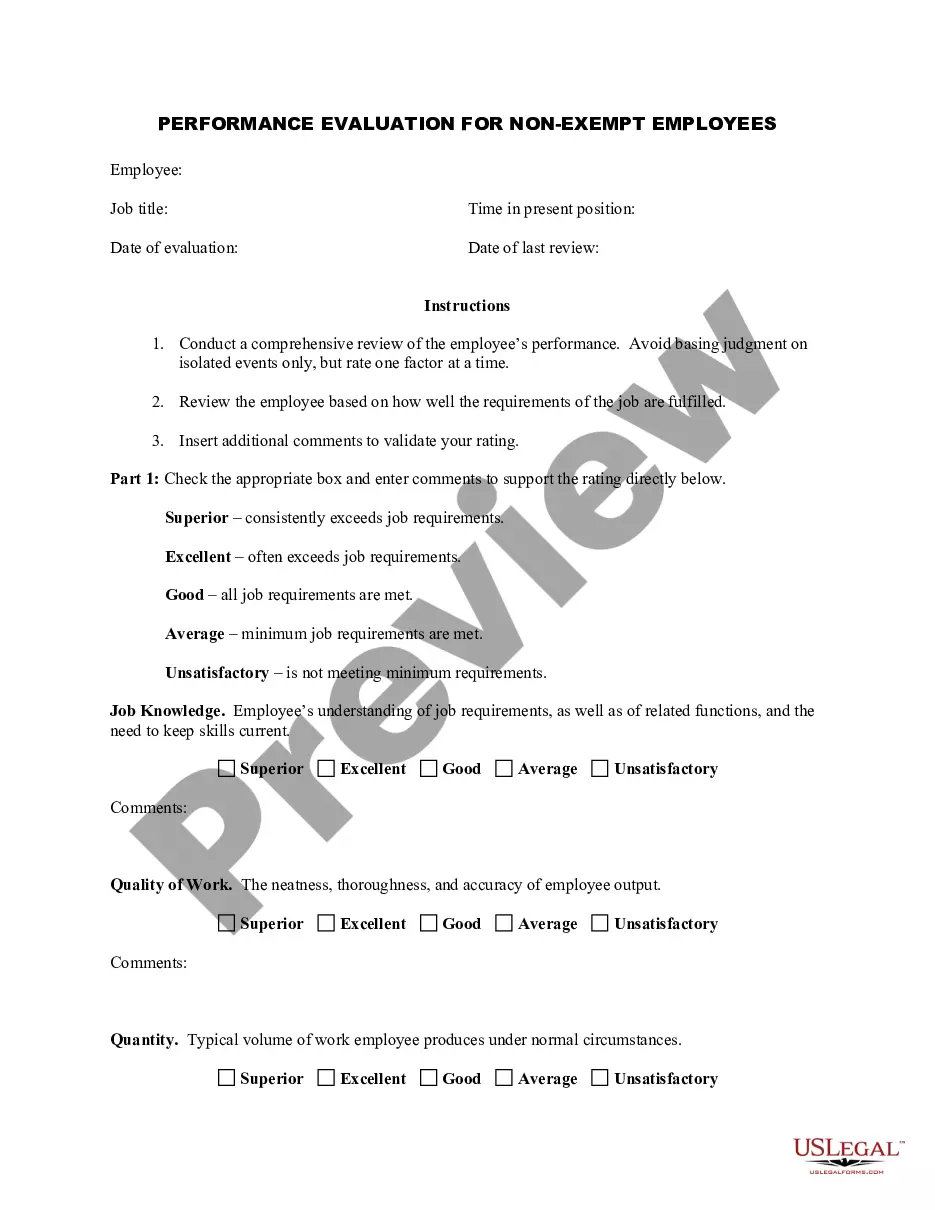

Connecticut Salaried Employee Appraisal Guidelines - General

Description

How to fill out Salaried Employee Appraisal Guidelines - General?

Finding the correct legitimate document format can be challenging.

Clearly, there are numerous templates accessible online, but how can you locate the right form you require.

Utilize the US Legal Forms website. The platform offers a vast selection of templates, such as the Connecticut Salaried Employee Appraisal Guidelines - General, suitable for both business and personal needs.

You can view the document using the Review option and examine the form details to confirm it is suitable for your needs. If the document does not meet your criteria, use the Search feature to find the appropriate form. Once you are confident the form is suitable, click on the Purchase now button to acquire the form. Select the pricing plan you wish to use and provide the required information. Create your account and fulfill your order using your PayPal account or a Visa or Mastercard. Choose the download format and retrieve the legal document for your device. Complete, modify, and print the Connecticut Salaried Employee Appraisal Guidelines - General, then sign it. US Legal Forms is the largest repository of legal documents where you can find numerous file templates. Use the service to obtain properly designed documents that adhere to state requirements.

- All forms are reviewed by experts and comply with state and federal regulations.

- If you are already registered, Log In to your account and click on the Download button to obtain the Connecticut Salaried Employee Appraisal Guidelines - General.

- Use your account to review the legal forms you've previously purchased.

- Navigate to the My documents section of your account to fetch another copy of the document you require.

- If you are a new user of US Legal Forms, here are some simple steps to follow.

- First, ensure you have selected the correct form for your locality.

Form popularity

FAQ

In Connecticut and Massachusetts, effective January 1, 2020: Exempt white-collar employees must be paid a guaranteed salary of at least $684 per workweek.

The FLSA includes these job categories as exempt: professional, administrative, executive, outside sales, and computer-related. The details vary by state, but if an employee falls in the above categories, is salaried, and earns a minimum of $684 per week or $35,568 annually, then they are considered exempt.

An employer is legally required to issue the pay or salary earned by an employee within the time period stated in their employment contract. An employer cannot hold back an earned paycheck.

In case of any discrepancy or non-payment of salary one can approach the labour commissioner to seek redressal. 3. Cases that come to the labour court must be decided upon within a three-month period. If the matter is not resolved by the labour commissioner the same can be pursued in a court of law by the employee.

1. Exempt Employees in Connecticut. Exempt employees are not subject to overtime law. For an employee to be classified as an exempt employee they must pass both the duties and the salary tests, under both Connecticut and Federal law.

Connecticut requires employers to pay nonexempt salaried employees overtime equal to 1 1/2 times their standard hourly wages after employees work more than 40 hours during a week. Employers do not have to pay employees overtime based on the numbers of hours they work each day.

Connecticut's Overtime PayEach employer shall pay 1-1/2 times the employee's regular rate of pay after 40 hours in the workweek. Overtime pay is due for actual hours worked over 40. No requirement to pay overtime on a daily basis, weekends, or holidays except by agreement.

It does not prohibit the employer from asking for your salary requirements. It does, however, allow you to put the employer on the spot, and will help save the time wasted interviewing for a position that does not pay well.

Exempt Employees in Connecticut For an employee to be classified as an exempt employee they must pass both the duties and the salary tests, under both Connecticut and Federal law. Duties Test - Under the Duties Test, the employee's primary duty must require that they act with discretion and independent judgment.

The Connecticut law, H.B. 6380(Opens in a new window), prohibits employers from asking prospective employees about their previous wages unless the individual has voluntarily disclosed such information.