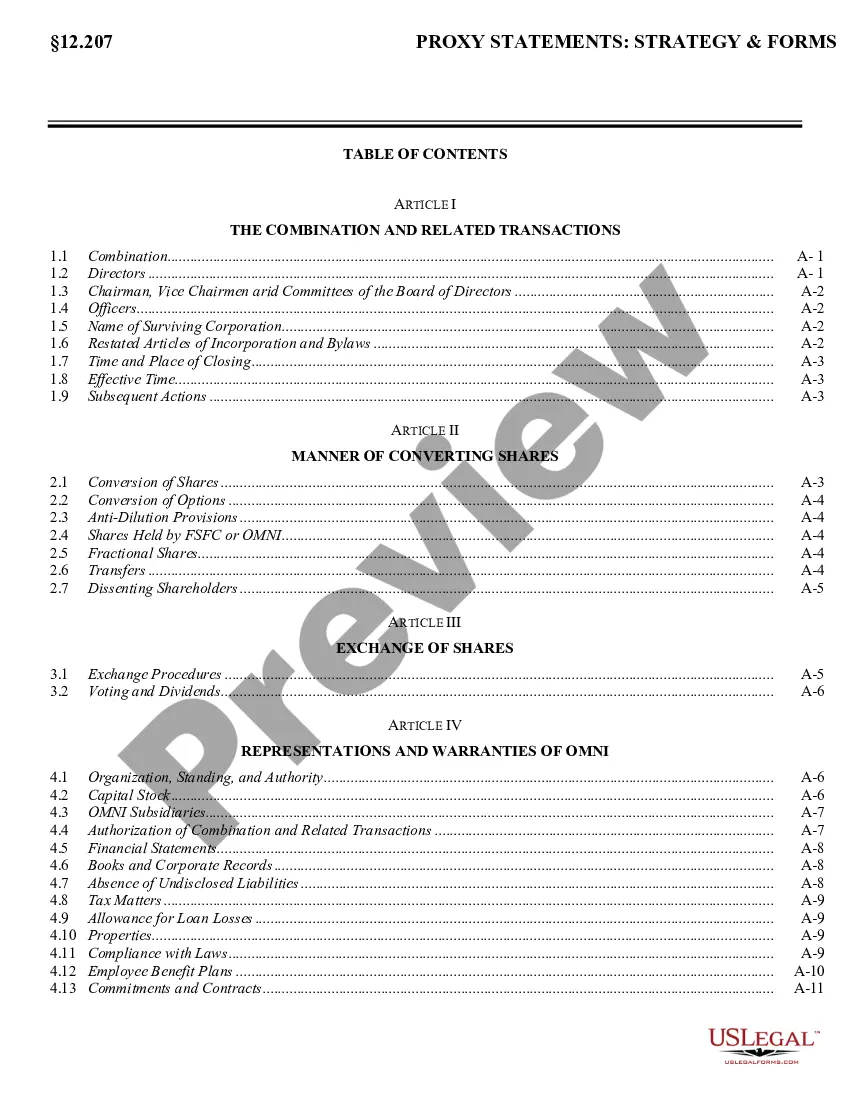

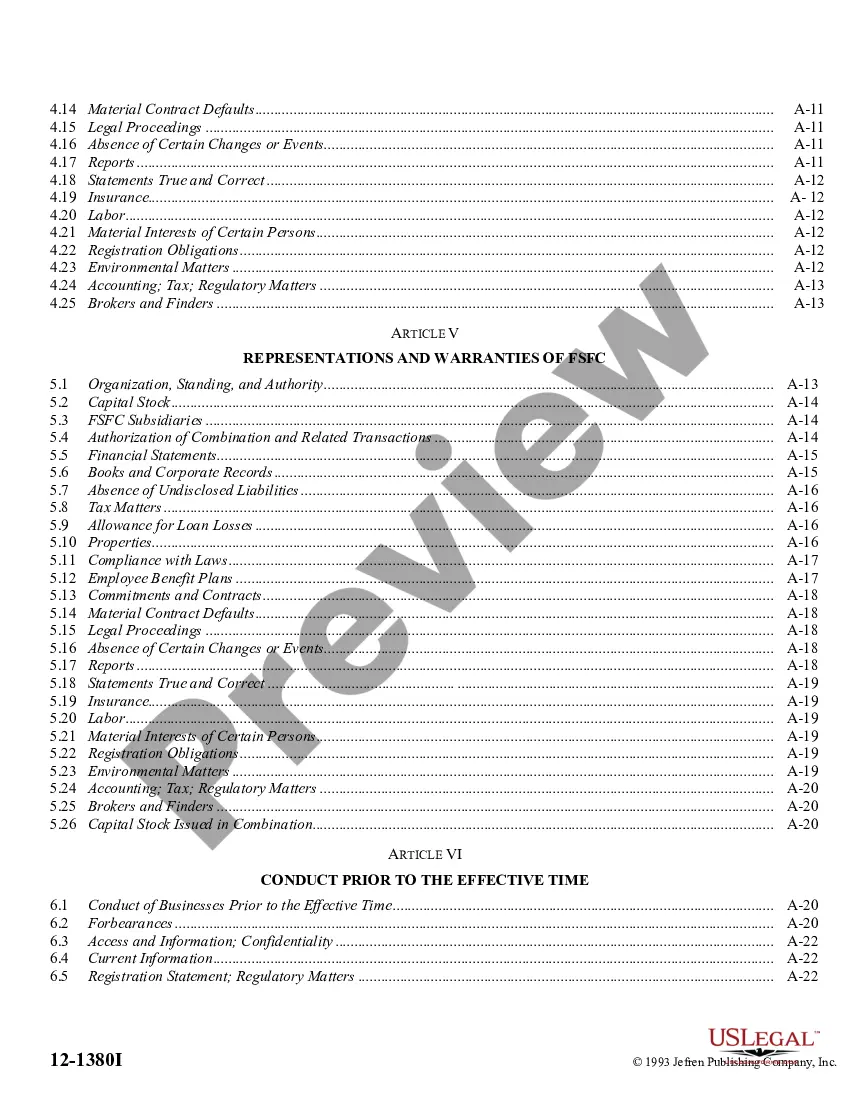

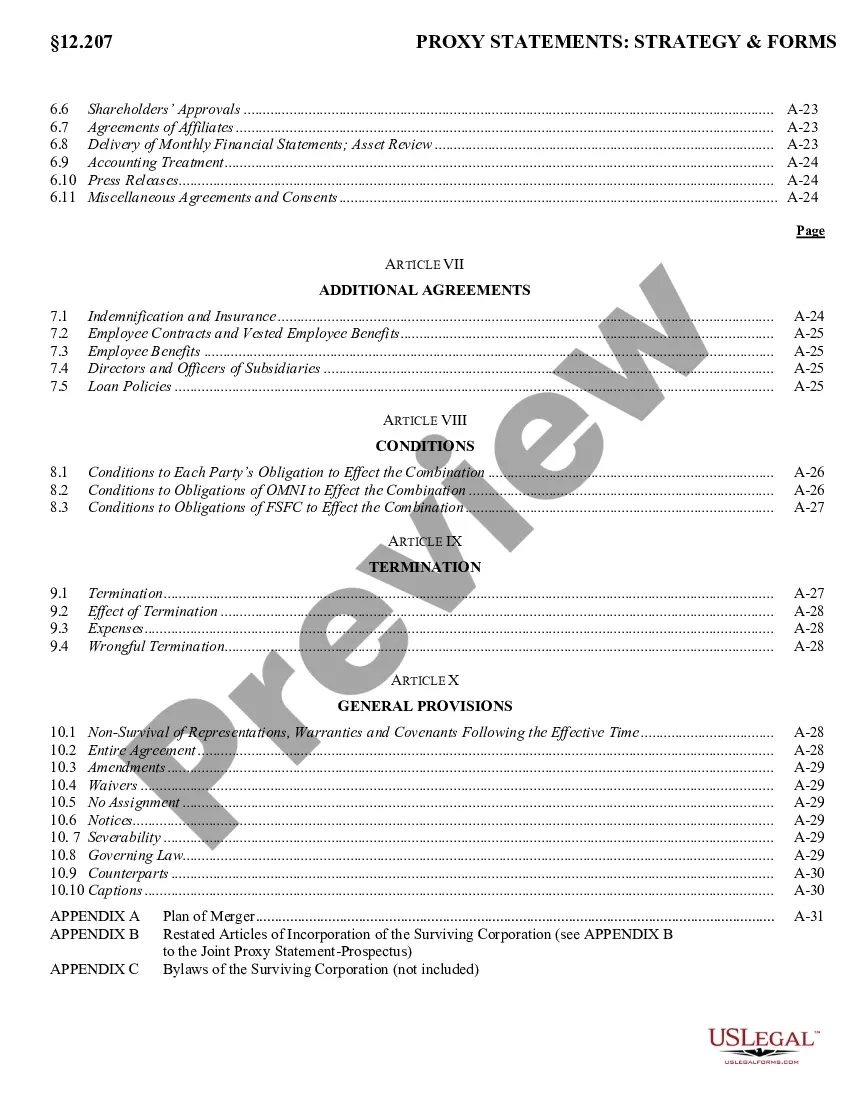

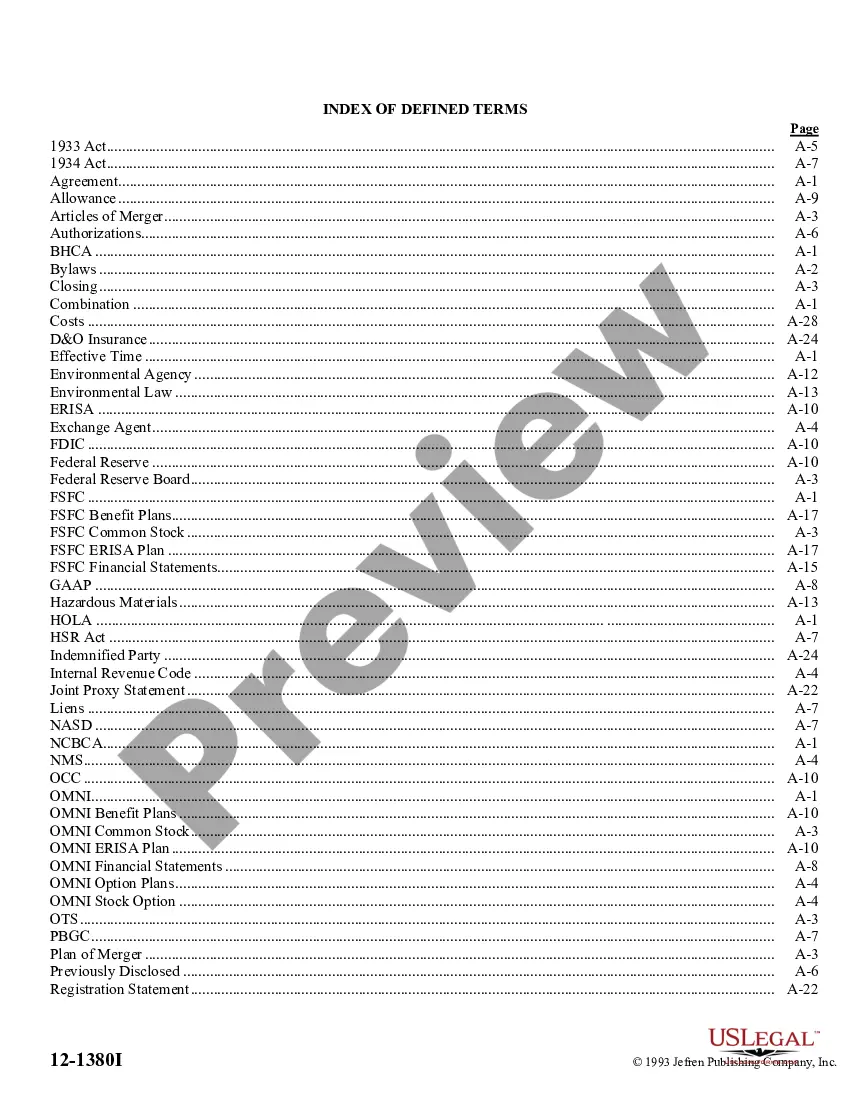

Connecticut Agreement of Combination

Description

How to fill out Agreement Of Combination?

If you want to complete, down load, or produce legitimate papers templates, use US Legal Forms, the biggest assortment of legitimate kinds, that can be found on the Internet. Take advantage of the site`s simple and handy lookup to discover the papers you will need. Various templates for business and individual reasons are categorized by classes and states, or keywords and phrases. Use US Legal Forms to discover the Connecticut Agreement of Combination with a couple of mouse clicks.

In case you are already a US Legal Forms consumer, log in in your bank account and click on the Acquire switch to find the Connecticut Agreement of Combination. Also you can entry kinds you previously downloaded within the My Forms tab of the bank account.

If you are using US Legal Forms initially, refer to the instructions listed below:

- Step 1. Ensure you have chosen the form for the correct town/land.

- Step 2. Use the Review option to look through the form`s information. Don`t overlook to see the description.

- Step 3. In case you are not satisfied with the type, take advantage of the Look for industry at the top of the display screen to discover other models of the legitimate type web template.

- Step 4. After you have found the form you will need, select the Buy now switch. Pick the pricing strategy you choose and put your qualifications to register for an bank account.

- Step 5. Approach the transaction. You should use your bank card or PayPal bank account to accomplish the transaction.

- Step 6. Select the file format of the legitimate type and down load it on your own gadget.

- Step 7. Complete, modify and produce or sign the Connecticut Agreement of Combination.

Each and every legitimate papers web template you get is the one you have for a long time. You may have acces to every single type you downloaded within your acccount. Click on the My Forms section and pick a type to produce or down load once more.

Contend and down load, and produce the Connecticut Agreement of Combination with US Legal Forms. There are thousands of skilled and express-particular kinds you can utilize for the business or individual needs.

Form popularity

FAQ

If federal Form 7004 was not filed, the corporation may apply for an extension to file the Connecticut Corporation Business Tax return if there is reasonable cause for the request. Pay the amount shown on Line 15. Form CT-1120 EXT extends only the time to file the Connecticut Corporation Business Tax return. Form CT-1120 EXT Instructions zillionforms.com ? ... zillionforms.com ? ...

If the Corporation files a federal extension, the entity must still electronically file the CT-1120 EXT. If the Corporation does not file a federal extension it can still file Form CT-1120 EXT, but the Corporation must provide reasonable cause for requesting the extension.

Every corporation must file a return on or before the fifteenth day of the month following the due date of the corporation's corresponding federal income tax return for the income year (May 15 for calendar year taxpayers). For example, if a corporation has a December 31st year end, the return is due on May 15th. Who is required to file a Connecticut Corporation Business Tax Return? ct.gov ? Corporation-Tax ? Corp-FAQs ct.gov ? Corporation-Tax ? Corp-FAQs

Connecticut Tax Extension Tip: If you have a valid Federal tax extension (IRS Form 4868) and you owe zero Connecticut income tax, you will automatically receive a Connecticut tax extension. In this case, you do not need to file a separate Connecticut request.