Connecticut Private placement of Common Stock

Description

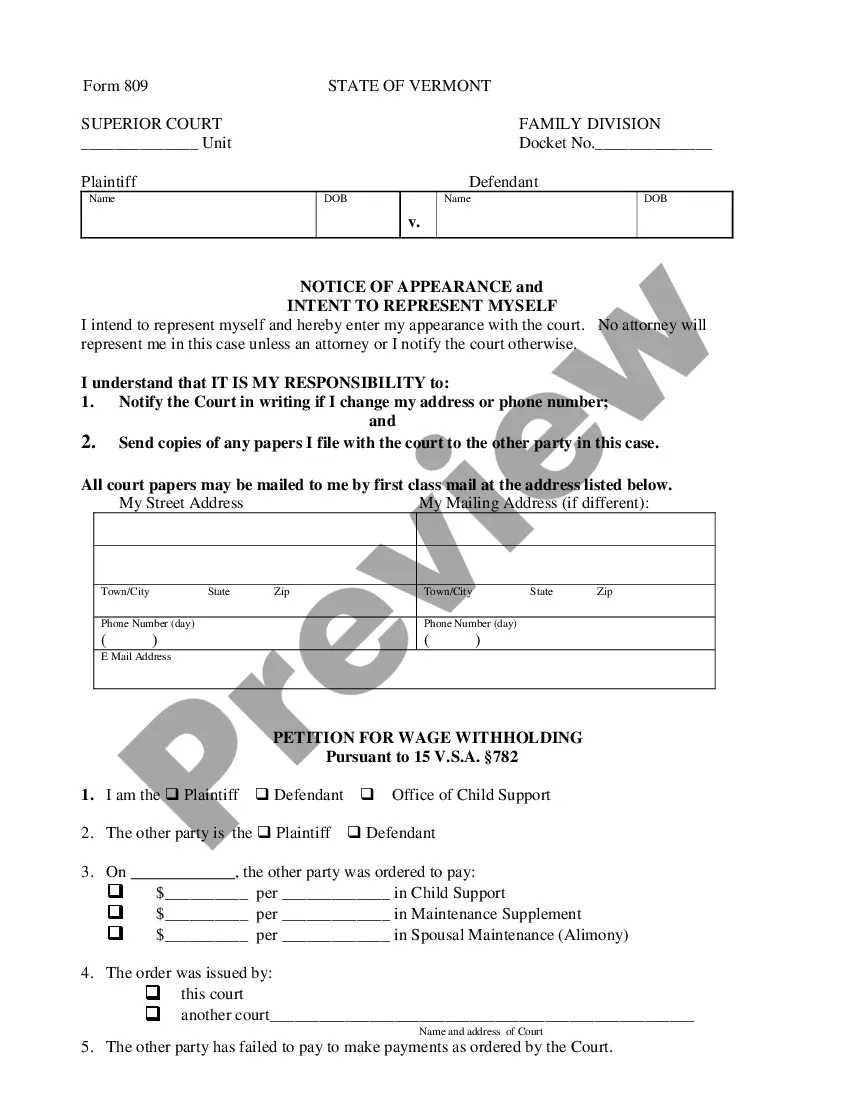

How to fill out Private Placement Of Common Stock?

Discovering the right authorized file template can be quite a have difficulties. Obviously, there are plenty of layouts accessible on the Internet, but how would you find the authorized develop you require? Make use of the US Legal Forms web site. The support offers 1000s of layouts, including the Connecticut Private placement of Common Stock, that can be used for business and personal requires. Each of the varieties are checked out by pros and meet federal and state requirements.

If you are presently authorized, log in to the bank account and click the Down load switch to get the Connecticut Private placement of Common Stock. Use your bank account to appear from the authorized varieties you may have bought in the past. Check out the My Forms tab of your own bank account and get another copy of the file you require.

If you are a whole new consumer of US Legal Forms, allow me to share basic recommendations for you to comply with:

- Very first, be sure you have selected the appropriate develop for the city/region. You may check out the shape utilizing the Preview switch and read the shape outline to make sure this is the right one for you.

- In case the develop fails to meet your preferences, take advantage of the Seach industry to get the right develop.

- Once you are sure that the shape is acceptable, go through the Buy now switch to get the develop.

- Choose the rates plan you want and enter the necessary information. Build your bank account and pay money for your order utilizing your PayPal bank account or charge card.

- Opt for the document structure and down load the authorized file template to the device.

- Total, change and print and indication the acquired Connecticut Private placement of Common Stock.

US Legal Forms is definitely the most significant catalogue of authorized varieties that you can see numerous file layouts. Make use of the company to down load expertly-produced paperwork that comply with status requirements.

Form popularity

FAQ

The Rule 3a4-1 Safe Harbor The associated person must not be compensated in connection with the sale of the issuer's securities by the payment of commissions or other remuneration based either directly or indirectly on transactions in securities.

Most "brokers" and "dealers" must register with the SEC and join a "self-regulatory organization," or SRO. This section covers the factors that determine whether a person is a broker or dealer. It also describes the types of brokers and dealers that do not have to register with the SEC.

An issuer is a business organization, such as a corporation, partnership or limited liability company that offers or sells its own securities to investors.

Code Section 25200 is specifically related to broker-dealers and provides an exemption from the licensure requirement to any broker-dealer that (1) is registered with the Securities and Exchange Commission (?SEC?), (2) has not previously had any certificate denied or revoked by the Commissioner of Financial Protection ...

Section 4(a)(2) of the Securities Act (formerly Section 4(2) but redesignated Section 4(a)(2) by the JOBS Act) provides an exemption from the provisions of Section 5 of the Securities Act for "transactions by an issuer not involving any public offering." Companies rely on this private placement exemption for a wide ...

An issuer agent is any third party that works on behalf of an issuer as part of a corporate action, legislative requirement or information request, that has the authority to interact with investors to help successfully execute the transaction.