - Collecting an Amount not Authorized by the Agreement Creating the Debt or by Law with US Legal Forms. There are many specialist and state-specific types you can use for the company or specific needs.