Connecticut Employee Evaluation Form for Farmer

Description

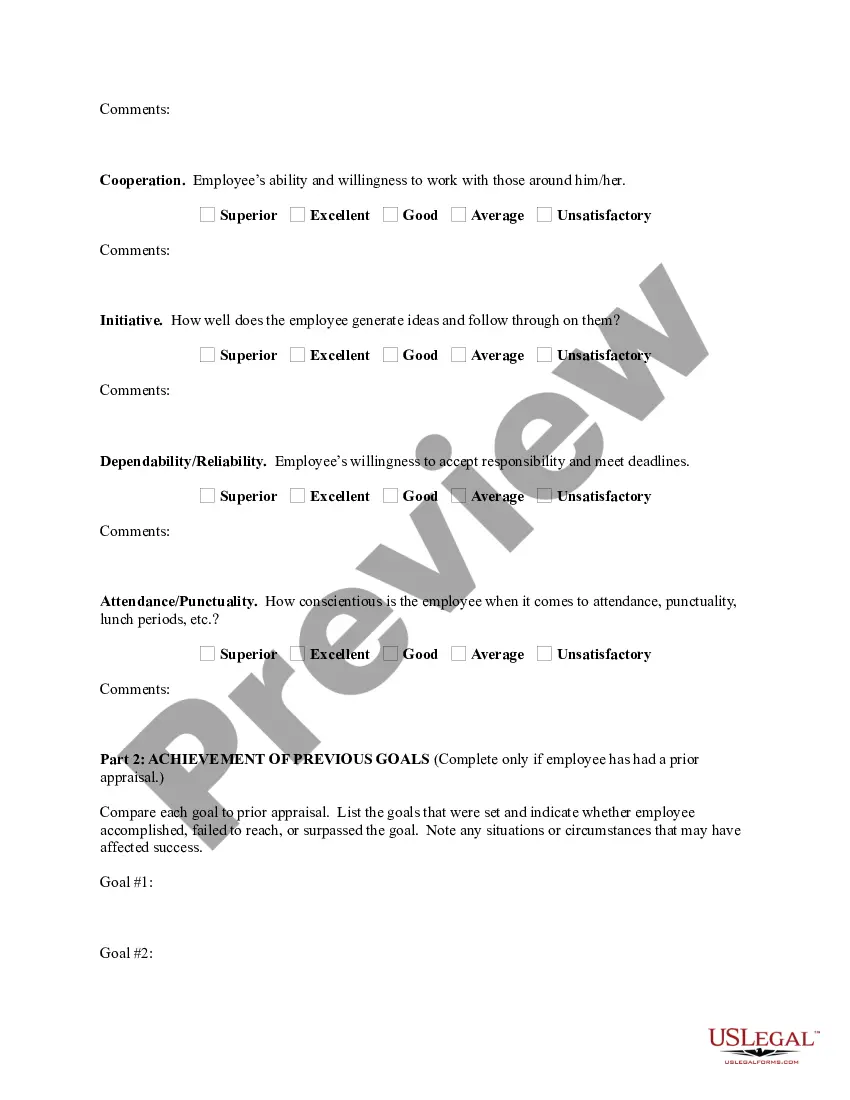

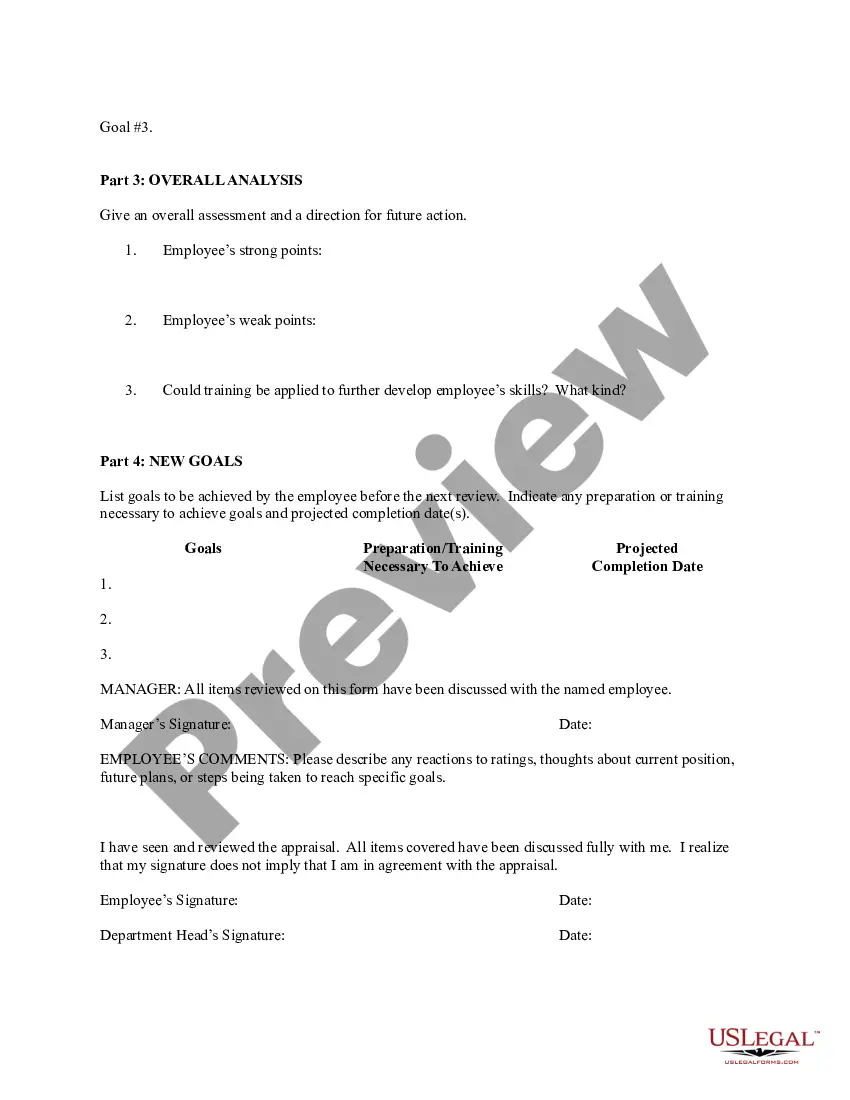

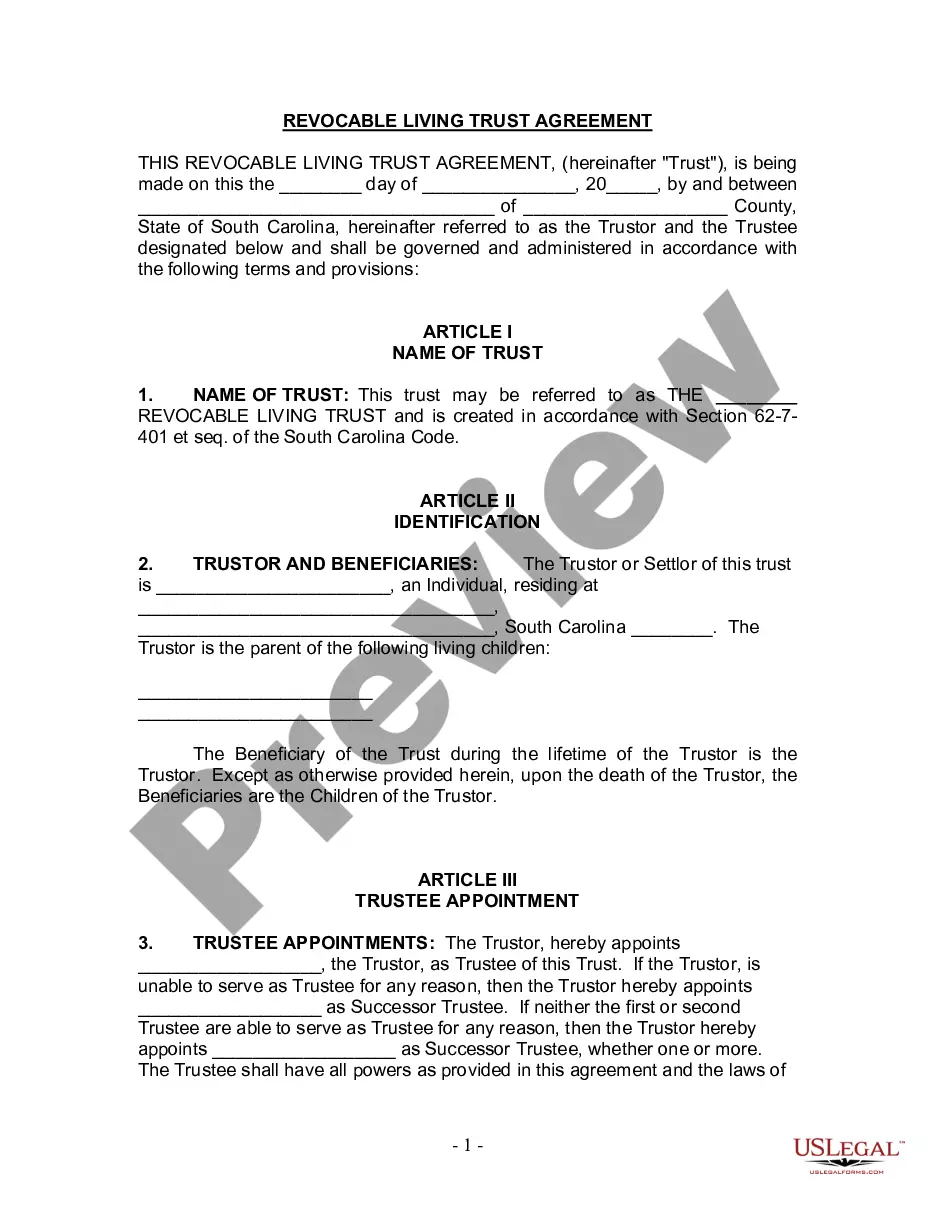

How to fill out Employee Evaluation Form For Farmer?

US Legal Forms - one of the most significant repositories of legal templates in the United States - offers a vast array of legal document formats that you can download or create.

By utilizing the website, you will find thousands of documents for business and personal purposes, organized by categories, states, or keywords. You can access the latest document types like the Connecticut Employee Evaluation Form for Farmer in just moments.

If you are already registered, Log In and download the Connecticut Employee Evaluation Form for Farmer from your US Legal Forms collection. The Download button will be visible on every document you review. You can access all previously downloaded documents from the My documents section of your account.

Process the transaction. Use your credit card or PayPal account to complete the transaction.

Select the format and download the document to your device. Edit. Fill out, modify, print, and sign the downloaded Connecticut Employee Evaluation Form for Farmer. Every template you add to your account has no expiration date and is yours permanently. So, if you want to download or print another copy, just visit the My documents section and click on the document you need. Access the Connecticut Employee Evaluation Form for Farmer with US Legal Forms, the largest repository of legal document templates. Utilize thousands of professionally created and state-specific templates that satisfy your business or personal needs and requirements.

- If you are utilizing US Legal Forms for the first time, here are simple steps to help you get started.

- Ensure you have selected the correct document for your city/state.

- Click on the Preview button to review the document's details.

- Read the document summary to confirm that you have chosen the right template.

- If the document does not meet your requirements, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the document, confirm your selection by clicking the Buy now button.

- Then, select your preferred payment plan and provide your credentials to register for an account.

Form popularity

FAQ

Under the program:An applicant for a farmland assessment must own the land and file an application with the municipal tax assessor.Land must be devoted to agricultural and/or horticultural uses for at least two years prior to the tax year the applicant is applying for an assessment.More items...?

To be eligible for Farmland Assessment, land actively devoted to an agricultural or horticultural use must have not less than 5 acres devoted to the production of crops; livestock or their products; and/or forest products under a woodland management plan.

So there are really two ways your farm business can be valued the market value, which is market price less taxes, and an intrinsic value based on the value of past and anticipated future cash flows. A guideline I use to determine the intrinsic value of a privately owned business is five to seven times past earnings.

To qualify for the tax assessment reduction, a landowner must have no less than five acres of farmland actively devoted to an agricultural or horticultural use for the two years immediately preceding the tax year being applied for and meet specific minimum gross income requirements based on the productivity of the land

--An agricultural assessment provides for a reduction in property taxes for land used in agricultural production. --The farmer must apply to the town assessor on an annual basis.

2022 Farm saved seed exception or exemption (also known as farmers' privilege) refers to the. optional exception permitted by the breeder's right in Article 15(2) of the 1991 Act of the. UPOV Convention which within reasonable limits and subject to the safeguarding of the.

Official definition of farms According to the United States Department of Agriculture, A farm is defined as any place from which $1,000 or more of agricultural products were produced and sold, or normally would have been sold, during the year.

Farmer or farming group must derive at least $15,000 in gross sales from farming or have at least $15,000 in expenses related to farming in the most recently completed tax year before the assessment year. The building must be actually and exclusively used in farming and cannot include the farmer's residence.

In order to qualify for the sales tax exemption, a farmer must first apply with the Department of Revenue Service (DRS) by filing Form REG 8 . The form must be forwarded to Taxpayer Services at DRS for review. The application is then either approved or denied.

What is an agricultural assessment? An agricultural assessment allows land utilized for agricultural purposes to be assessed based on its agricultural value as opposed to its commercial value. An agricultural assessment applies to school, country and town property taxes and is based on the soil types on the farm.