Connecticut Disclosure of Compensation of Non-Attorney Bankruptcy Petition Preparer - For 2005 Act

Description

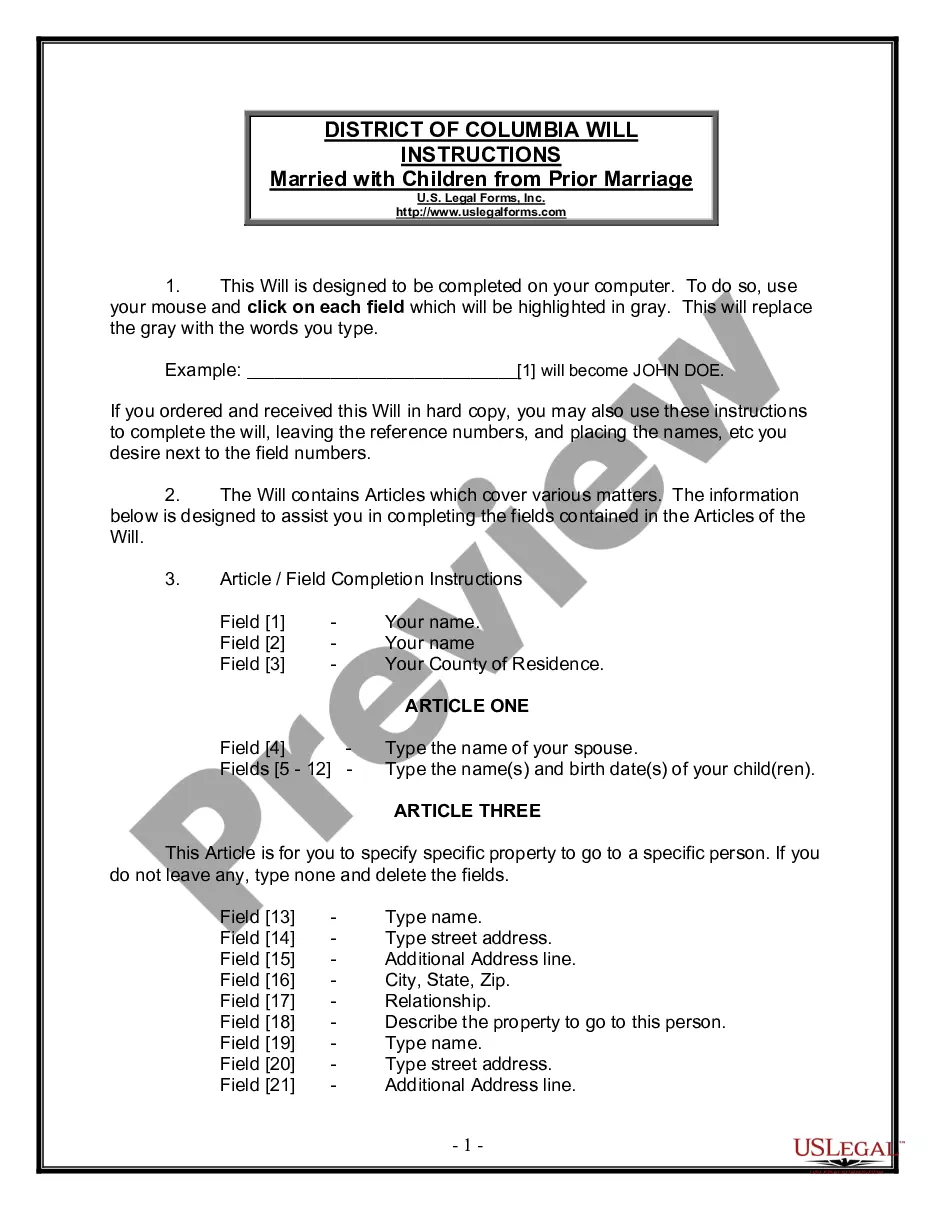

How to fill out Disclosure Of Compensation Of Non-Attorney Bankruptcy Petition Preparer - For 2005 Act?

If you wish to full, acquire, or print legal file templates, use US Legal Forms, the most important selection of legal varieties, that can be found on the web. Take advantage of the site`s easy and convenient search to discover the documents you require. Numerous templates for business and specific purposes are sorted by categories and claims, or search phrases. Use US Legal Forms to discover the Connecticut Disclosure of Compensation of Non-Attorney Bankruptcy Petition Preparer - For 2005 Act in just a number of clicks.

In case you are already a US Legal Forms customer, log in to your profile and then click the Down load switch to have the Connecticut Disclosure of Compensation of Non-Attorney Bankruptcy Petition Preparer - For 2005 Act. Also you can access varieties you earlier delivered electronically inside the My Forms tab of your own profile.

Should you use US Legal Forms the very first time, refer to the instructions beneath:

- Step 1. Ensure you have chosen the shape for that proper area/nation.

- Step 2. Make use of the Review solution to check out the form`s information. Never neglect to read the description.

- Step 3. In case you are not happy with all the type, make use of the Search field on top of the monitor to find other versions of the legal type web template.

- Step 4. After you have discovered the shape you require, select the Get now switch. Pick the rates prepare you choose and put your credentials to sign up for the profile.

- Step 5. Process the purchase. You can use your credit card or PayPal profile to finish the purchase.

- Step 6. Pick the format of the legal type and acquire it on the product.

- Step 7. Full, change and print or indicator the Connecticut Disclosure of Compensation of Non-Attorney Bankruptcy Petition Preparer - For 2005 Act.

Each legal file web template you acquire is yours eternally. You might have acces to every single type you delivered electronically with your acccount. Select the My Forms section and decide on a type to print or acquire once again.

Remain competitive and acquire, and print the Connecticut Disclosure of Compensation of Non-Attorney Bankruptcy Petition Preparer - For 2005 Act with US Legal Forms. There are thousands of skilled and condition-specific varieties you may use to your business or specific requires.

Form popularity

FAQ

The undeniable upside to filing for Chapter 7 bankruptcy is the debt relief it provides. It has the power to lift a major burden off your shoulders in just a few months. Most unsecured debt can be discharged, including credit cards, medical bills, and personal loans.

Chapter 7 bankruptcy allows liquidation of assets to pay creditors. Unsecured priority debt is paid first in a Chapter 7, after which comes secured debt and then nonpriority unsecured debt. Filing Chapter 7 typically involves completing forms and a review of assets by the trustee.

Background. A chapter 7 bankruptcy case does not involve the filing of a plan of repayment as in chapter 13. Instead, the bankruptcy trustee gathers and sells the debtor's nonexempt assets and uses the proceeds of such assets to pay holders of claims (creditors) in ance with the provisions of the Bankruptcy Code. Chapter 7 - Bankruptcy Basics | United States Courts uscourts.gov ? services-forms ? chapter-7-b... uscourts.gov ? services-forms ? chapter-7-b...

A bankruptcy will stay on your credit reports for up to 10 years. This may make it difficult to get new credit, but your scores could start rebounding sooner than you think. Editorial Note: Intuit Credit Karma receives compensation from third-party advertisers, but that doesn't affect our editors' opinions.

If your total monthly income over the course of the next 60 months is less than $7,475 then you pass the means test and you may file a Chapter 7 bankruptcy. If it is over $12,475 then you fail the means test and don't have the option of filing Chapter 7. Chapter 7? - Connecticut Bankruptcy Means Test connecticutbankruptcylaw.com ? means-test connecticutbankruptcylaw.com ? means-test

$335 Chapter 7 bankruptcy ? Filing fee: $335. Attorney fees: Between $1,000 and $2,500 in most consumer bankruptcy cases. Chapter 13 bankruptcy ? Filing fee: $310. Attorney fees: Between $1,500 and $3,000 in most cases. Connecticut Bankruptcy FAQs | Chapter 7 & Chapter 13 Lawyer ... ambrogiopletter.com ? practice-areas ? bank... ambrogiopletter.com ? practice-areas ? bank...

Chapter 7 bankruptcy is a type of bankruptcy filing commonly referred to as liquidation because it involves selling the debtor's assets in bankruptcy. Assets, like real estate, vehicles, and business-related property, are included in a Chapter 7 filing.