Connecticut Company Property Agreement

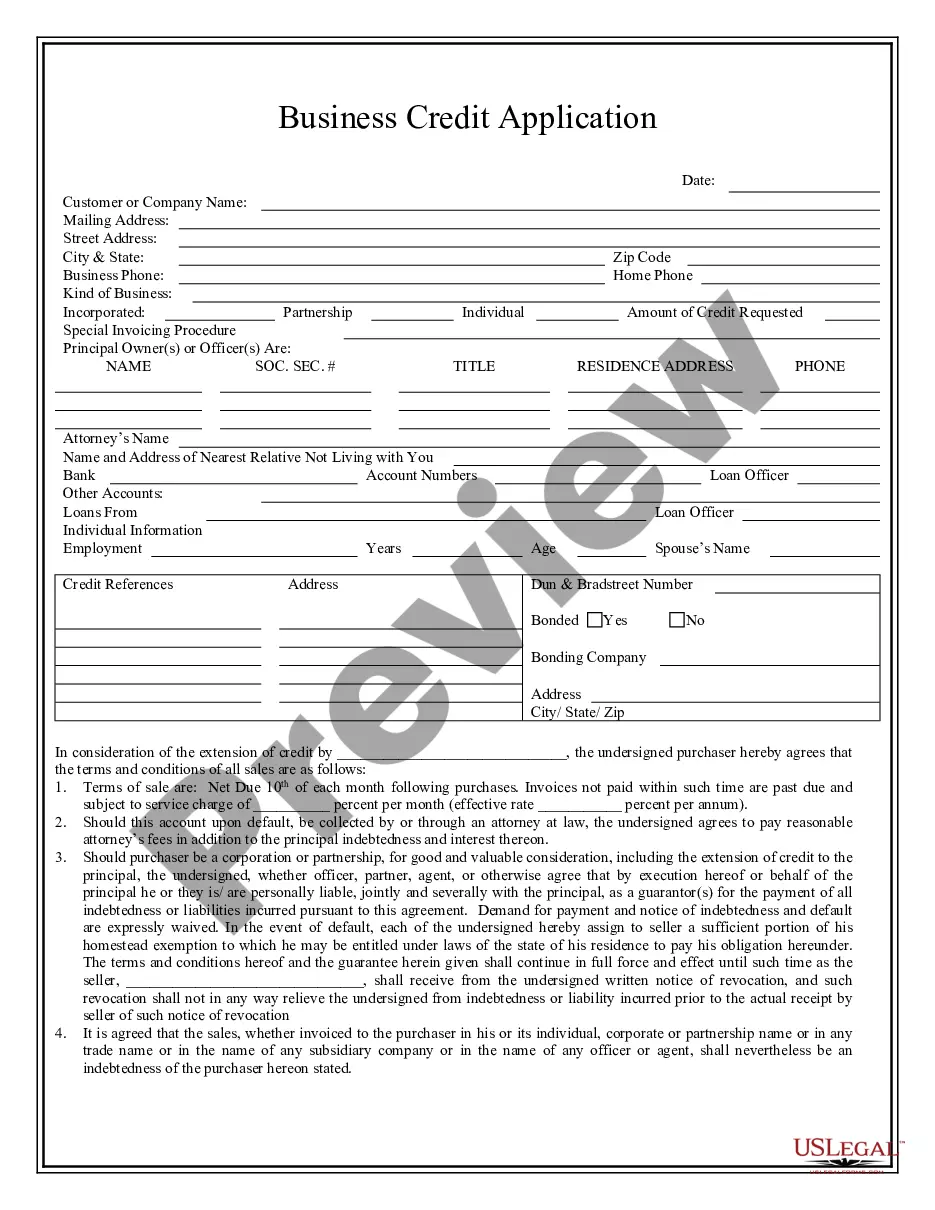

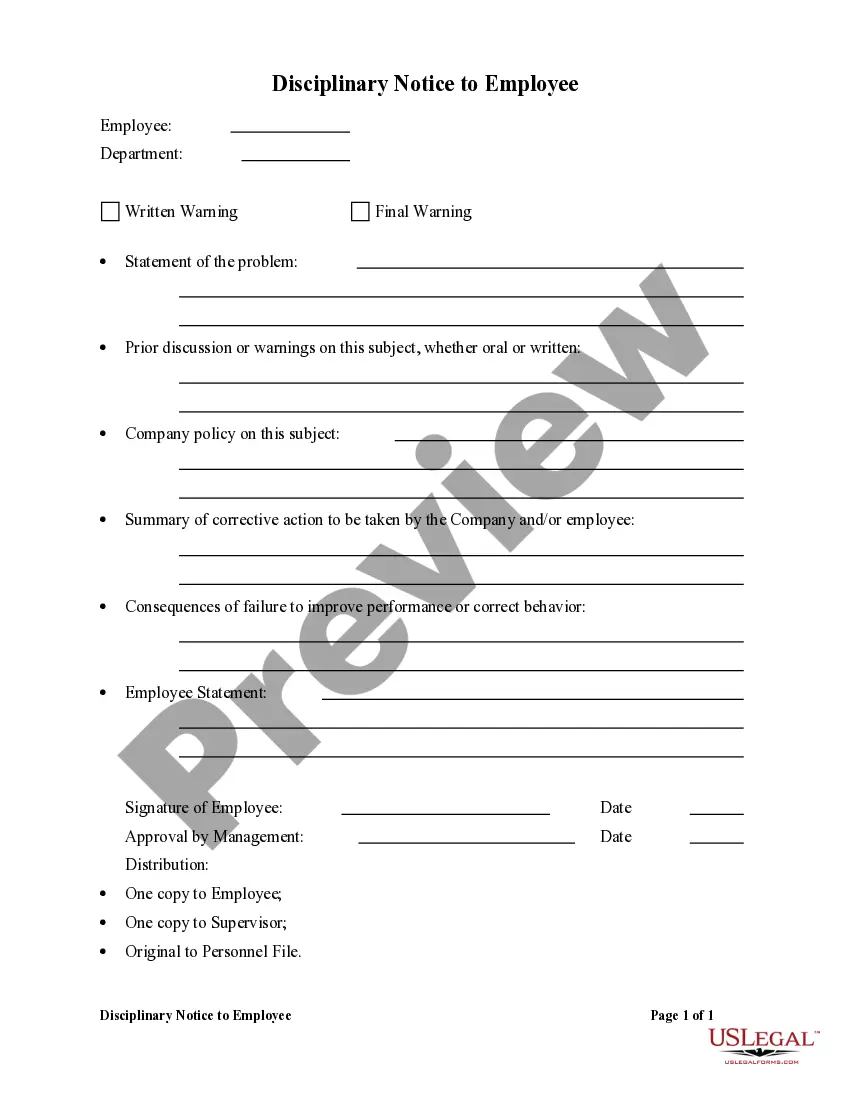

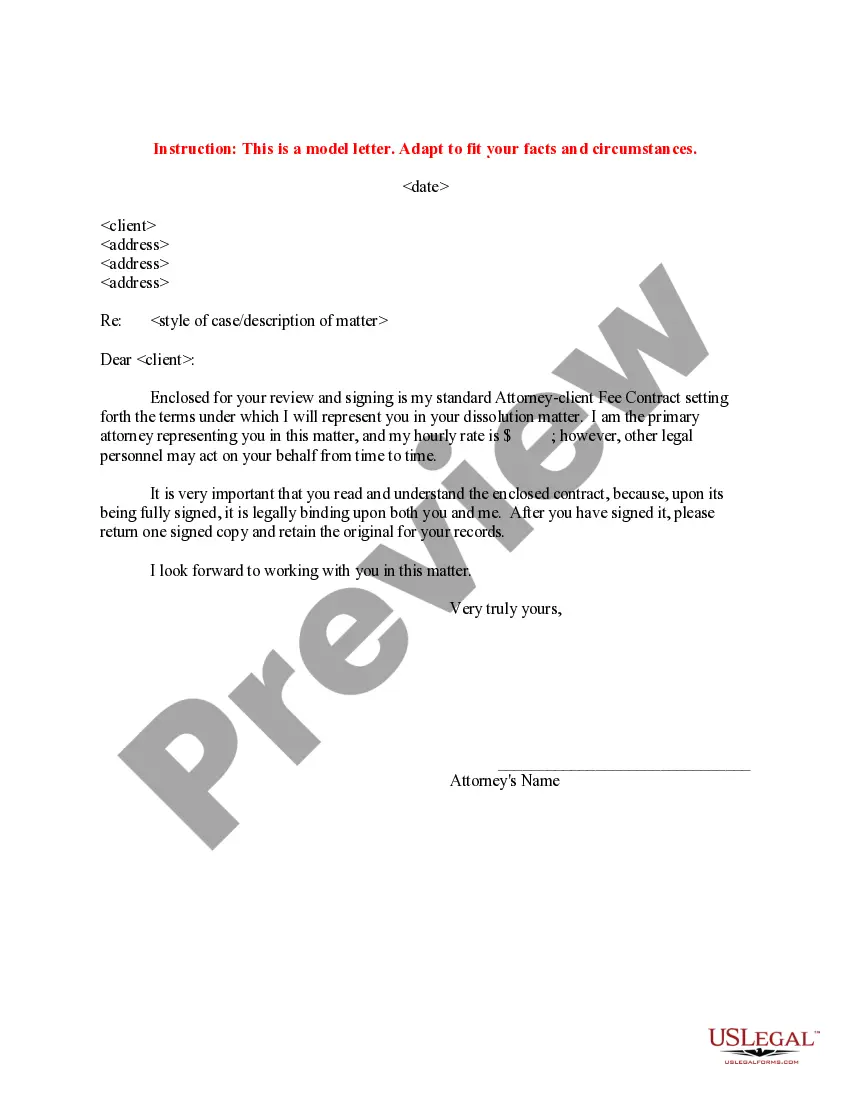

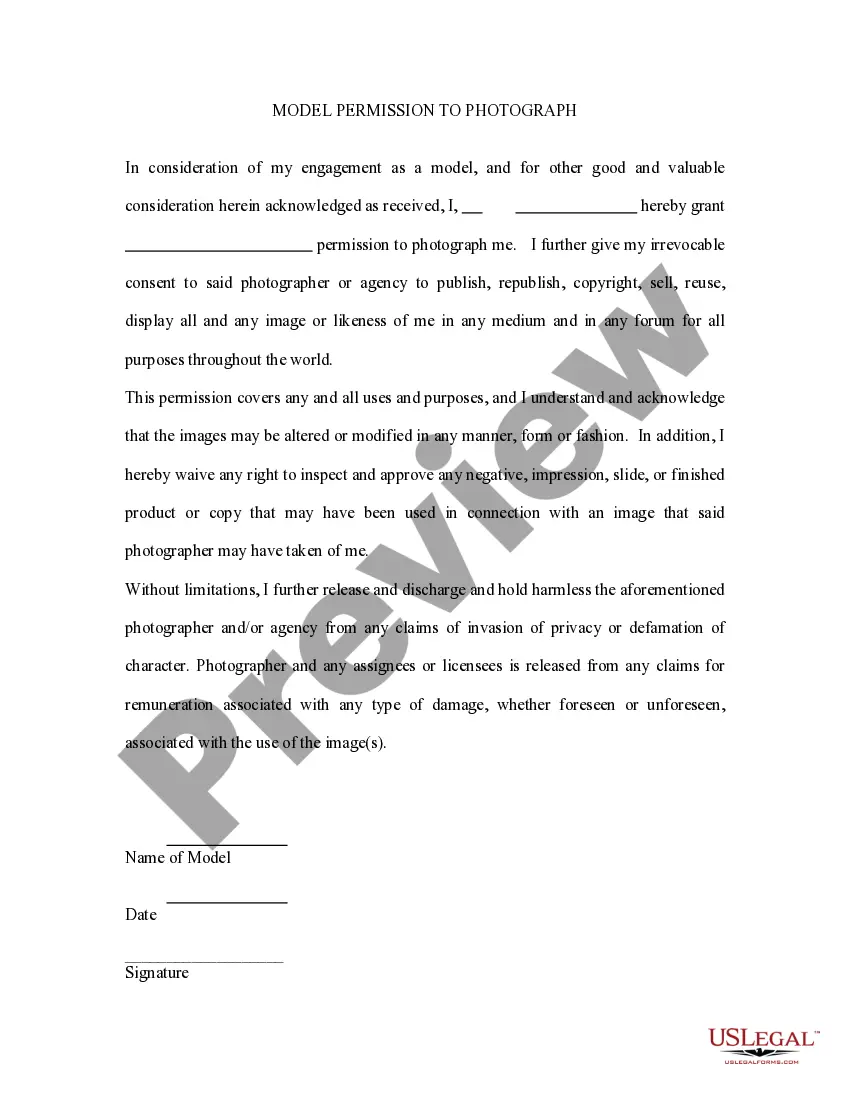

Description

How to fill out Company Property Agreement?

Selecting the most suitable legal document template could be a challenge.

Of course, there are numerous formats available online, but how can you find the legal form you require.

Utilize the US Legal Forms website. This service offers a vast array of templates, including the Connecticut Company Property Agreement, which can be utilized for both business and personal purposes.

First, ensure you have chosen the correct form for your specific community/region. You can preview the form using the Preview button and review the description to confirm it suits your needs.

- All of the forms are vetted by professionals and comply with state and federal regulations.

- If you're already registered, Log In to your account and click the Acquire button to obtain the Connecticut Company Property Agreement.

- Use your account to search among the legal forms you have purchased previously.

- Visit the My documents section of your account to obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are some easy steps to follow.

Form popularity

FAQ

Connecticut Department of Revenue ServicesRegister online.Allow approximately 10 business days to receive your Connecticut Tax Registration Number.If you need to speak with the Department of Revenue Services, call: 860-297-5962.

An LLC operating agreement is not required in Connecticut, but is highly advisable. This is an internal document that establishes how your LLC will be run. It sets out the rights and responsibilities of the members and managers, including how the LLC will be managed.

Articles of organization are part of a formal legal document used to establish a limited liability company (LLC) at the state level. The materials are used to create the rights, powers, duties, liabilities, and other obligations between each member of an LLC and also between the LLC and its members.

Corporation & Business Entity Search You can find information on any corporation or business entity in Connecticut or another state by performing a search on the Secretary of State website of the state or territory where that corporation is registered.

Contact your tax advisor or the taxpayer service center at the Department of Revenue Services as to any potential tax liability relating to your business. Taxpayer Service Center: (860) 297-5962 or .

Is an LLC Operating Agreement required in Connecticut? LLCs aren't legally required to file an Operating Agreement in Connecticut. Companies are advised to create an Operating Agreement, though. It establishes ownership in your company and outlines how the business will run.

PHONE: 860-509-6002.WEBSITE: : 860-509-6057.

Articles of organization form your Connecticut LLC. Preparing and filing your articles of organization is the first step in starting your limited liability company (LLC). Approval of this document secures your business name and creates the legal entity of the LLC.

An operating agreement is a key business document that shows your business operates like a legit company. Without the operating agreement, your state might not acknowledge you as an LLC, and which means someone could sue to go after you without there being any shield to protect your personal assets.

As a licensed professional in Connecticut you can structure your business as a Connecticut professional limited liability company (PLLC).