Connecticut Purchase Order for Computer

Description

How to fill out Purchase Order For Computer?

It is feasible to invest hours online trying to locate the correct legal document template that meets the federal and state requirements you need.

US Legal Forms offers a vast array of legal forms that are reviewed by professionals.

You can easily download or print the Connecticut Purchase Order for Computer from our service.

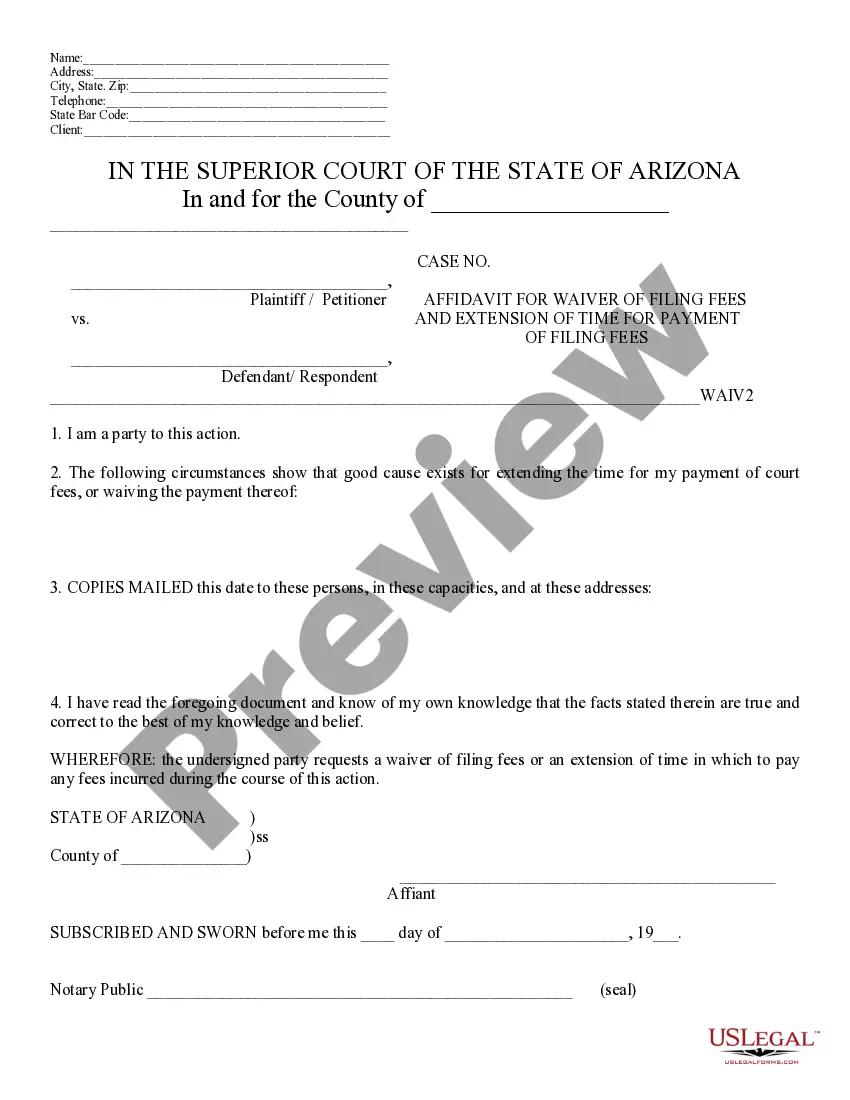

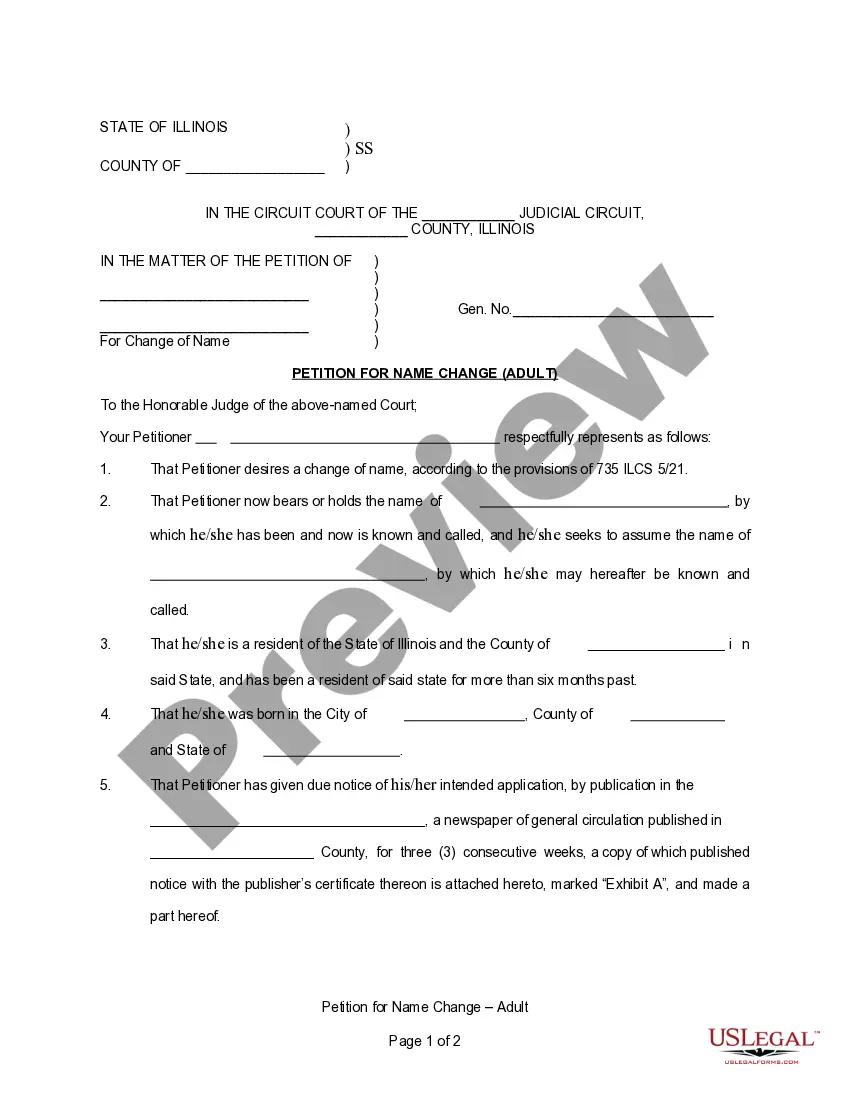

If available, utilize the Preview button to view the document template as well.

- If you already possess a US Legal Forms account, you can sign in and click the Obtain button.

- Next, you can complete, modify, print, or sign the Connecticut Purchase Order for Computer.

- Every legal document template you acquire is yours permanently.

- To obtain an additional copy of a purchased form, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for your jurisdiction/region of choice.

- Review the form description to ensure you have chosen the correct form.

Form popularity

FAQ

A Purchase Order, or PO, is a document that a buyer sends to a seller to confirm a purchase. For instance, when a business in Connecticut needs to buy computers, it creates a Connecticut Purchase Order for Computer detailing the items, quantities, and agreed prices. This document helps both parties ensure clarity in the transaction and serves as a legally binding agreement. Using a platform like US Legal Forms can simplify creating and managing your Connecticut Purchase Order for Computer, ensuring all necessary details are accurately captured.

Getting a CT tax registration number involves submitting an application through the Connecticut Department of Revenue Services. Provide the required information about your business, including its structure and location. A valid tax registration number is essential for fulfilling obligations tied to a Connecticut Purchase Order for Computer, so be sure to handle this promptly.

To obtain a copy of your CT registration, you should contact the Connecticut Secretary of State's office directly. They will guide you through the process and inform you of any fees associated with obtaining documentation. Having an up-to-date registration can be useful for processing things like a Connecticut Purchase Order for Computer.

No, a CT tax registration number is not the same as an Employer Identification Number (EIN). While both numbers are essential for business operations, the CT tax registration number is specifically for state tax purposes, whereas the EIN is issued by the IRS for federal purposes. If you plan to use a Connecticut Purchase Order for Computer, ensure you have both numbers to facilitate smooth transactions.

You can get a CT tax registration number by applying online through the Connecticut Department of Revenue Services' website. Fill out the required forms with accurate information about your business. This registration will enable you to collect sales tax and can be beneficial for transactions like a Connecticut Purchase Order for Computer. Ensure you have your business details handy to expedite the process.

To obtain a CT state ID number, you need to visit the Connecticut Department of Revenue Services (DRS) website. Complete the application form and provide necessary identification details. Once processed, you will receive your state ID number, which is crucial for conducting business. This number can be essential when working with a Connecticut Purchase Order for Computer.

In Connecticut, certain items are exempt from sales tax, which can include certain types of machinery, food items, and specific medical equipment. For a comprehensive list of exempt items, reviewing the Connecticut Department of Revenue Services PDF is highly advisable. Utilizing a Connecticut Purchase Order for Computer might offer exemptions for specific technological purchases, depending on their use. Always refer to the detailed PDF for the latest information, ensuring your purchases align with tax regulations.

Connecticut Policy Statement PS 2006 8 provides guidance on the tax treatment of purchases of computer hardware and software. This policy outlines different categories of purchases, detailing which items qualify for exemptions. If you plan to make purchases using a Connecticut Purchase Order for Computer, understanding this policy can help you take advantage of potential tax savings. Always review the policy for the most current regulations to optimize your computing purchases.

Yes, Connecticut imposes a sales tax on most electronic items, including computers. However, the tax situation can vary based on specific circumstances and exemptions. When using a Connecticut Purchase Order for Computer, it's essential to be aware of any applicable taxes to ensure compliance and budgeting. Always consult a tax professional for the most accurate information regarding your purchase.

Yes, Connecticut allows you to file taxes online, making the process efficient and straightforward. When dealing with a Connecticut Purchase Order for Computer, this option proves useful for managing your tax obligations. Take advantage of a user-friendly platfrom like uslegalforms to assist you in filing your taxes seamlessly.