Connecticut Profit Sharing Plan

Description

How to fill out Profit Sharing Plan?

US Legal Forms - one of the largest libraries of authorized types in the USA - provides an array of authorized document web templates it is possible to download or produce. Making use of the website, you can get a large number of types for enterprise and person functions, categorized by types, states, or key phrases.You can get the newest variations of types like the Connecticut Profit Sharing Plan within minutes.

If you have a registration, log in and download Connecticut Profit Sharing Plan from your US Legal Forms collection. The Acquire key will show up on every develop you perspective. You have access to all formerly saved types from the My Forms tab of your accounts.

In order to use US Legal Forms for the first time, listed here are simple instructions to help you get started out:

- Be sure to have chosen the proper develop for your personal city/state. Go through the Review key to check the form`s content. See the develop description to actually have selected the appropriate develop.

- When the develop doesn`t match your specifications, take advantage of the Lookup field near the top of the display to obtain the the one that does.

- Should you be satisfied with the shape, validate your decision by clicking the Buy now key. Then, pick the pricing plan you want and offer your accreditations to sign up for an accounts.

- Method the financial transaction. Use your Visa or Mastercard or PayPal accounts to finish the financial transaction.

- Pick the formatting and download the shape on your device.

- Make changes. Fill up, edit and produce and indication the saved Connecticut Profit Sharing Plan.

Each and every format you put into your account lacks an expiry date and is also your own property permanently. So, if you would like download or produce another backup, just visit the My Forms portion and click on the develop you require.

Obtain access to the Connecticut Profit Sharing Plan with US Legal Forms, probably the most comprehensive collection of authorized document web templates. Use a large number of expert and express-certain web templates that satisfy your organization or person requires and specifications.

Form popularity

FAQ

1. Profit-sharing plans can create a sense of entitlement among employees. If employees feel like they are entitled to a share of the company's profits, then they may be less likely to work hard when times are tough. This could lead to lower profits and less money for everyone involved.

Profit sharing helps create a culture of ownership. As owners, employees have more incentive to increase the company's profitability. However, this strategy will work only if the company and its management create ways for employees to understand the company's challenges and contribute to the solutions.

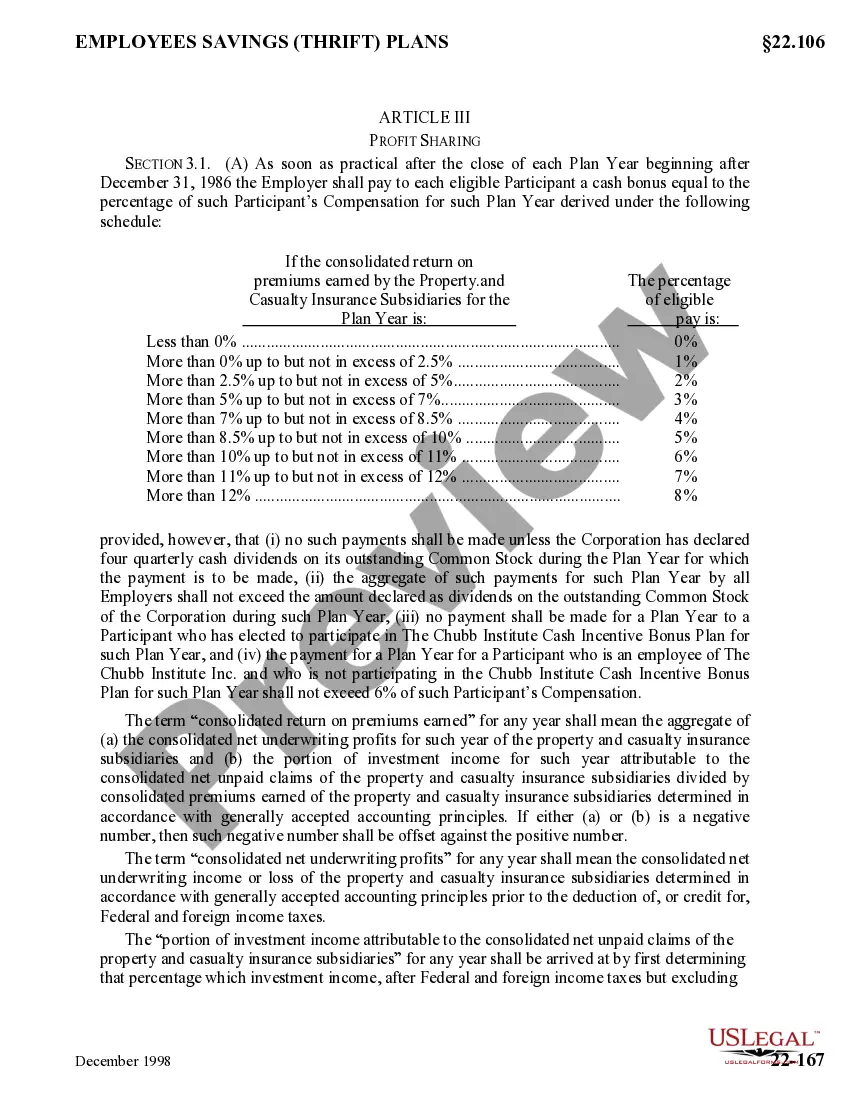

sharing plan is a retirement plan that allows an employer or company owner to share the profits in the business, up to 25 percent of the company's payroll, with the firm's employees.

Profit sharing may increase compensation risks for employees by making earnings more variable. Profit sharing may incur high administrative costs. There is a negative link between unionization and profit sharing as most unions oppose such organizational incentive programs.

The State of Connecticut 457 plan is a voluntary, deferred compensation plan open to all State employees. The 457 plan gives employees the opportunity to save for retirement, supplementing their mandatory retirement plan. The 457 is a tax-advantaged plan.

Employee benefits in a profit-sharing plan are subject to IRS rules designed to discourage early withdrawal. As with a 401(k), employees who take distributions from their profit-sharing plan's retirement account before age 59.5 will face a 10% penalty. Withdrawals will be taxed as income.

Profit sharing helps create a culture of ownership. As owners, employees have more incentive to increase the company's profitability. However, this strategy will work only if the company and its management create ways for employees to understand the company's challenges and contribute to the solutions.