Connecticut Confirmation of Orally Accepted Employment Offer from Applicant to Company - Exempt or Nonexempt Positions

Description

How to fill out Confirmation Of Orally Accepted Employment Offer From Applicant To Company - Exempt Or Nonexempt Positions?

If you wish to gather, acquire, or print legitimate document templates, utilize US Legal Forms, the largest assortment of legal forms accessible online.

Utilize the site’s straightforward and convenient search to obtain the documents you need.

Numerous templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. After you find the form you need, click the Get now button. Choose the payment plan you prefer and enter your details to register for an account.

Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the purchase.

- Use US Legal Forms to secure the Connecticut Confirmation of Orally Accepted Employment Offer from Applicant to Company - Exempt or Nonexempt Positions with just a few clicks.

- If you are already a US Legal Forms member, Log In to your account and click the Obtain button to receive the Connecticut Confirmation of Orally Accepted Employment Offer from Applicant to Company - Exempt or Nonexempt Positions.

- You can also access forms you previously acquired in the My documents tab of your profile.

- If you are using US Legal Forms for the first time, follow the instructions provided below.

- Step 1. Ensure you have selected the form for the correct area/state.

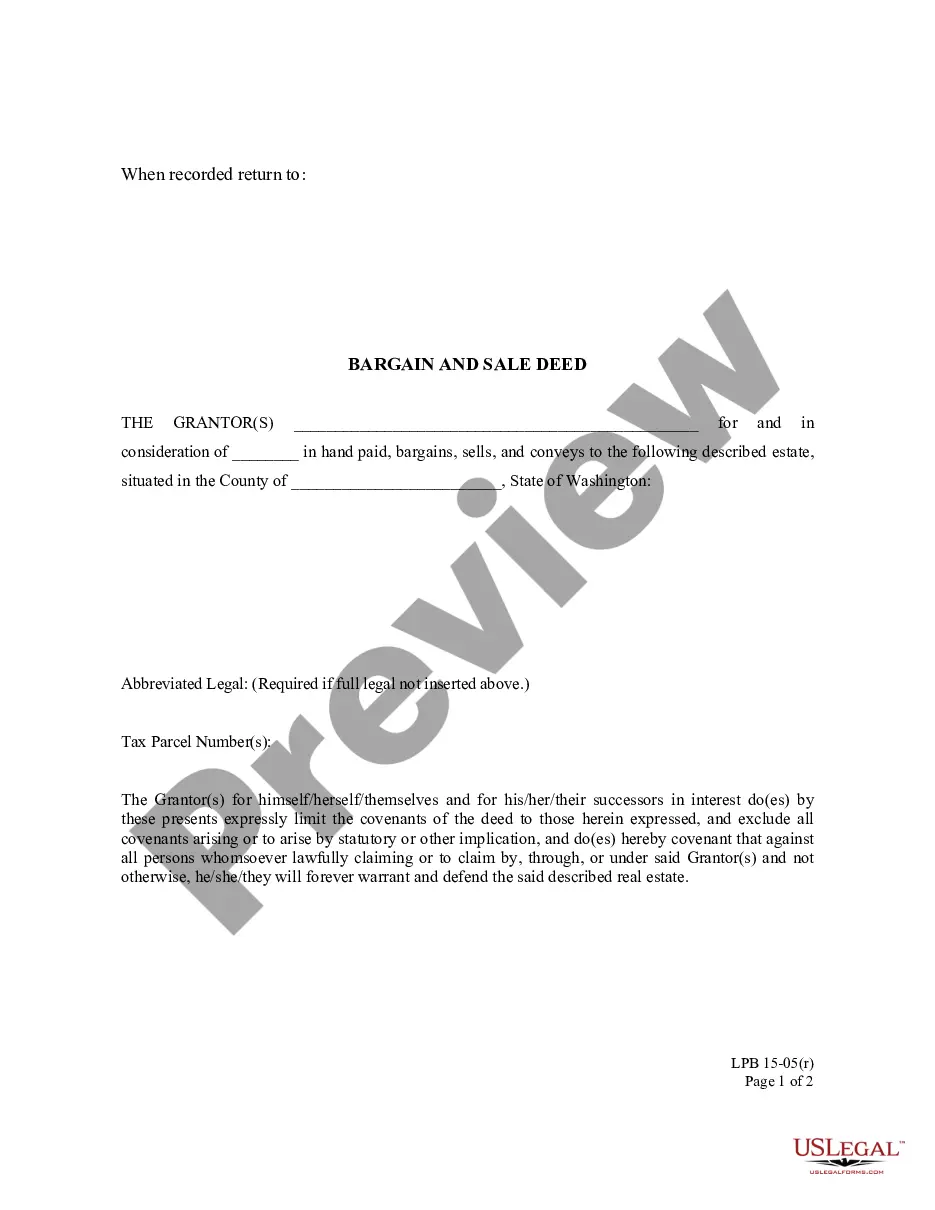

- Step 2. Use the Preview option to review the form’s content. Remember to read the details.

- Step 3. If you are not satisfied with the form, use the Search area at the top of the screen to find other forms in the legal document format.

Form popularity

FAQ

Key Takeaways. An exempt employee is an employee who does not receive overtime pay or qualify for minimum wage. Exempt employees are paid a salary rather than by the hour, and their work is executive or professional in nature.

If you are a non-exempt employee, your employer must pay you at least the federal minimum wage (currently $7.25 per hour in Texas and under federal law) and must pay you overtime pay at a rate of at least one and a half times your hourly pay rate for all hours worked over 40 in each workweek.

An employer can rescind an offer of employment at any time before a potential employee has accepted it. However once a job offer is accepted and the employment relationship (a binding contract) has been formed, then it can't be retracted even if the employee hasn't yet started work.

While the specific criteria for duties vary somewhat depending on whether exempt status is claimed as an Executive, Administrative, and/or Professional employee, examples of exempt duties include hiring and firing employees, scheduling employees, determining credit policies, formulating personnel policies, assessing

Offer LetterAnother common proof of income is a recent offer of employment on company letterhead. This is forward-looking and indicates the salary or hourly rate. Be careful: offer letters are often conditional upon things like drug tests, which the applicant may not yet have passed.

Exempt Employees in Connecticut For an employee to be classified as an exempt employee they must pass both the duties and the salary tests, under both Connecticut and Federal law. Duties Test - Under the Duties Test, the employee's primary duty must require that they act with discretion and independent judgment.

Non-Exempt Employees in ConnecticutEmployees that do not meet the requirements to classify as exempt are classified as non-exempt. This means that they are subject to overtime requirements under state and federal law.

With few exceptions, to be exempt an employee must (a) be paid at least $23,600 per year ($455 per week), and (b) be paid on a salary basis, and also (c) perform exempt job duties. These requirements are outlined in the FLSA Regulations (promulgated by the U.S. Department of Labor).

An exempt employee is not entitled to overtime pay according to the Fair Labor Standards Act (FLSA). To be exempt, you must earn a minimum of $684 per week in the form of a salary. Non-exempt employees must be paid overtime and are protected by FLSA regulations.