Connecticut Vehicle Policy

Description

How to fill out Vehicle Policy?

You might spend hours online searching for the legal document template that meets the federal and state requirements you need.

US Legal Forms offers thousands of legal forms that have been verified by professionals.

It is easy to obtain or create the Connecticut Vehicle Policy from my service.

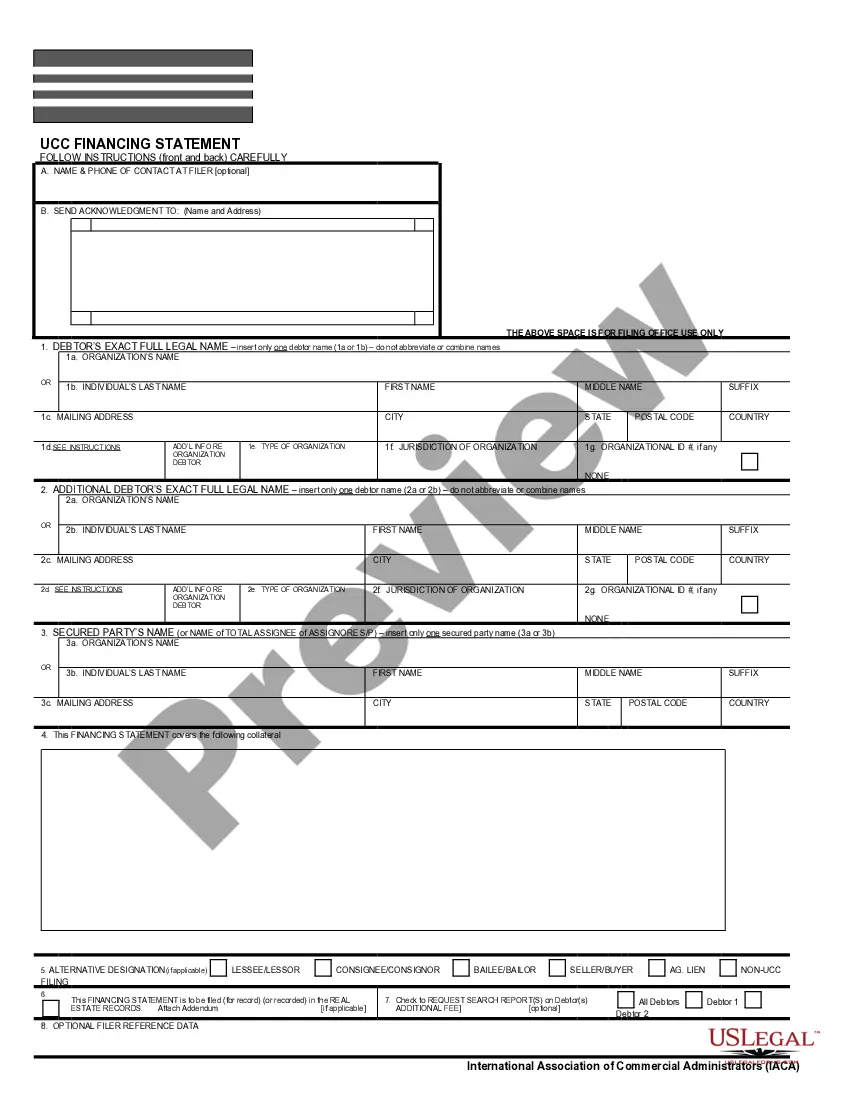

If available, utilize the Preview button to view the document template as well.

- If you already have a US Legal Forms account, you can Log In and click on the Download button.

- Then, you can complete, edit, print, or sign the Connecticut Vehicle Policy.

- Each legal document template you acquire is yours indefinitely.

- To obtain another copy of a downloaded form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, make sure you have selected the correct document template for the state/region you choose.

- Review the form description to ensure you have selected the right form.

Form popularity

FAQ

Connecticut is no longer a no-fault state for automobile insurance, but was before 1994. The term no-fault automobile insurance often refers to automobile insurance that permits a person to recover financial losses from his or her own insurance company regardless of who caused the loss.

No, Connecticut is not a no-fault state. Connecticut is an at-fault (or tort) state. That means the driver who causes an accident uses their insurance to pay for the other driver's bills from the collision. Police and insurance companies use the available evidence to decide who is at fault for the accident.

Connecticut state law requires continuous insurance coverage on any registered vehicle. If you have not maintained insurance on a registered vehicle, you will receive a "warning notice" from DMV.

Connecticut requires drivers to maintain liability insurance as well as mandatory uninsured and underinsured motorist coverage. All drivers must also carry proof of insurance that must be shown at the request of law enforcement officials.

A number of states, excluding Connecticut, also have enacted no pay, no play laws, which restrict the ability of an uninsured driver who is injured in a motor vehicle accident from receiving certain compensation, even if not at fault for the accident.

State of Connecticut Insurance DepartmentA minimum of $25,000 per person and $50,000 per accident for bodily injury liability and $25,000 per accident for property damage liability, is required by law, but drivers are strongly urged to consider higher limits.

Connecticut requires drivers to maintain liability insurance as well as mandatory uninsured and underinsured motorist coverage. All drivers must also carry proof of insurance that must be shown at the request of law enforcement officials.

Connecticut is a 'Fault' Insurance State This means the at-fault driver must compensate everyone injured in the accident, including other drivers, passengers, pedestrians and cyclists. Determining who's at fault might seem straightforward.

Full coverage insurance in Connecticut is usually defined as a policy that provides more than the state's minimum liability coverage, which is $25,000 in bodily injury coverage per person, up to $50,000 per accident, and $25,000 in property damage coverage.