Connecticut Separation Notice for 1099 Employee

Description

How to fill out Separation Notice For 1099 Employee?

Selecting the finest sanctioned document template can be challenging.

Naturally, there is a multitude of designs available online, but how can you find the sanctioned form you require.

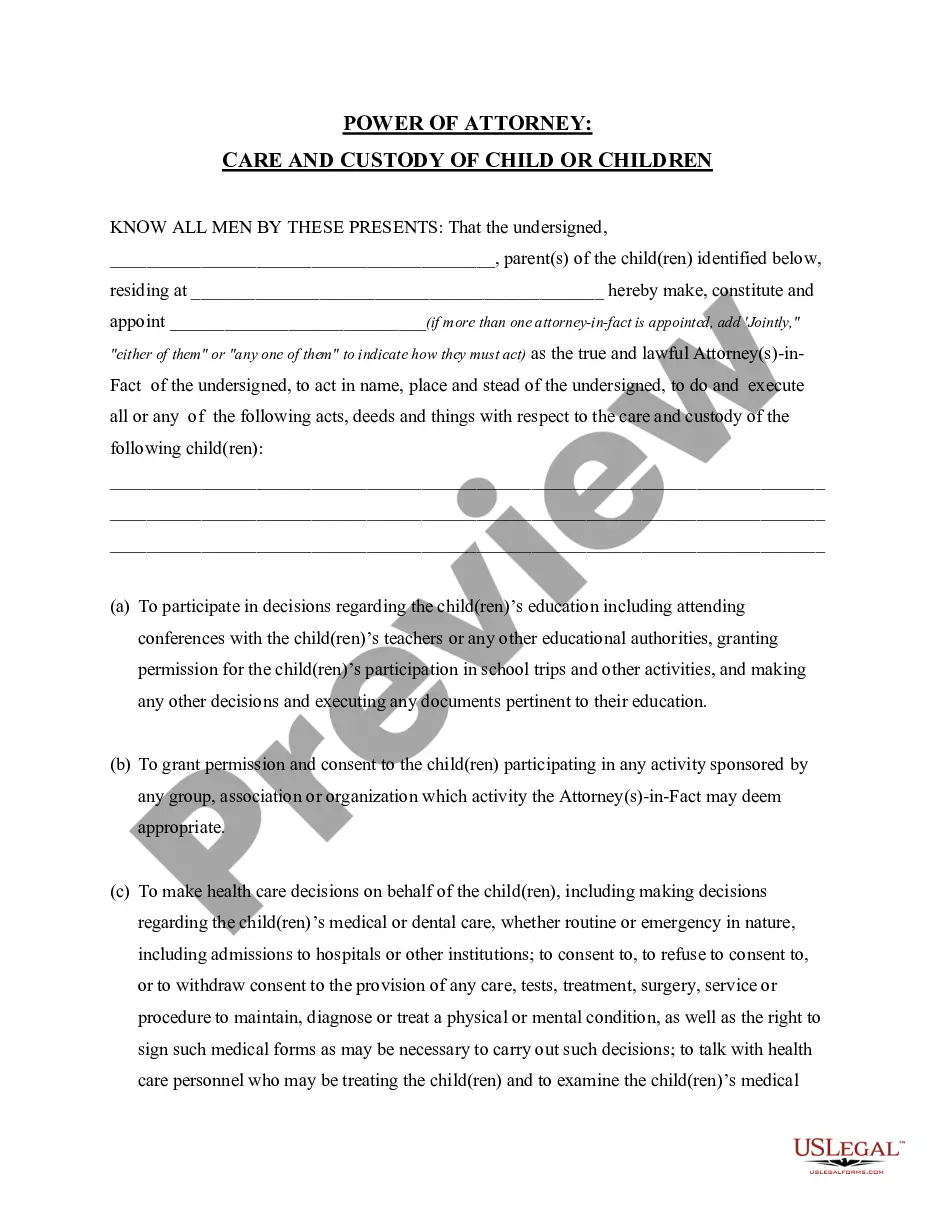

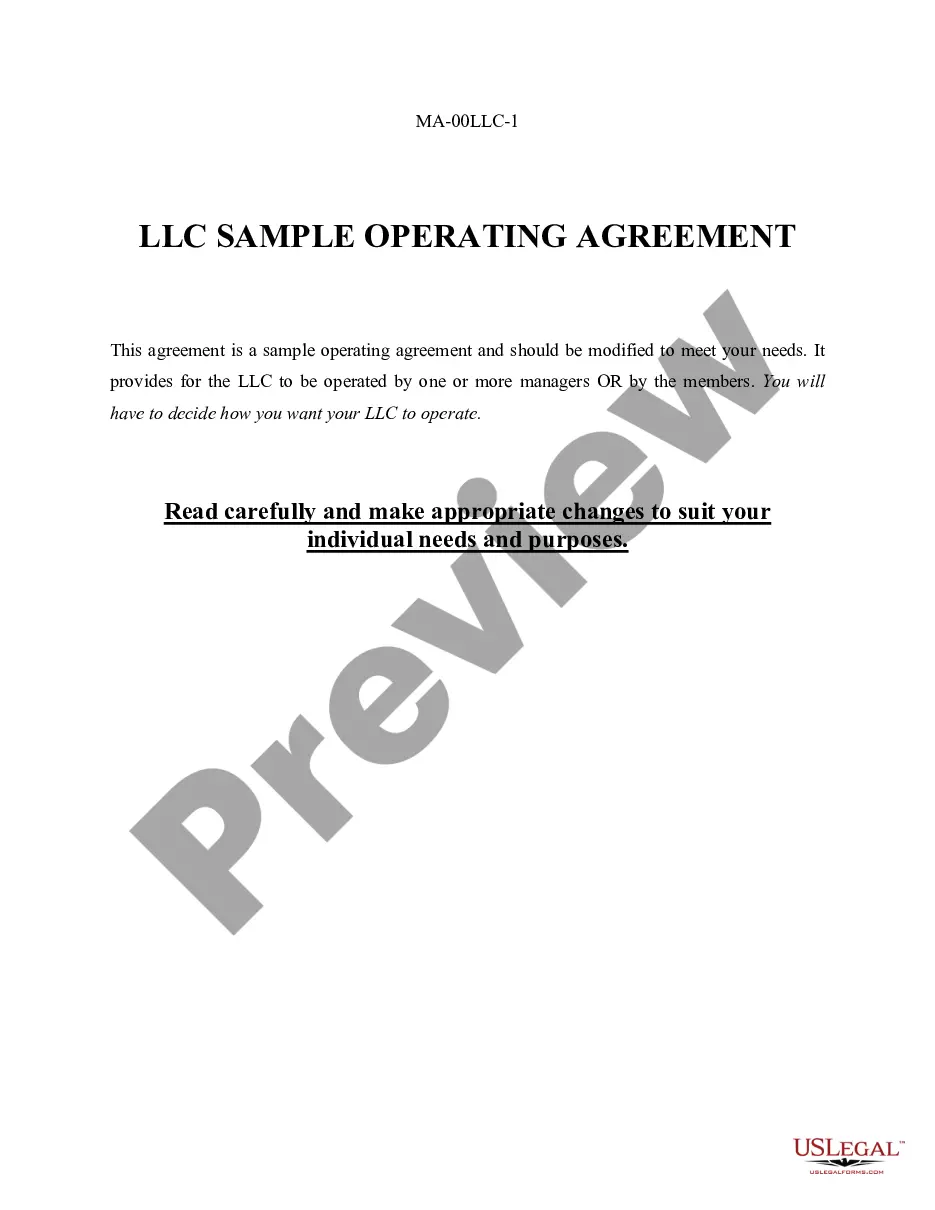

Utilize the US Legal Forms website. The service offers an extensive array of designs, such as the Connecticut Separation Notice for 1099 Employee, which you may utilize for both professional and personal purposes. All the forms are verified by experts and comply with federal and state regulations.

If the form does not fit your needs, use the Search area to find the appropriate form. Once you are confident the form is valid, click on the Get now button to download the form. Select the pricing plan you desire and provide the necessary information. Create your account and pay for the order using your PayPal account or credit card. Choose the file format and download the sanctioned document template to your device. Complete, edit, print, and sign the acquired Connecticut Separation Notice for 1099 Employee. US Legal Forms is the ultimate repository of sanctioned forms where you can find various document templates. Use the service to obtain properly-crafted documents that comply with state regulations.

- If you are currently registered, sign in to your account and click on the Download button to acquire the Connecticut Separation Notice for 1099 Employee.

- Use your account to review the sanctioned forms you have obtained previously.

- Navigate to the My documents section of your account and download another copy of the document you require.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

- First, ensure you have chosen the correct form for your city/region.

- You can examine the form using the Review option and read the form details to confirm it is suitable for your needs.

Form popularity

FAQ

Are termination letters required? Most companies are not required by law to give employees letters of termination. The exceptions are those located in Arizona, California, Illinois and New Jersey. Most employers, however, do provide termination letters as a professional courtesy and a legal record.

I'm self-employed or an independent contractor. Am I eligible for unemployment benefits during the coronavirus crisis? On , the Connecticut Department of Labor made active the filing site so those who are self-employed can complete filing applications for Pandemic Unemployment Assistance (PUA).

This form is a Quarterly Combination Correction for to be used to correct an EMPLOYER CONTRIBUTION RETURN (Form Conn. UC-2) and EMPLOYEE QUARTERLY EARNINGS REPORT (Form UC-5A), which you have previously filed with this department. Submit the original and keep a copy for your files.

Section 2102 of the CARES Act creates a new temporary federal program called Pandemic Unemployment Assistance (PUA) that in general provides up to 39 weeks of unemployment benefits, and provides funding to states for the administration of the program.

Do independent contractors qualify for unemployment insurance? Yes, with the passing of the CARES Act, independent contractors, gig workers, and self-employed individuals are eligible for unemployment insurance if they are unable to work due to COVID-19.

If you sign a release of claims in return for severance pay, you may collect unemployment benefits for the same period of time as your severance payments.

Connecticut is an "at will" state. This means that employers have the right to fire or terminate an employee at anytime without providing a reason, as long as it is not illegal.

Log into your PUA account by entering your User ID and Password. Verify your email address. To file your PUA application, click Unemployment Claim 2192 Pandemic Assistance (PUA) 2192 File PUA Claim.

All Connecticut employers must provide a Separation Packet, which includes a Separation Notice (UC-61) and instructions to the worker immediately upon termination of employment or indefinite layoff. The notice should be provided regardless of whether the termination is voluntary or involuntary.

Visit us today! The Connecticut Department of Labor today began accepting claim applications for the self-employed, many of whom are eligible to collect unemployment insurance benefits under the federal Pandemic Unemployment Assistance (PUA) Program.